5 steps to pick a software company

Tasmea, the next 10-bagger?

This week’s setup:

1. The markets are in a slowdown

2. Tasmea: The next Mader Group? (10-bagger)

3. Watch out for the software meltdown, don’t jump too fast1. Bubble meter

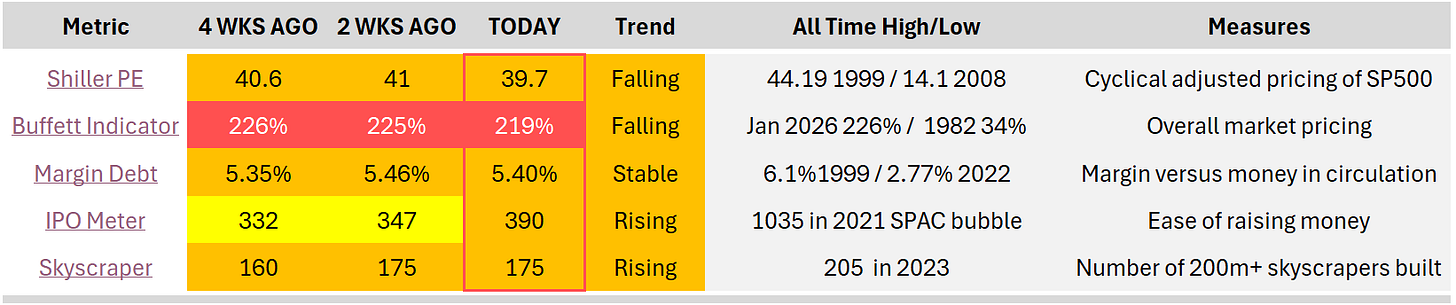

“We look at some metrics to gauge what the market temperature is.”

This is the first time, since we started tracking these metrics, that some of them have traded down. The Shiller PE went below 40, and the Buffett Indicator below 220%.

What does it mean?

Nothing.

It’s a blip, all the result of a very focused drawdown in software companies due to the AI will eat software for lunch.

Are you thinking of looking through the rubble to see if there are any gems in there?

Beware before you start dumpster diving. I’ll go deeper into this in part 3 of this article.

It’s not as easy as you might think to find great opportunities.

2. Stock in the funnel

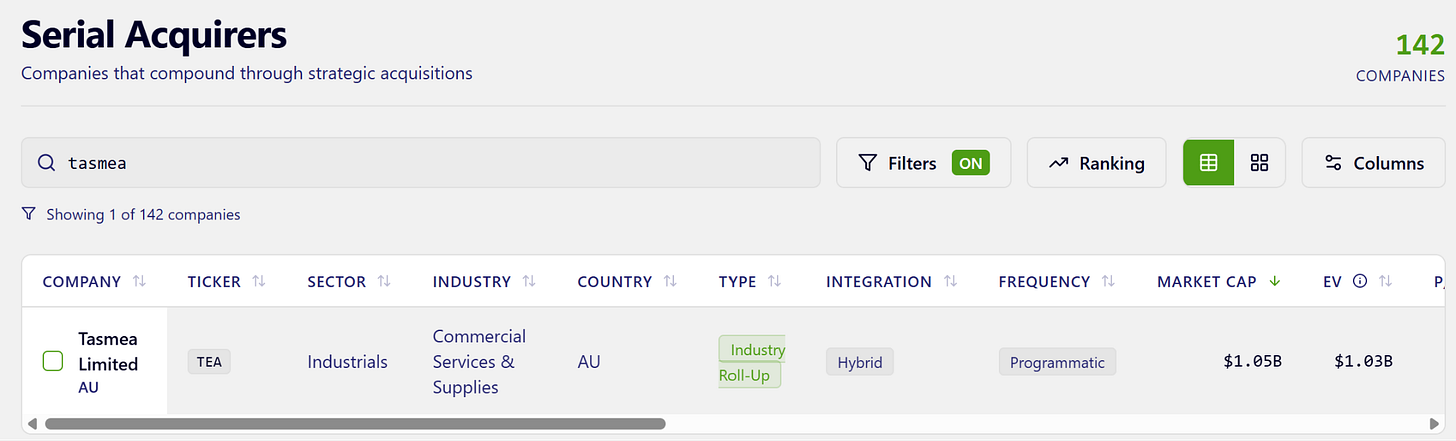

Tasmea is a serial acquirer in Australia. You can find the details in our database over at 100baggerhunter.com

Ticker: TEA.ASX

Description: Serial acquirer providing maintenance and engineering services mainly to the mining, resources, and energy industry

Type: Programmatic industry roll-up with a hybrid acquisition approach. (hybrid sits in between hands-on and hands-off)

Pricing: Forward P/E of 13 and EV/EBIT below 10

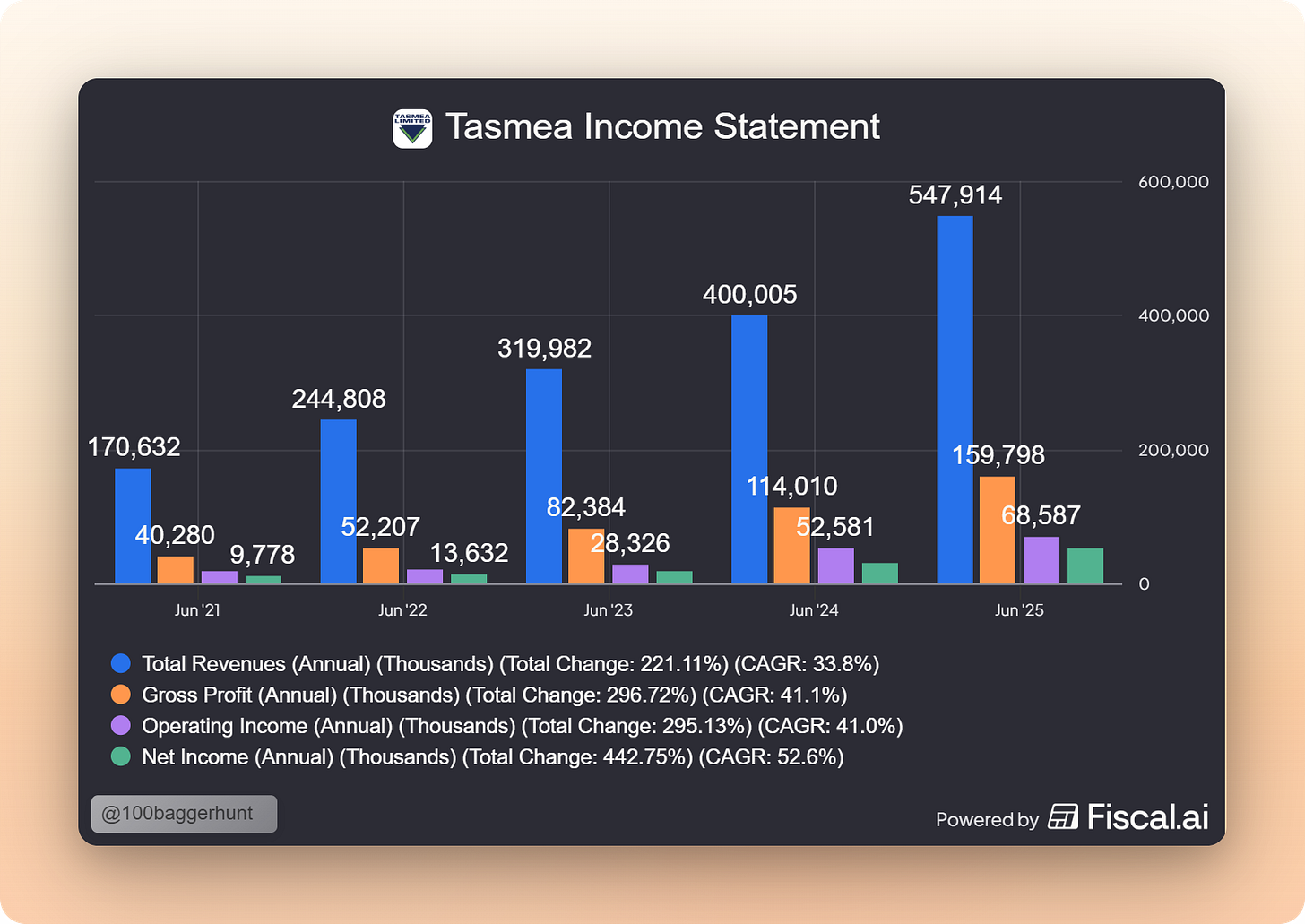

Past growth (3y): 30% sales and 50% EPS CAGR

Interested in charts like this? Grab your 15% discount here.

Why it’s interesting: Programmatic acquisition and execution through November 2025 have been flawless. Sales and profits increased, with profits surpassing sales growth. They have been doing bolt-on acquisitions over the past few years. Here’s an overview of their subsidiaries by service segment:

In 2022, they made some smaller acquisitions, around $2M per company. Then they started ramping it up, paying on average $20M per company throughout 2023 and 2024 until August of 2024, when they acquired Futur Engineering Group for $84M. They use a decentralized approach where most of these companies retain their brand. Management stays on board for several years as payment is structured as cash + earn-out schemes. The integration is mainly with back office systems, and cross-selling along a wider client portfolio.

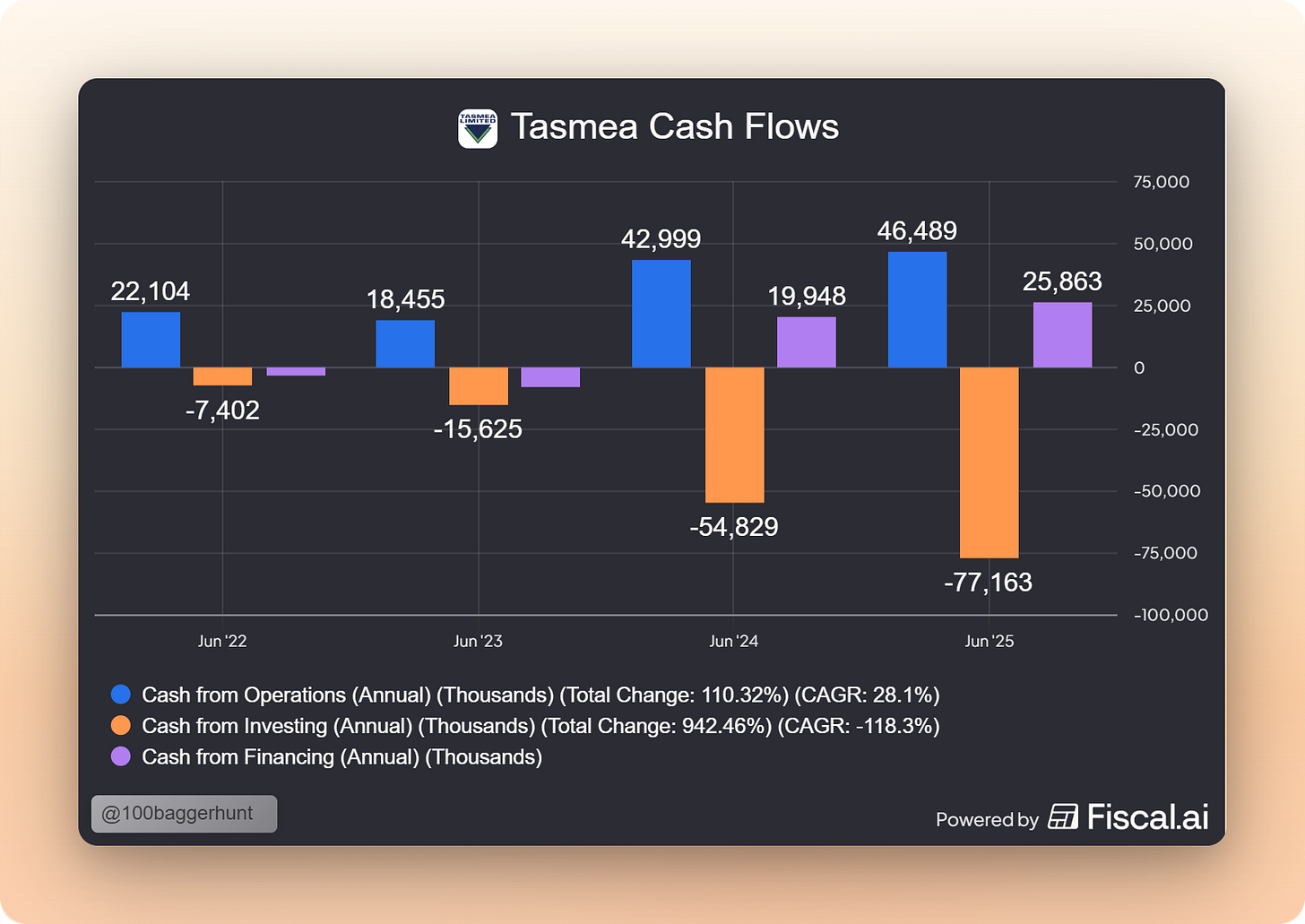

Then they acquired Workpac in November of 2025. You can see how the cash flows evolved:

The problem here is that Workpac is a recruitment agency.

That’s a completely different business model, typically run with high revenues but thin margins. Tasmea has asked investors to judge them on earnings and net income and not on revenue. In addition, they did do 2 equity raises to fund the acquisition, diluting existing shareholders.

Tasmea has mentioned that Workpac will continue operating as a separate entity. Then what’s the rationale behind this acquisition?

It’s difficult to find skilled labour in Australia. Workpac becomes a prime feeder of skilled labour for the whole of Tasmea (bottleneck for Tasmea’s subsidiaries)

This will allow them to bid for bigger projects (as without sufficient staff and capacity, you cannot participate)

Additional cross-selling opportunities as Workpac is present in regions where Tasmea is not. The goal will be to generate more business.

The previous run-up in price (to a P/E of 22) with an unusual acquisition combined with a (small) equity raise, has made the price and multiple come down over the past 4 months:

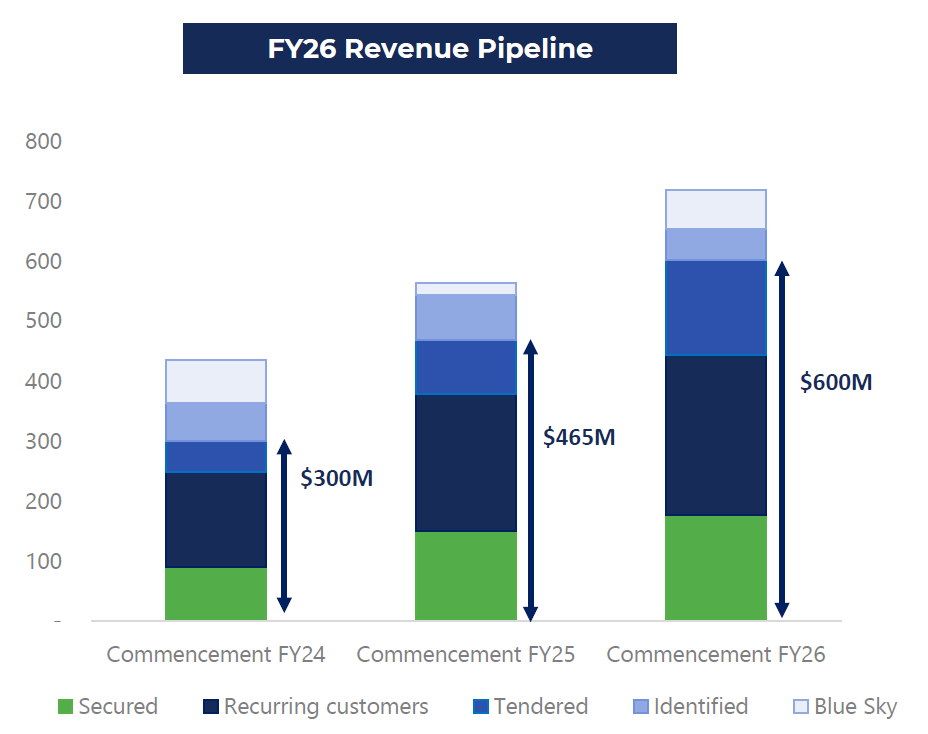

But management seems confident, giving an EBIT guidance for 2026 of 128M, which would mean the company is currently trading at an EV/EBIT of 9. And about 80% of their 2026 future revenue seems solid:

Current status: The company went through the ideation phase and passed phase 1 of my research funnel. The big question for this company is: Will the market rerate this company forever because of the change in the hybrid business model? And will this acquisition have the positive effects management is hoping for?

3. Best article of the week

Todd Wenning wrote an interesting short article on the current software slump.

I agree with his conclusion: When there is a downturn, always think about what kind of downturn it is.

I would classify them into 3 categories (he uses 2)

Market wide

Industry wide

Company specific

2020 was a market-wide crash. At the time, I was scrambling for as much cash as possible to buy more companies. Those 2 years were the best years I ever experienced as an investor. The downturn was market-wide, which means you can comfortably buy great companies and wait.

Time is your friend.

The recent downturn in software companies is more of an industry downturn. Future terminal values of these companies are being rerated due to the rise in AI capabilities.

So the question becomes: Is the rerating temporary or permanent?

With a market-wide downturn, the answer is easy. But with this industry downturn, the answer is a lot less obvious.

I’ve been using these AI tools intensely over the past 12 months, and the speed of improvement is astounding.

If you’re hunting in the software space, take your time and do proper due diligence.

I believe the 5 factors you need to look for are:

Does it own proprietary data?

Does it mainly serve enterprise clients?

Are there regulatory or legal requirements that can act as a barrier to entry?

Do you see opportunities where their current software stack can get better by using AI?

Do they charge for an outcome instead of charging for a seat?

If you’ve got 5 yesses, you might have found a great candidate poised for a rebound. (I’ll do some digging myself)

Which company do you think fits these 5 criteria?

That’s it for this week.

May the markets be with you, always

Kevin

What’s your opinion of $CSU at C$2,300?

Agree, TEA is worth an active monitoring. Beyond usual key metrics, TEA ticks many boxes. WorkPac is a strategic move to channel skilled "blue collars" & avoid the "empty bus" (& pay penalties). WorkPac price tag is shockingly low with a "scrip" hedge: WorkPac sellers are betting their own exit recovery on TEA share price performance. The shareholder profile is extremely bullish. So far, so good. Let's see on Feb'24 their HY performances & how they're digesting WorkPac. And watch ASX 300 quartely rebalance likely on next Mar'06 (index inclusion?). To be cont'd ...