A market-leading security roll-up aiming for a 5x in revenue

Earnings Update IMB

The One-Paragraph Thesis:

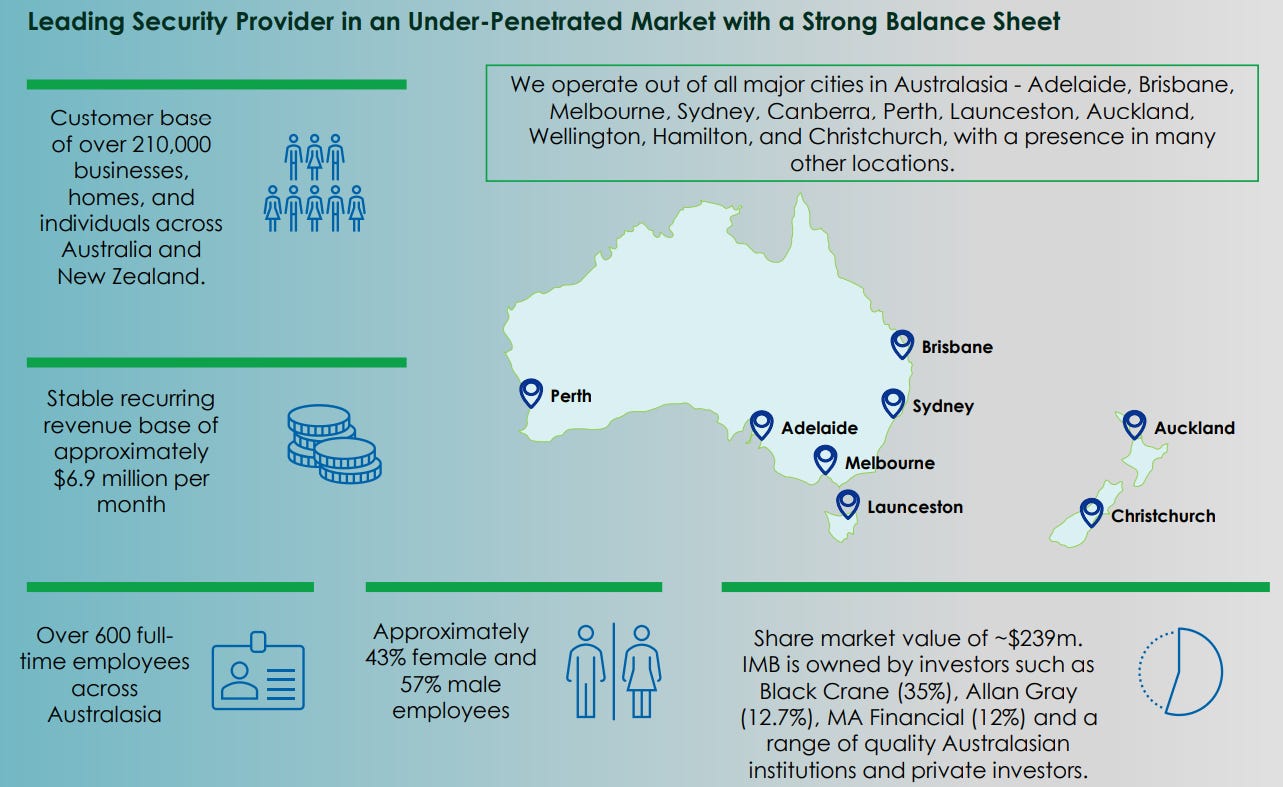

Intelligent Monitoring Group (IMB.ASX) is a security roll-up in Australia that aims at getting nationwide coverage to attract larger customers with higher margins. When we say security, we say cameras and security systems. The business model is mainly recurring revenues, as once the security system is installed, the customer pays for the monitoring.

IMB has grown through acquisitions, fueled by debt and an equity raise.

The last quarter is the first sign that they could become a true cash-generating machine.

Our full write-up can be found here:

Let’s go through the annual report and presentation. Here’s what the current photo looks like for IMB after all the acquisitions ⬇️

And their flywheel to increase their competitive advantage is as follows:

The numbers

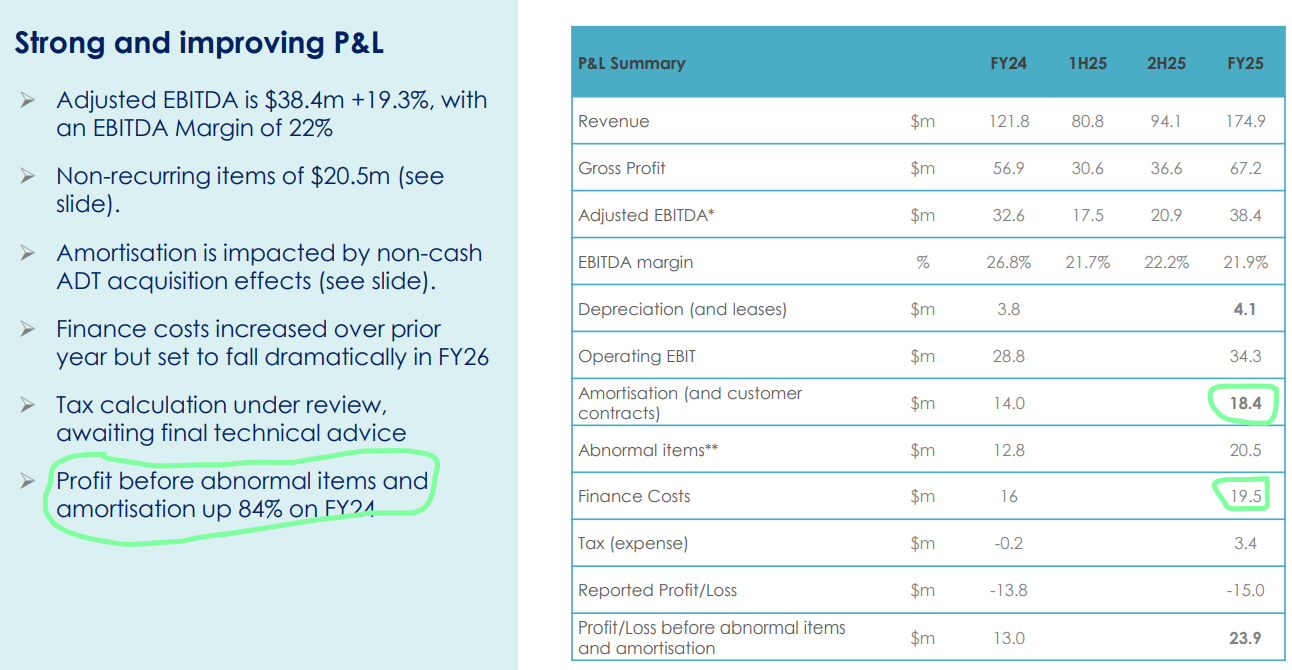

Over the full year, IMB reported $174.9 million in revenue thanks to the impact of the previous acquisitions, with a record Operational cash inflow of $17 million in the first quarter that ended the 30th of June.

This was the result of earnings growth, combined with, for the first time, the absence of one-off costs from previous acquisitions or refinancing.

Gross margin also increased by 9.7%. However, the company reported a widening of losses at the bottom line, in part due to higher financing costs in the first quarter of the year. (Financing costs will be cut in half due to the refinancing in February in the future.)

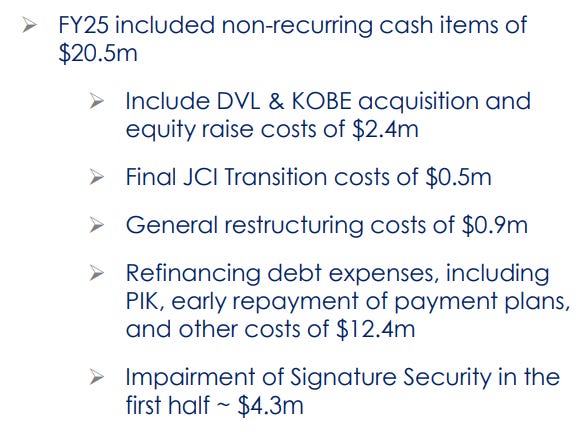

Although the last quarter looked cleaner, the full year for 2025 was still impacted by:

Amortization charges related to the acquisitions

Pretty high finance costs, which will be reduced in 2026

And here’s a detailed breakdown of the line item displaying the non-recurring items when looking at the cash flow statement:

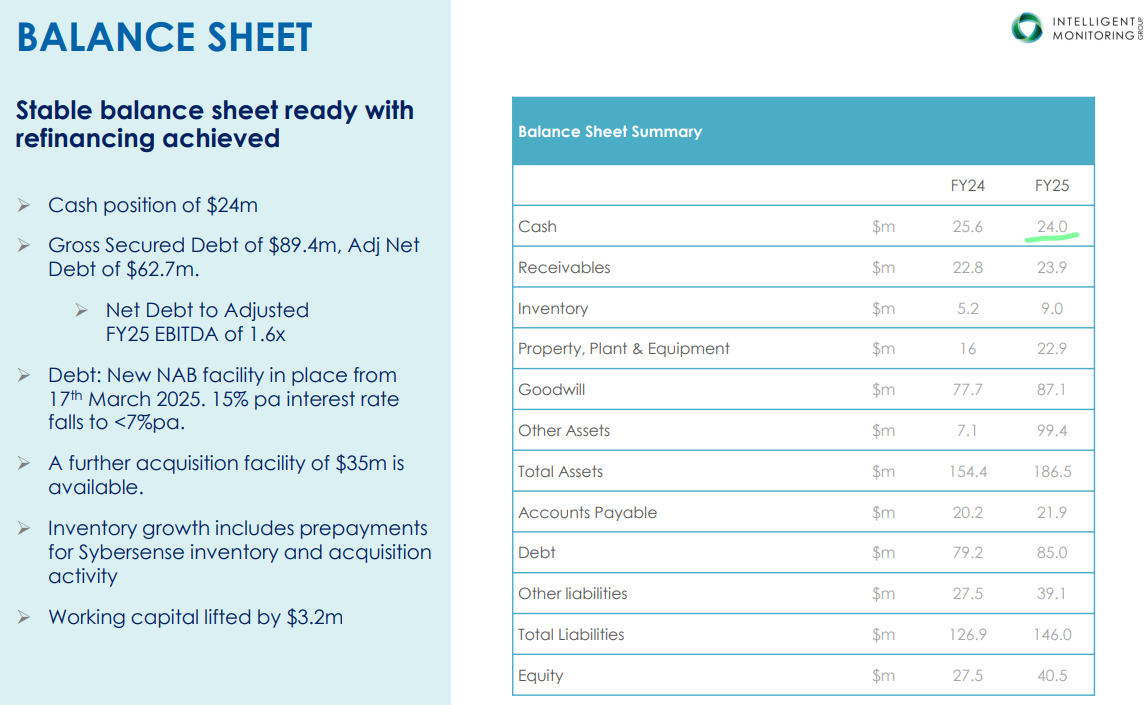

What about the balance sheet? We can conclude that everything increased except the cash position.

Cash is comfortable at $24 million

To assess the increase in liabilities, EBITDA/Interest now sits at 7, which is a lot more comfortable than before

Inventory growth is also a consequence of the Sybersense acquisition

Net working capital increased by about $3 million, with the rise in inventory being the biggest differentiator

The Outlook

Management made some bullish statements.

They are claiming the “transformation” or the hard part is now behind them, and the first clean Q4 quarter is a testament to what IMB will generate in the following year.

But they have ambition that’s for sure, to obtain a 25% market share as opposed to the current 4.5% today.

That would mean a 5-fold increase in revenue in 5 years, which means a 37% CAGR.

Those are some bold claims.

I like an ambitious management team, but I’m not going to take those kinds of growth rates in the valuation.

Guidance will be given at the AGM in November 2025.(I believe the market was hoping for guidance during the update).

Looking ahead, management is optimistic about FY2026. They noted that underlying earnings growth (approximately +8–9% on a like-for-like basis) in FY2025, combined with a robust sales pipeline, provides momentum for the new year.

Some large project contracts that were pending at year-end are expected to be secured in early FY2026, which should bolster revenue and EBITDA growth.

The recent acquisitions (e.g., DVL and KOBE) are already contributing above expectations and will furnish a full year of earnings in FY2026.

With interest costs now sharply reduced post-refinancing, cash flow is projected to further improve, supporting growth initiatives.

Now I do expect them to continue doing smaller acquisitions.

On that front, there was an update a couple of days ago with the completion of the acquisition of Western Advance, strengthening their foothold in Western Australia.

If you’re interested in all our deep dives, earnings updates and full access to our investor portal over at 100baggerhunter.com, a 20% discount is available but only for the next 48 hours.