David vs Goliath, David is winning and growing fast

When margins expand...

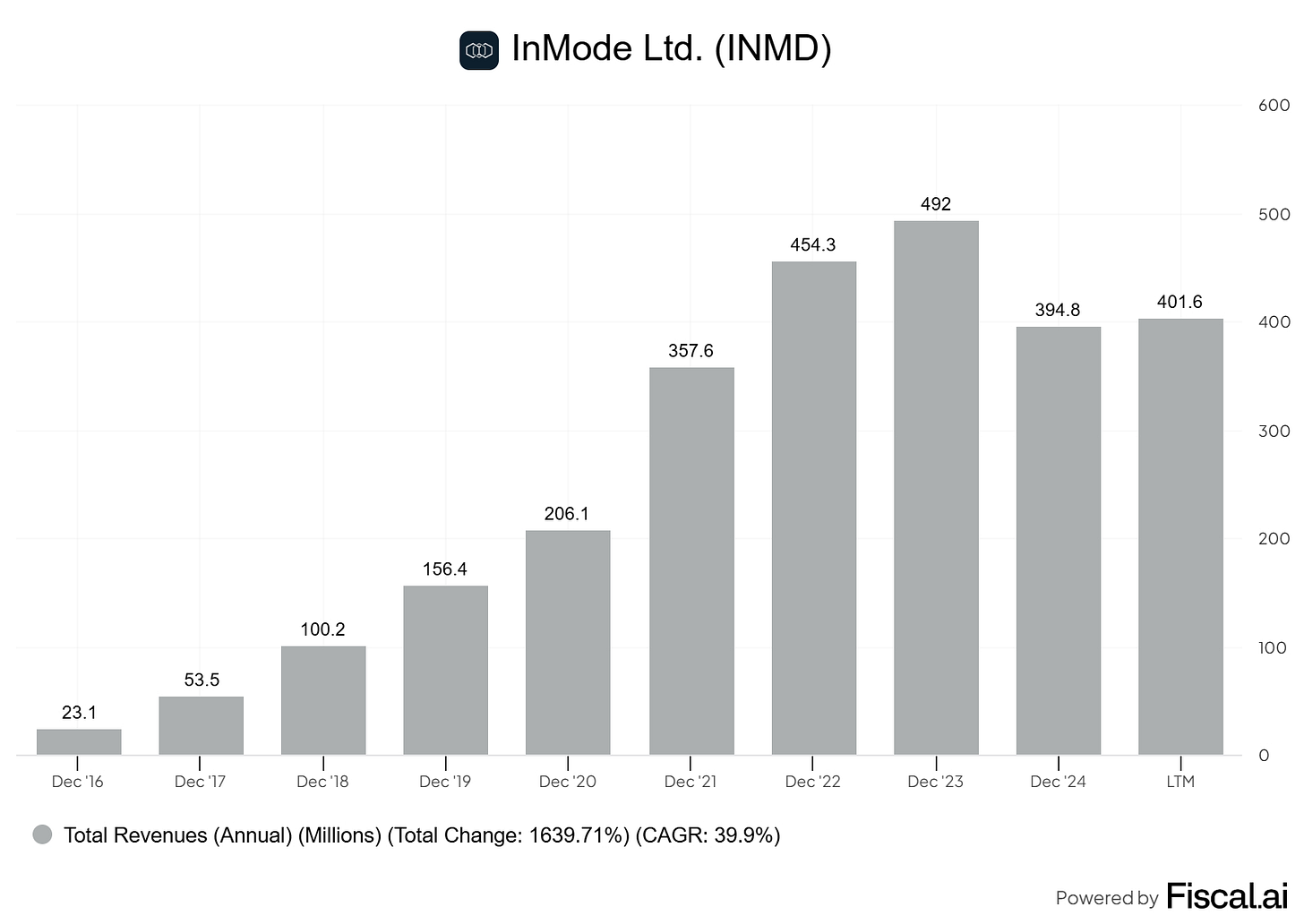

If you’ve been reading this little newsletter for a while, you know I was knee-deep into a company called Inmode (INMD) from 2020 to 2024..

You can find my older deep dive here.

I made good money from that company. A 7-bagger in 18 months after the COVID crash. Later on, I got back in but lost 30% on my position.

Since then, I left the company because I don’t see them coming back from this. A 20% revenue decline, they keep struggling:

Then a strange thing happened.

In April, I heard of a new company in the medical devices space that, in my mind, has a genius business model. The business model I wish Inmode had.

And for some reason, I had not come across it while I was doing all the research on competitors on Inmode. Remember this table?

Weird.

Anyway, this company is taking market share from everyone in the space, and it seems it has a long runway to go.

3-Y revenue CAGR at 41%

Loved by some of your favorite celebrities

And the kicker: It just turned profitable, cash is coming in

This company uses a razor-blade business model on steroids (it’s better than Gillette’s)

It’s also a prime candidate for Paul Andreola's discovery cycle, where, if the growth story continues, institutions will come in.

And if the company reaches the height of Inmode, we’re looking at a 6-bagger or more.

Let’s dive in ⬇️