A to Z: Quick and Dirty n°1/10: AMTE.L, AEO.L, ANR.W, B90.L, BCM.W and BBT.W

As I mentioned in our last article we’ve developed an investible universe of 64 companies for 2024. In these types of articles, I quickly go through them to see if some warrant further investigation. This is step 3 of my investment process.

I use data from Simply Wall Street, Uncle Stock, and Yahoo Finance to have a general overview of the company. Then we skim through the most recent annual report to get a better feel for the company.

We are specifically looking for reasons to say NO.

The 100x checklist was developed inspired by Chris Mayer’s 100x baggers. It presumes that the company is making a profit. It’s specifically attuned to compounders. The result of going quickly through the checklist is a one-pager. You can find all the one-pagers here.

There’s an enormous amount of variables and data that you can look up for each company. My goal here is to avoid as much noise as possible, limit myself to some specific data points that I deem most important, and use them to judge if I should continue diving into the company. The one-pager has to be specific to the company (not generic) and hold the most interesting data.

Based on the one-pager, they either go to the NO list or the Potential Deep Dive list with specific reasoning. The NO-list is tracked to look for potential opportunity costs and during the annual review, see if I should change my process.

This means there’s a slight change in the process I use because of my goal to mimic Paul Andreola’s process.

If the potential deep dive list grows, then I will rank the companies and do a deep dive on the best one based on the quality of the company.

So here’s what the process now looks like:

Here is a quick reminder of how the universe was screened using the most powerful screener known to man: Uncle Stock

3-Y revenue CAGR of > 10%

Insider ownership > 15%

Institutional ownership < 5%

Excluding industries like finance, commodities

In this first edition of Quick and Dirty company analysis, we’ll look at the first 6 companies in the investable universe we defined in our latest article.

Let’s dig in.

Company 1: AMTE Power PLC

Company Overview

AMTE is a UK developer and manufacturer of lithium-ion and sodium-ion battery cells. Its automotive products are designed specifically for performance cars and heavy goods vehicles to help decarbonize travel and freight. The Company serves markets, including electric vehicles, energy storage, and specialized markets.

It was founded in 2013 and IPO’ed on the AIM market in 2021.

News

Shares have been suspended from trading. Here’s what happened:

The company has never been profitable and ran out of cash. It tried to raise additional capital but to no avail.

They are now looking to see if other parties are interested in acquiring the company. While this is ongoing, shares are suspended from trading on the AIM market until the 19th of January 2024.

Suffice to say, I won’t bother spending any more time researching this company.

Company 2: Aeorema Communications PLC

Company Overview

Aeorema is a live events agency, that delivers corporate communications solutions in the UK, US, and internationally. It was founded in 2001.

It is the parent organization of:

Cheerful Twenty-first: Strategic Corporate Communication agency

Eventful limited: The event agency

It was forced to change its business model during the pandemic as all events were shut down. It pivoted towards virtual and hybrid events and this appeared to be very successful and is now growing at a fast pace.

The company can be considered a nanocap:

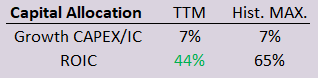

Popularity

The stock is illiquid and I couldn’t find analysts tracking the company. There is one short write-up on the stock.

It has been discussed on X in the past.

Ownership Structure

Although the screen I ran was to look for low institutional ownership, this one might have slipped through the cracks as here’s what the ownership breakdown looks like:

We’ll carry on with the quick and dirty analysis nonetheless.

Past Performance

Performance since COVID has been spectacular. Their pivot has paid off:

From a revenue point of view, they only started expanding into the US at the end of 2022, and already the US branch is about 35% of the total revenue of the business.

And here’s a quick overview of their gross margins:

If the company would be a candidate to dive deeper, we’ll need to take a more thorough look at what has exactly changed with the business before and after COVID which might explain the difference in gross margins. Also, in the event industry, look at who are the biggest companies, and what is this company doing differently than others. Can you have some sort of competitive advantage in this industry?

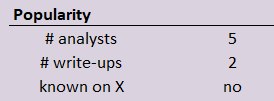

Capital Allocation strategy

Because it is an event business, it is capital light. Here’s a quick look at their capital allocation:

Again, the performance over the last year shows through the ROIC. They have a solid cash position (about 2 million GBP) and low debt levels.

They keep on reinvesting in their current business to grow in the future.

They do pay a dividend, and it has increased because of the success of the company.

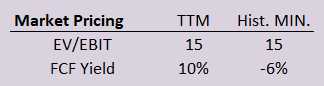

Market pricing

The stock has performed well since COVID, gaining 5x in 4 years. The current pricing in the market is reasonable and not far removed from their historical lowest value. Free cash flow yield is high at the moment.

Latest news

Nothing special.

Verdict

I was not expecting it so quickly, especially since this is a company that fell through the cracks into our investible universe. But I’m adding it to the potential deep dive list because I would like to understand in more detail what happened to the business, what their market looks like and what are the future growth prospects. In their old business model, their market was physically constrained in the UK. Now they can organize events anywhere and they even opened an office in the US. It’ll be interesting to figure out what their potential future growth runway looks like.

Here’s the complete one-pager for the company:

Company 3: Answear.com S.A.

Company Overview

Is an online multi-brand fashion retailer in Poland, the Czech Republic, Slovakia, Hungary, Romania, Bulgaria, Ukraine, Greece, Croatia, and Cyprus.

Its strategy is to focus on mid-priced clothing (so not cheap nor luxury) targeting the 20-40-year-old segment. Its main competitor is Zalando. It has its private label which is increasing in sales and volume.

Answear.com is the biggest company we’re looking at today:

Here’s how it has developed itself in Europe over the last few years:

Popularity

Answear.com is well-known in Poland. Here’s an overview of the data:

I could only find write-ups on the company in Polish.

Ownership Structure

This time the screener came through as there is a very high insider ownership and some institutional ownership.

Thinking of Paul Andreola’s discovery cycle, we’re at the stage where more retail is coming in, and if the company keeps growing, you could see more institutional investments flowing into the stock, if insiders are willing to increase the float.

Past Performance

The company is growing fast:

It is leasing a central warehouse in Poland and thus is capital light. It wants to continue to expand in Eastern Europe maybe even going towards Western Europe although it will face a lot more competition there.

Capital Allocation strategy

From a capital allocation point of view, ROIC has dropped but it is still reasonable.

They have about 20M PLN in cash (50 the year before). They have no long-term debt other than the leases in particular the lease on the warehouse.

They acquired other companies like prm.com at the beginning of 2023 which is an online sneaker and streetwear retailer in line with their competitive positioning.

Market pricing

It’s more expensive than the previous company covered, but it’s growing very fast. For comparison purposes, Zalando is priced at an EV/EBIT of 34 at the moment. We’ll need to dig deeper to be able to better assess and discriminate pricing from the valuation.

Latest news

In November of this year, the company entered into the Italian market. New shares were issued in October of this year to raise capital (about 1 million shares at a share price of 29 PLN - the current number of shares sits at 17.5 million) to allow the company to continue to invest in the future.

Verdict

Online retailing is hard. You have everything stores like Amazon and Alibaba, and they will have to compete with the likes of Zalando and other smaller players. Based on this quick run-through, it seems, compared to Zalando, they have a cost advantage at the moment. The question is how this will evolve into the future as they are going to go head to head. Will there be room for both players to co-exist? Can they maintain their current margins? I’ll add the company to the potential deep dive list.

Here’s the one-pager for the company:

Company 4: B90 Holdings PLC

Company Overview

A group of companies operating its own online Sportsbook and Casino product as well as marketing for its own and third-party online gaming companies.

This is a nanocap company:

It was founded in 2011 and has been trading since 2016.

Popularity

There are some analysts following the company, but I couldn’t find any write-ups:

Ownership Structure

In line with our screener, there is a pretty solid insider ownership of the company with only a marginal participation of institutions in the company.

Past Performance

This is our first company that hasn’t made a profit yet:

In addition, in the first half of 2023, they encountered a significant decline in sales, which they claim was due to some internal restructuring (which could mean anything) and the promise to address these issues going forward.

Capital Allocation strategy

The company is going through different cycles of raising capital and investing that capital to acquire companies and provide for their working capital.

They managed to raise almost 5 million pounds in 2023 alone. This is done through convertible notes and share issuance. Here’s what the shares outstanding growth looks like for the past years:

Which is, of course, not a pretty picture. Besides the convertible notes, the company has no debt.

Market pricing

Because of the absence of positive operating income, we’ll need to look at pricing by sales:

This of course is the result of the sudden drop in revenue in 2023.

Latest news

Management has declared to focus on their core business of B2B with their Bet90 brand.

At the moment, that website is not working.

Verdict

I’m putting this company on the NO-list. Maybe at a certain point in time, they will become cash flow positive, and an inflection point will occur, but how much capital needs to be raised beforehand? Impossible to assess.

Here’s the one-pager for the company:

Company 5: Betacom S.A.

Company Overview

Betacom is an IT consulting firm in Poland. There are many small and publicly traded IT consulting firms in Poland.

Although the small size, it is generating a high multiple in revenue.

Popularity

The company is mostly unknown outside of Poland. Here’s the data I managed to recover:

Ownership Structure

There is a high level of insider ownership in the company with the CEO owning about 11%.

Past Performance

Past performance was good with an increase in revenue and free cash flow:

Current data on TTM FCF is negative, so we could take a look at the end of the fiscal year to see what the actual increase or decrease in FCF/share will be.

Gross margins have decreased during the pandemic but are stabilizing:

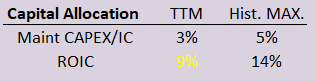

Capital Allocation strategy

About 5% of invested capital is used for growth investments. A dividend has been approved because of the better performance in 2022 going into 2023.

The ROIC has been the highest it has ever been. Does this mean there is some sort of inflection happening within the company?

The balance sheet is good with a solid cash position and low debt.

Market pricing

Data from Yahoo Finance shows a negative free cash flow. Looking at H1 2023 report, even the operational cash flow was negative.

Verdict

There are several nano-cap IT consulting companies in Poland. Here’s an overview taken from Simply Wall Street

I wouldn’t go into detail in this one company, I would approach it from a sector view and see who is the better performer and the worst performer.

In the end, the company goes to the NO-list:

I don’t see how the company can differentiate itself enough from its competitors to create a real competitive advantage in this sector

The rise of AI will not be beneficial for this type of company

Here’s the one-pager for the company:

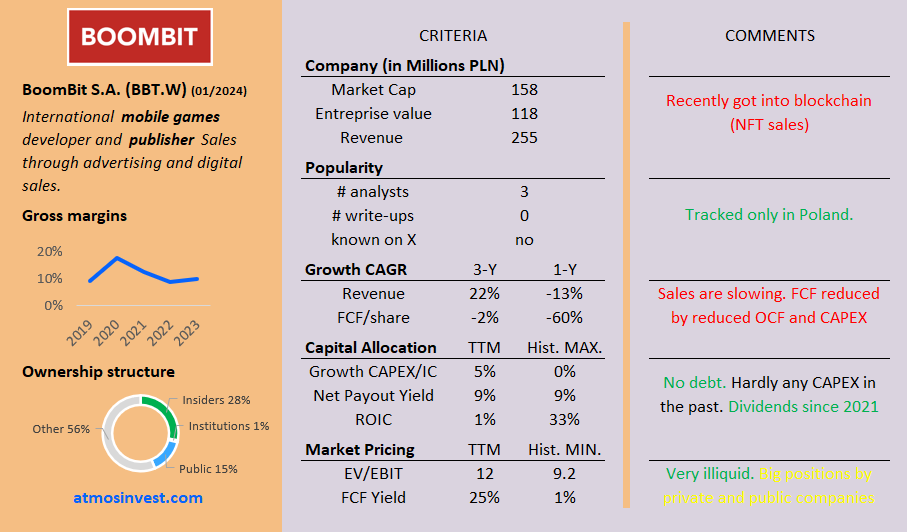

Company 6: Boombit S.A.

Company Overview

Boombit is a mobile game developer and publisher located in Poland but with an office in the UK and UAE. It was founded in 1997 and IPO’d in 2019.

It makes money through advertising (50%) and sales or digital transactions from its games. Revenue is 50% generated from the US, 30% from Europe, and the remaining from the rest of the world.

Its current market cap is about 158 Million PLN and because of the almost absence of debt and cash position, its enterprise value sits at 118 Million PLN.

Popularity

3 polish analysts are following the company. It is not followed outside of Poland. There are no write-ups on this company that I could find.

Share turnover is very low, at 0.05% so a very illiquid stock. This isn’t necessarily a bad thing. Available float is 15% which is low.

Ownership structure

Boombit has a strong insider ownership structure, with 28% owned by insiders and less than 1% owned by institutions. The float is low at 15% because one private and one public company each owns 25% of the company.

Past performance

Boombit has been growing but like most of the companies in the gaming industry, growth has slowed down in the last 2 years. Gross margins are about 10% at the moment. COVID bumped up their gross margins in 2020, but they have returned to their previous margins.

The table below shows revenue and free cash flow per share growth which we consider top line and real bottom line.

Revenue is declining and although FCF per share has increased between 2019 and 2022, it has taken a massive hit in 2023.

Capital allocation strategy

Almost no CAPEX has been accounted for in the past. Maybe this is due to accounting, maybe they got lucky with certain games. Only this year, CAPEX was accounted for (at 5% of invested capital) which combined with the reduced operational cash flow explains the decrease in Free Cash Flow.

Dividends have been paid to shareholders since 2021 with the current dividend yield sitting at about 9%. There were no buybacks and no acquisitions last year.

ROIC is low, a lot lower than it has been able to generate historically.

Financial strength - liquidity

The company has a rock-solid balance sheet (45 million PLN) and very low debt (1M). Their growth has increased their cash position over the last 3 years, and this cash has been managed conservatively.

Latest news

Boombit reports a strong last month of sales in December 2023 and considers a positive outlook for mobile gaming in 2024.

Verdict

The Pros

Significant FCF growth over the last years

Fortress balance sheet

Conservative cash management

The Cons

Very competitive industry

NFT’s?

Hardly any CAPEX in the past. Increased CAPEX in 2023. Where did the growth come from?

I’m putting it on my NO list for the following reasons:

It has low gross margins

Highly competitive industry

Can’t seem to find anything unique about the company: what is it doing that other gaming companies are not doing?

Involvement in blockchain projects through their office in the UAE (NFT sales). I get the general principle of the public immutable ledger that blockchain brings, but because I know nothing of NFTs, I consider this outside my circle and thus a pass.

Here’s the one-pager for Boombit S.A.

Final overview

With this, we wrap up this quick overview of the first 6 companies. I hope you’ve gained some value from this first issue of “A to Z Quick and Dirty”.

Here’s the final overview:

AMTE Power -> No-List

Aeorome Communications -> Potential Deep Dive

Answear.com -> Potential Deep Dive

B90 Holdings -> No-list

Betacom -> No-list

Boombit -> No-list

Question to you:

A one-pager should only reflect the most essential information. What should I remove or replace from the one-pager?

Any feedback is appreciated.

As always, may the markets be with you!

Kevin

Hi Kevin,

I like your approach generating Ideas described in "The 8-step AtmosInvest Investment process" and that you let inspire you from succesful investors. I also like Poland as a habitat of healthy growing companys. Other countries I like since some time are Sweden and Japan. I have some companys from those in my watchlist as well.

I already did a quick check on your unclestock-list (https://docs.google.com/spreadsheets/d/1_o5ooRjSzKbOsv5KyFkV3_Fi8DZftLPV/edit?usp=drive_link&ouid=115374332850168050035&rtpof=true&sd=true.) and

wanted to share some infos ...

Let me start with your question: What should I remove or replace from the one-pager?

I miss information about

1. "shares" and "fully diluted shares" (Small Companys often have a lot of options/warrants. For example aeorema has >9Mio shares and additionally also 1.53Mio options.)

2. Dilution (Dilution could be a big problem, Spoiler-ALERT! e.g. Brave Bison Group plc (#8 of list) grew sales in last 4yrs CAGR 23.5% and at the same time diluted by CAGR 23.6%)

From the companys you already made a onepager of, I checked closer aeorema which I put on my watchlist. I like their flexible management and expansion to US. This kind of biz (live events agency) rise and fall with their relationships to customers. From my understanding that's good and their client list has some big names.

I also made some checks on some other companys. An incredible company is IFirma. Good industry, dividend of 4% and due to capital-light still nice growth and also long runway. I am curious what you will write/think about them.

Thanks for sharing your thoughts and process!

Many Greetings,

Max