Dino Polska is accelerating!

Q4 24 Earnings Update ($DNP)

I love Dino, although it's no longer a small company.

I like its purity, its simplicity.

But simple can be powerful.

This might be the eighth or ninth earnings call I've listened to, and it’s incredibly boring. The same questions are always asked anew. But don’t get me wrong.

Boring in a good way!

But then I get this uncanny feeling, creeping towards me, and I have to think about what Charlie Munger said:

“Any year that you don’t destroy one of your best-loved ideas is probably a wasted year.”

It’s decided then.

I’ll do an updated deep dive on Dino Polska in April or May, with the intent of killing the idea. I know of some investors who don’t believe in Dino, and I’ll contact them to learn why.

If you’d like to receive that deep dive, you might consider our paid subscription offer

So, what did the earnings call and results teach us?

Dino is putting the pedal to the metal.

Let’s dive in ⬇️

Growth

Let’s take the first slide of their results and compare them with those of their main competitor: Biedronka

Biedronka is still the number 1 in Poland in total sales (98.8 Billion PLN versus 29.2 Billion PLN for Dino), but when it comes to growth, Dino beats them on every metric. I was surprised by the 26 store closures that Biedronka reported. A store closure at Dino is rare.

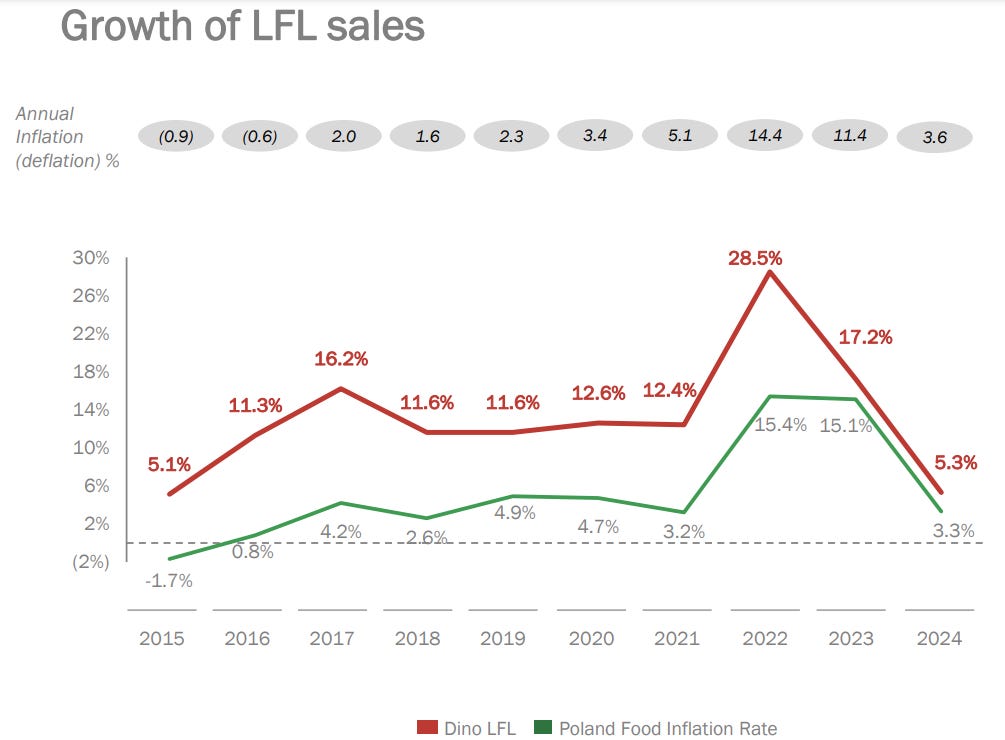

This means that sales growth has come down, but that’s not surprising, as for the first time, instead of past rapid inflation, Dino (and its competitors) have suffered several quarters of price deflation. This period is over and Dino expects inflation to resume in 2025.

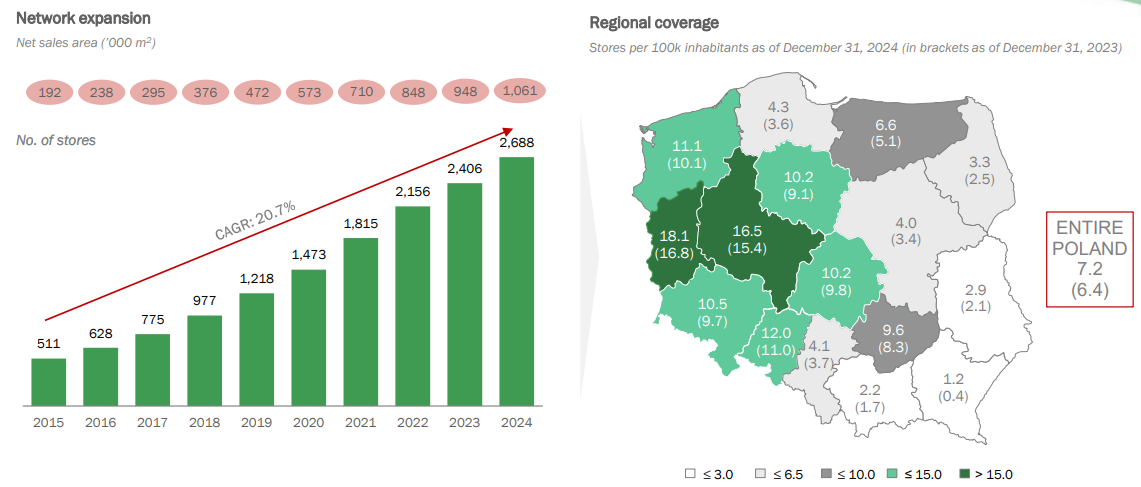

Here’s an overview of their stores’ growth and stores per 100,000 inhabitants:

One of the common metrics for a retailer is the Like for Like sales. This allows us to exclude the growth from new store openings.

Like for Like sales have gone down hard together with the drop in inflation. Here’s a chart of Biedronka which shows it happened industry-wide.

I consider this result good, and the future looks promising as we’ll discuss later on.

Margins

Dino’s EBITDA margins:

Management stated they were not happy with the current margins. They have achieved an all-time high of 10% in the past, and currently are close to 8%. They aim to recover to a value (higher than 8%, and probably below 10%).

On the one hand, you have prices coming down, but on the other hand, you’ve got wages going up. They seemed to think a stabilization and slight recovery is now in order.

Dino’s net margin hovers at 5% which is good for a big retailer. They are back at the level pre-COVID.

Capital Allocation

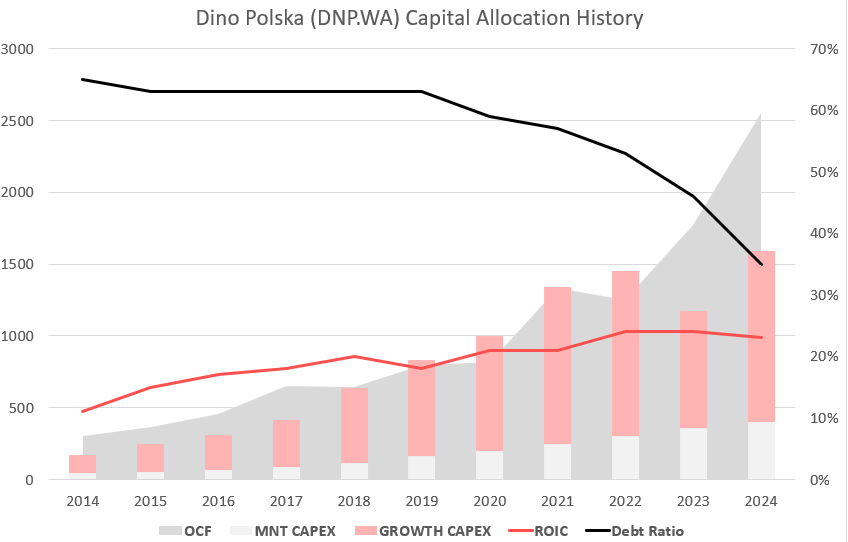

One of the most important things for Dino is the capital allocation strategy.

Here’s what the past looks like

Their operational cash flow increased by a whopping 44% due to better working capital management.

Dino finds itself in a rather new situation. Up until 2022, it reinvested everything.

A pure compounder.

In 2023, due to rapidly rising inflation and uncertainty, they decided to be prudent. They decelerated the pace of expansion with new stores and focused more on their debt reduction.

Last year, they accelerated, building more stores and increasing growth CAPEX while continuing to reduce debt. (Note: Long-term debt has decreased from about 950 M PLN to 196 M.)

So the big question was: What will Dino do in the future, as their cash flow from operations will continue to increase?

The response from management: Accelerate the number of store openings.

This is music to my ears.

Remember when we talked about capital allocation?

The possibilities they have:

Pay of debt

Pay dividends

Buy back shares

Reinvest in the business

Acquire other companies

Each store needs a catchment area of 2000-3000 people. I believe management still sees an opportunity to expand near existing locations. There is still room to increase the density of the network (and expand to the east of course).

They have explicitly stated during the earnings call:

To open more stores in 2025 vs 2024

To open more stores in 2026 vs 2025

Last year they opened 283 new stores, 2 new distribution centers, and a new meat processing plant. In 2022 they opened 344 stores. They want to get back to the level of 2022. They plan to invest 1.7B PLN in 2025.

Since permitting the land for a store can take up to 2 years, they look far ahead and have already secured the plots for 2025.

Conclusion

Dino has published results on a very strong quarter. After derisking the business by taking a step back in 2024, they are ready to speed up the engine once more.

If operational cash flow keeps increasing, there will be a time when they will not be able to reinvest everything.

Will they pay a dividend?

Will they then start to buy back shares?

Or will the owner Biernacki, conjure something else?

The market seems to like their performance, as at the time of this writing, Dino achieved an all-time high.

And to end this update, what do I mean by conjuring up things?

Biernacki, the Polish Billionaire who owns 51% of the company, is bidding to buy Starka, a Polish vodka brand.

The seller claims the value of the barrels alone would range from 12 to 160 Million euros. But that is unconfirmed.

May the markets be with you, always!

Kevin

Concerning Dino Polska. How long do you think the runways still is? I don’t want to be the person holding their stock when they announce they can’t grow that hard anymore. Do you think we’ll see similar expansion for the next 5 years?

Nice write-up. Happy to see the company is doing great. However, I’m missing a small section on the valuation? Will this be present in the deep dive?