I missed a 10-bagger in 6 months (IRR = 9900%)

I’ll make sure you don’t

I promised you I’d write about successes and mistakes. Here goes.

You’ll discover below how I missed a 10-bagger, but that doesn’t mean you had to. I have a list of my best ideas, but I generally only write about them in a full-blown article. That’s what happens when time is a scarce resource.

In August, you filled out a survey. Among the feedback, one group wants shorter insightful articles, the other group wants more company deep dives.

To make sure you’ll get the full list of my best ideas, and to cater to both groups, I’ll publish an additional weekly article starting next week called “Investing in 123”. It’ll be short, with each time 3 stock ideas I haven’t been able to dive deep into. I will always mention why I think it’s interesting. You can give it a try next week, but if it’s not for you, you can unsubscribe from “Investing in 123” separately.

Now let’s do a postmortem on that missed 10-bagger that could have delivered an IRR of 9900%!

Previously I mentioned my investing strategy, which is a yin and yang approach. Using two opposite contrasting strategies, the underfollowed microcap and known high-quality companies.

But Taoism says the yin is strongest when it has some yang in it and vice versa. The missed investment I will outlay below is that holy grail, the yin with some yang.

This is not an article I wanted to write. An error of omission doesn’t hurt as much as an error of commission, but it still hurts. I don’t care about not buying Nvidia in the past, as I never looked at the stock. But when a stock finds its way into my idea list, now that’s a different story.

The company we’ll cover today is called EZZ Life Sciences Holdings (Ticker: EZZ.AX). I’m guessing you’ve never heard of it as there are to my knowledge no write-ups available on it.

Even after a 10x run-up, it is still a microcap.

The goal of this analysis is 2-fold:

What can we learn to improve our investing process?

Is this run-up just the start or is there more juice left in the can?

What does EZZ do?

EZZ was founded in 2018 and IPO’ed on the Australian Stock Exchange in 2021 with a market cap of 38M USD.

Welcome to nano cap territory (<50M USD).

Here are the current metrics:

EZZ Life Sciences Holdings (EZZ)

Market Cap: 132M USD

5-year revenue CAGR: 43%

Gross Margins = 76%

EV/EBIT = 18

No debt

EZZ started as an exclusive wholesale distributor of skin care products under the EAORON brand to pharmacies, supermarkets, and retailers in Australia and abroad. Here’s an example of the products sold:

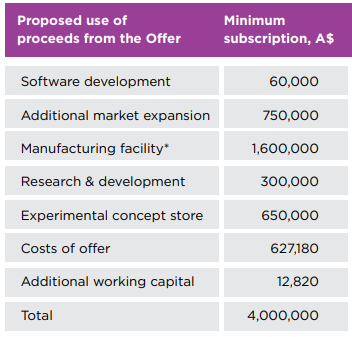

The proceeds from the IPO would be used to expand their distribution but more importantly to increase manufacturing efficiency and branding for their in-house developed consumer health products called EZZ. This distinction is important as it strengthens their business model. For EAORON, they are a middleman. Here are the 3 products on offer at that time:

The number of SKUs has since increased from 8 to over 50. For EZZ, they aim to build out vertical integration with a focus on direct-to-consumer sales.

Here’s some basic metrics from the income statement pre-IPO:

The overview of the use of proceeds of the capital raise:

Selling skincare and consumer health products, you can imagine this being a very competitive market. Although there are regulations, there are very few barriers to entry. And remember, we are in nanocap land where MOATS are rarely seen.

At the time of the IPO, it had no debt, it had solid revenue growth, but very low gross margins. The company was profitable, but it had customer concentration risk.

What did we see 6 months ago?

This company appeared on my radar when I used screens to find high-quality microcaps. I wrote about the company in my investing journal on the 12th of March 2024. Here’s what I had written down:

Found EZZ by using Uncle Stock screener. Quality metrics for such a small company. Skincare products… yikes. I would prefer a microcap that does not pay dividends. Add it to the review list.

I did a quick check of their website to take a first look at the company. The company seemed legit but didn’t look super exciting. It stuck in my journal up until last week.

On the 12th of March, this is what price chart I was looking at:

My conclusions back then:

Big price drop after IPO

The company is paying regular dividends

The current price has dropped below the 200-day moving average

The FCF Yield at the time stood at 20%

First mistake: I probably only took 30 seconds to review the company and file it away into my idea list without looking at more fundamentals.

Second mistake: I do not like a microcap that is paying dividends (dogma)

What happened?

Let’s first look at past sales. They increased the number of SKUS, especially for their EZZ products which have higher margins. Revenue exploded.

Sales for EAORON are steadily declining. It’ll make more sense when we look at where the sales are coming from:

The direct-to-consumer e-commerce sales from China went through the roof. They are now expanding towards the United States. We’re seeing 100% sales growth rates for fiscal years 2023 and 2024.

Let’s go towards the bottom line.

Gross margins increased:

Net income grew:

And the balance sheet, well they never had any debt, so here’s their cash position:

In other words, this company has been firing on all cylinders over the last 24 months. And if we had looked deeper into the fundamentals in March of this year we would have seen:

150% growth in revenue quarter over quarter

170% growth in net income quarter over quarter

no debt and increasing cash balance

trading at an FCF Yield of 20%

When you see something like this, the only question that remains: Is this a one-off? Did they sell something, have a 1-time deal, some kind of asset sales, or anything that could cause a jump like this? In retrospect, it was pure operational performance.

How to explain the low valuation?

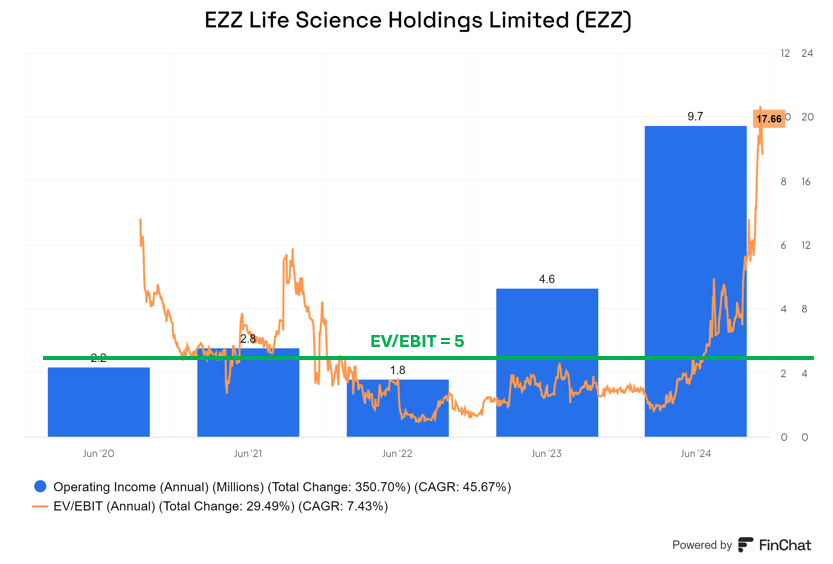

In the chart below, you can see the increase in EBIT versus the price of the company expressed in EV/EBIT. The price being depressed in 2022 seems normal as sales were down. I imagine there were worries about the economy in China and whether their expansion into this area would pay off.

However, the annual report was published at the end of September 2023. So the market had all the information. Still, the price stayed depressed.

The price increase started in April 2024 once the quarterly results were published and with growth rates in the triple-digit percentages.

Hypotheses of why this opportunity existed between September 2023 and April 2024 (or further, it traded at an EV/EBIT of 5 in June, 2 months after the quarterly results)

Low float

Very illiquid

Only retail investors

I can only think of 2 reasons why the valuation was so depressed:

Very few people were looking

Those who were considered the results of 2023 unsustainable

If you know the company and have other ideas, please leave a comment below.

Lessons learned

There is significant hindsight bias going on. Who knows what would have happened if I had bought the company in March? If we had looked deeper, the only information we had was a fast-growing nanocap trading at an FCF Yield of 20%. That’s an investment with very low downside risk.

Here’s the lessons learned to reinforce my investing process

When the FCF Yield is higher than your hurdle rate, take a minimum of 10 minutes to look at the annual and quarterly fundamentals.

Watch out for dogma. I was not prepared for the fact that a quality screen for microcaps would work. (to be honest, EZZ was the only company on that list that was trading so cheaply)

Prioritize inside the idea funnel: My idea funnel is a combination of following investors I admire, and my own research. EZZ was a company I discovered by myself. There were no write-ups available. -> Always prioritize your ideas above others especially if nobody has ever written about the company yet

Momentum alerts: I was completely unaware of the price action going on. Maybe, if I was aware that momentum was building I would have taken a deeper look. (This does not mean I would have bought in) Set price alerts, even if after the first 5-minute look you dismiss the company

And the future?

At the moment, the price action for EZZ is 100% driven by retail investors. Remember what we wrote about Paul Andreola’s discovery cycle.

Based on this cycle, this would mean if the company keeps performing, the best is yet to come, and when the company grows, and the “smart money” can come in, the stock could go a lot higher.

However, institutions would only consider it if,

The market cap grows beyond 3-400 MUSD

The float and liquidity increase

The current float sits at 25% and the insider ownership is a whopping 73%. I would expect, given the price increase, that insiders would start taking some profits.

This is still an illiquid stock. The average daily volume sits at 130k USD.

The company is scheduled to start selling its products in the United States. They are growing their potential market. It’s not impossible that their revenue will keep growing in the coming 2 years at a rate above 50%.

The biggest problem: At an EV/EBIT of 18 the margin of safety has been significantly reduced. The current FCF Yield sits at 3%.

Let’s go back to where shareholder returns come from:

EPS growth

P/E multiple change

Dividend or buyback yield

From the current price, your shareholder returns have to come from EPS growth alone. Maybe the company will increase its dividends, but at the moment, the dividend yield sits at 0.2%. It seems more reasonable that EZZ would invest in their manufacturing capacity if demand stays strong.

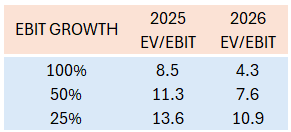

If we only look at EBIT growth, we can create the following view for the next 2 years:

The scenario where the EBIT growth is only 25% might be accompanied by a multiple contraction. So returns would be worse.

Our absolute minimum hurdle: Can the company with a high probability, double in the next 5 years? (= 15% CAGR).

It might double, but the probability at the moment doesn’t seem high enough because of the reduced margin of safety.

Final decision: I’m going to wait and monitor the company. My gut says the current margin of safety is not sufficient to get a high probability 15% return. I’ll do some more work on the company in the coming weeks and try to contact management to get an idea about their supply capabilities.

Maybe this will be the second mistake of omission I make, who knows 🙂 I might have to write a postmortem of this postmortem (very inception-like).

Let me know if these multi-bagger breakdowns are interesting!

May the markets be with you, always!

Kevin

I don't know. There is always going to be companies that we can't predict. I think this is one of them. Skin care? Why are these products selling like hotcakes? That is what I want to know. Is it a fad in China more than quality products that will appeal universally? I can hear your frustration here. But this is more gamble than insight. Nothing wrong with a small gamble either. It might be a huge winner, and if it is you want to ride it. But currently my watchlist of star studded companies has become larger than my cash kitty. I have more ideas than cash. The problem isn't ideas at this juncture in the market. The problem is valuation of the whole damn market. No margin of safety there either. Why else is Warren selling stocks like Apple, and BOA like they are suddenly lepers? I am fine sitting here on the sidelines with 40% of my money in stocks,funds etc.. Patience, patience, patience. The world will serve you on a silver platter if you wait long enough. Ted Williams, the only player ever to hit 400, did so because he was super selective about the pitches he would swing at. I am going to let a few strikes go by and probably become a little frustrated that the ball isn't coming to me when I am ready for it. I know the game. The game is cycles. Markets will be at your beckon call before long.

Kevin, as always I find your articles very insightful, one should always learn from his mistakes. I looked into Cava a year, I found valuation too high and still share price doubled, sometimes the market follows the story and not the essentials