If Constellation Software and SAP had an Italian child...

A serial acquiring multibagger machine?

The company we are going to cover today shares the same traits as Constellation Software and SAP, but remains largely unknown due to its small size and short presence in the public markets.

This company is led by the second generation of the founder, who to this day remains involved in the company.

It has recurring revenues that make up to 70% of total revenues, with clients who rely heavily on its solutions, with high switching costs, and high barriers to entry.

The business has low capital Intensity and benefits from low net working capital thanks to the payment structure.

Revenue has recently reaccelerated as the company put a higher emphasis on M&A as part of its strategy shift.

They operate almost exclusively in one of Europe’s most attractive Markets for small private companies, where trust and who you are as a buyer tend to be more valued than what you pay.

What makes serial acquirers such an attractive business model for multi-bagger returns?

Programmatic serial acquirers have structural advantages over other companies. It starts with the high optionality through the high deployability of capital in new deals, which then later can fund the next deals and so on. Another advantage is that a higher number of smaller acquisitions tends to diversify the risk, with the additional advantage of often having to pay lower valuations since, for most big players, they are too small to meaningfully impact the top or bottom line.

Serial acquirers, as they grow, solve the reinvestment problem.

Most businesses cannot keep compounding as they grow. If they are shareholder-friendly, they will give capital back through dividends or buybacks.

A serial acquirer, as long as it keeps finding opportunities, can keep on compounding capital.

Even with the latest drawdown, you would have compounded your capital at a 20% CAGR if you had bought Constellation Software a decade ago.

No wonder Christopher Mayer, author of 100-baggers is a fan of serial acquirers.

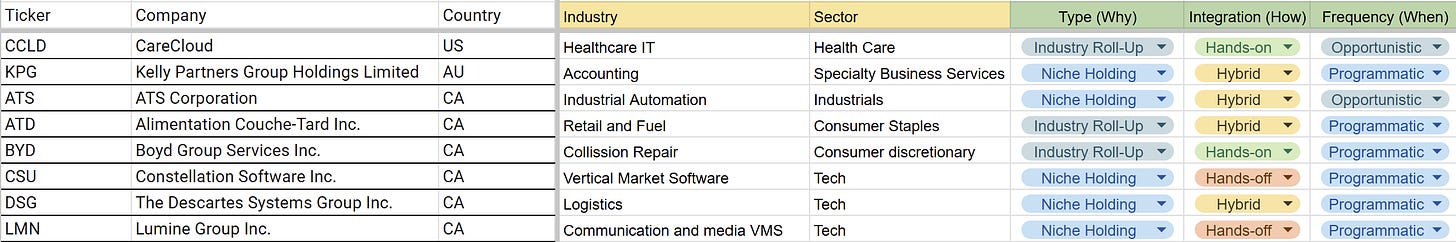

So we’re building a serial acquirer database.

Here’s a glimpse.

The database will hold our own classification and financial metrics to easily compare the companies between them.

But let’s first take a look at a lesser-known market opportunity.

The market opportunity

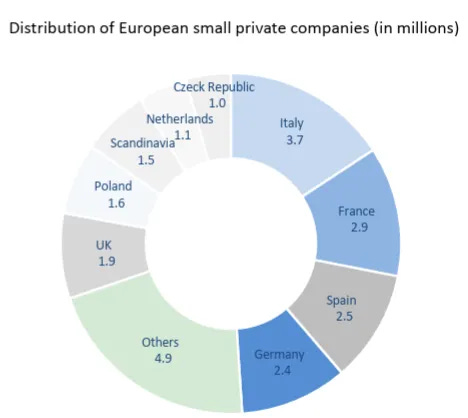

In the article from REQ Capital: “A Deep Dive into Shareholder Value Creation by Acquisition-Driven Compounders” they state that in Europe, 99.8% of all companies are small and medium-sized enterprises with fewer than 250 employees. This concludes a total of 23.5 million companies. Of those 23.5 million companies, 94% are “independent,” meaning large corporations do not control them. Families and founders own these companies. In Europe, around 15,000 companies change owners each year. The acquirers range from large corporations or private equity firms to acquisition-driven compounders. The country distribution of SMEs in Europe is as follows (in millions of companies):

Italy is one of the largest manufacturing countries in Europe, with many family businesses being around for almost a century. What makes Italy’s business culture stand out is the cultural importance of close personal business relationships, which is why acquirers must have a local presence in Italy. It’s not surprising that this huge potential doesn’t go unnoticed. Swedish Serial Acquirers like Lifco and Addtech are doing an increased number of their new deals in the Italian market.

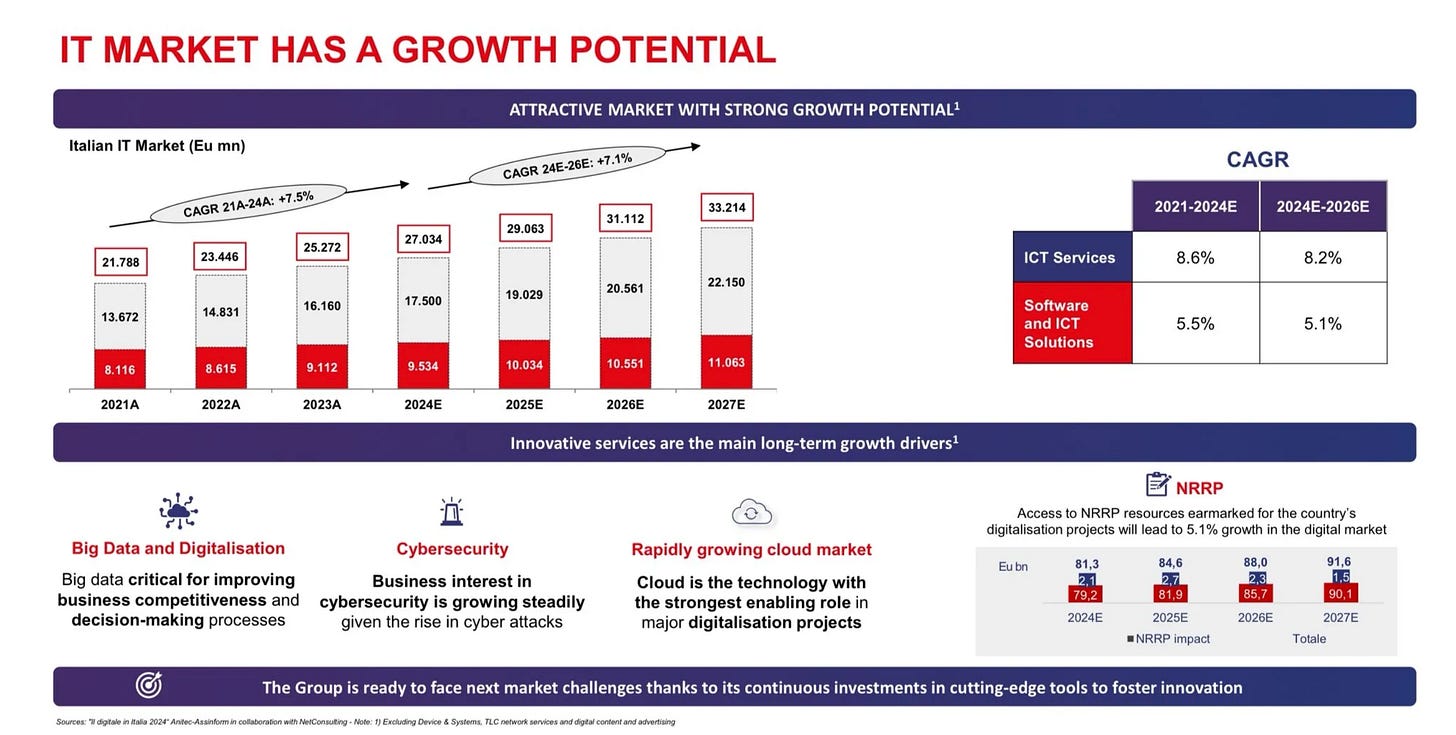

According to the “Il digitale in Italia 2024”, a report which covers the trends in the Italian IT sector, the market is supposed to grow around 7% p.a. in the foreseeable future. This increase in demand comes from the government initiative NRRP (National Recovery and Resilience Plan) and industry tailwinds and long-term drivers such as Big Data and Digitalisation, Cybersecurity and the further migration to the cloud.

The only question left to answer is how can we participate to capture some of that market opportunity?

Here’s how ⬇️