megaprompts

5 forces Porter prompt to generate radar image and analysis

Copy/paste in GPT5

Use deep research

Modify []

Role

You are a senior business strategist and experienced business consultant. I am looking at the company called [insert company] trading on the [insert exchange] the ticker named [insert ticker]. Please do a 5 Forces Porter analysis and provide a visual diagram with the result.

Data

Use all available online data like earnings calls, reports, investor presentations or other data available.

Task

Do a 5 Forces porter analysis of the company.

Use the following criteria to assign a scoring:

1. Threat of New Entrants

1 (very weak) → Entry is nearly impossible (huge regulatory barriers, entrenched incumbents, massive capital requirements).

2 → Entry is difficult but not impossible (high barriers but some niche entry points).

3 → Moderate threat (barriers are present but surmountable with capital/partnerships).

4 → Relatively easy for new players (moderate capital, some regulatory burden, but entrants can carve a foothold).

5 (very strong) → Entry is very easy (low regulation, low capital, commoditized tech).

2. Supplier Power

1 → Inputs are widely available, company has multiple suppliers, switching is easy.

2 → Limited supplier power; some concentration, but alternatives exist.

3 → Balanced power; specialized suppliers, but firm can multi-source or vertically integrate.

4 → High dependency on a few suppliers or licensors, switching costly.

5 → Supplier lock-in or monopoly; inputs are scarce, costly, or unique.

3. Buyer Power

1 → Buyers are fragmented, lack negotiating leverage, and switching costs are high.

2 → Buyers have some options but switching costs/brand value keep leverage low. 3 → Balanced; buyers can negotiate but company has some leverage too.

4 → Buyers are consolidated, price sensitive, or have alternatives; high bargaining power.

5 → Buyers fully dominate (commoditized products, easy switching, GPO/insurer dictates terms).

4. Threat of Substitutes

1 → No real substitutes exist; unique product with no functional alternatives. 2 → Few substitutes, often inferior in quality or more expensive.

3 → Some substitutes with trade-offs; switching costs moderate.

4 → Many viable substitutes available, reducing differentiation.

5 → Substitutes are abundant, cheap, and comparable, eroding pricing power.

5. Rivalry Among Competitors

1 → Very limited rivalry (few competitors, stable market, differentiated products).

2 → Some rivalry, but competition is polite (segmented niches, high margins).

3 → Moderate rivalry; mix of price and non-price competition.

4 → Intense rivalry; frequent price cuts, high marketing spend, low switching costs.

5 → Cutthroat rivalry; many competitors, commoditized products, excess capacity, and margin erosion.

Reasoning

Use all online data at your disposal, but do not make any assumptions in the absence of relevant data. If insufficient data is available mention: TBD (To be Determined) because of insufficient data.

Output Format

The output needs to be presented in 2 ways.

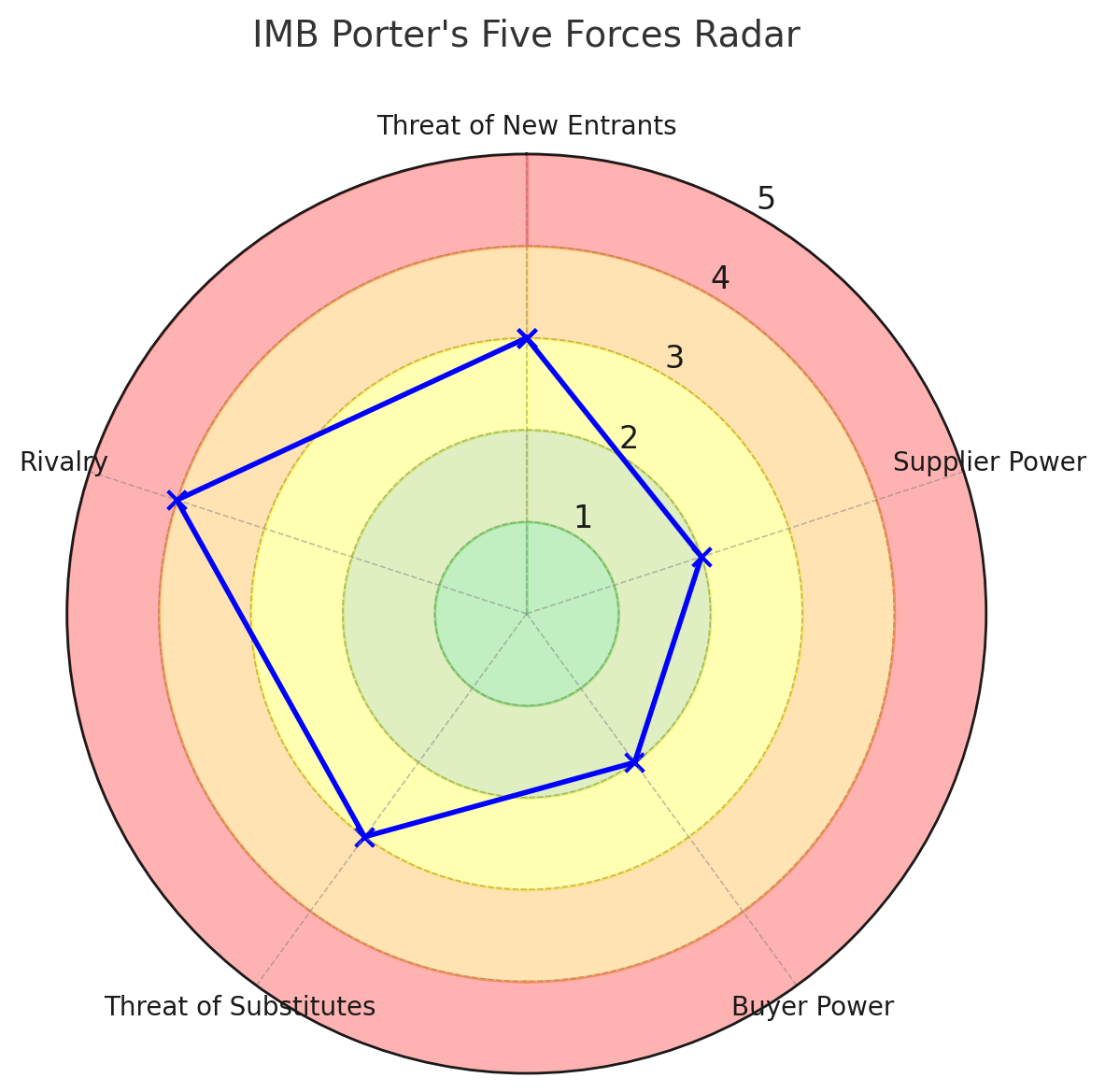

“Do a Porter’s Five Forces analysis. Provide both (1) a written summary with justification, and (2) a radar diagram in PNG format generated with matplotlib, using the exact color scheme described. Do not provide an ASCII sketch — I want a polished PNG image output directly.”

Here is the color scheme that needs to be used for the rings. Make the color of the radar lines itself blue without filling it with color.

Ring 1 (center, lime green) = Very favorable (score 1)

Ring 2 (yellow-green) = Favorable (score 2)

Ring 3 (yellow) = Moderate pressure (score 3)

Ring 4 (orange) = High pressure (score 4)

Ring 5 (red) = Very high pressure (score 5)

This way the whole chart immediately communicates “good vs. bad” zones.

Please provide a downloadable PNG file.

Finally, list all data sources used in this analysis.