Monthly Portfolio Update

Position sizing is half the game

Thanks to all of you who have filled out the survey.

I’m making lots of improvements to the newsletter.

Before diving into the portfolio, a quick shout-out to David Barbato, who runs https://value-bridge.co/

David invited me for an interview, and the video got published on his YouTube channel.

We discuss 100 Baggers of course 😉

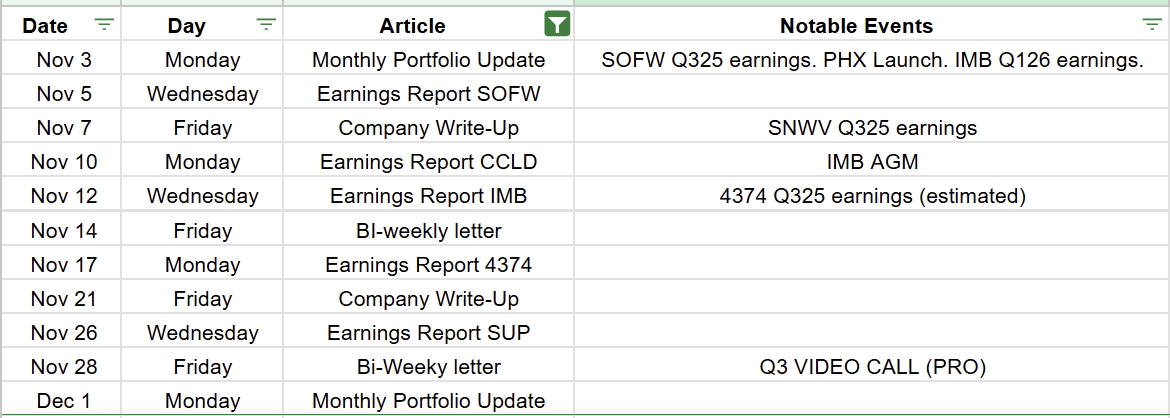

From now on, each month will start with a portfolio update. And I’ll show you exactly what is coming at the start of each month:

November will be busy!

Note: If you are a paid member, you will receive all the articles. The bi-weekly letter is 100% free.

Quick portfolio look

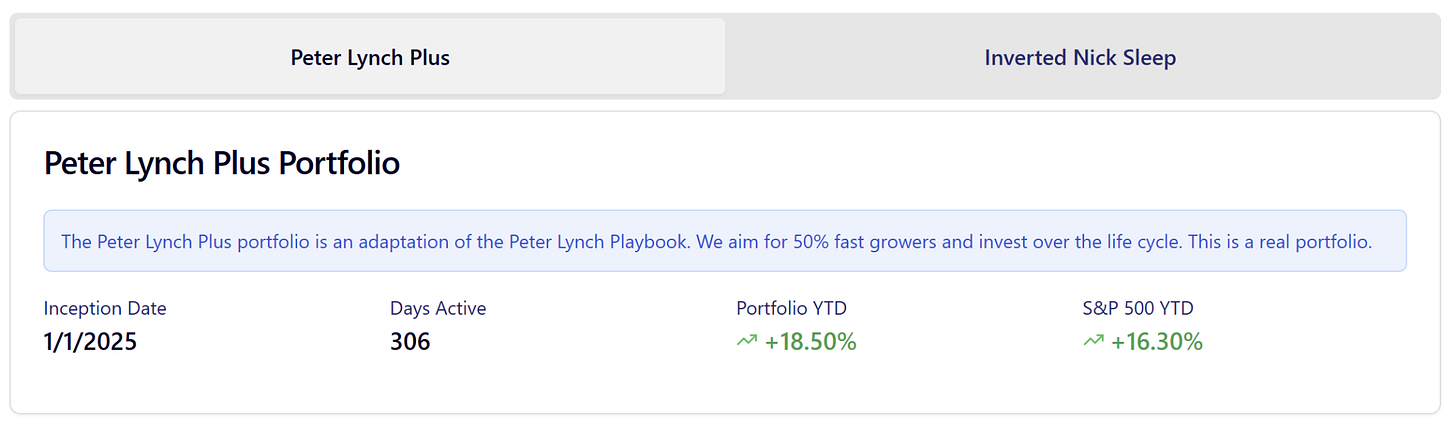

Both portfolios are beating the S&P 500 at this time. Although the recent surge for Nvidia has pushed the YTD of the S&P500 upwards 😉

The Peter Lynch Plus portfolio is still going strong, considering half of the portfolio is in cash.

As a reminder, we use the Peter Lynch “bucket” approach, with the goal of having 50% fast growers in the portfolio, complemented by some other type of investments.

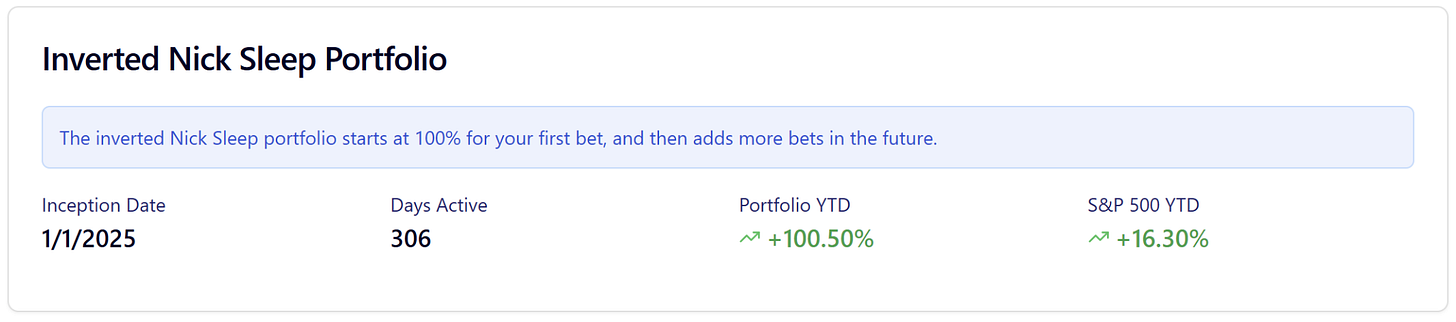

The Inverted Nick Sleep portfolio is a very concentrated portfolio. It turns traditional portfolio management upside down. One big winner drives all the returns:

Yep, that’s a 100% YTD. I do not expect that kind of performance in 2026, even with a concentrated portfolio like his!

Companies will be added to reduce the high concentration.

Let’s go through each company and see what has happened. You can check out 100baggerhunter.com if you want to easily navigate to their deep dives or earnings updates.

Pharmx Technologies(PHX)

Nothing new to report. Price action has been very volatile. It’s now up 115% over the year.

Conclusion: Thesis unchanged. The price has risen significantly over the past year. A lot of growth has been priced in. It remains a HOLD if you have a full position. If you have no position, I would rate it a BUY for the long term.

The next 12 months are crucial. Expect volatility. I do not expect a significant improvement in fundamentals over the next 2 quarters. It will take more time. But if Tom and his team can do what he said during our interview, then this company will look a lot different in 5 years than it does today.

What to look out for: New software platform to be launched on the 3rd of November. AGM on the 10th of November.

Intelligent Monitoring Group(IMB)

David Barbato released an interview with Dennison Hambling, the managing director of IMB.

Here are some takeaways:

Ambition: They outlay their TAM at $9 billion with a long-term goal to take 20 to 30% of that market. That’s about $2 billion. That’s more than ten times what they are doing today.

Focus: Surveillance service through Cameras and AI.

Growth strategy: Mainly organic with acquisitions as a supplement. They don’t want to overpay and have walked away from some targets priced > 4 times EBITDA

Supply: They have capacity left to spare, so ample room to grow

Pricing power: He believes there is pricing power as they have been able to sell results. (Camera surveillance that actually led to the apprehension of a criminal). They have tangible results and rarely have a discussion on the price.

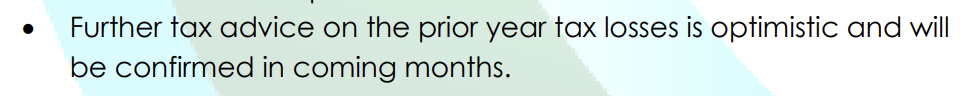

The NOLS cannot be used: The issue sits unresolved. They must seek a final ruling from the Australian Tax Office (Best to consider that they cannot be used). This issue forces them to start dividends sooner (as it will make dividends more tax efficient versus buybacks in Australia)

Note: IMB Earnings Update dropped today. I quickly glanced at it, and this caught my eye:

So I read this as, based on all the information they have at the moment, the NOLS can be used in the future.

What to look out for: They should deliver new guidance during their general meeting on the 10th of November. That guidance will be a reflection of whether they can reproduce their latest strong quarter. The full earnings update will be delivered shortly.

Conclusion: Thesis Unchanged. IMB remains an attractive investment. It’s our second-largest position in the portfolio. I am itching to ADD to it some more, but I will first do the full earnings review.

If you’d like to receive the full monthly updates, all earnings reviews, and future write-ups, please check out our offering below.