Monthly Portfolio Update (Dec 25)

Up 18% and 90%+

This is only the second portfolio update.

I don’t really need to look at the portfolios every month since we invest with a 3-5 year horizon.

But I actually like it because it forces you to think about your entire portfolio construction. In addition, instead of always looking for something new, you can ask yourself the question: Shouldn’t I add to something I really like?

During earnings updates, you re-underwrite your positions (or not). During portfolio reviews, you re-underwrite your entire portfolio.

Are you happy with the risk level?

Are you happy with the position sizing?

Now I’m not going to regurgitate everything that was written during the previous earnings updates, so I’ll keep it short.

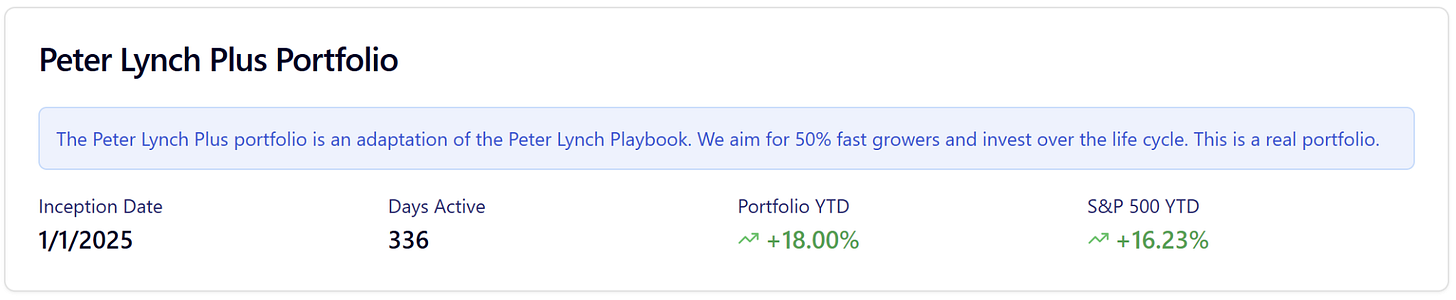

The Peter Lynch Plus portfolio

This is our variation of how Peter Lynch invested.

We want to have about 50% of the portfolio in fast growers, and the remaining in other types of bets. Turnarounds, bigger companies in a temporary downturn, and other types of situations.

We’re sitting at an 18% YTD performance, which I’m happy with for 2 reasons:

Most of this portfolio still sits in cash. We still have 50% to deploy

Of the 8 positions, half are down YTD, and I’ve recently checked my conviction in these companies. I do believe they are undervalued by the markets.

The Inverted Nick Sleep portfolio

In the Nomad Partnership letters, written by Nick Sleep when he managed his fund, he proposed a radical approach.

Instead of building a portfolio from 0, take your highest conviction bet. Buy that bet for the full portfolio. Then add bets based on conviction. Only add companies that have a moat.

So we did what Nick said:

The YTD performance of over 90% is, of course, entirely the result of a highly concentrated portfolio.

There are only 4 companies within this portfolio, and one of them accounts for 90% of the total.

Individual positions

Pharmx Technologies

Although we’ve trimmed a little this year, and I have a limit order set to trim some more, this shouldn’t be seen as a drop in conviction. We’re effectively de-risking both portfolios after the run-up in price for this company.

At a 21% position in Lynch and 90% in Sleep, even after the trim, they will remain our biggest positions.

In a nutshell:

Pharmx has a unique opportunity to become the only marketplace in the pharmacy space in Australia and New Zealand

It’s a unique situation, as when looking at other countries, these types of gateway/marketplaces are offered by the dominant wholesaler (like a mini Amazon)

I must emphasize that at this time, Pharmx has limited pricing power. To paint the picture:

Pharmx revenue: 7.3 Million AUD

Chemist Warehouse revenue: 6 Billion AUD

To frame it differently: This company should not exist. It was a happenstance, the baby of 3 POS vendors.

What happens within the market if Pharmx is down -> Pharmacies have to order their products the old way (by phone or email). Chaos. In other words, the market needs Pharmx.

Could Pharmx be bought by Chemist Warehouse? Unlikely, because that would mean Chemist would gain a significant advantage over all the other retailers. Australia is the land of the monopolies, but even this would be a bridge too far

So what’s the bet?

They can expand the market by onboarding new suppliers and offering additional value through data analytics.

They convert their business model to a volume take rate pricing fee. A retailer like Chemist already operates on thin margins. So Pharmx won’t be able to extract a 5% take rate from them. But if they can offer value and, in exchange, get a take rate of 0.3%, that’s a 10X in revenue.

In November, they launched their new iteration of the marketplace. Their latest investor update claims they’ve seen a 20% increase in usage immediately after the launch.

These are good signs. But we’re not out of the woods yet. The next 12 months hold execution risk.

Conclusion: Unchanged. Still high conviction. Price has run up ahead of fundamentals. TRIM, especially in the Inverted Nick Sleep portfolio, to make room for a new company (Deep Dive incoming).

Now let’s talk about a company I started adding to…