Our portfolio and 2 fat pitches - 30 hours left

This is unusual

Last week I published our first deep dive on a hidden monopoly.

I made a buy.

Then that company had its earnings call. The company has grown stronger.

So I added to the position.

Yesterday, I made a new purchase in yet another company (next deep dive).

This is unusual.

Fat pitches come along rarely, but now they seem to come at once. I’ll do my best to publish the write-up soon. But I do not expect to be able to discover these kinds of situations every month!

Let’s take a look at the current portfolio and how I plan to handle portfolio construction.

Surprise: I’m introducing a second portfolio, you’ll quickly learn why ⬇️

Only 7 spots left out of 50 to get the current discount. The below link will be active for the coming 30 hours.

Placing a bet

First off, as explained in a previous post, each bet has a downside risk and an upside potential. They both have a probability of occurrence. Check out our previous post on the topic:

Placing a bet means answering the following questions:

Does the bet have a high probability of meeting my hurdle rate?

Is it better than what I already have? (if no cash is available, and you need to sell something to buy a new position)

Since we’re starting a portfolio from scratch, the second question has less weight.

This does not determine the size of the bet.

Stan Druckenmiller (one of the GOATS) was mentored by George Soros (both Billionaire investors). For the same positions, Stan achieved a better return than George, because of better position sizing.

For Stan, if you feel you have a big edge, you go for the jugular.

Sizing is 70% to 80% of the equation. Part of the equation is seeing the investment, part of the investment is seeing myself in a good trading rhythm. It’s not whether you’re right or wrong, it’s how much you make when you’re right and how much you lose when you’re wrong

- Stan Druckenmiller

But Stan sits in a league of his own.

Position sizing is personal. It depends on risk tolerance, willingness to take risks, the number of stocks you want to track in your portfolio, and your attitude toward volatility.

Let’s take a look at the guidelines I use for the portfolio ⬇️

Sizing the bet

This assumes I’ve decided to place my bets and I believe of have a good probability of meeting my hurdle rate.

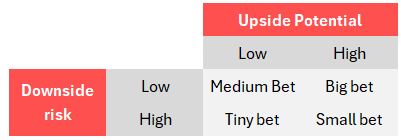

I place bets based on the difference between the downside risk and the upside potential:

Low downside risk | High potential → Bet Big

Low downside risk | Low potential → Medium

High downside risk | High potential → Small bet

High downside risk | Low potential → Tiny bet

This last one normally does not occur, but I’ve added them for completeness.

However, there is a process to position sizing. We never place Big bets all at once!

Building bets

When I do my first due diligence on a company and my gut tells me it might be an interesting prospect, I will take an initial position of 1%.

➡️Invest then investigate

Then, based on more research, if my conviction increases, and if the risk-reward profile is good, I will increase gradually to the position sizing outlined above.

The only exceptions are speculative bets. These are 1% max. I can only have a max of 5 of them in the portfolio, but it allows me to “ride a wave” if I see one.

Since we want to build a portfolio of about 15 positions, the guidelines I use are:

Starter positions: 1-3%

Speculative bet: 1%

Core positions: 5-15%

Let’s take a quick look at the current portfolio and the new one