Our second-best bet, up 50% this year

Earnings Update Q2 2025

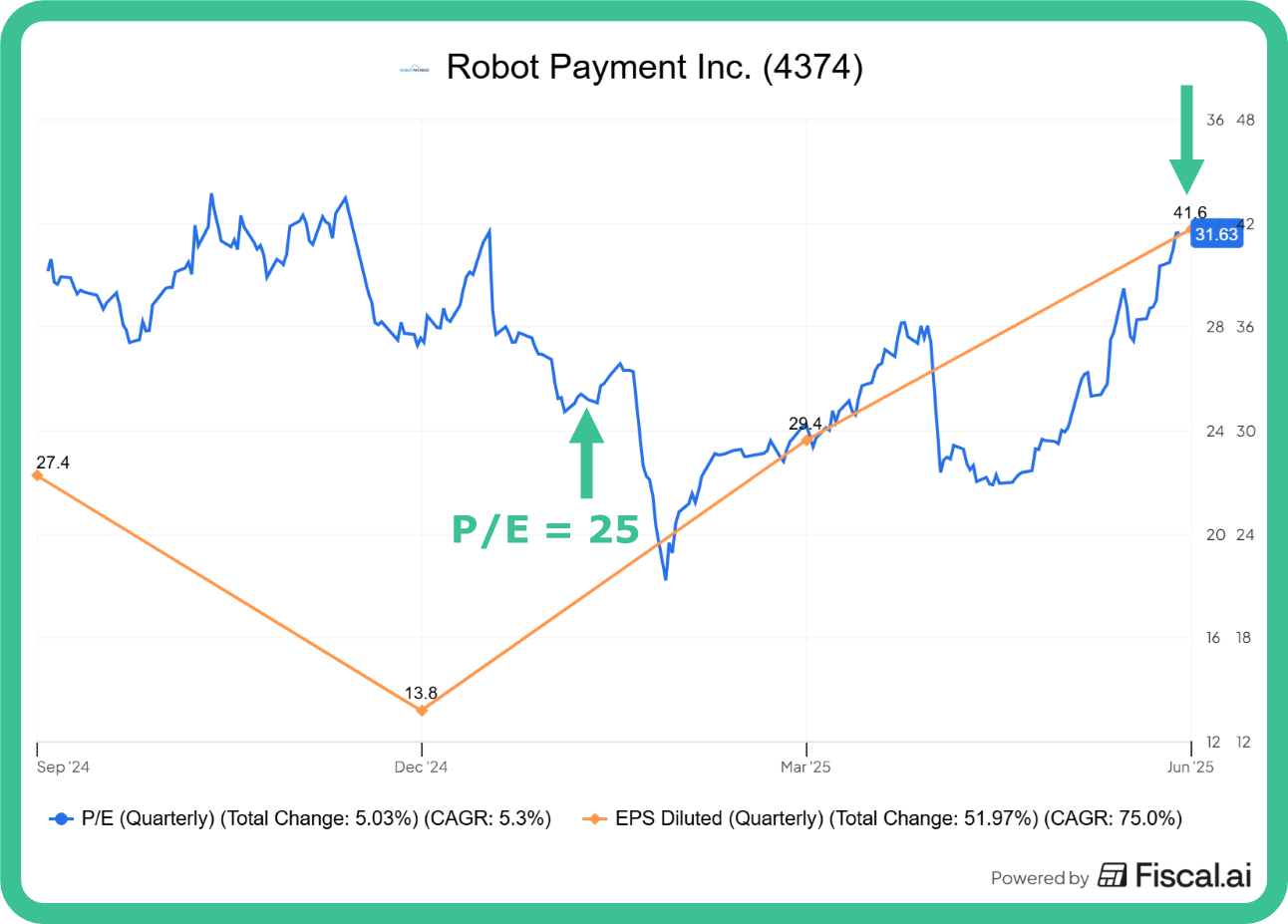

So we are up more than 50% on this position, a lot quicker than I initially imagined, as we got in at a pretty high P/E. (25)

We’re talking about Robot Payment, our favorite Japanese payment processor. You can read the full deep dive here.

Let’s first read the market.

What was the cause of the price increase?

From Q1 to Q2:

EPS increased by 29.4 to 41.6, meaning a 41% increase

P/E went from 24 to 25.9, meaning an 8% increase

Immediately following the Q2 update, the price actually went down.

Since the Q2 update on the 12th of August, however, the price of the stock has steadily gone up, and the company is now trading at a P/E of 31.6.

That's not based only on past fundamentals.

That’s based on increasing future expectations by the market.

I don’t mind a multiple expansion, but an expansion by 40% in such a short period of time is either unsustainable or the company has to play catch-up by increasing EPS at the same rate.

Now, historically, a 32 P/E for Robot Payment, and this may be surprising, is still low. Now we know from our deep dive into P/E ratios that comparing to historical P/E’s only makes sense if it’s the same business.

➡️ It’s the future earnings potential that matters.

And over the last 2 years, they have dramatically increased their operating and net income. You need to take that into account.

Imagine they increase their EPS by another 50% over the next year, then their current forward P/E would be 21.

So why have market expectations risen over the last couple of weeks?

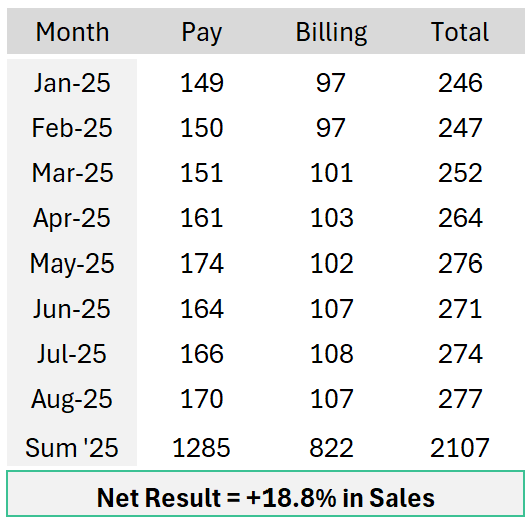

First, let’s take a look at the monthly sales numbers:

Both business lines keep on growing with a current 18.8% increase in revenue compared to exactly 1 year ago.

Other information:

September 4th: Highest increase in employee participation in the stock options plan (could be seen as a sign of confidence by the market)

September 10th: A New CTO office that established to conduct “New research for how to use AI” for efficiency and business

That does not explain the price increase.

However, the overall market in Japan saw a sharp increase. It seems there is some “Risk-On appetite” with the Nikkei increasing almost 5% since the start of September.

I believe that this overall market sentiment, in combination with:

The operational leverage this business is showing

The possible pricing power it commands

Explains the increase in multiple over the last month.

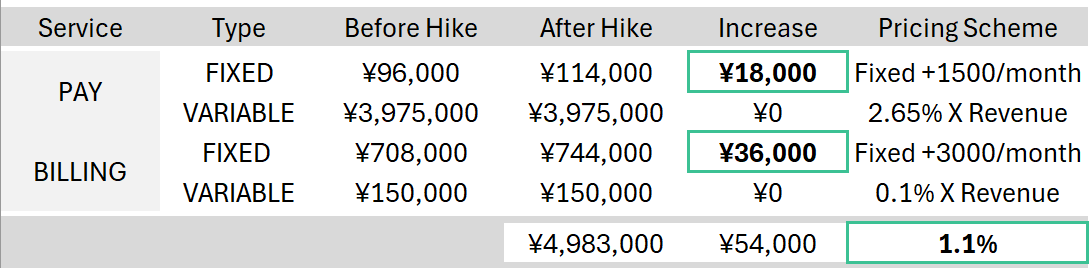

Now, investor relations mentioned a price hike in July.

Do we smell the sweet aroma of pricing power in the distance?

Let’s see⬇️

Wait, what pricing power?

The best thing that can happen as a partial owner of a business is that you see the business increase prices towards its customers, and then nobody leaves.

They just pay up.

Now, your typical monopoly will try to hide these price hikes as much as possible. They’re not going to advertise it too much. They don’t want the regulator to notice.

Robot is not a monopoly.

In addition, it seems to be the most transparent public Japanese company I have ever owned (maybe they communicate too much?)

So what happened?

Remember that their pricing scheme looks like this:

➡️Fixed platform fee + volume-based fee

Now, let’s take a hypothetical Online Subscription Service that sells $1 million per year.

How will their costs change due to the price hike?

That’s a 1.1% increase. And you can see what will happen.

It’s the smaller businesses that will see the biggest increase in price. The larger businesses will hardly feel it.

So, real pricing power?

The answer is: A little.

The hike, I believe, is too modest to be able to talk about true pricing power.

If they want to demonstrate true pricing power, they need to increase the 2.65% variable fee.

I just want to emphasize that this 2.65% is what the merchant pays; several costs will be subtracted from this. The actual take rate for Robot Payment is about 0.78% which is calculated by dividing revenue by GMV.

Now let’s get deeper into the weeds and use a typical Clint Eastwood approach to see if we want to buy, sell, or hold.

➡️The Good, The Bad, and The Ugly…