Hidden serial acquirer up 125% in 6 months

Multibagger in the making

First, a quick reminder.

After all the writing we did about “How to use AI in investing”, we’re putting our money where our mouth is, and are building an “Invest with GPT-5” course which will include:

Over 15 videos

A prompt library

And custom GPTs

A waitlist is open for early bird perks and an exclusive behind-the-scenes look.

You can join by clicking on the image below:

I’ve written a bit about the AI boom, and the data infrastructure plays at work.

And it seems that large capital investments are needed to build everything. The problem might not be demand. It’s the financing. And once demand dwindles…

In other words, I see the upside, but I also see the downside. And I prefer investments that show a much clearer asymmetry.

But the company we’re digging into today has none of that.

It needs capex to grow, but…

It’s already bringing in cash from operations

And after a tumultuous past, it’s in a prime position to grow

Meet CareCloud

A serial acquirer you probably never heard of.

Company Snapshot

Company: CareCloud

Ticker: CCLD

Exchange: NASDAQ

Industry: Health Care IT

Market Cap: $136 M

Founding year: 1999

Gross Margins: 46%

FCF margins: 19%

Guidance for 2025: $118 M (7% growth)

How does the business make money?

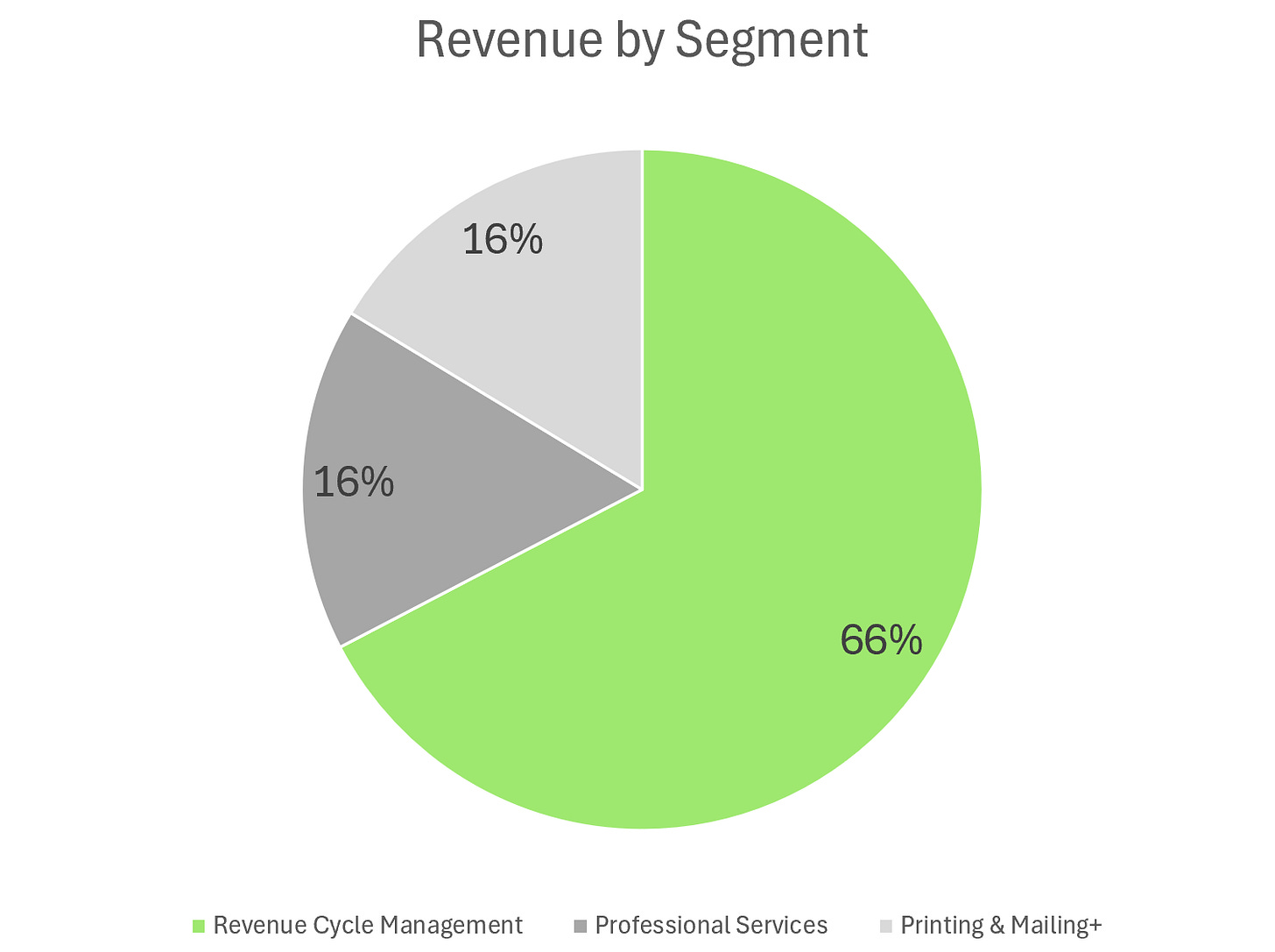

Here’s the breakdown based on their 2024 sales segments:

The main sales channel is what is called Revenue Cycle Management.

To illustrate this, meet Dr. Greene, who runs a small clinic.

She uses CareCloud’s EHR (Electronic Health Records) to chart visits and CareCloud’s RCM (Revenue Cycle Management) team to send bills to insurance.

In a week, Dr. Greene’s clinic collects $10,000 from insurers/patients.

CareCloud’s RCM fee is, say, 3% (illustrative) → $300 to CareCloud, $9,700 to the clinic. https://www.businessnewsdaily.com/carecloud-review.html

If Dr. Greene didn’t buy full RCM, she’d instead pay a monthly software subscription for EHR/PM.

If she wants extra help (e.g., training or a special integration), that’s a professional services project.

If she joins CareCloud’s vaccine buying program, CareCloud earns small group purchasing fees from suppliers.

If the clinic asks CareCloud to print & mail statements, that’s a per-print fee.

Now, we’ll keep it simple and only focus on the Revenue Cycle Management, as this is where the bulk of the money is coming from.

Basically, CareCloud ensures the doctor gets paid for their services and removes the hassle of having to deal with the insurers, which can get complex as there are many different billing codes to be handled.

You know we like this type of company.

A large money flow where a company takes a tiny fraction. ✅

The lay of the land

The RCM/Medical billing market is very fragmented.

In this market, CareCloud can be considered small to mid-sized.

You’ve got the Juggernaughts like R1 RCM, Waystar, Conifer/Ensemble, with, for example, R1 RCM reporting 2.4 billion USD in revenue in 2024.

Some reports claim about 2000+ companies in the space.

Even the biggest players don’t have a dominant market share. Waystar, which did about 1 billion USD, claims to have 4% market share in all the hospitals in the US.

But this is not a fixed-size market.

It is growing.

An aging population means more patients.

Prices continue to increase.

More patients X higher prices = more money to be collected.

The market also grows with increasing complexity. More billing codes. More denials from insurers, etc.

And increasing complexity also leads to more outsourcing. Some hospitals might have their own RCM department. But there is a trend to outsource this service to specialists.

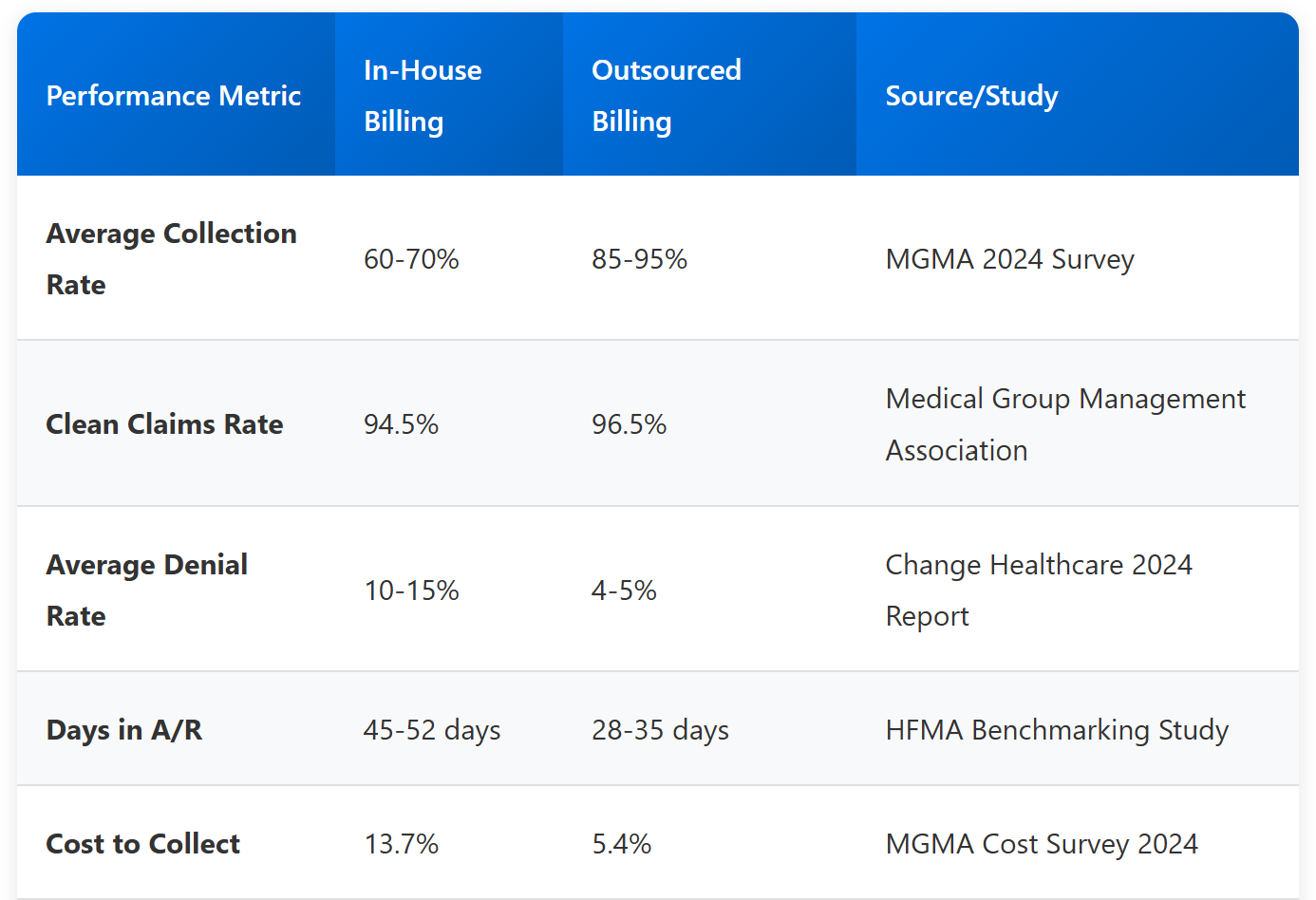

This article argues that outsourcing is a lot cheaper. ⬇️

The Opportunity

A troubled history

The best serial acquirers:

Buy companies with their internally generated cash flow

Buy companies while raising equity at high multiples, and buy companies at low multiples

Or use some mix with debt

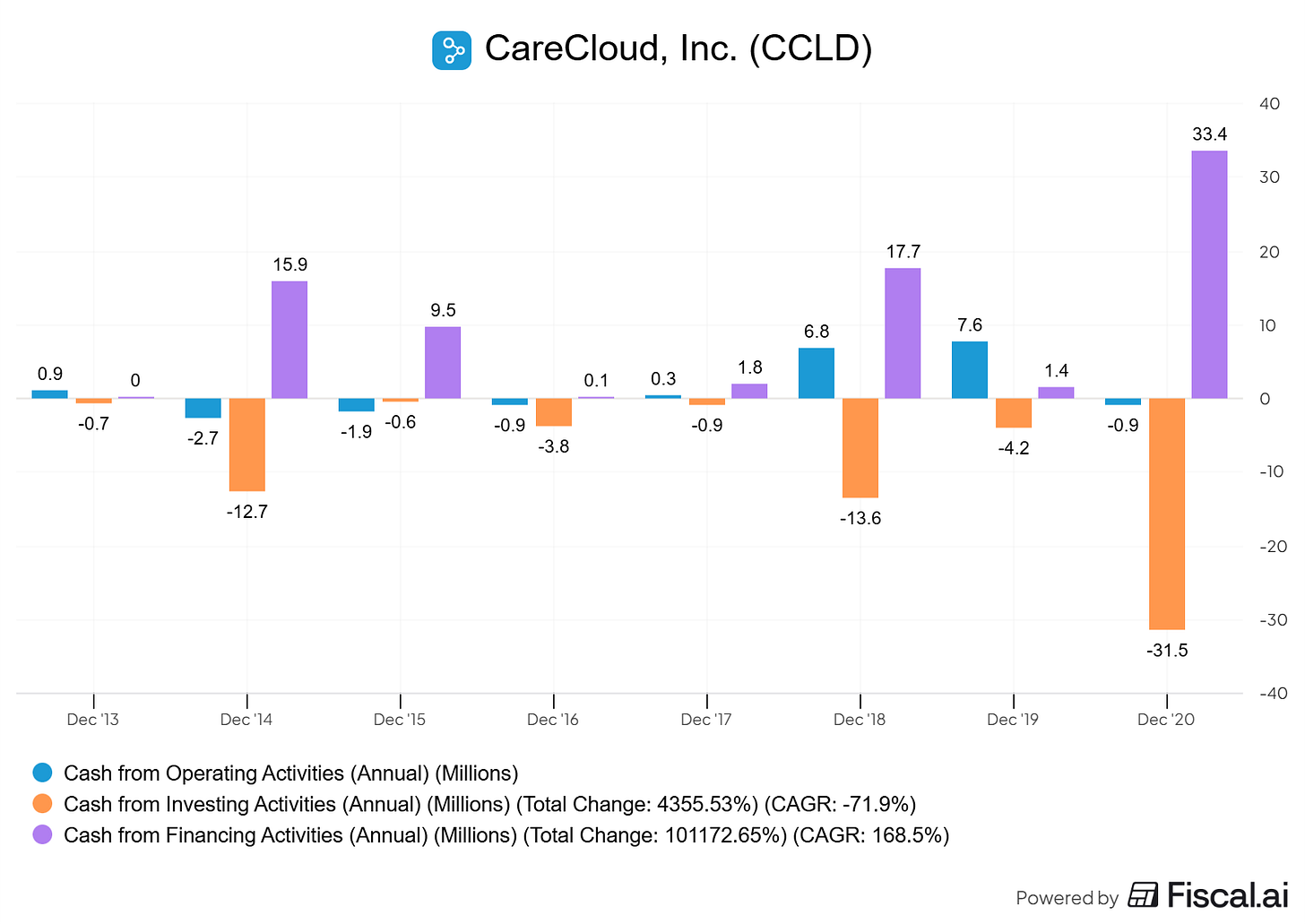

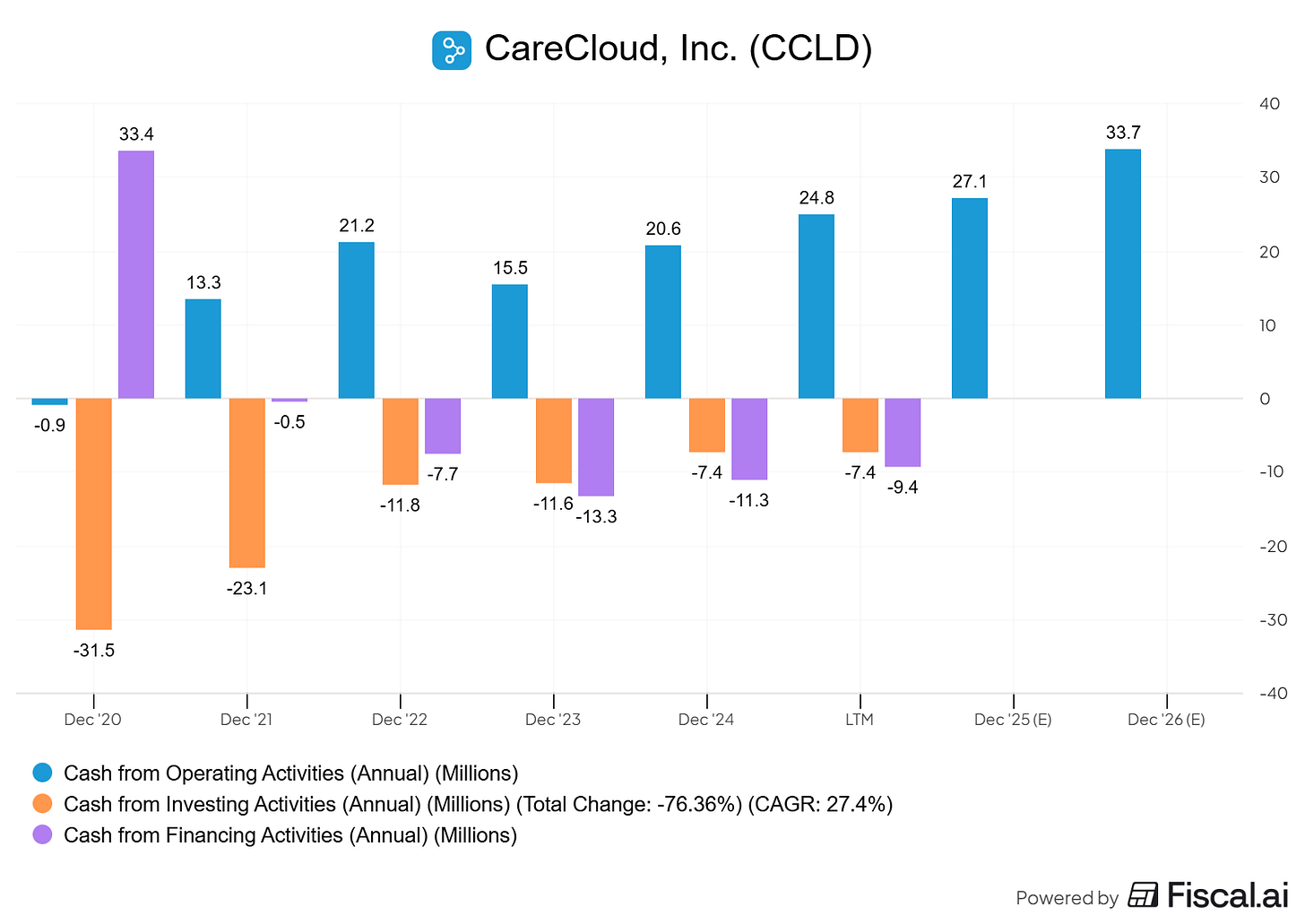

This is the cash flows before the new CEO, Mr. A. Hadi Chaudhry, took the helm in 2021.

What we want to see is a lot of blue. Meaning, a lot of operational cash flow coming in.

But as you can see, that’s not the case. Every time they invested and acquired a new company, they loaded up on debt (preferred shares to be specific).

Now, let me show you the situation after 2020 (I left 2020 for reference)

That’s exactly what you want to see. High operational cash flow that can be used for further growth.

Poised for future growth

The very best serial acquirers buy businesses and improve them.

And a hospital that has an RCM hardly ever switches. It’s a pain to do so. But since there are a lot of smaller RCM companies out there (2,000), there are plenty of opportunities for a great serial acquirer.

Since they now pay fewer dividends on the preferred shares, they have extra cash to reinvest. Here’s their dividend payments in the past:

2022: $15.3

2023: $14.3

2024: $0 (board decision)

2025: $5.3

They have the tech, they have more cash. In a fragmented RCM market, this company has a bright future.

And of course, they are jumping into the AI frenzy. But I’m going to disregard that at this point.

So, although the past looks bad, and the future looks promising, is this company a BUY or not?

In the end, it’s all about valuation ⬇️