The n°1 stock pitch from Omaha

Not what you might expect

Omaha was amazing.

I’ve never been to a place where so many like-minded people flock together. Never underestimate the power of passionate people who are all obsessed with stock investing.

I’ve met fund managers, private investors, and capital allocators and heard a lot of stock pitches.

The best one I heard, you can discover at the end of this article. You can scroll down if you’re not interested in all this Omaha stuff 😉

If you’re thinking about going to the Woodstock of capitalism next year, here are 7 tips for you.

1. Traveling

If you’re coming from outside the US, consider doing a layover or staying longer to do some sightseeing. We did a 24h layover in Chicago, and I was blown away by how beautiful the city is.

2. Community

Join a community: Happiness is shared. I went with a lot of my country mates. Some of them are heavy hitters you probably know, like Sam from Valuing Dutchman, Kris from Potential Multibaggers and Pieter Compounding Quality.

But I would recommend joining an investment community like Good Investing Plus (I get nothing out of this, no affiliate). Tilman is a great guy and runs more than 20+ events during the Berkshire week. These allow you to meet lots of new people and discuss stocks. Tilman has written the most extensive practical guide on the Berkshire Hathaway meeting out there.

3. Events

Subscribe to some free events like the Vitaly breakfast organized by the great Vitaliy Katsenelson or the Markel Brunch on Sunday.

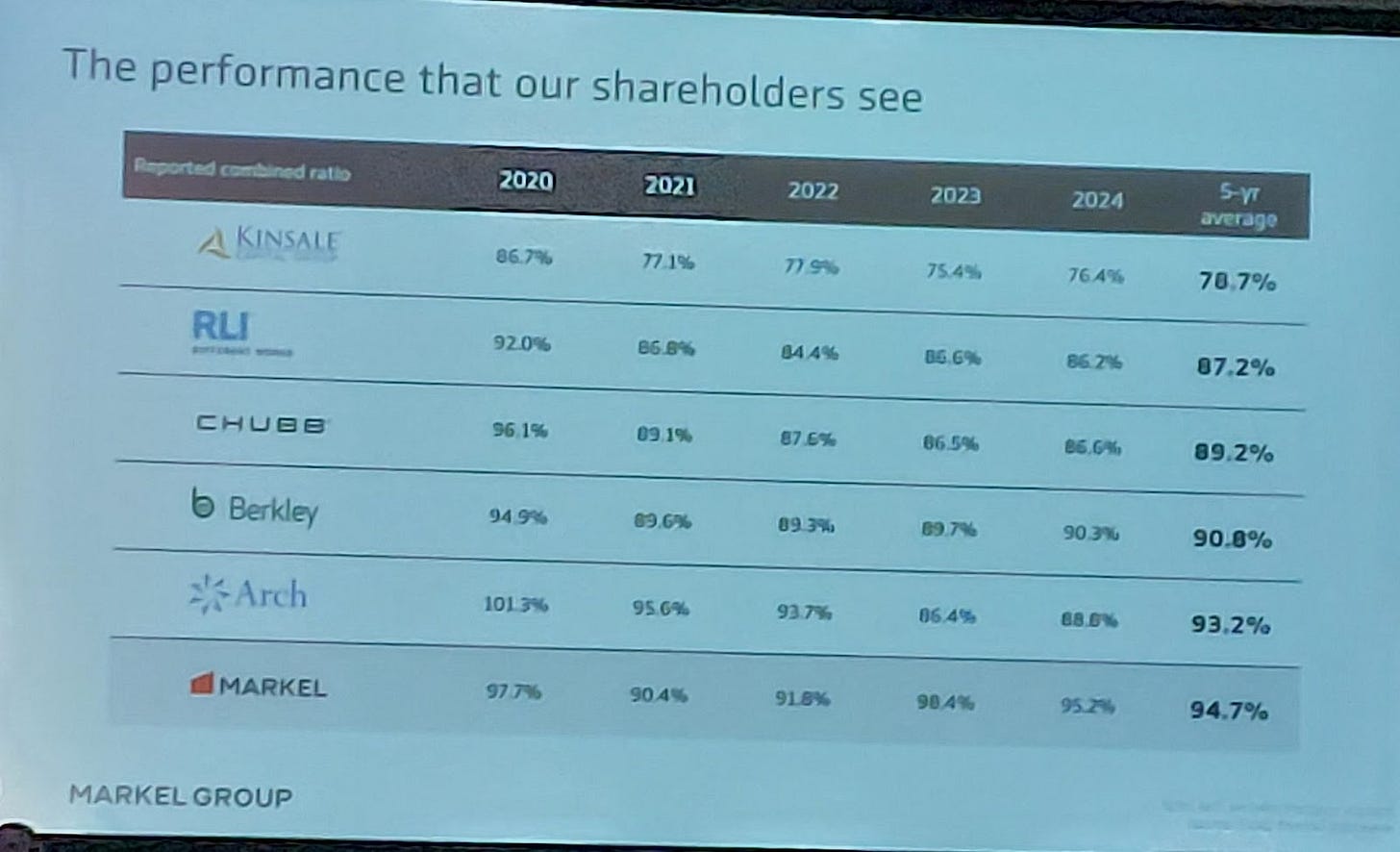

I didn’t know Markel that well, but the presentation (and the food) were excellent. Markel is like a tiny Berkshire, with an insurance company at the center that produces float that can be reinvested by the Markel Group. I greatly appreciated the honesty, as their insurance branch has been struggling in the past. They have shared the below slide, which shows the combined ratio of their competitors, with Kinsale Capital having the highest ratio of the lot. That’s a class act when talking to your shareholders and should be music to the ears of any of you holding Kinsale Capital (Ticker: KINS)

Intermezzo: If you’ve never studied an insurance company before, the combined ratio is one of the most important metrics to keep track of.

In insurance, the combined ratio is a key metric used to assess an insurer's profitability. It's calculated by dividing the total of incurred losses and expenses by the total earned premiums. Essentially, it reflects how much money an insurer is spending on claims and operations relative to the revenue it generates from premiums4. The AGM

Go to the AGM and just talk to random people. I met several people from Europe and the US while queuing. You’ll never know who you’ll bump into. There are some pretty famous people waiting in line. (not Bill Gates or Tim Cook, they have VIP access, but famous investors like Guy Spier, you might be able to meet (if you start queuing at 4 AM)

5. Ask a question

Try to sneak in a question into the AGM. I sent my question beforehand to Becky Quick from NBC and I also added my question to the local lottery. There are 10 “question stations” at the AGM, and questions go from Becky to one of the stations sequentially. However, I sat on the wrong side of the CHI center. I sat at station 8, and stations 1 to 5 were able to ask 2 questions. So to increase your odds, make sure you’re sitting in sections 118 - 122 on that side of the CHI health center. Becky will only ask “serious questions". If you want to get a more light-hearted question in, like the one I wrote, you’ll need to try the lottery system.

My question:

And of course a picture from the AGM, about 20,000 people having a great time!

6. Book signings

Get your favorite book signed. I’ve had the pleasure to shortly meet up with Brett Gardner and Alex Morris from TSOH Investment Research. Two incredibly kind people. As usual, I forgot my copies of both books at my Airbnb, but hey, if you’re smarter than me, you can get them signed!

7. Ticketing

Final tip: I ordered my tickets on eBay. There are other methods, but it took 35 days of international shipping before arriving at my doorstep (Omaha to Belgium). So if you plan to go there, make sure you order them early. (you can also get them in Omaha, but you might have to wait in line)

What about the Berkshire meeting?

You can find this thread I made on X, which summarizes it.

I’ve been a happy shareholder since 2020 when I bought Berkshire shares at 176 USD (they are trading at 513 USD). After the COVID crash, it seemed like a steal to me to be able to do some sidecar investing with the best capital allocator known to man.

If you don’t believe me, here is his track record to show it.

And bear in mind that this is the track record since Berkshire Hathaway's existence. We know from his period before Berkshire that his annual CAGR was even higher. ⬇️

From 1957 to 1969, he had a 31% CAGR.

These were the times where he was able to invest in smaller companies.

The future going forward?

There is no doubt in my mind that Greg Abel is a fantastic capital allocator. But as Buffett mentioned, size is the enemy of great returns. Berkshire now has a market capitalization of 1.1 trillion. But with more than 300 billion USD in cash, they are ready for new opportunities.

Greg lacks the charisma and humor of a Warren Buffett. I will still be going to Omaha next year and secretly hope that Buffett will make a 1 or 2-hour appearance during the AGM.

One can dream.

I’ve heard a lot of stock pitches in Omaha, but there was one in particular that stood out. Always keen to discover Lynch-type fast growers that display some kind of a moat, I believe this company has both.

Let’s talk mussels.