TOP 2 "Lynch" fast growers to buy

Time to lock and load

In a previous article, we dove back into Pharma, and through that analysis, I stumbled upon Cipher once more.

Cipher Pharmaceuticals (Ticker CPH) probably has one of the best business models in the industry in that they don’t need to do a lot of R&D. They buy a license for the pharmaceutical product and distribute the medicines. Especially if the medicine's success has already been proven in another country, you get a low-CapEx, high-margin business. They also outsource manufacturing.

It has been generating positive free cash flow for some time now.

And to top that off, in their latest earnings call, they consider the current share price to undervalue the company, so they have started the process of being able to repurchase shares.

You may have followed the “nail fungus” hype in the past with their partnership with Moberg (A Swedish pharma) to sell MOB-15 in Canada.

The drug was in a phase 3 trial in the US, but it did not meet its endpoint requirements. As a result, Moberg suspended the trials and refocused on the European market.

This means we need to value Cipher as if MOB-15 doesn’t exist. If one day, the trials resume and the FDA approves, it would provide additional optionality to the business case. (Note that they currently only have the rights to sell in Canada, not the US, but one can imagine that if Moberg decides to reinstate Phase 3 trials, and since Cipher now also has a US presence, it would be a logical step that the 2 companies would make a deal.)

The business in a nutshell

We already covered the business model before, which is pretty straightforward. It’s all about their portfolio and future potential. From their 2024 annual report:

In addition to these products, it also has some licensing revenues:

However, licensing revenue is decreasing, while product sales are increasing fast.

So they sold 26.7M of products in 2024, with Q4 accounting for 10.4 (The Natroba effect).

How does it fit in Lynch’s playbook?

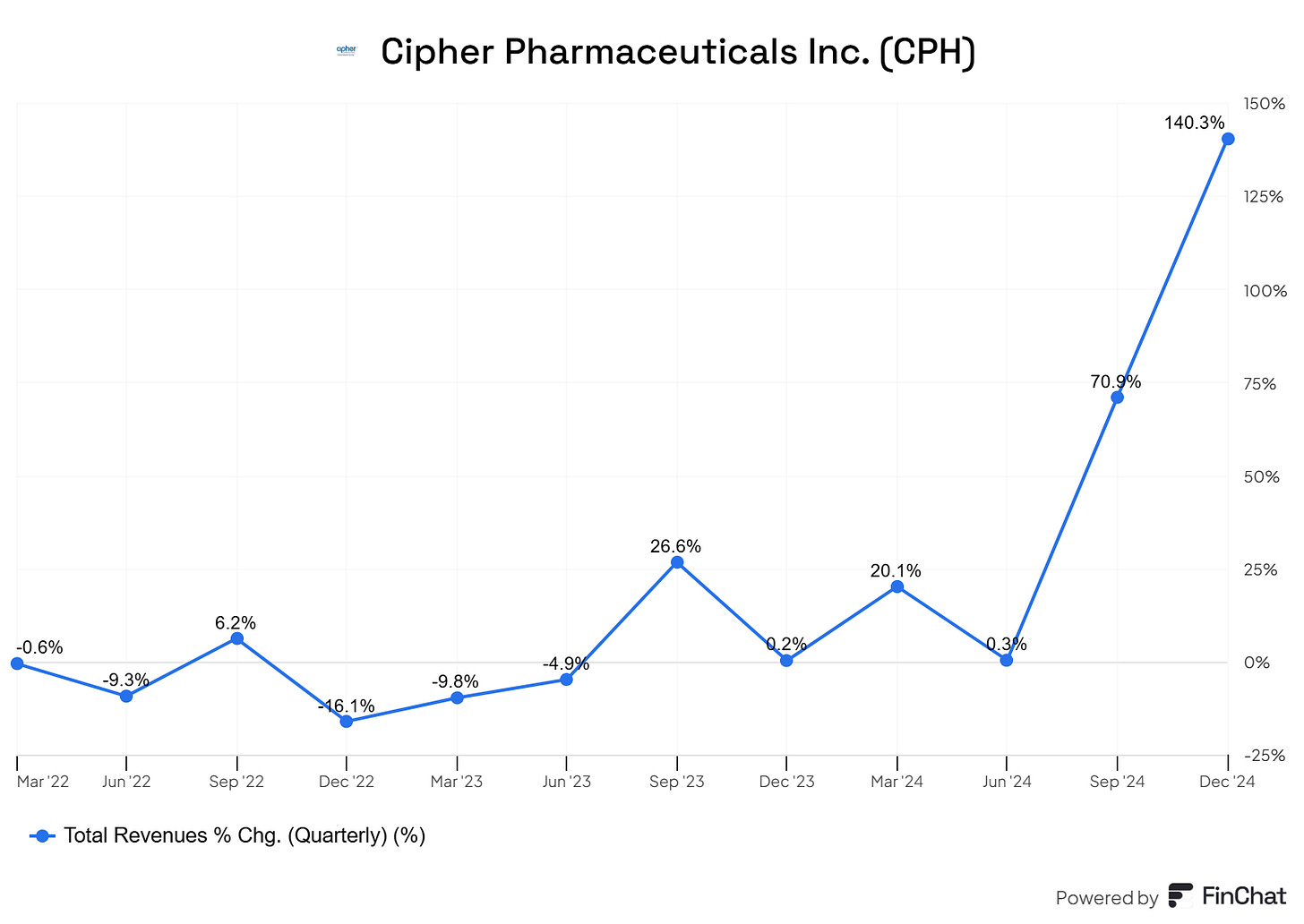

Well, it has become a super-fast grower. The chart below shows the revenue change over the past quarters.

Lynch wouldn’t make speculative bets, like a pharma company developing a cancer drug and hoping for a Hail Mary.

Cipher builds a portfolio with products that have big markets and serves them in an asset-light manner.

It’s a cash-generating machine, growing fast.

The portfolio

Let’s do a quick scan of their products, market potential, and shares:

As you can see in the table, you can imagine the disappointment of certain investors when the MOB-15 trial didn’t go through. It’s a billion-dollar market in the US. You never know if Moberg decides to have another shot at the trials.

This company has debt, but it’s generating cash, so that’s not a problem.

The quick valuation

Let’s look at the Peter Lynch chart:

Normally, Peter would be interested when the price drops below the black line. But remember, this is a fast grower. The Chart has little use in that regard.

Then Lynch looked at the PEG ratio.

According to Finchat.io, the current PEG is 0.5, which would deem it very attractive.

And based on their latest Q4 quarter and how Natroba has been received, and given their asset-light structure, I’m guessing additional free cash flow is going to be generated in 2025.

But to fuel future growth, they will need to acquire or license new products in their portfolio.

Conclusion

➡️I’m keeping it on my watchlist for the moment, but I’m going to dig deeper. An in-depth write-up will be coming in the future.

You can buy Cipher on the Canadian stock exchange or the OTC market in the US.

Now let’s get to the company I like even more. (and which I set a limit order for)