Towards a multibagger with the twin engines

Deep Dive part 1

I covered Adyen over a year ago.

And the time has come to dive deeper into many other companies.

What’s so attractive about the payment companies?

It’s the business model.

You’ve got high-gross-margin businesses generating revenue by taking a small percentage of a big money flow.

These types of businesses are usually sticky.

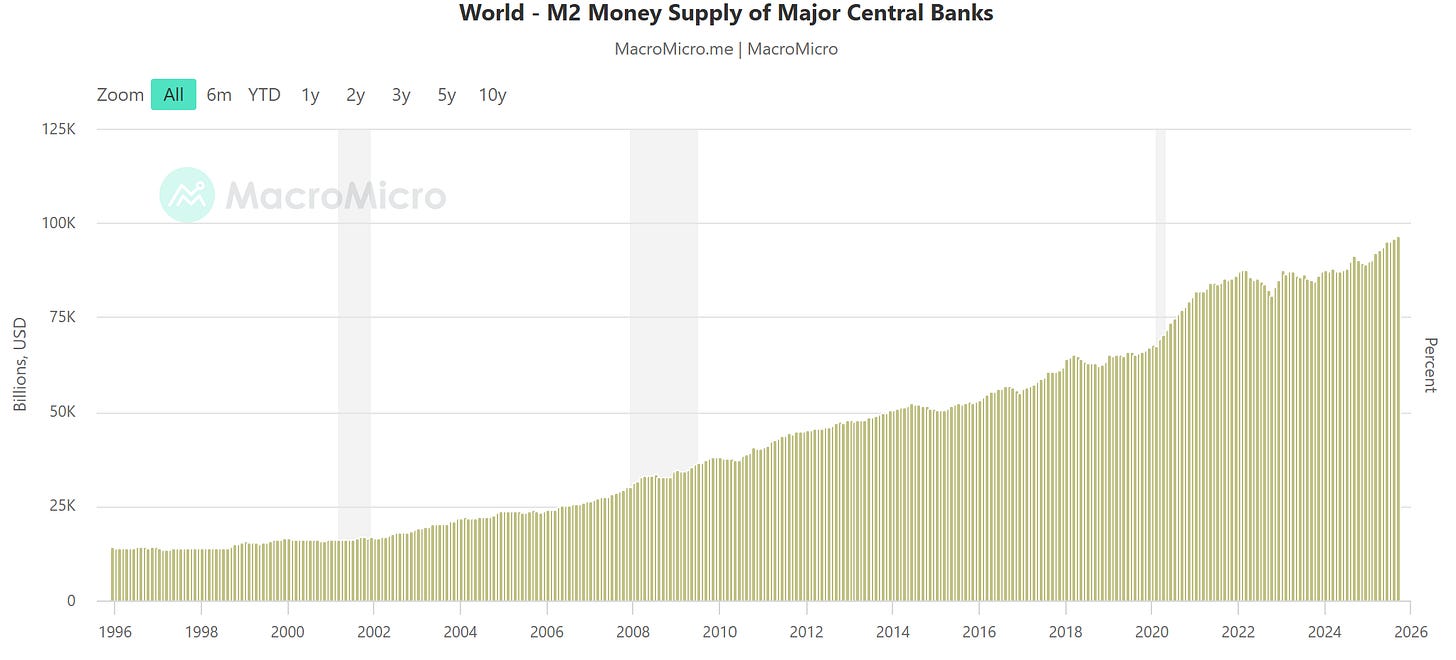

And the flow of money just keeps on increasing:

With a short explanation, if you’ve never heard of the M2 Money Supply before:

The payments sector is complex. And businesses that seem to be competitors are not. But the basic gist is always the same:

Person/Company A sends money to Person/Company B, and different businesses that facilitate this transaction get paid a fee.

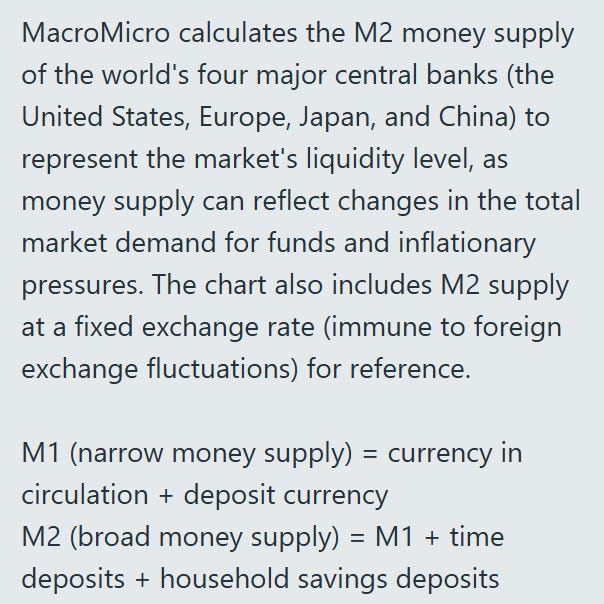

In our Adyen Deep dive, we showed this table, which paints a pretty good picture of the situation.

When you buy a pair of $100 Nikes, different parties take their cut. (although we should have used ONON instead?)

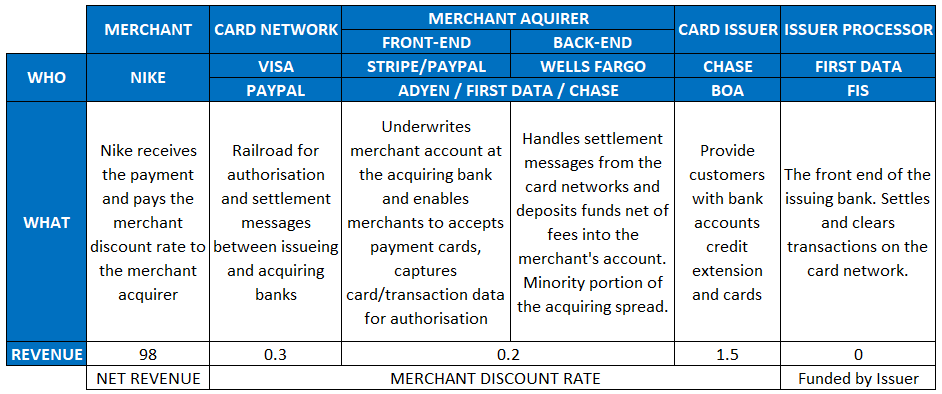

But this is a transaction between a merchant and a customer. Sometimes the sender and receiver differ.

Each company is different based on:

Who is the sender and receiver

Where it operates geographically

Where in the payment chain does it sit

When just looking at the sender and receiver, there are nuances by company:

And one other reason to go deeper is that the overall performance of the fintech sector has been slower.

This is BPAY, the iShares Fintech Active ETF, up a mere 17% since 2023

Or the Amplify Digital Payments ETF, trading with the ticker IPAY, which did even worse:

The question is, which are the best companies within this universe, and are some of them attractively priced?

Today, we’re diving deeper into a payments company that has:

Grown revenue by 37% over the last 3 years

Grown EPS by 16% over the last 3 years

Huge return on invested capital

And trades at a PEG of 0.7

If you want to read further and get our payments sector report in the coming weeks, now is the time, as during this black friday week, we offer our deepest discount yet.