3 prompts to find hidden winners

Advanced searching for opportunities

First, an announcement.

We’re building a “How to invest with GPT-5 course.”

It will include videos, a prompt library, and Custom GPTs you can use.

If you want to receive updates and more information, please join the waitlist with the button below.

In our Invest with AI series, we’ve written that you can analyze companies with GPT-5 faster.

“The person that turns over the most rocks wins the game”

Peter Lynch

Which, to me, is the biggest advantage of using these AI tools at the moment.

But can you find interesting ideas?

Typically, a stock screener can be used to look for quality or high-growth companies:

EFFICIENCY: ROIC >15%

GROWTH 3-Y Sales CAGR > 20%

PROFITABILITY: Net Margins > 10%

But you can do that with any stock screener.

And since GPT-5 is not directly connected to financial data, it is likely to perform worse in this regard. (You can force it to look for official filings, though)

So what can it do?

Let’s go over the basics first

The Repository of Knowledge

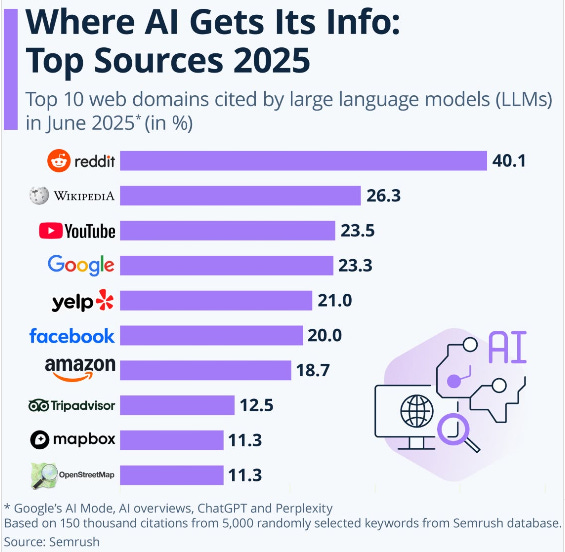

A recent article in the Wall Street Journal argues that less and less “New knowledge” is added to the overall knowledge base of the internet since the introduction of ChatGPT into the world.

People started asking and replying less on sites like Quora, and instead ask ChatGPT directly.

And where does ChatGPT get its data?

The problem stated is that the overall quality will decrease as less content is originally generated by humans.

My take ⬇️

This makes me think of the passive (index) versus the active (approach). As long as there are active investors, passive investors can profit from active price discovery.

As long as there are humans adding knowledge to the system (we can’t help ourselves), humans who use AI can profit from that knowledge.

Now, what are these language models good at?

Screening text.

Huge amounts of it.

The more context you feed it, the better.

So the “edge” of screening stocks with GPT-5 should be found in rapidly reading through a large amount of filings.

Let’s see how we as investors can exploit this superpower.

Prompt 1: Look for inflection

A company that goes from unprofitable to profitable can deliver massive returns to us as investors.

There are different setups:

Fast growers: Investing hard in growth, which makes the company currently unprofitable

Turnarounds: A ‘structural’ change is happening within the company

The fast growers you can find with traditional screeners are by looking for trends. We talked about why the direction is more important than the absolute value here.

Interesting turnarounds can be found by looking for certain “words” in the filings:

“Divestments”

“Strategic Review”

“Unprofitable business segment”

I like this last one because it’s your typical good cop, bad cop, profitable business segment, bad business segment situation.

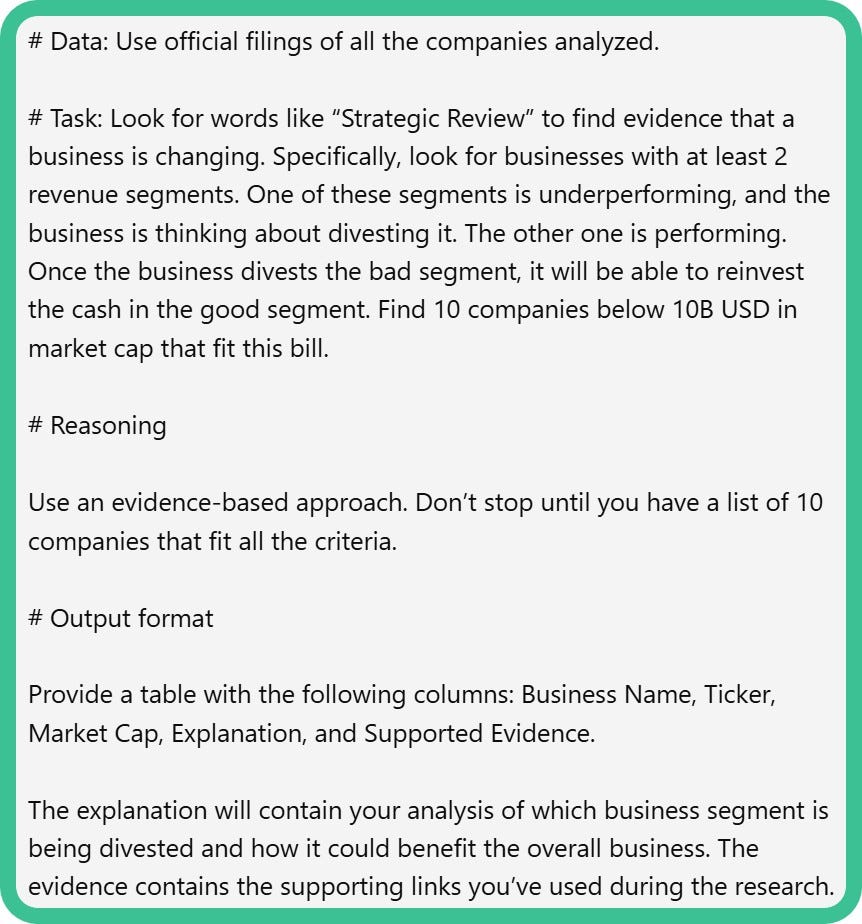

Let’s see what GPT-5 can do.

Ideally, you would want to parse all the filings and press releases daily and receive an alert when certain keywords are found.

And you can actually turn GPT-5 into a watchdog.

But it does not natively access specific data unless you tell it to.

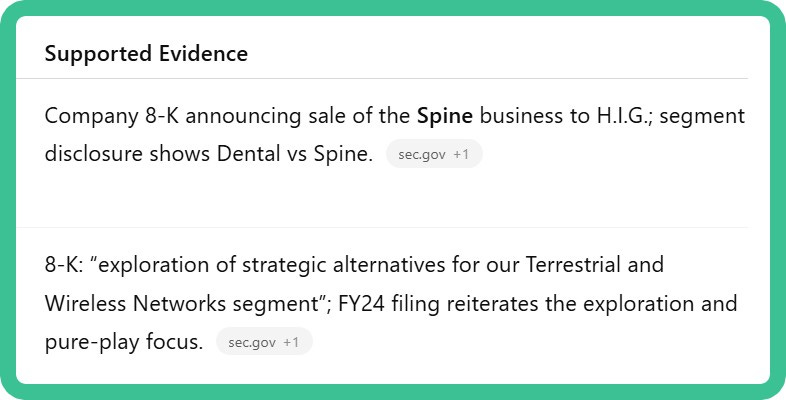

So in this example, we’ll use a prompt and ask it to go through official filings. It will browse the web for us and open 10Qs and 10Ks. And it works, you can see it in the evidence column of the result:

Click the image below to copy/paste the prompt.

And here’s the GPT link to look at the result.

Note: If you use deep research (which I recommend), it will take GPT some time, as GPT will start opening many files. Remember, you can start multiple new chats and let GPT take care of them all in parallel.

The overall result is that these companies look pretty bad (which is exactly what we wanted). And since it searches on strategic reviews, it means the board is not happy with how things are going.

Prompt 1.1: The power of semantics

You could just use Python to crawl a bunch of documents for keywords and replicate the above.

But GPT is powerful when it comes to semantics. It can “reason” by analogy.

So you can build on top of the first keywords, and ask it to look for Strategic Reviews or something similar.

You’ll often find:

Comprehensive business review

Evaluation of strategic alternatives

Exploration of options to maximize shareholder value

The last one is my favorite 😉

Adapt the prompt to include these, are tell it explicitly to look for analogies to Strategic Review

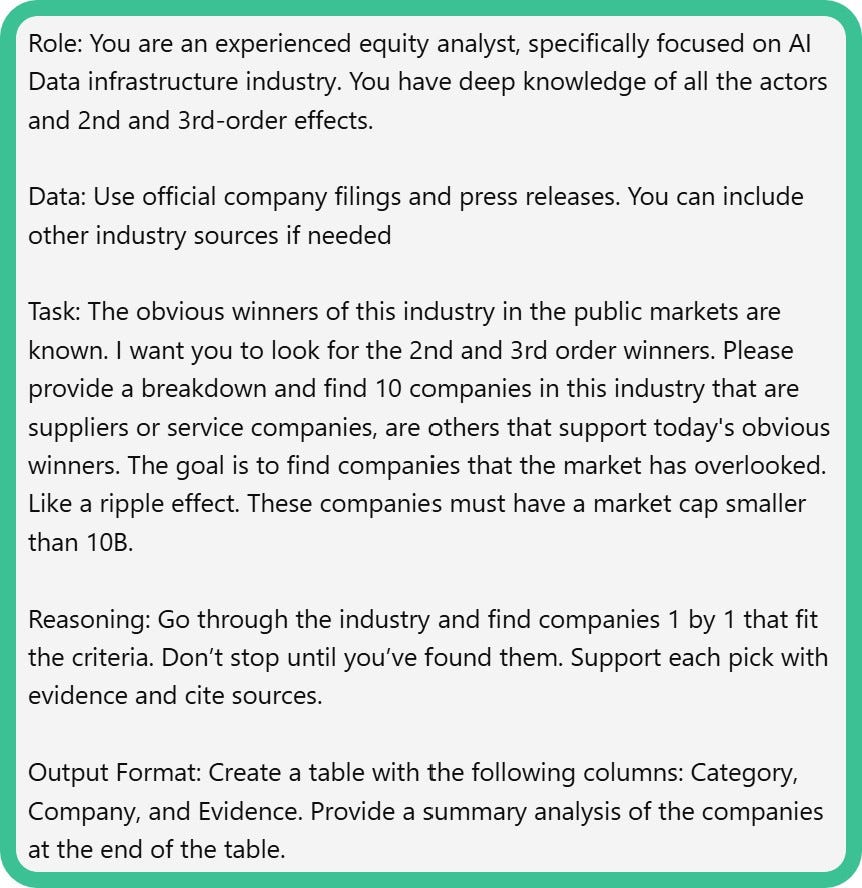

Prompt 2: Find hidden beneficiaries

Datacenters are all the hype right now, with companies becoming multibaggers in less than a year.

GPT-5 can help go deeper. And it can do this for any industry you want.

➡️What are the 2nd and 3rd order companies that will benefit from this AI Boom?

These can be service providers or other smaller companies that the market has not yet discovered. (Although in AI, that’ll be difficult, I believe, because it attracts the most eyeballs right now). If you copy and use the below prompt, try using it in another less “in the picture” industry that is still growing in the next 5 years..

Get the prompt by clicking on the picture and use the ChatGPT link to see what it uncovers.

The resulting ChatGPT table.

Conclusion

There are different ways to source ideas.

Traditional screening

Going A to Z through an exchange

An investment network where you source from

GPT-5 allows us to do a different type of screening, like a Google search on steroids.

The next level would be a Custom GPT that continuously parses and updates its search. Maybe I should build it 😉

Thanks for reading, and if you like this article, make sure to join the waitlist.

What’s next?

A company write-up!

May the markets be with you, always!

Kevin

Good read. I like the focus on inflection and second-order effects — that’s where real multibaggers hide. You’re doing solid work here, Kevin.

Every new tool expands our reach—and technology accelerates discovery.

The real edge isn’t in finding more information—it’s in asking better questions.