20 Founder-Led Companies: The one skill you need to look for!

L for Leadership

What’s the most important thing you learned from your time at Apple that you can implement at Next?

Look at how he responds.

He was special.

It’s the age-old question in investing.

Do you bet on the jockey? Or do you bet on the horse?

Or as this famous quote so eloquently frames it:

Buy a business so good, a dummy can run it because sooner or later, a dummy will run it! - Peter Lynch

In my stock analysis deep dives, I use a framework. I assess how S.P.E.C.I.A.L. a company is.

S for Sales Strength

P for Profitability

E for Endurance

C for Competitiveness

I for Industry

A for Asset Agility

L for Leadership

And we dove deep into the L for Leadership in a previous article:

Now, let’s go even deeper and look at founder-led companies.

The performance of founder-led companies

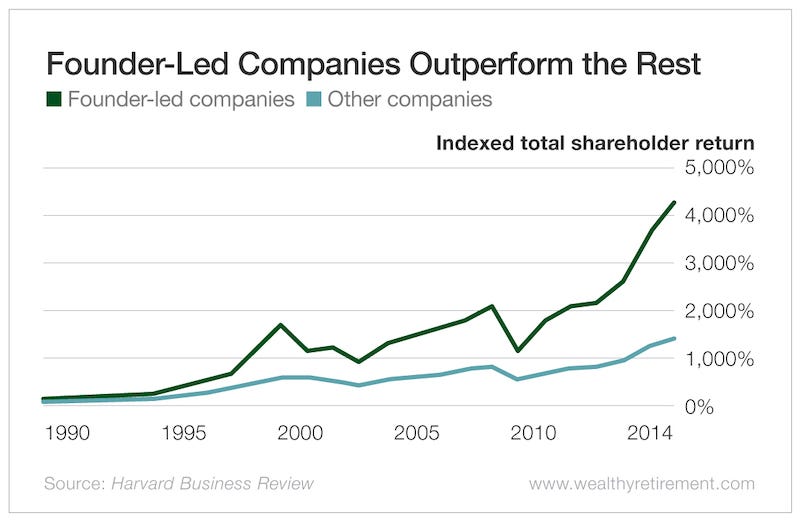

Research on this topic has been conducted. And you’ve probably seen this chart going around:

And often the conclusion is ➡️ Go buy founder-led companies for better performance

But let’s dissect what they did:

They took the data from the S&P 500 over 15 years

They selected the companies that were founder-led in those

They then compared the performance

The S&P 500 is a sample of the overall market

The founder-led companies are an even smaller sample

Is this the right conclusion?

➡️Think about the company lifecycle.

Every company is run by a founder at the start

Most of them fail in their first year

Those who succeed go from startup to young growth

They are acquired

They continue to grow

Eventually, they achieve a mature growth phase, and the reign passes over to someone else

It’s not fair to compare a 100-year-old mature company where the founder is long gone, to a software company that took 20 years to get into the S&P500 and is still led by its founder.

A better study would be comparing a cohort of companies with roughly the same age in a similar sector and comparing the companies that are still led by the founders to the companies where founders are long gone.

But such a study does not exist. And even then, there’s survivorship bias in there.

Let’s be honest.

All startups are created by founders. And most startups fail.

So is this all for nothing then?

Of course not.

As Professor Damodaran explains it, each stage of the lifecycle needs a different skillset/person.

Stage 1: Startup: Steve the Visionary: The idea, the product, the vision

Stage 2: Scale-up: Paula the Pragmatist: Back to reality, deliver on the promise

Stage 3: Young Growth: Bob the Builder: Mass production, time to scale

Stage 4: High Growth: Oscar the Opportunist: Geographical expansion, business lines

Stage 5: Mature Growth: Donna the Defender: Defend the moat

Stage 6: Larry the Liquidator: Time to say goodbye

It’s rare that a founder develops the skills to do it all.

But there’s one skill any founder or management team needs to master. ⬇️

The one skill

In his book “The Outsiders”, William Thornton sets out what the traits are for those who have accumulated wealth at a high rate. But if we were to distill the entire book into one sentence, it would be this:

“Capital allocation is the CEO’s most important job.”

- William Thorndike

And the capital allocation needs change throughout the life cycle and throughout the context the company is in. That’s why it’s so hard.

Without further reinvestment opportunities, an acquisition could be the right move

At the right price, a buyback might be justified

Sometimes, derisking and paying down debt could be the only option

There is no right or wrong answer. It depends on the situation at that time.

If you like this article, please consider sharing it with someone.

Too much skin might kill you

A high skin in the game.

It seems obvious.

If a founder holds a significant portion of a company, their intentions should be aligned with those of you as an investor.

And generally this holds true. A “good” amount could be 10% at a minimum.

But what happens when a founder has more than 50% of the voting rights? What happens when founders can hurt the minority shareholders?

I don’t think this is a problem for the biggest of companies. Mark Zuckerberg, for example, has the absolute power at Meta.

But when you go small, like we do, you need to be careful.

I have been burned in the past because of founders who have absolute control of their companies, making bad decisions. And the board or shareholders couldn’t do anything about it.

So an ownership % between 10 and 30% seems like a sweet spot.

20 Founder-led Companies

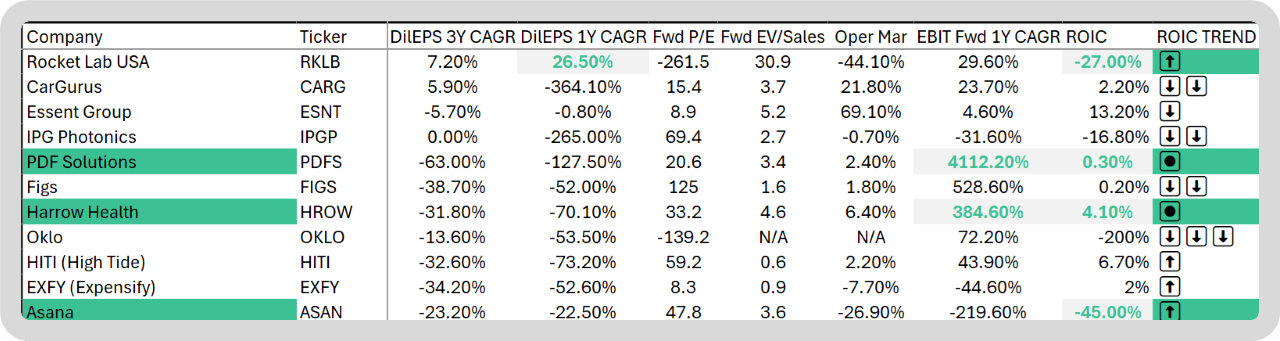

Below is a list of 20 founder-led companies with a market cap below $5 billion.

As we mentioned in this article

The direction a company is trending is more important than the absolute value.

You can download the full Excel here for free.

All the data was retrieved from Fiscal.ai. You can get a 15% discount with the link below on all their subscription plans.

Now I did not do a full sweep of these companies, but when I look at a list like this, 2 situations catch my interest:

The ROIC is negative, and improving -> If the company can keep improving, then an inflection point may be on the horizon

Asana

KULR Technology

American Superconductor

The ROIC is small, positive, and stable -> if the company can break out of the stable, again an inflection point may be on the horizon

PDF Solutions

Harrow Health

Why?

Because the market has a lot of trouble pricing in possible inflections. It likes a high stable ROIC to assign a price to a stock.

I might cover one of these companies in the future.

Conclusion

I don’t think it’s about being the founder, the professional CEO, or whatever name tag is assigned to a person.

It’s about skin in the game, it’s about maintaining the culture, and it’s about skill.

If I had to boil it down into 3 specific skills:

Vision: Can management build a long-term vision and actions to get there?

Marketing: Is the story simple and understandable to anyone?

Capital: What do past capital allocation actions look like?

Look for those when you analyze management.

And if you ever listen in to an earnings call, don’t do it for the information (you can just read that)

Do it to assess management’s behavior. Read between the lines. Look at the non-verbal.

This was an extension of our first article on leadership analysis.

Let me know what you think!

May the markets be with you, always!

Kevin

Great article Kevin

Hi Kevin. Will you be doing an deep-dive on the 3 companies with growing ROIC?