2025 was crazy

Lessons for 2026

Let’s get straight to it.

My lessons for 2026

Humility as opposed to hubris.

Clarity as opposed to cleverness.

Connections as opposed to private thinking

That sums up my 3 main takeaways for 2025 and what I want to implement in 2026.

Let me explain in some numbers:

Overall portfolio returns: +71%

100 Bagger Hunting subscriber growth: +7,500 or +204%

100 Bagger Hunting paid members: 250+

3 lectures at conferences

4 podcast appearances

That’s not just thanks to me.

That’s you.

Your support has been incredible. Your questions have kept me sharp.

I have lots of things planned for 2026. But let’s first look at the past.

Did we apply the previous lessons from past annual reviews?

What are the true lessons from 2025?

What’s in store for 2026?

Applying lessons from the past

You can read my previous annual reviews here:

The year 2023

The main takeaway from 2023 was that I got cocky. After several wins in the market, I was thinking, “I got this”.

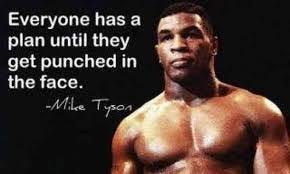

Of course, then the market punches you in the face.

Since then, my approach has been rooted in humility. Always thinking about where a thesis could go wrong.

And with a 71% return in 2025, I believe this remains the most important lesson of all.

But what can we actually do?

Always look for the short thesis in any stocks (write-ups in 2026 will explicitly mention where things can go wrong)

Use AI to help you with this (which I believe still is the best use of any model)

And finally, management expectations: My goal remains a 15% return each year. No benchmark or past performance will change that. However, once all portfolios are fully invested, I will get back to this topic.

The year 2024

The 5 takeaways were:

Takeaway n°1: Write, and write some more. For every company analyzed, write down why you think it would be great to own it, or not. Journal how you think about the company, and how your thinking evolves.I have never written more words and articles in 2025 than ever before. But I slacked on the journaling part. I’ll get back to that.

Takeaway n°2: Turn over a lot of rocks. There are no shortcuts to finding winners.I still think this is true. But AI has now helped me speed up the process. In 2026, I will be tracking the number of companies I go through.

I still have a waitlist open for our prompt library/investing course we’re building.

More information in the coming weeks.

Takeaway n°3: Be ruthless. If a thesis crumbles or a company weakens, and you did not expect it, cut and take the loss.I feel I failed on this lesson. ITECH was an example of this. In small companies, if unexpected bad news surfaces in a quarterly call, it’s better to be ruthless and afterwards buy yourself back in, if you think the market is overreacting. This is a way to mitigate your losses. The keyword here is unexpected.

Takeaway n°4: Build positions slowly. Use multiple quarters to confirm your thesis on the investment.I definitely applied this. Don’t think about transaction costs because of multiple trades.

All new positions we took were built up slowly.

Takeaway n°5: Investing is about deliberate practice, putting the reps in. Read the filings. Do lots of valuations. Repeat.Yep, and although AI helps us, in the end, it’s about conviction, and to build conviction, you need to put the work in.

No free lunches.

To conclude, my biggest failure in 2025 is probably not putting my health first. My obsession for stock investing and writing has only increased over the year, sometimes putting that “next 1h on an article first” before going out for a run.

That’s dangerous, as it might work in the short term, but not in the long term.

True Lessons from 2025

Clarity over Cleverness

In the past, our write-ups have been quite long, sometimes up to 5,000 words or more.

But more information and cleverness do not lead to better results.

How much information is enough to be comfortable with a certain investment?

So my goal in 2026 is to publish shorter write-ups more frequently. Looking for a signal, avoiding the noise.

Not every write-up will lead to a buy decision. Some may go on the watchlist for now.

Position sizing

The game of investing in entering a position can be broken down into:

Decide WHAT to buy

Decide WHEN to buy

Decide HOW MUCH to buy

Not enough is written about how much to buy or the position sizing. Based on my 2025 experience, my general rules are:

Always start small

Build positions over time

Prefer averaging up > averaging down

The lower the downside risk, the higher the position sizing

You could think I didn’t apply this to Pharmx in 2025, but when I entered at 0.04 AUD, I calculated the value of the company if the marketplace failed, and considered there was enough downside protection to go all in (well, almost anyway)

Selling Rules

One of you asked for my selling rules in the past. And I don’t think I ever published them, so here they are:

If fundamentals are broken, don’t hesitate to take the loss if needed

The higher the quality of the company, the less you should sell on valuation.

The number 1 reason to sell is if you find something better

Investing is a process: Try to add or trim before selling outright. But if you decide to sell outright, do it fast.

And I think it’s important to mention the “Be ruthless on the selling lesson”.

So I’ll say it a second time: Don’t be surprised in 2026, even after an initial bullish write-up, if I sell the initial position when a company reports some unexpected bad news.

Let your winners ride, but take your losses fast.

I am writing a full guide on 100 Bagger Hunting and the process behind it, including full chapters on position sizing, selling rules, etc.

Stay tuned for that in 2026.

Connections

I’m an introvert.

I’m strong in a 1-1 situation. I’m strong when speaking in front of an audience.

I’m bad at mingling in large groups.

Visiting Omaha last year was a challenge for me.

But being in a room full of like-minded people was somewhat of an epiphany for me. At times even exhilarating.

As a bonus, some of my best ideas came from discussions with other investors. It taught me an important lesson. You don’t always have to be the guy with the original idea. You can find a compelling idea, and then do your own due diligence and go with it. There are lots of smart investors out there.

It’s these human connections that matter more than a YTD result on paper.

And since I will be going back to Omaha in 2026, let me know if you’ll be there!

So, 2026?

2026 will be about clarity.

And what I mean by that will be apparent next week.

2026 will be about more and better connections

You can expect:

More company write-ups

A clear structure:

Monthly portfolio updates

Quarterly earnings updates

A deep dive into serial acquirers

And an occasional webinar so that I can see some of you!

All the while, staying humble, being slightly paranoid, and trying to kill our best ideas.

I wish you and your family health and prosperity in 2026!

May the markets be with you, always.

Kevin

P.S. What did I miss? What should I have added? What are your main lessons from 2026?