5 easy steps to multibagger returns

Wisdom from India

Short devlog: 100baggerhunter.com was updated with several improvements last week:

Increased performance on the backend (portfolio values are cached)

Added a performance benchmark: S&P500 -> not sure it’s the right one

Dark/Light theme on a click of a button (before it was a pop-up)

If you like the below article, you’ll love the deep dive planned for next week

➡️A small, quality, and growing company.

Enjoy this week’s read!

The 2 books that have been written on 100-baggers have a problem.

They are focused on the US.

However, we know from another study on 10-baggers (Global Outperformers) written by Dede Eyesan that many countries are fertile hunting grounds for finding multibaggers.

One particular study, by Motilal Oswal, examines 100-baggers in India from 1994 to 2014, and it reveals some interesting insights that we haven’t covered yet.

With all the hotness on “quality investing”, we should start with the following quote:

“Quality does not guarantee growth, and in turn, rapid long-term Wealth Creation.”

And if there’s one key ingredient that is needed for multibaggers, massive growth in sales and earnings is one of them.

100-Baggers in India

India, as an overall stock exchange, has been a success story. The Sensex Index, which holds a mere 30 companies, was more than a 100-bagger on itself since 1990:

What’s interesting is to distinguish between the transitory 100-baggers and the enduring ones. From 1994 to 2014, they found:

Over 100 transitory 100-baggers, just as in the US, several of these were IT companies that got burnt during the dot-com bubble

Precisely 47 companies that gave a 100-fold return and kept growing. These are the enduring 100-baggers

But did these 47 companies continue to endure?

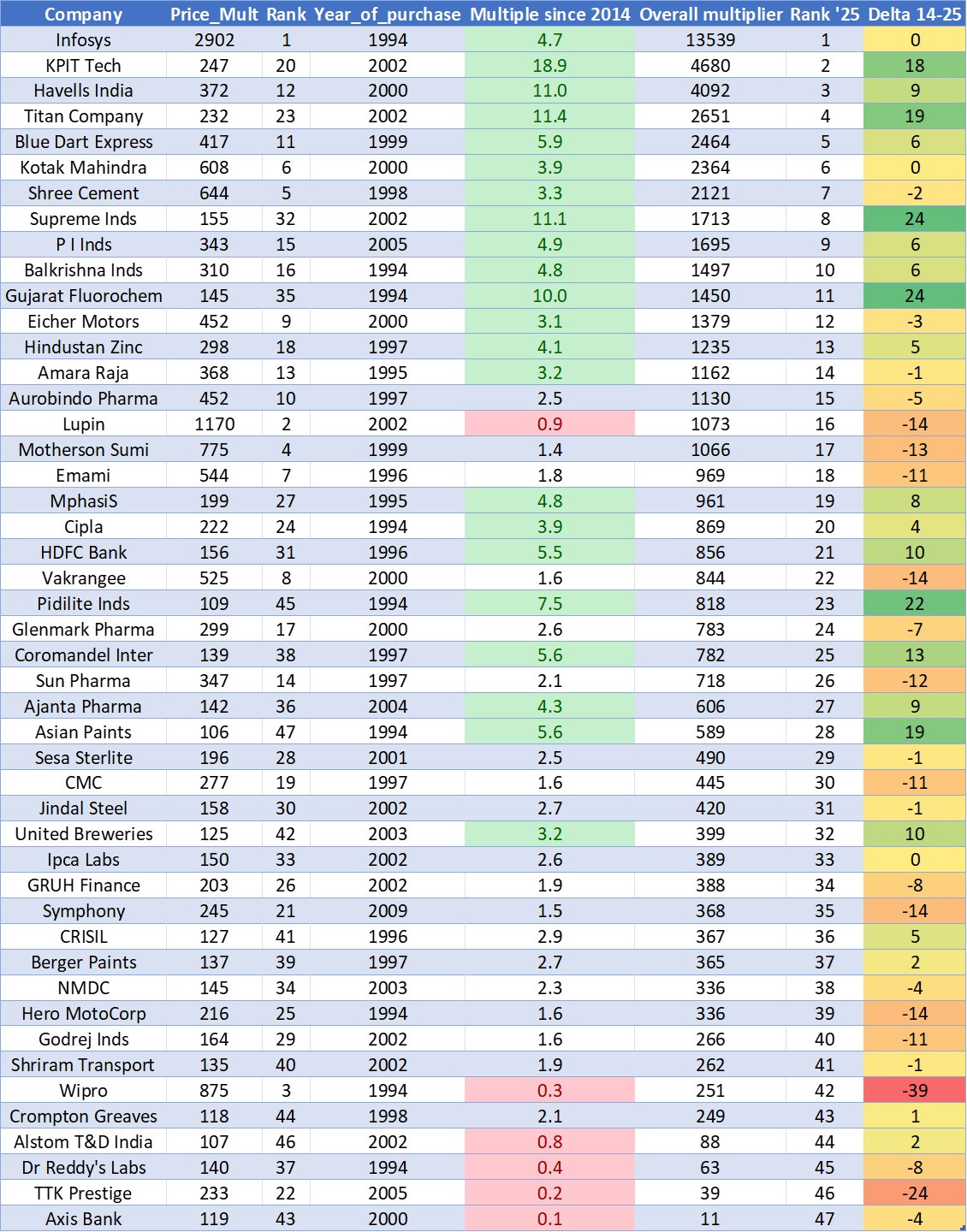

The table below is an updated version of the original table that Motilal listed as a 100-bagger in 2014. It’s interesting to see what happened to them over the past 11 years:

Some conclusions:

Only 6 out of the 47 companies depreciated in price

17 out of 47 companies have become 1000-baggers

22 out of 47 companies have achieved a 10% CAGR or more since 2014

This means that:

Dominant companies tend to stay dominant overall. Winning is sticky

But more than half were unable to deliver a 10% yearly return, probably because of the absence of the low base effect. The companies were already too big relative to the market size they could capture.

What was surprising, though, is the average speed at which these 47 companies achieved 100-baggers status

A mere 12 years.

Remember the data from the US, where the average speed was 26 years.

This emphasizes the explosive growth the indian market has known over the last 30 years.

There are about 3,500 stocks in the indian market, so 47 of them make up about 1.3%.

However, Motiwal observed that investors had time to buy these stocks. There were ample opportunities to get in.

Below is an interesting table that shows the time you had before buying these and holding them.1

For these kinds of incredible companies, as an investor, you don’t need to worry about being late. Getting in later on can still be beneficial. But the updated table we’ve made shows that as time passes, the chances do decrease.

The Framework for finding 100-baggers

“Alchemy — the medieval forerunner of chemistry, concerned with the transmutation of base metals like lead and copper into gold. “

We looked at the Alchemy of Multibaggers in a past article.

The framework used by Motilal Oswal uses the following acronym: SQGLP

Size

Quality

Growth

Longevity

Price

Let’s dig deeper into these 5 factors necessary for 100-bagger stocks.

Size

A fast-growing company must be small. Sheer size militates against growth - Thomas Phelps from 100 to 1 in the stock market

Going small allows for the low-base effect: a small change from a low base amounts to a large relative change. In other words, 10M on 100M is 10%. 10M on 1 Billion is 1%.

Now you can look at size in 2 ways: Small in revenue or small in market cap.

When investing in stocks, the size of the market cap is crucial. And disregarding underlying fundamentals, the market cap can be low because the company is unknown (just like Monster Beverages before 2005).

So we should look for:

Low institutional holdings

Relatively low traded volume

Low number of analysts tracking the company

As you already know, if you’ve been reading for a while, this is our favorite hunting ground.

For India, the average revenue at the start for these 100-baggers was 35 million USD, and the average P/E was a measly 6.

Just as in the most recent data we pulled for the US, they advise hunting for 100-baggers in the realm of companies with market caps below 500M USD.

Quality

Quality of the business

What is the competitive landscape?

Is there potential for sustained high ROIC?

What is the existing or potential size of the profit pool for the industry?

From the 47 companies they analyzed, they were able to divide them into 3 big buckets:

Value migration beneficiaries (19)

Dominant players with leading market shares (10)

Niche players in unique profitable business segments (10)

Value migration

In his book Value Migration, author Adrian J Slywotzky says, “Value migrates from outmoded business designs to new ones that are better able to satisfy customers' most important priorities.” Value Migration results in a gradual yet major shift in how the current and future Profit Pool in an industry is shared.

Value Migration is one of the most potent catalysts of the 100x alchemy as it creates a sizable and sustained business opportunity for its beneficiaries.

It has two broad varieties

1. Global (geographic) Value Migration: global manufacturing value migrating to China; value in IT and healthcare sectors migrating to India, etc

2. Local Value Migration: value in telephony migrating from wired networks to wireless networks; value in Indian banking migrating from public sector banks to private banks.

Now let’s take a look at what today’s value migration looks like ⬇️

Now you probably know all these companies. The most important aspect here is to make sure you’re betting on a company that is riding a wave, and not having any headwinds.

Niche opportunities

The market size might be smaller, but when a company gets a foothold and starts to dominate, it can grow quickly.

One example:

The cooling market for data centers is poised to grow rapidly in the coming years at a CAGR of 12.5%.2

Especially, liquid cooling will be the fastest-growing segment within that cooling market

AI data centers require a lot more cooling than traditional data centers

Some of the companies we covered in the past operate in very niche markets.

Dominance

Market leaders, even in a saturated market, tend to take more and more market share. In addition, when they have pricing power, their profits continue to increase. The 10 companies in the previous chart were considered dominant market leaders.

Quality of management

Although for the business we can use numbers, the approach to evaluating management is a lot more qualitative.

3 traits are important:

Unquestionable integrity: As Buffett says, your reputation is everything. You can build it up over multiple decades and destroy it in a matter of minutes

Excellence in Execution: Anybody can have ideas, but it’s the execution that is hard. Look at their track record.

Growth mindset: Is management actively looking for new business ventures? How are they allocating capital? Do they have a long-term mindset?

Growth

Growth is essential. A 100-bagger must be viewed as a 100-story building. You need a solid foundation. And that foundation is a small, quality business led by quality management.

The twin engine of growth for a stock is defined by:

Multiple expansion (P/E)

Earnings growth (EPS growth)

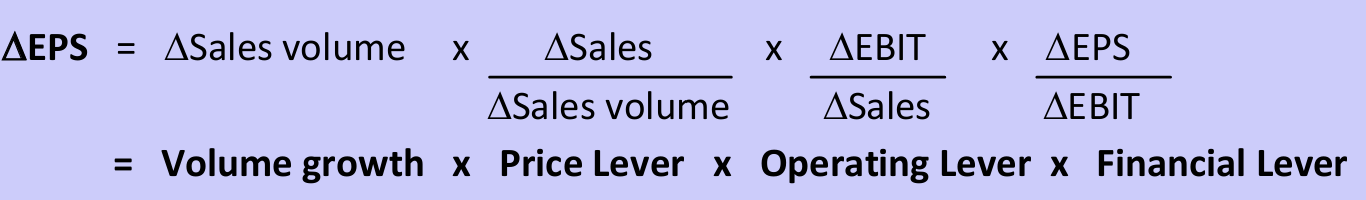

Motilal breaks down the earnings growth into the following levers:

This means:

Volume growth: a function of demand growth matched by the company’s capacity to supply

Price growth: a function of the company’s pricing power, which in turn is a function of the competitive landscape

Operating leverage: a function of the company’s operating cost structure; the higher the fixed cost, the lower the unit cost incidence, and the higher the operating leverage

Financial Leverage: a function of the company’s capital structure; the higher the debt-equity ratio, the higher the financial leverage and vice versa.

Often, we get lost in the weeds when analyzing a company. Going back to basics, to the 4 levers makes sense.

Longevity

You’ve found a high-quality business led by outstanding management. It’s a small company, poised for future growth.

But how long will that growth continue? What does the future runway look like?

We discussed this in the past when we talked about the competitive advantage period: How long (in years) will the company be able to hold on to its competitive advantage?

When a company earns supernatural returns, then others will take notice and try to eat a piece of the cake. Barriers to entry, patents, and network effects all play a role in deciding if the company has a sustained advantage. The longer the CAP, the more valuable the company.

This longevity is the key difference between what we call: Transitory 100-baggers and enduring 100-baggers.

Price

When all is said and done, buying at the right price is what matters. Going back to the twin engine of growth:

You buy at a high P/E -> All growth needs to come from EPS growth

You buy at a low P/E -> EPS growth can be supplemented by multiple expansion

Motilal explains it like this: ➡️Buy at single-digit P/E’s

Easier said than done.

And I agree, they are hard to find, but they are out there.

Here’s what the P/E for the 47 100-baggers looked like:

Only 6 companies had a P/E above 10…

Conclusion

Here’s the summarized overview of the SQGLP framework:

Now, to be able to buy wealth creators, you need quality and growth:

Quality: Refers to the quality of management and the quality of the business model

Growth: Refers to the market (example: value migration) and the competitive positioning within that market. It’s a combination of how fast it can grow and the duration of that growth.

When you combine both on a matrix, you get the following:

Low Quality - Low Growth: The wealth destroyers, avoid these at all costs

Low Quality - High Growth: Transitory multibaggers at best, due to cyclical uptrend. A clear example of this is a company we previously held called Inmode

High Quality - Low Growth: The quality traps. We covered this in more detail here. These should only be bought during sudden downturns in the market, at a great price.

High Quality - High Growth: True wealth creators, the enduring multibaggers

This report is a nice complement to what we learnt from the book 100-baggers or other reports on the topic. I’m glad to see that all the above aspects are covered in our deep dive SPECIAL framework, but I will add the value migration theme more clearly in our Industry analysis. If you would like to read the full analysis, you can find the full report here.

Next week, we’ll cover a high ROIC, high-growth company trading at a P/E of 10.

May the markets be with you, always!

Kevin

https://www.motilaloswal.com/site/rreports/635542588369519988.pdf

https://www.grandviewresearch.com/industry-analysis/data-center-cooling-market

This is one of the most grounded and global takes I’ve seen on 100-baggers — especially refreshing to see India’s history spotlighted instead of just US case studies.

After 35 years of investing, I’ve learned that high growth is never enough. It’s the combination of quality, discipline, and market fit that makes a multibagger endure. Your SQGLP framework lines up well with what I use inside my own tools — especially the emphasis on longevity and value migration.