A hidden monopoly promising multi-bagger returns

Pivoting into something wonderful

Sometimes, while digging through the rubble, you uncover a company with a past wasted potential where the stars seem to have aligned for a bright future.

This company :

Has an almost 100% monopolistic position in its industry

Has a new management team that sets ambitious goals

Has divested its non-core business to regain focus

Has a lot of tailwinds behind it

Looks bad on any screener

This last one is important, as the market might not have fully recognized the company’s potential.

Their current revenue is 6 million, but management sees a long-term potential of 300 million.

“You had me at 50x” 😉

Buffett mentions that you don’t need to swing at every pitch. Be ready for when that fat pitch comes into your sweet spot. Sadly, these fat pitches only come around once or twice a year.

I believe this to be one of the best set-ups I’ve seen over the past 5 years.

We’ll assess the company's quality, apply a valuation range, and determine whether management’s claims are realistic.

The structure of this 40-page deep dive (summary inside) looks like this:

Let’s go! ⬇️

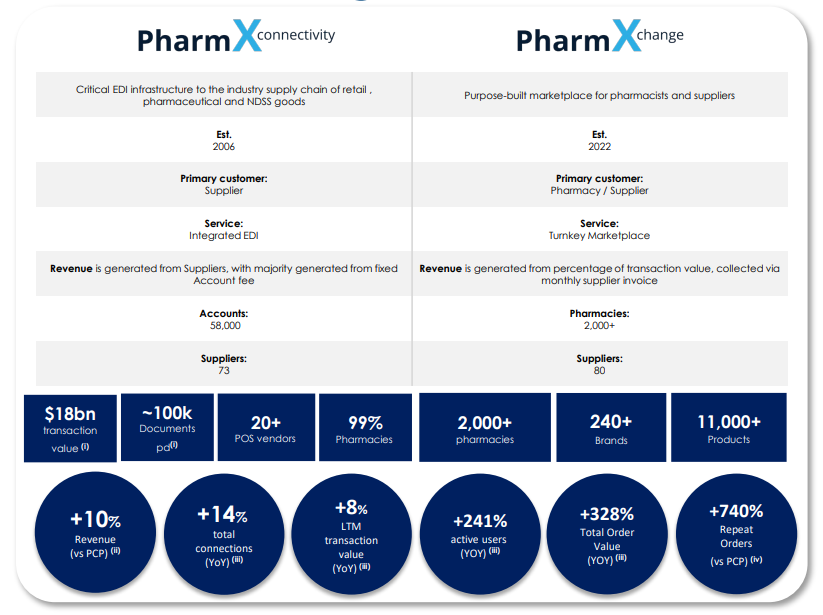

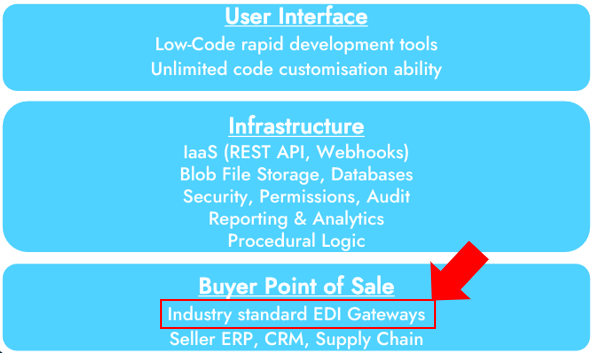

Who is Pharmx?

Pharmx is a tiny Australian software company that sits between the pharmacies and the suppliers. They have developed an EDI gateway (Electronic Data Interchange) that links both parties together. In 2023, they added a B2B marketplace and a data analytics product to their offering. Their service allows pharmacies to easily order their products and receive invoices from the suppliers. The main value proposition for the pharmacy is a gain of time (about 40 working hours per month). Through the marketplace, the supplier has an alternative way to sell products to all pharmacies in Australia (instead of using sales reps).1

Historical underinvestment in their product, past litigation, and divestment from a part of their business show a messy past. The future, however, could be very different.

All numbers in this article are expressed in Australian Dollars.

Below you’ll find the one-sentence and one-page pitch followed by the complete deep dive. The one-sentence and one-pager are thought exercises to reduce the deep dive to its bare essentials.The one-sentence Pitch

Through its moat and asset-light business model, Pharmx should be able to capture a significantly higher revenue and profit level from the $20 billion transaction volume that flows through its proprietary gateway, which connects retail pharmacies and suppliers in Australia.

The one-page Pitch

Pharmx has had a tumultuous past, but the skies seem to be clearing up. With a lawsuit settled, a renewed focus on its core business, and reinvestment to expand it, the company is set for growth.

Why is the company in a great position?

Its EDI gateway is a monopoly, integrated within all pharmacies in Australia

It would take at least 3 years for another to replicate the system and grow it (court filings)

Its gateway is mission-critical for some of the pharmacies and suppliers

Past filings show the gateway is very profitable and has pricing power (court filings)

Development of the new marketplace seems to be the logical next step, which should lead to higher profitability (think eBay or other marketplaces)

Directo, another pharmacy marketplace, is a direct competitor. But it runs on the EDI Gateway. Is it a competitor then?

Why is the company undervalued?

In 2024, the margin of safety was bigger. The undervaluation did not need any growth at that time

Undervaluation is based on high projected double-digit growth in the future.

The theoretical upside potential is large (up to 50x current revenue)

The downside is that all growth initiatives fail. You would then only be able to count on the EDI gateway, which can grow at the inflation rate. Based on past filings, the company should earn $2 to 3 million in EBIT. This translates to a 30% downside risk from the current price.

What are the risks?

The following risks are ranked from high to low:

The new marketplace gains no traction. All CAPEX spending is wasted. Impairments will be needed.

Management wastes CAPEX on non-core M&A instead of focusing on expanding its core business

The marketplace will cannibalize their existing business. The company will need to balance the cash flows

Their cash inflow is insufficient to develop the marketplace and analytics product. An equity raise is needed

A competitor succeeds at launching a similar offering (Directo is unprofitable at the moment)

End of one-page pitch

Company History

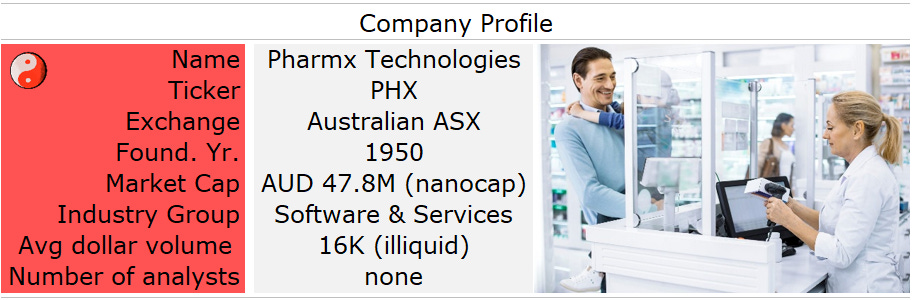

Pharmx Technologies (PHX.AX) was founded in 1950. This is not “the new kid on the block”. We’ll disregard what happened in the 20th century (not relevant). In the year 2000, 4 Point of Sale(POS) providers decided to develop a common industry standard for data exchange within the fragmented pharmacy sector. Its goal is to increase overall efficiency and to allow the POS vendors themselves to differentiate on the POS offering.

The Electronic Data Interface (EDI) gateway, PharmX, is born.

The POS vendors were Corum Group, FRED IT, Mountaintop, and Simple Retail. Corum Group initially owned 30% of Pharmx. In 2020, it acquired all the shares. Since 2023, Corum Group has changed its name to Pharmx Technologies as we now know it.

PharmX currently serves 99% of pharmacies in Australia and is expanding throughout New Zealand (no numbers). In 2023, it sold its software business so that it is less exposed to regulations. A new CEO, Tom Culver, came in mid-2023. Tom hired new key executives to transition the company into a bright future.

One key metric stood out to me when I first looked at their company presentation.

Transaction volume over gateway: $20 billion

Pharmx 2024 revenue from gateway: $6.5 Million

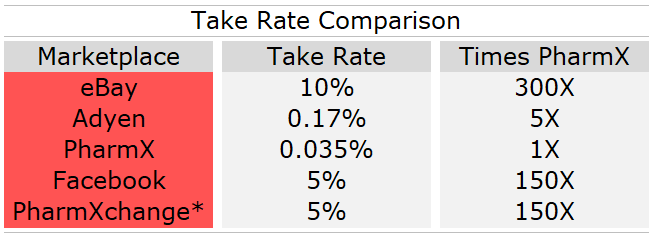

If we think about it in ‘take rate terms’, that’s a 0.035% take rate. That seems low. If their software is so crucial, why isn’t that number a lot higher? We’ll get to that. (Remember, in payments, Adyen takes about 0.17% which is 5 times higher).

To emphasize this, here’s an overview:

PharmX is the existing EDI gateway. PharmXchange is the new marketplace they launched. The take rate is directly proportional to the value you bring to the customers. Management has mentioned a 5% for the marketplace, but this percentage will vary in volume and could go as low as 1% for very high-volume transactions.

So where does the potential $300 Million in revenue come from as we touted at the start of this analysis?

$20 Billion currently flows through the gateway

If half is ‘transferred to the marketplace = $10 Billion (long-term management ambition) in Gross Merchandise Volume

Average 3% take rate = $300 Million in revenue

Now before you start buying this company, please continue reading. It can’t be that simple, right?

Here’s a step-by-step overview of the most important past milestones:

1950:

PharmX Technologies Limited (originally under a different name) was founded and incorporated in Sydney, Australia

2000s:

PharmX is developed in collaboration with major Australian pharmacy POS vendors to create an e-invoicing platform for pharmacies and suppliers

2013:

PharmX connects 73 suppliers to its gateway software

2020:

Corum Group Limited becomes the 100% owner of PharmX

First lawsuit between Corum and Fred IT

2021:

Competitor Directo launches its pharmacy B2B marketplace

2022:

PharmXchange B2B Marketplace is launched

Corum Group disposes of its e-commerce real estate business

2023:

April: PharmX adds an Education and training hub called EduCentre to its platform

July: Corum Group sells its Pharmacy Software business to Jonas Software AUS Pty Ltd (removal of regulatory hurdles)

New CEO, Tom Culver, comes in

October: The company changed its name from Corum Group Limited to PharmX Technologies Limited

2024:

PharmX connects 140 suppliers to its gateway software

The company reports significant growth for PharmXchange:

Active users increase by 353% year-on-year

Total order value grows by 428% year-on-year

Repeat orders increase by 329% year-on-year

By the end of the financial year (June 2024), PharmX is transmitting approximately 80% of all B2B pharmacy industry transactions

2025 (Current state as of January):

PharmX Technologies Limited is servicing 99% of Australian pharmacies

The company facilitates over $20 billion in transactions annually

PharmX provides access to over 80,000 products from hundreds of suppliers

The company is expanding rapidly in New Zealand

I will not take New Zealand into account for the rest of this analysis, as there is very little data provided by Pharmx. We will concentrate only on Australia. We’ll come back to the history of litigation later in the analysis.

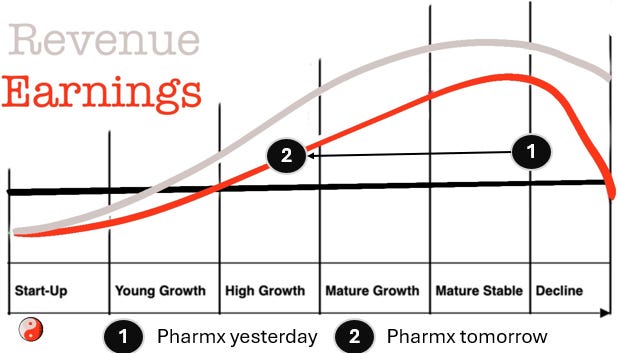

Before going into the complete assessment of the company, we need to take a look at its lifecycle. ⬇️

Pharmx was in a state of decline. With the new marketplace, they hope to pivot and revert to that high-growth phase.

A structural turnaround (divestments) with a renewed focus, a new management team, and a clear growth strategy?

Call me intrigued. Now let’s go deeper. ⬇️

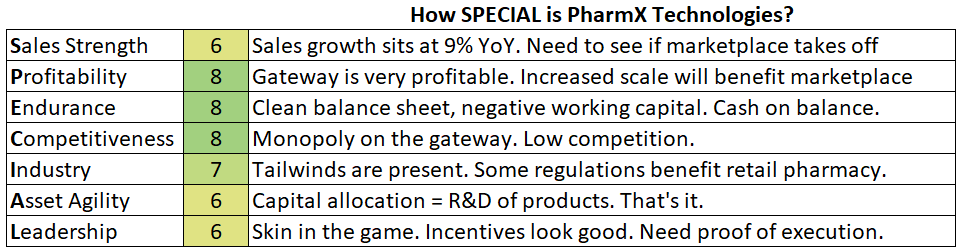

How SPECIAL is Pharmx?

We measure the quality of the company through our SPECIAL score. We define it through 7 attributes.

S for Sales Strength

P for Profitability

E for Endurance

C for Competitiveness

I for Industry

A for Asset Agility

L for Leadership

Sales Strength

We want to gain a fundamental understanding of the business model. Who buys what and why? How strong is the business model? Do they need to spend a lot on marketing to sell? If applicable, what are the unit economics? Where is the company in its life cycle? (source used: income statement)The business model

Who pays whom for what and why?

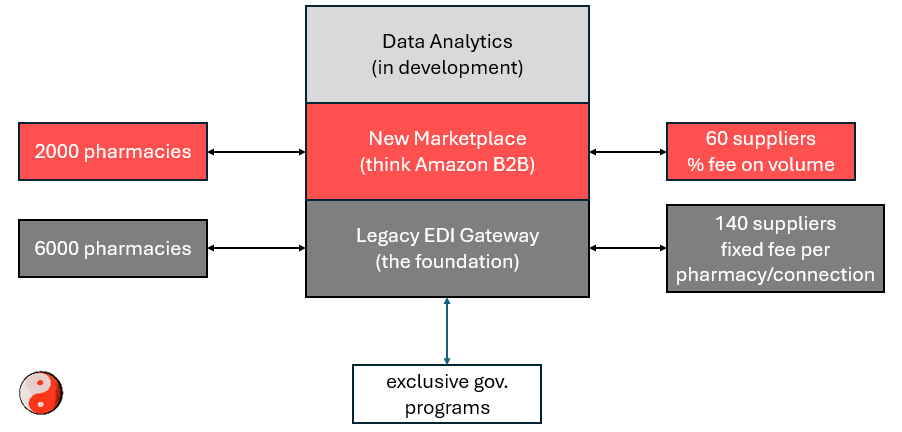

It looks like this:

Here’s another schematic from their Investor Presentation in 2024:

The Legacy EDI Gateway

A pharmacy wants to sell a certain number of products. It needs to buy these products from a wholesaler or a smaller supplier.

Before the existence of the gateway, each supplier needed to use its sales reps to set up a sales channel with the different pharmacies. The pharmacy would use its POS system, which may or may not have been compatible with certain suppliers. There was still a lot of manual work involved.

So the 4 biggest POS vendors came together and developed the gateway ⬇️

What happens now?

A pharmacist wants to buy a product to sell in their store

He uses the Point of Sale system to place his order(s)

The order is standardized through the gateway and arrives at the supplier

The supplier sends an invoice back (which is also standardized)

The product is delivered at a certain moment

The pharmacist pays 30 days later (or something in that timeframe)

Some pharmacies still go ‘direct’, bypassing the gateway. According to Pharmx, 80% use the gateway as it’s more efficient (up to a savings of 40 hours per week for the pharmacist).

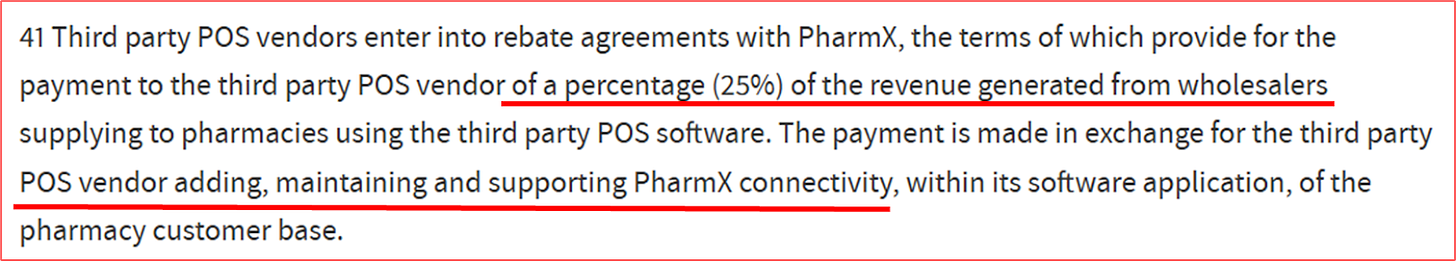

The pharmacy pays nothing to Pharmx. The pharmacy has no direct contact with Pharmx whatsoever. The gateway runs on the backend of the POS system.

The supplier has to pay Pharmx on an accounting-based model: a fixed monthly fee per pharmacy connected (In 2007, it was about 12 AUD/pharmacy/month)

The POS vendor gets a 25% rebate (this is important as they are incentivized to keep developing the connection with the gateway)

These are mentioned in the filings related to the lawsuit that was ongoing between Fred IT and Pharmx in the past2:

The first growth driver for Pharmx is to reinvest in the gateway and increase the number of suppliers. More suppliers lead to more connections and more revenue. (Note: In one year, they have doubled the number of suppliers)

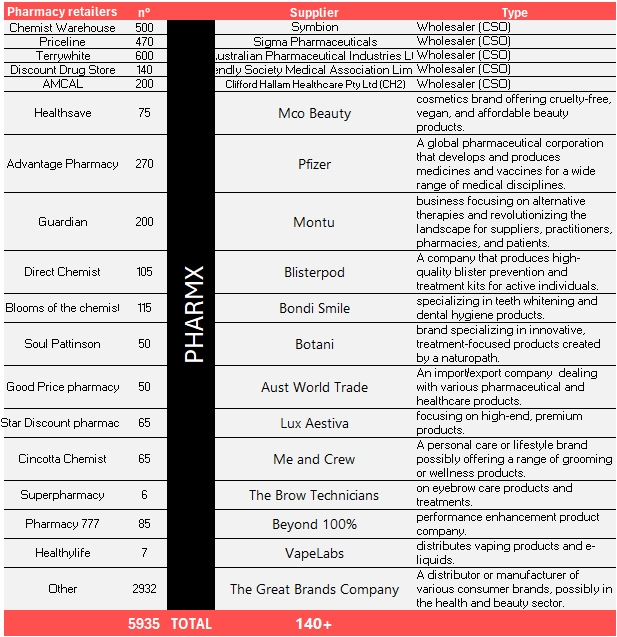

Because pharmacies are becoming more and more “wellness stores” as opposed to selling pure medicines (more about this in the industry section), management sees the following potential:

30% increase in suppliers in the short term

Up to 500 suppliers in the long term (73 in 2013 and 140 now)

There is one caveat, though. Suppliers are not created equal.

1 wholesale supplier can have 2000 active connections with pharmacies, while others may only have 5. Inversely, 1 pharmacy can be supplied by multiple suppliers or just 1 wholesaler. (On average, a pharmacy has 7 suppliers, whereas the best in class have 25. The goal will be to entice pharmacies to increase their assortment and use more suppliers.

So while the number of suppliers is an indicator, doubling that number does not mean you will double revenue, as the wholesalers take a big chunk out of that 20 billion in transaction flow.

I compiled this table with, on the left, the biggest pharmacy retailers and on the right, the 5 Wholesalers and, as a sample, 13 of the latest suppliers the company has added based on their most recent presentation (November 2024). Notice that most of these new suppliers have nothing to do with medicines.

The 5 biggest wholesalers are also what is called CSO (Community Service Obligation). They are part of a funding obligation established by the Australian government. A yearly 200 million dollar funding pool is available to these wholesalers. But in exchange, they have to meet certain obligations under the Pharmaceutical Benefits Scheme (PBS)

Maintain certain stock levels of PBS medicines

Stock and supply the full range of PBS medicines

Deliver medicines to over 5,800 pharmacies nationwide

Provide timely supply, generally within 24 hours of order placement

Supply PBS medicines at or below the approved price to pharmacies

…

The goal is to ensure that all Australians have timely access to PBS medicines.

If you want to go deeper into the basics of an EDI, go here.

The new B2B Marketplace

While the gateway provides efficiency and standardization, it is limited in what it can offer as additional value to both sides. The marketplace is the answer to increasing the customer value proposition.

This marketplace is not something new. Directo, a startup, already has a B2B marketplace for the pharmacy industry with 3000 pharmacies and 200+ suppliers onboarded. Think about it as an additional layer of functionality built on top of the existing legacy gateway.

Additional benefits for the Pharmacist3

Like Amazon, a web-based platform where he can order different products from different suppliers. There is a single checkout basket. After the checkout, he will receive invoices from the different suppliers.

Additional benefits for the Supplier

The marketplace allows suppliers to add new products or run promotions and sales. It's a new way of marketing as opposed to going through the human sales rep.

The supplier pays a fee (5%-10%) on volume transacted

Pharmx continues to add new functionality. Recently, they have added an education and training module to their marketplace and integrated a payment system4 ⬇️

The most important thing to remember: Since it’s web-based, you do not need a POS system anymore for ordering. The long-term goal might be to displace the current POS systems (One of the questions for management).

Data Analytics

Finally, there is a lot of data floating around in the system. The data and customer behavior patterns could be useful for several parties involved. This is the newest business line that is still under development.

It’s the suppliers that are the biggest customers at this time. The pharmacies are the potential distribution market. Pharmx’s focus is firmly on expanding the number of suppliers. Their rationale is the following:

Grow the number of suppliers

More products for the pharmacies + add new pharmacies

New suppliers add more pharmacy accounts (revenue goes up)

More purchasing activity creates more and better data analytics

Better data leads to better solutions to attract even more suppliers

A typical flywheel.

This is a typical 2-sided marketplace business model with strong network effects. As with other marketplace business models, as more supply is available, the solution becomes more valuable to the pharmacy and vice versa.

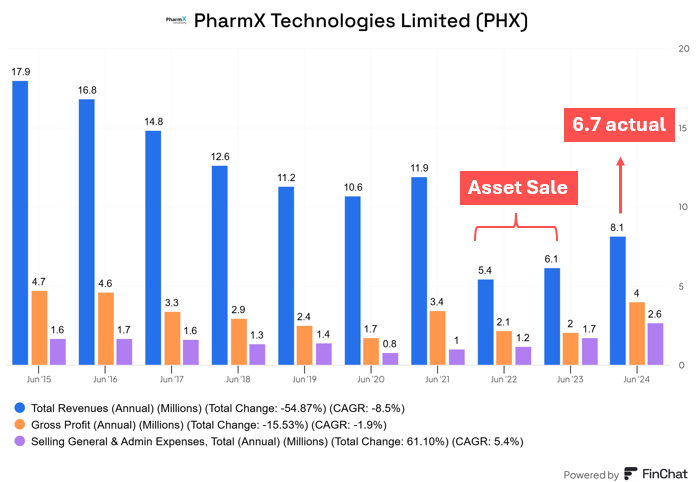

Past sales

As I mentioned, this company doesn’t look good on the surface, with their e-commerce business sold in 2022 and their remaining software services business sold in 2023; it’s complicated to use past financials.

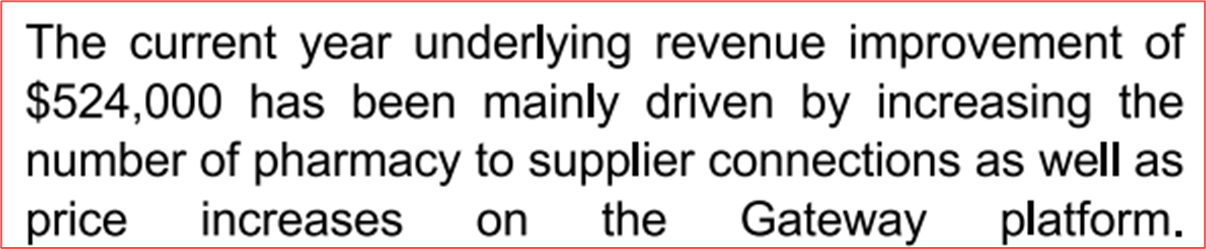

A decline in revenue reaches a pivotal moment in 2022 when assets are sold. We then see a gradual increase in revenue, but be careful with 2024. The ‘real’ revenue is $6.5M (the remaining $1.4M was received due to a litigation settlement with Fred IT. Since then, they lost the case on appeal, and had to pay back $8.5M in cash).

At this moment, 94% of revenue is dominated by the gateway. 6% is generated through services. The new marketplace has no impact at this time on total revenue (the annual report mentioned 20% month-over-month growth, though). The analytics business is still in the early stages and will take 3 years of development to reach a viable commercial product.

From a sales point of view, management has the ambition to:

Grow geographically: New Zealand, Europe (pharmacies and suppliers)

Continue developing the new business lines

Has ideas to increase the overall take rate (as mentioned before, they have included a payment integration into their current marketplace)

SG&A has hovered between 10 to 15% of revenue with a steady increase over the last 3 years. This increase is related to the development of new products. The legacy gateway sells itself. The company has very low marketing costs. I consider this a positive thing (as long as eventually, sales growth will follow).

The current weaknesses in sales strength are:

Sales are mainly in Australia

Unproven future sales growth potential

Growth is still slow (the marketplace is not taking off just yet)

Customer Concentration risk: management does not disclose numbers, but since there are wholesalers in the supplier's list, it might be that a couple of suppliers provide a big chunk of the revenue

Sales Strength Verdict: 6/10

Profitability

We look at the different margins and the quality of the earnings. Can the company be self-sufficient? Is there reinvesting potential or will they have to rely on debt or share issuance? (source used: income statement)The most recent financial data is not reliable since a lot has happened to this company.

But there is other data we can use. We mentioned that there was a legal battle going on between Fred IT and Pharmx. I’m not going to go into the specifics as the case has been settled.

In 2023, a ruling ordered Fred IT to pay $8,128,486 to Pharmx5

In 2024, during the appeal, a ruling ordered Pharmx to pay back $9.9M to Fred IT6

A bummer for Pharmx, but at least the issue is closed.

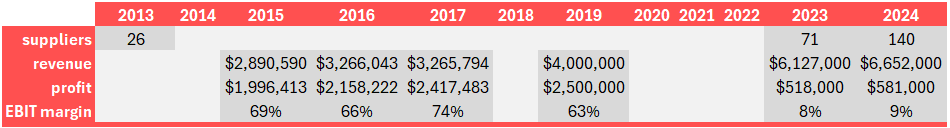

We’ll use the legal filings (which you can consult here 2023 and 2024) to get some sort of estimate of profitability potential.

Here’s a partial table where I collected partial data from the filings.

It provides historical data on the EDI Gateway. How to read this table?

The data from 2015 to 2019 comes from the court filings where both parties try to prove/disprove the value of the PharmX gateway. We can intuitively guess that an EDI Gateway that requires only maintenance costs is very profitable. Does this mean PharmX EBIT margins will get back to 60% Probably not. (I estimate a 5% MNT CAPEX for the gateway)

2023 and 2024 are the actual financial data (excluding the impact of the legal issues). EBIT margins are a lot lower as the company is increasing spending to improve the gateway and develop its new products.

Conclusion

The gateway in itself is a cash cow. From their 2024 annual report:

Since all pharmacies are already connected, revenue growth will come from price increases and additional suppliers. However, the profits generated from the gateway are used to develop the marketplace. This is what we see in the latest financial results.

Although we do not have historical data on the marketplace to assess its profitability, we know that a typical marketplace becomes profitable with scale because there is operating leverage involved. (The costs shouldn’t rise proportionally with the increase in order volume). Their competitor Directo achieved a $40M Gross Merchandise Volume with as a result a $2M annual revenue. In other words, if Pharmx can match that, that will add 2M in revenue to their base in the coming year(s).

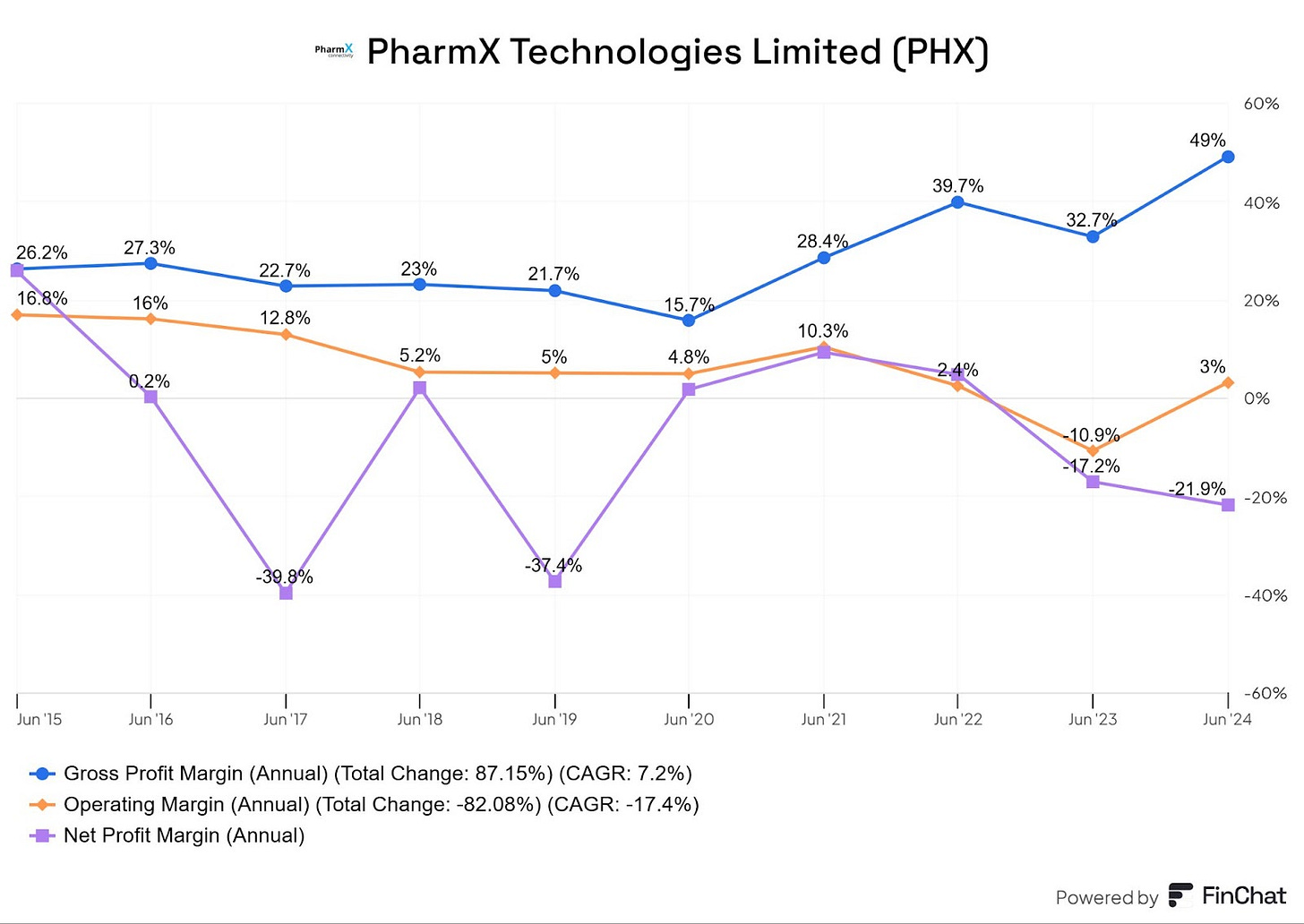

Here’s an overview of the historical margin profile, but as mentioned, don’t draw too many conclusions out of it.

Gross margins have increased in part related to the sale of the less attractive business. The 49% in 2024 is not representative because of the legal payments. Operating margins are very low.

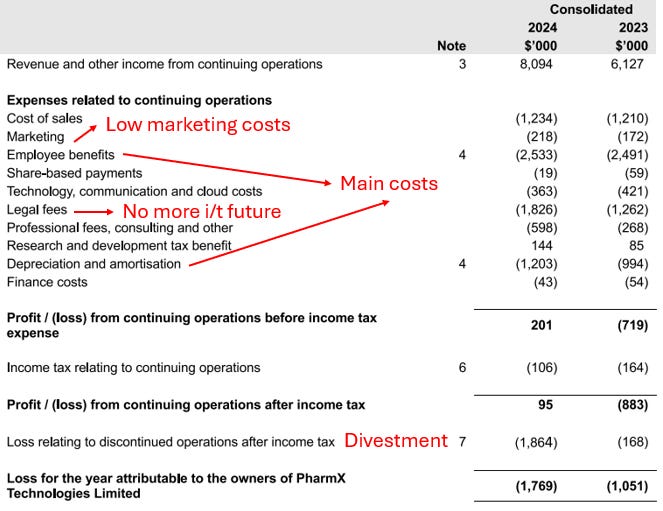

The last income statement looks like this:

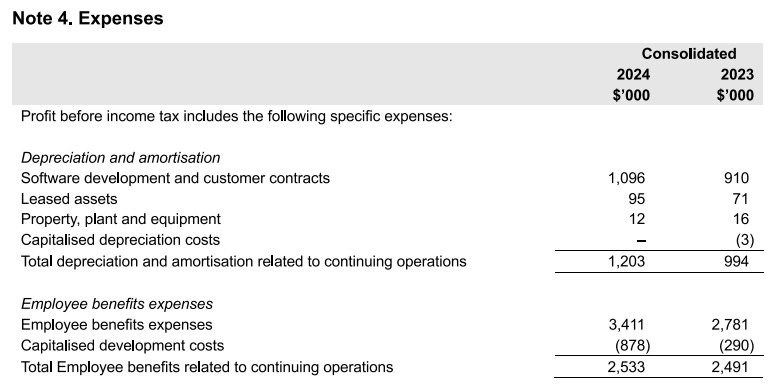

The biggest costs for PharmX in the future are personnel costs and depreciation (from intangibles). Development costs are partially expensed and partially capitalized. Here’s a detailed overview:

The legal fees and the loss related to the divestments are one-off items. Notice how marketing costs are very low.

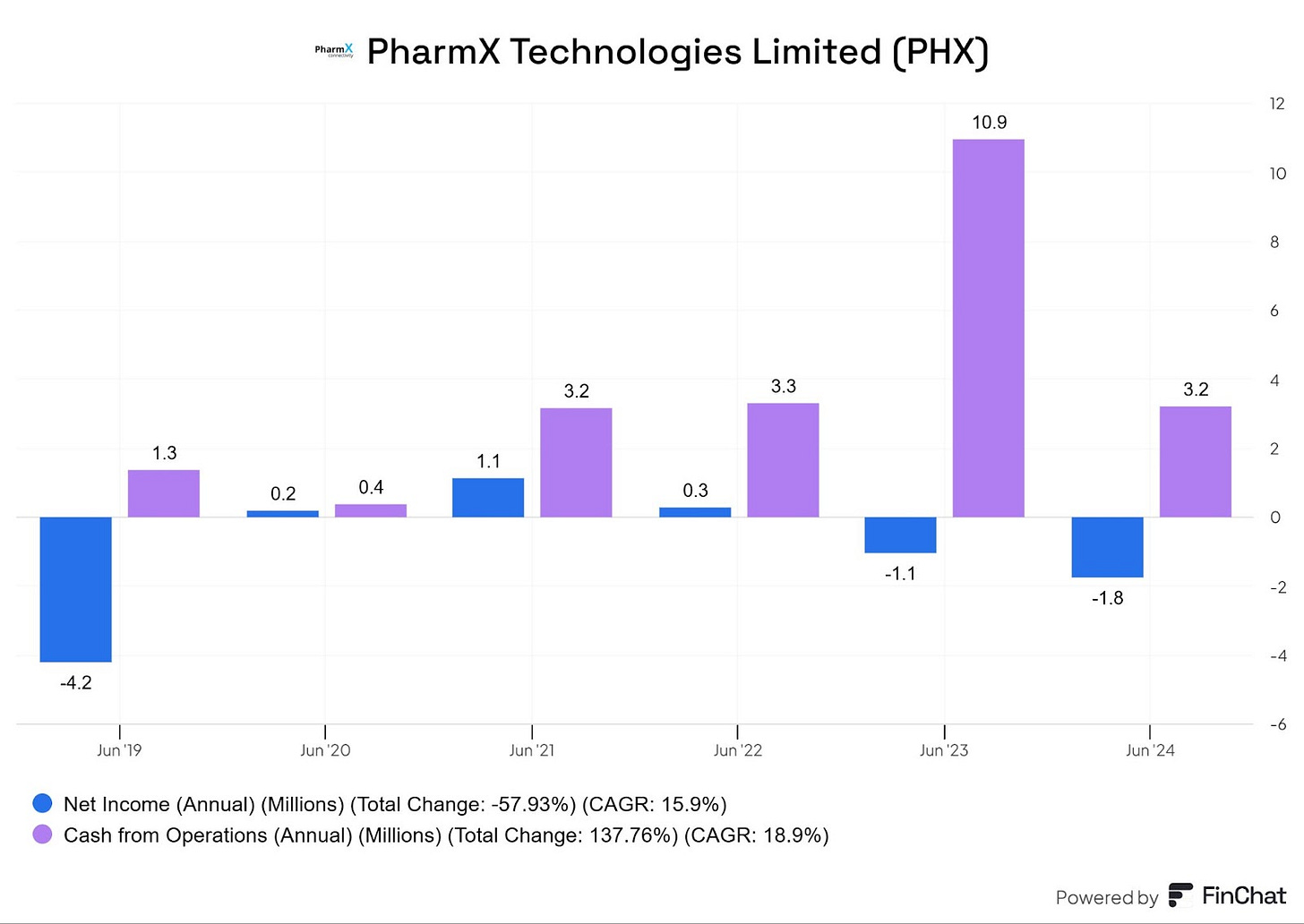

Finally, we look at the quality of earnings.

Net income has declined, but cash from operations is positive. We see the spike in 2023 due to the cash received in the legal case (which they have had to pay back). We can’t draw any definitive conclusions from this, as the business has been in continuous flux over the past 4 years.

Profitability Verdict: 8/10

Endurance

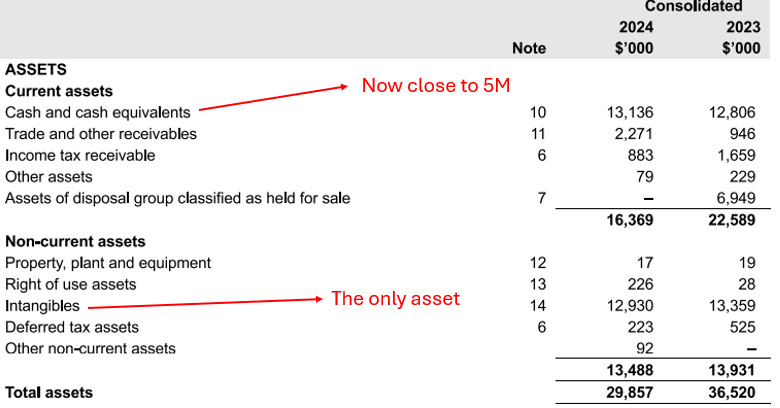

We look at the strength of the balance sheet and how resilient the business is. Can it withstand regulatory changes or downtrends in the economy? How long can the company endure? (source used: balance sheet)Their balance sheet (end of 2024 fiscal year = June 2024)

Pharmx has almost 5M in cash on its balance sheet. (Note: All the finance software tools still show a cash position of 13M AUD before the repayment of the legal case.) Historically, it has operated with a cash position between 2 and 7M. The company has no debt.

Regulations can impact their business, but as we will see in the industry chapter, these regulations currently provide a tailwind for the company. If a recession occurs, you can expect a decrease in transaction volume as total transaction volume is not only based on medication (which will have no impact) but also more and more on other goods (which can be reduced during a recession). But since most of the value still comes from medicines, their business model is pretty recession-resistant.

Finally, AI will not provide a disruption for this business in the near term.

We therefore conclude this business to be resilient towards outside factors. The biggest impact on future success will come from the quality of internal execution.

Endurance Verdict: 8/10

Competitiveness

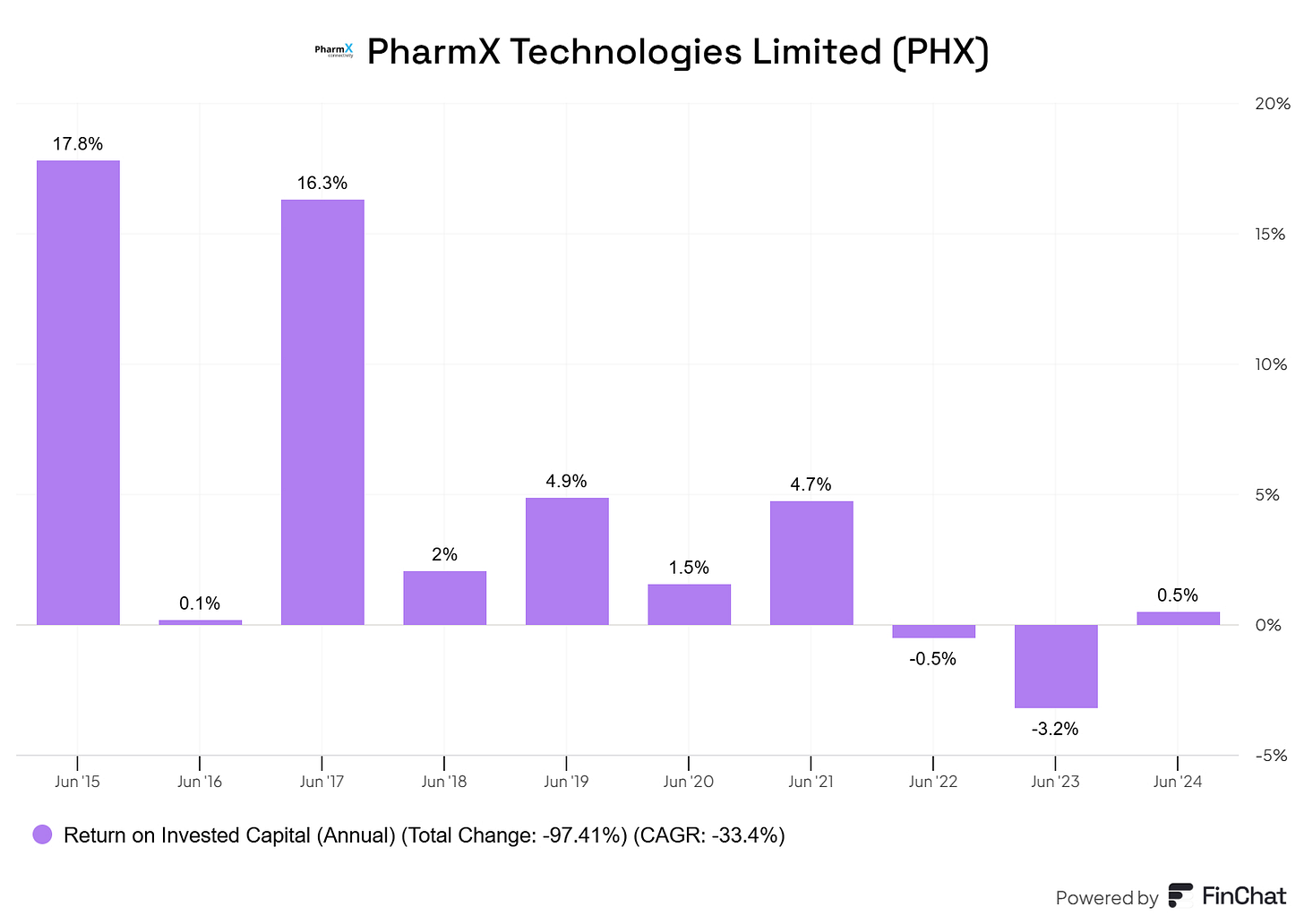

Here we look at the strength of its competitive powers. What are they? Who are the competitors? Is there a moat?Every business with a moat has a great ROIC. But every business with a high ROIC doesn’t necessarily have a moat.

Let’s not forget one thing. This is a microcap company! I’m usually very hesitant to talk about MOATS for such a small company. But for Pharmx, it seems they are in a pretty unique position. Part of the increase in revenue over the last fiscal year was a price increase on the gateway (as mentioned in their annual report). I do believe it possesses pricing power as the pharmacies and suppliers do not have a lot of alternatives.

Moats?

This company has a moat, but it needs to grow stronger. Network effects are obvious as they have a monopoly on the gateway. The only alternative to the gateway is if pharmacies and suppliers go direct. This comes with a cost in efficiency, but it is not impossible. This switching cost feels too low at the moment. Increasing the value proposition of the marketplace will increase the switching cost.

I’ll plot the ROIC for illustration purposes, but as with the other financial numbers, the data has been of low quality these past couple of years.

Direct Competition

We need to look at the competition for each value proposition: The gateway and the marketplace. At this time, I’m disregarding the data analytics product as it is still in its infancy.

For the gateway, Pharmx owns the only EDI solution that spans the entire fragmented retail pharmacy market in Australia. That does not mean there aren’t any other competitors:

MedviewExchange

Fred IT and Minfos Systems have developed MedviewExchange:

Purpose: Identical to Pharmx EDI

Pharmacies connected: 1500

Suppliers connected: unknown

The website Medviewx.com.au is no longer working, but the product still appears on the Fred IT website. Based on the court filings, medviewX was unprofitable. Fred IT has been acquired by Telstra Health. Telstra howeve,r announced in May of 2024 a reduction in workforce and cost cuttings. There is no data available to see if they would potentially cut the gateway.7

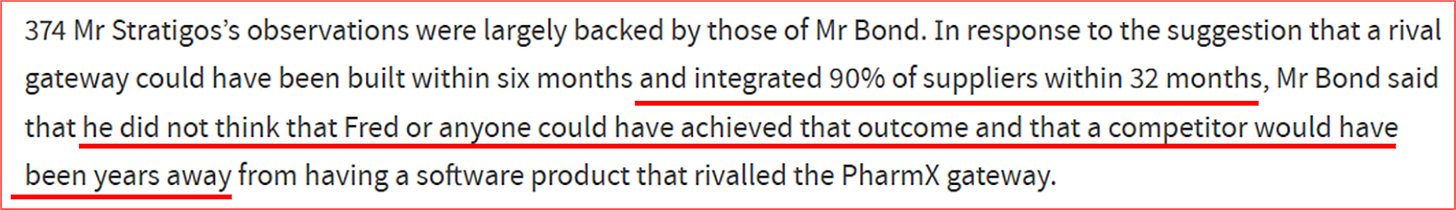

So there is 1 direct competitor that is not growing. When it comes to the pure gateway, the legal filings state that it would take 3 years for Fred It to develop something worthy of competition.

Pacific Health Exchange

Developed by Pacific Commerce, they provide their EDI solution to different industries. Their health exchange is sold to suppliers, hospitals, and pharmacies. However, no data is available on exactly how many pharmacies are connected to this exchange.

SPS Commerce

SPS provides an EDI solution to different industries. One of those is the Pharmaceutical industry in Australia. It has a contract with CVS Health, which is a large pharmaceutical retailer in the United States with 9,500 locations.

eZComsoftware

Lastly, EZComsoftware sells an EDI solution to Priceline Pharmacy. Priceline has about 470 stores across Australia.8

Pharmx does have competition. However, it’s safe to say they have the dominant EDI solution in the whole of Australia. This aligns with their historical returns and their pricing power.

What about the marketplace?

Directo

Directo was founded in 2018 and is a direct competitor to Pharmxchange. Analyzing this competitor might give us a glimpse into the future potential of Pharmxchange.

In 2024, the start-up raised $2 million in capital to fuel its future growth (they were aiming for 3 million to 6).9

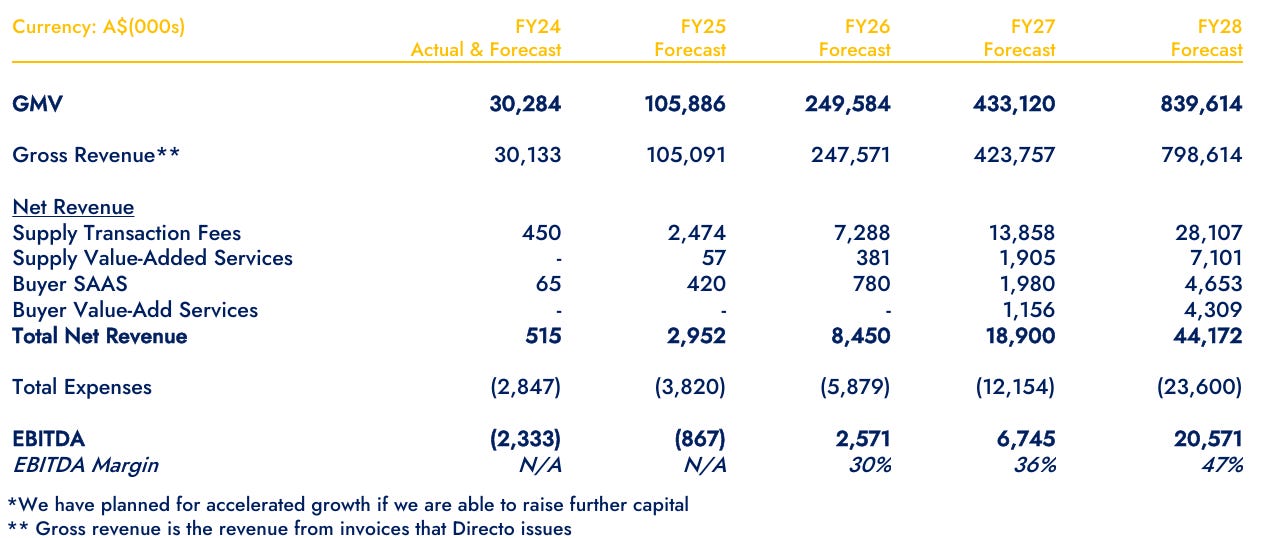

The numbers:

Gross Merchandise Volume of $40 Million

$2 Million in annual revenue

Unprofitable

54% of pharmacies onboarded

217 suppliers onboarded

Pre-money valuation: 25M

Here’s an overview of the projected future financials they used while doing the capital raise:

So the company is unprofitable, but growth projections are massive. How much of this is realistic is difficult to say.

By all means, Directo seems to have an advantage over Pharmx and is in the lead. This is important as when it comes to marketplaces, “there can be only one”

Apologies, I have been dying to slide something from the 80s in here 😀

But this got me wondering.

How was Directo able to onboard so many pharmacies so fast? Even if you build your proprietary tech stack from scratch, you need to create all those connections.

Then I saw one sentence in their filings for the capital raise that caught my eye:

Yep, an EDI Gateway. Which gateway?

Indeed. It seems Directo uses the Pharmx Gateway. So the question then becomes. Is Directo an actual competitor?

The answer: As long as Pharmx allows it. I would not be surprised if Pharmx achieves the growth they are after; they could acquire Directo and integrate or cannibalize their systems. (I plan to discuss this with management as I don’t have any other proof)

The other competitors are wholesalers. Symbion Wholesale and Anspec provide online ordering platforms, but these are not marketplaces. It’s just an online shop front. They would only be a real competitor if a pharmacy only shopped with them.

Indirect Competition

Since the gateway and the marketplace are there to serve retailers and suppliers, the obvious indirect competition comes from online pharmacies. If the customer buys online, that order flow does not go through the gateway.

There are about 121 online pharmacy offerings in Australia.10

The biggest players are:

Chemist Warehouse, which also has retail stores

Based on the data, online pharmacy sales are in the range of 4-10% of the total market, with the market being $20 billion. Although this is set to increase in the future (at a 3-4% CAGR), regulations prohibit sales of certain medications online.

In other words, currently, retail pharmacy is protected by government regulations, and it seems these regulations are becoming more stringent.

Conclusion: I generally do not like to talk about a MOAT for such a small company, but maybe, just maybe, Pharmx is the exception to the rule. Their gateway provides them with a monopoly, and even if at first glance, Directo seems to be winning on the marketplace front, a deeper analysis shows that Directo seems to be at the mercy of Pharmx.

In this market, although there are substitutes for Pharmx, they seem to be limited and dispersed. The past financial statements do not paint a pretty picture when it comes to ROIC. But based on the legal filings, historical numbers show a very high ROIC. More investment will be needed in the marketplace, so ROIC in the short term will not reach those levels just yet.

We conclude that Pharmx does seem to have a durable competitive advantage.

Competitiveness Verdict: 8/10

Industry

Is the industry providing a headwind or tailwind for the company? Are there secular trends? What does the runway look like? Is the market slow or fast-changing? What does the competition look like? Are there barriers to entry?The current retail pharmacy market in Australia is projected to grow at a 5-8% CAGR to reach $24 billion in 2030.11

Some key secular trends support this growth:

Australia’s population should increase from the current 26.6M to 33M in 2035

The number of people aged 85+ will increase from 500,000 in 2021 to 1,500,000 in 204112

Health consciousness is increasing among the population13

In addition, recent regulatory changes provide a benefit for retail pharmacies:

Nicotine vapes can only be sold in retail pharmacies (ruling in October of 202414). Although the total market size is estimated at $580M15 , 92% of vapes are sold illicitly. This means the potential market for the retail pharmacies is about 45M AUD. Vaping rates are declining, maybe due to the more stringent regulations.16

Medicinal cannabis can only be sold in retail pharmacies. This market is set to grow in the coming years.17

However, other regulations make it more difficult for pharmacies to make a profit. As such, more and more pharmacies are incentivized to store and sell products beyond medicines like wellness and others. 15 of these suppliers are now connected to the Pharmx marketplace.18

Some examples are:

McoBeauty (wellness)

Bondismile (teeth whitening)

Vapelabs (distributor of nicotine vapes)

Now, don’t go thinking about the American Walgreens just yet. A typical pharmacy is about 330 square meters in size. While not small, this is far from the size of a Walgreens. What I’m getting at is that they do not have the space to start stocking a lot of different products for sale. Now the average pharmacy size has grown over time (from 270 to 340), so maybe that trend will continue and some sort of consolidation will occur, with bigger ‘pharmacies’ but fewer of them.

Although the niche pharmacy software industry is competitive with few barriers to entry, specifically for the gateway and marketplace, the barriers to entry are high. The proof is that there is only 1 gateway and 2 marketplaces.

Pharmx competes in a growing market, with tailwinds from secular trends. Barriers to entry are high for both the gateway and the marketplace.

Industry Verdict: 7/10

Asset Agility

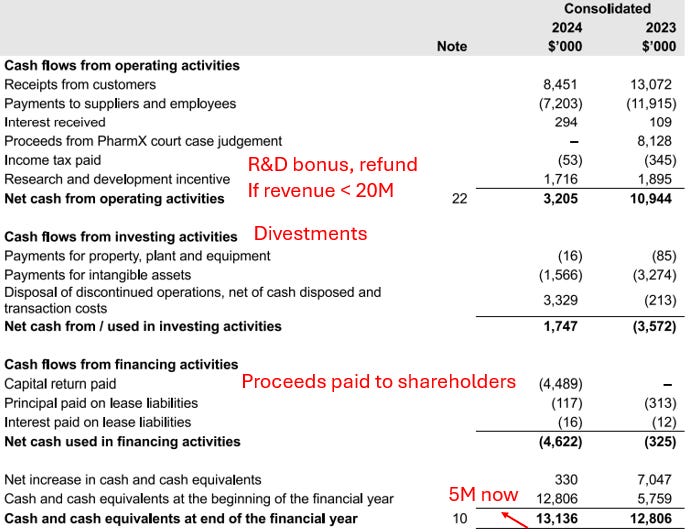

We look at the company’s assets. How much capital does it need to reinvest? What is their capital allocation strategy? (source used: cash flow statement)Let’s take a look at the cash flow statement ⬇️

The receipts include the legal proceeds (which they have had to repay since. The research and development incentive is a government program that allows companies to apply for a refund based on their R&D investments. This refund is only available for companies with revenue lower than 20M.19

In 2024, after the divestments, they paid out the proceeds to shareholders. As mentioned before, the current cash balance sits at 5M. There is however, one line item that we need to double-click: payments for intangible assets.

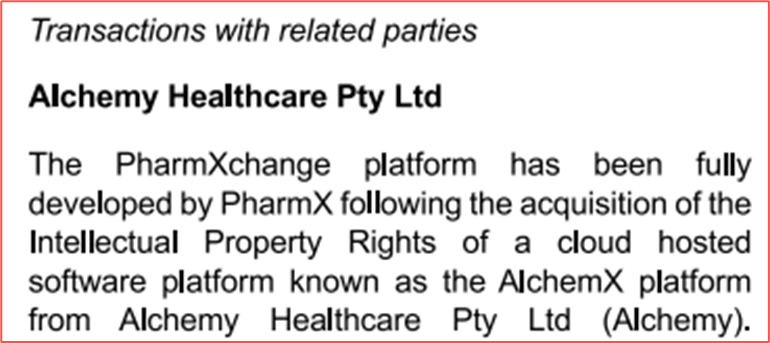

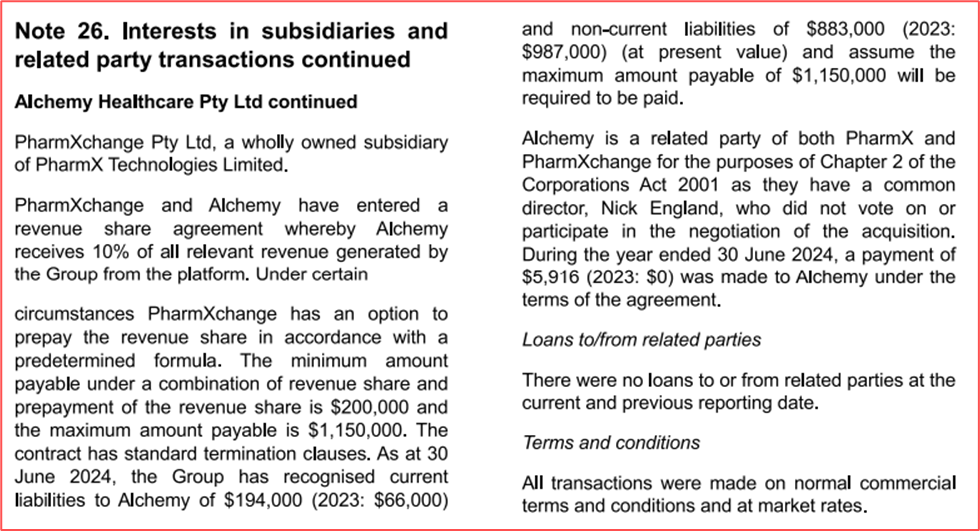

Here’s what is mentioned in one of the notes of the annual report:

Ok, no problem. But then it mentions this ⬇️

AlchemyX will receive 10% of all revenue generated by the platform up to a maximum of 1,150,000. This means the revenue share is capped at 11,500,000.

The note mentions the current and non-current liabilities for 2023 and 2024. At first, I wanted to use these to calculate the revenue that was generated by the marketplace. But that would mean the marketplace generated $1,940,000 in 2024, which is not possible as management has stated that marketplace revenue is still too low.

The only thing we need to take away from this:

Up to 11,500,000, 10% of revenue will go to AlchemyX

Nick England is a director at AlchemyX, and as you’ll see in the leadership section, he is a board member at PharmX. So incentives are aligned.

Their capital allocation at the moment is very straightforward:

Invest CAPEX for growth onthe gateway and marketplace

No buybacks

No dividends

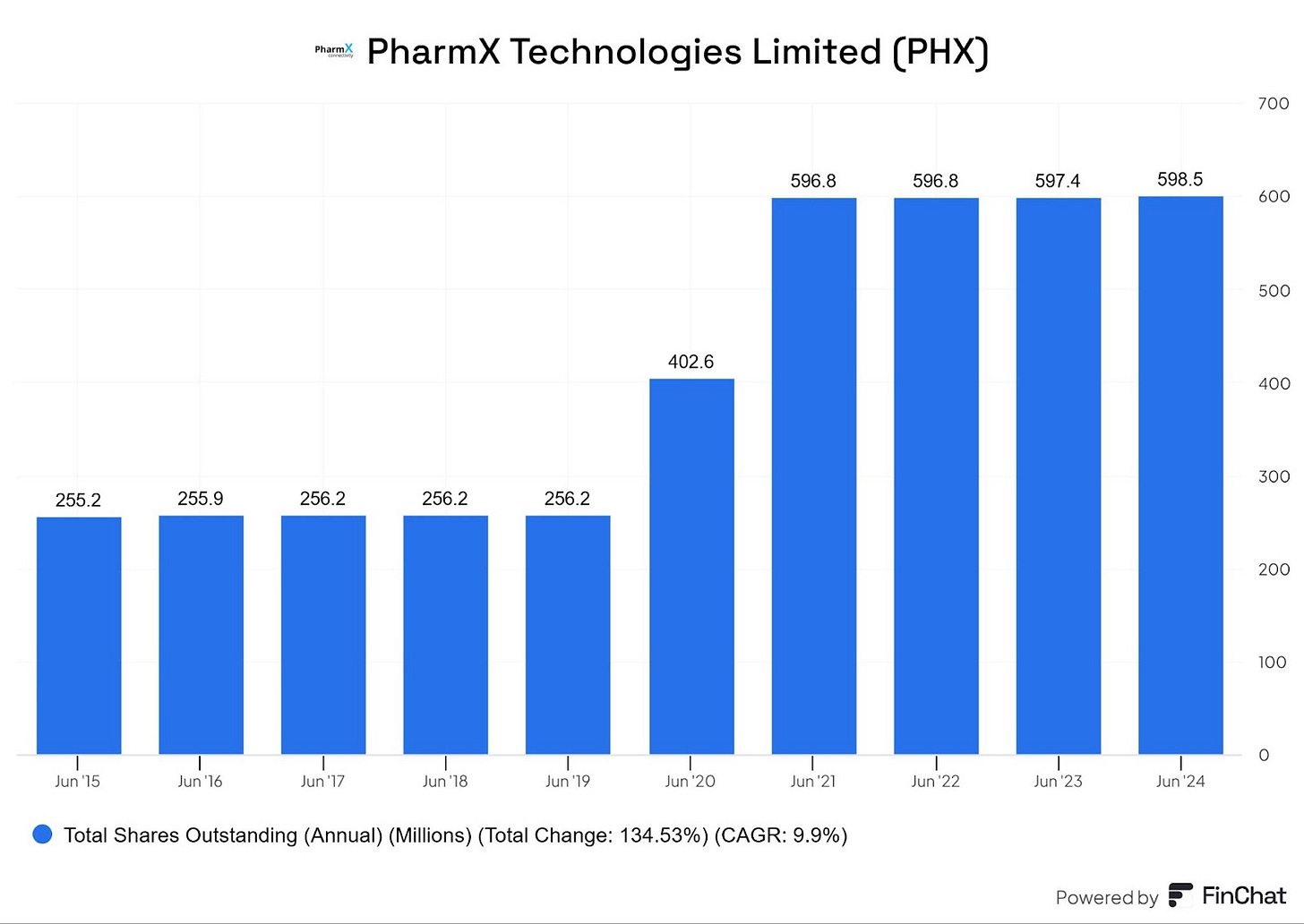

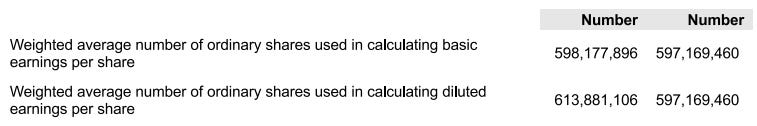

The historical number of shares outstanding does not paint a pretty picture.

But you now know the history of the company. A slight dilution can be expected due to employee incentive compensation. When taking into account shares granted in the last fiscal year, you’ll find the exact number for number of shares below.

From a liquidity point of view, this company runs on negative working capital. Since the company has no inventory, it makes sure that its days receivable are shorter than its days payable.

I expect maintenance Capex for the gateway to be around 5% of revenue (hard to predict for the marketplace)

PharmX is an asset-light company, and earnings quality is high. Investments through CAPEX on the R&D side are booked for future growth. They employ negative working capital. Free cash flow will probably be nonexistent in the short term due to the investments for growth. The fact of paying out the proceeds of the divestment to the shareholders is a positive sign.

Verdict: 6/10

Leadership

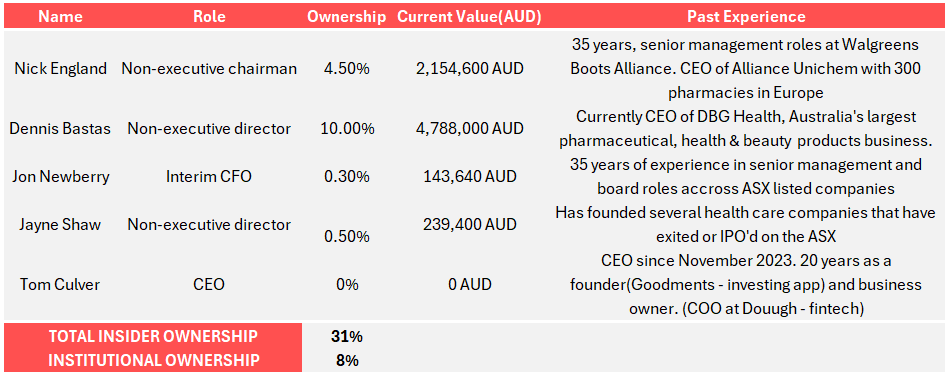

What is the incentive structure? Is there skin in the game? How are management and executives compensated? Do they have a track record? Do they have ambition, a vision, and a strategy to execute? Have they been buying or selling the stock? (source used: proxy statement)Ownership and experience

A new CEO, Tom Culver, was appointed in November of 2023. Here’s an overview of the board:

The new CEO doesn’t seem to have any experience in a retail setting, but he has been involved as a founder/operator in a couple of startups. This is the biggest uncertain factor, combined with their high ambitions. If a company does 6 million in revenue, and in a couple of years, you find yourself with 50 million in cash, it’s not always easy to allocate correctly. The current CEO, to my knowledge, does not have prior experience with these kinds of numbers. While I would prefer the CEO to have more skin in the game, bear in mind that his appointment is new. They have an incentive structure to award shares in the company.

The board, however, has significant experience in this business environment. They also have skin in the game. Nick England bought some shares on the open market in 2024, but the amount was very low.

Although there is some institutional investment (8%), these are, of course, not BlackRock or Vanguard, everyone knows.

Incentive structure

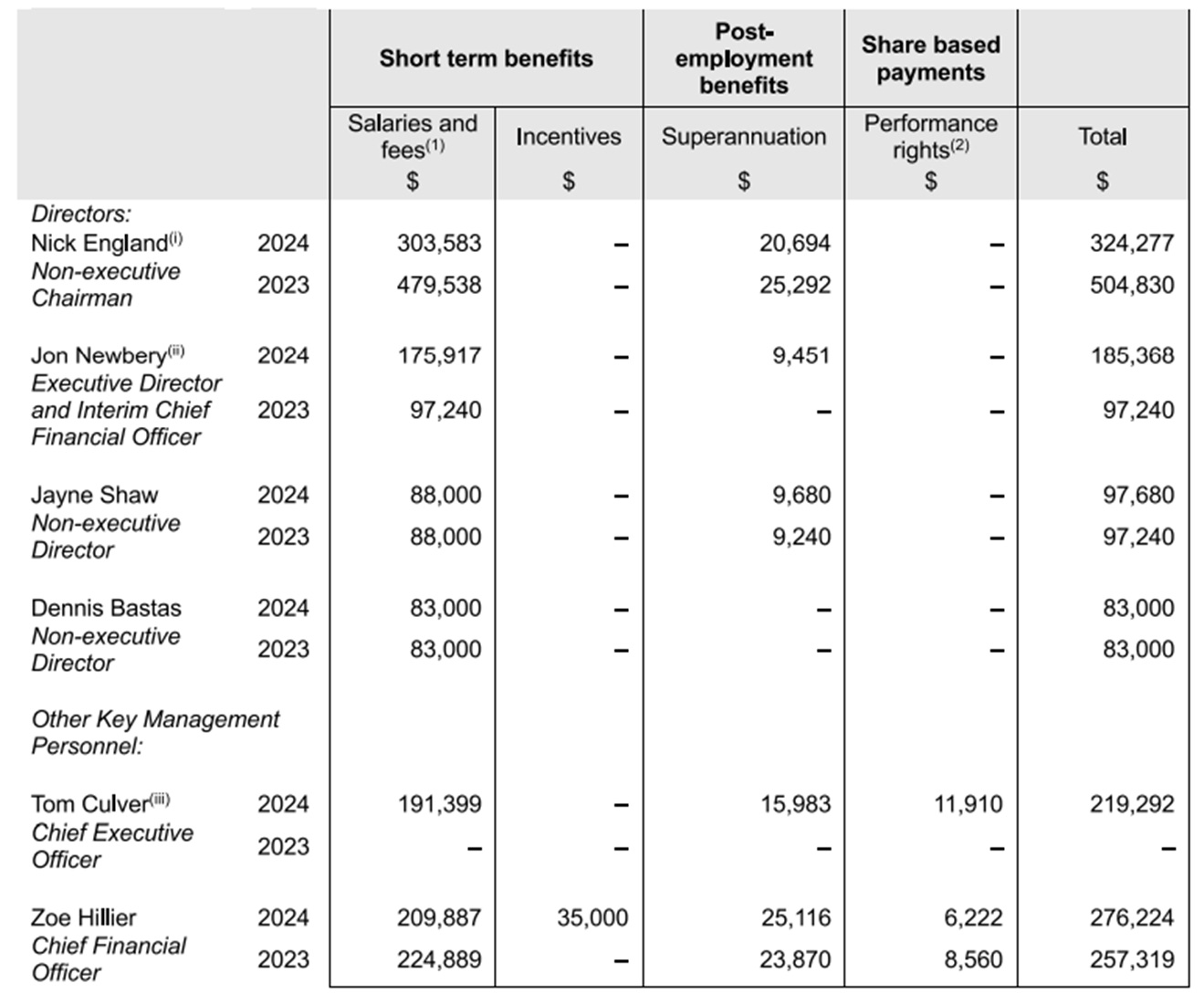

Below you’ll find the remuneration report taken from the 2024 annual report.

Salaries amount to 1 million for a company that did 6.5 million in revenue. That seems pretty high (15% of revenues just to pay top management). Let’s hope they can deliver growth as mentioned.

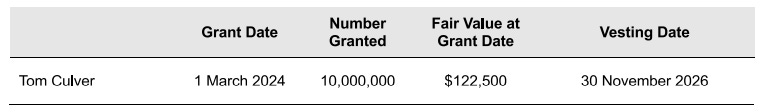

The CEO has an annual salary of 300k and several performance rights granted:

Performance hurdles are based on the achievement of certain earnings per share targets with a vesting date at the end of 2026. The rights expire after 5 years.

I understand the need to get the company back on track in the short term. I do hope longer-term targets (5 years) will be used after 2026.

The future

Both the board and the CEO have communicated a clear long-term vision for the company.

Leadership Verdict: 6/10

Short Summary

Scuttlebutting

Going outside of the reports, talking to people, boots on the ground (if possible).I spoke to my local pharmacist about their POS system and their suppliers. For context, this is a family-owned retail pharmacy. They use 1 wholesale supplier for most of their goods. Then they have a direct sales channel with 2 smaller suppliers, which allows them to negotiate better prices.

Takeaway: Although the situation for my local pharmacy is different, I do think it signals that the EDI Gateway and the marketplace are not as sticky as an ERP system. If tomorrow the gateway fails, these pharmacies and suppliers will find a solution. I still believe the company has a moat, but the value proposition is not as strong as a company like SAP.

This means it provides Pharmx with an opportunity to develop additional functionality through the marketplace to increase the switching costs.

I would like to talk to an Australian pharmacist or supplier. If any of you know someone in Australia who can help me, please send me a message.

Valuation

In the end, it’s all about valuation. We use a football field approach, using different angles to come up with a rough idea of valuation. Our hurdle rate is 15%. Ideally, we want more cash in the near term, high FCF yields, or low EV/EBIT values. Important: Our final decision is never on precise numbers.When all is said and done, we want an answer to the following 3 questions:

What does the downside risk look like? (We first look down before we look up)

Is there a high probability of a double in 5 years? (our hurdle rate)

Is there potential for more? (further multi-bagger returns)

We’ll go through the different valuation methods and then answer these questions at the end.

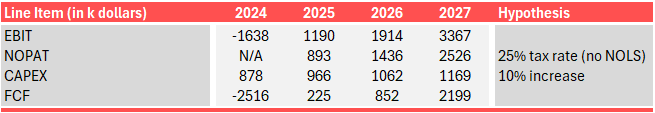

Greenblatt method (Normalized future EBIT)

As I mentioned in the P for Profitability, it’s very difficult to estimate EBIT for 2025 and 2026. Everything depends on the marketplace (eBay has 30% EBIT margins). How much OPEX (and CAPEX) will be needed to develop it? The marketplace Pharmx is trying to build does not have a logistical hardware component; this is an asset-light marketplace.

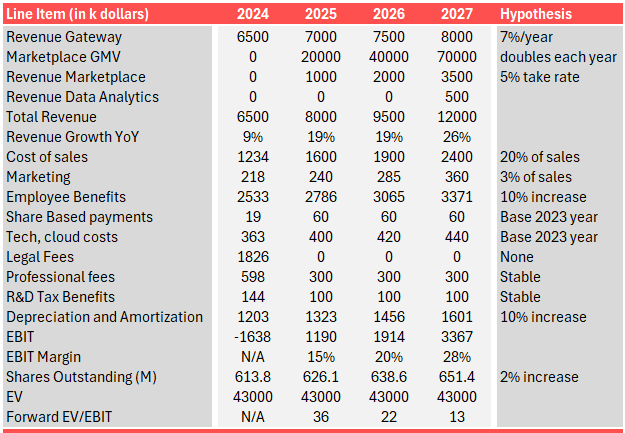

In the coming year, Pharmx should be able to generate 7 million in revenue from the gateway and 2 million in revenue from the marketplace. Here are my assumptions for the coming years:

So if next year, the marketplace contributes 1M in revenue, and the gateway grows at 7%, the current price you pay is an EV/EBIT of 36. That’s expensive.

However, if the marketplace keeps doubling its GMV (which it should based on Directo’s performance), it should be able to generate a 3.7M in EBIT in 2027. The 2027 EV/EBIT of 11 would then be low because the market will pay a higher multiple if it sees this company doubling its GMV.

Bear in mind that this projection shows substantial operating leverage (as it should be for a marketplace). With EBIT margins increasing from 15% to 28% in only 2 years.

From a Greenblatt perspective, the company does not look cheap. But if you look at my estimates of growth in GMV and compare these to the previous numbers provided by Directo, I am being very conservative. (but I’m not the one raising capital 😉)

Price-Implied method

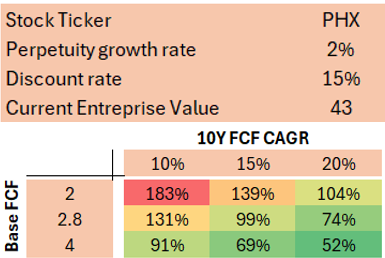

Instead of valuing the company, we determine what kind of growth the price is implying. Then we ask the question, is this realistic or not? We use a reverse DCF for this.

What does this mean?

To get a 15% CAGR on our investment, the company needs to generate 2.8M in free cash flow and grow this cash flow at a rate of 15% each year.

Here’s how we go from EBIT to FCF to get an idea of what this means. The 2.8M might be achieved in 2027, and from that point on, FCF needs to grow at 15%. The terminal value in the calculation represents half of the total value.

Based on a reverse DCF, a double-digit growth trajectory is currently priced into the stock.

The 3 final questions

What is the downside risk?

The marketplace is not gaining traction. Then the company would still be stuck with the gateway, which can only grow at around 5-7% each year. If the company then downsizes to only focus on the gateway and takes into account the past profitability on the legal filings, you would be looking at an EBIT between 2 and 3M each year (in 5 years).

I estimate this probability to be low. If it happens, the company would trade at an EV/EBIT of 10, which means a 30% price reduction from the current levels.

Is there a high probability of doubling in the next 5 years?

I think so. But it will all depend on the growth. If the assumption in the Greenblatt analysis plays out, the market multiple, at such a growth pace, will be higher than 13 in 2027. I would estimate that with 2 additional years (in 2029), the price should be trading at double from now.

Is there potential for more?

Yes. A lot more. If they manage to displace suppliers from the pure gateway (take rate 0.035%) to the marketplace (1-5%), then we’re talking about an order of magnitude difference. Management has mentioned a long-term goal of letting 50% of the total transaction volume (20B) flow through the Gateway. We’re talking about revenues going up towards a range of 100 to 300 million.

What’s the bet?

If you buy this company, you’re betting on it actually having a moat, of playing in a market with very low competition, and on it executing its growth ambitions.

It is the wide difference between downside risk and high upside potential that makes it so compelling.

As I mentioned at the start of this article, I have rarely come across such a combination where a competitive advantage is paired with a long runway.

Based on all of this, I have bought the company and made it a 10% position in the model portfolio. (link will be sent to paid members shortly)

Be aware that I have been following this company for multiple quarters. I took an initial small position when I started investigating in 2024, and due to my increased conviction, position size has followed. (I would never take an initial 10% bet!)

If the next earnings call shows execution in growth in the marketplace, then I’ll have to decide if the position is enough, or if I should go further. I need proof first, though.

Phew, I have to say, this was a lot of work. Let me know what you think of this first paid deep dive! If you have any comments, feel free!

As always, may the markets be with you!

Kevin

Please rate this deep dive

Competition

Directo is the largest B2B marketplace currently operating in Australia, with a reported GMV of $40M and revenue of $2M. Why has Pharmx not tried to acquire Directo?

What kind of contract agreement has been signed with Directo since they use the PharmX Gateway?

In the business of marketplaces, there usually can be only one dominant player, and Directo seems to be in the lead. What is the plan to tackle this competition in the future?

Marketplace development

Since the marketplace is web-based, does it already have all the functionality of a typical POS system?

Is the final goal to displace the POS systems so that the marketplace becomes the only software the pharmacy needs?

What is the incentive for a supplier to go through the marketplace? Why would a CSO wholesaler want to switch his transaction volume to the marketplace, knowing he will have to pay a much higher fee compared to the current gateway?

Market potential

There is the rationale of signing up more suppliers (beyond prescription medicine), increasing SKUs, etc. A typical pharmacy has a surface area of 330 square meters (much smaller than an American Walgreens). It seems there are physical constraints on growth. Will this not limit the future market potential?

What to track for this company?

Pure operational performance

How many suppliers are added to the marketplace?

Is the number of active connections increasing?

Is CAPEX delivering growth? (You should be able to see something in the near term)

The speed of implementation

To create a dominant marketplace, you need to go fast. I would like to see the marketplace reach 80% of pharmacies fairly quickly. If it does, it would show the product ‘sells itself’.

Gross Merchandise Volume (GMV) should increase rapidly

Monitor competitor reaction

The marketplace displaces the traditional use of a POS system (the marketplace is web-based). I cannot imagine competitors will just roll over.

https://www.pharmxchange.com.au/

https://pharmx.com.au/wp-content/uploads/2024/10/ASX-Announce_20241030_Investor-Presentation.pdf

(https://www.ibisworld.com/australia/industry/pharmacies/1878/)

(https://fr.statista.com/outlook/cmo/tobacco-products/e-cigarettes/australia-oceania)

(https://www.statista.com/outlook/hmo/cannabis/medical-cannabis/australia)

I became a paid member yesterday evening. I’ve just read this article and I’m not regretting my decision.