From heaven to hell: $ADYEY and $INMD

Welcome to purgatory

It’s been a quarter of ups and downs for some of the companies we cover. Let’s start with the bad news first. ⬇️

Inmode: Welcome to hell

Let’s be honest.

The thesis is not holding up at the moment. In my previous write-ups, I was betting on a no-growth scenario. It is not happening. Inmode is in a decline.

You can check out our full 30-deep dive in a previous article ⬇️

When a business is not performing as expected, there are 2 big questions to ask:

Is the decline related to mistakes the business made?

Is it temporary or permanent?

But first, a quick update based on the latest quarterly results:

Latest Quarter

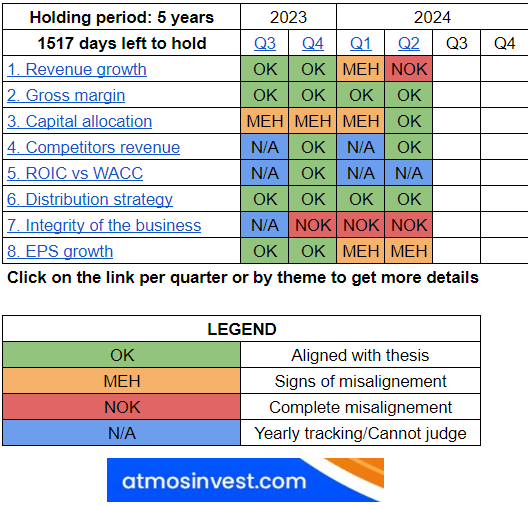

Here’s a screenshot from our thesis tracker.

As you can see, my goal was to hold on to it for 5 years. But first a small poll.

Let’s go through the 8 topics based on the latest quarterly results.

Revenue growth

Revenue declined once more to 86M USD (versus 136 USD in 2023). It’s important to recognize that as long as a medical device has not been delivered, the revenue is not recognized. Because Inmode had some production delays, they have started posting pro forma numbers (if they correct the numbers awaiting delivery).

Pro forma, numbers increase to 102.6. That’s still a 24.5% drop in revenue compared to the same quarter last year. Management was surprised with how weak the quarter was as they had to (again) revise guidance for the year.

Honestly, the quarterly reports now read like this:

Non-GAAP numbers

GAAP numbers

Non-Gaap Pro Forma numbers

That’s not a good sign

But we haven’t gotten to the really bad news.

Selling fewer medical devices is one thing. As we mentioned before, higher financing costs over a 5-year lease (at a 15% interest rate) make physicians hesitate to sign. In addition, the financing companies take a lot longer the vet the buyer, and the more time it takes, the higher the probability the buyer gets second thoughts.

What’s more important is the drop in consumables (30% YoY). The amount of consumables sold is an indication of the number of procedures that are performed by existing installed capacity.

Up until now, the story was the problem with rates, but demand was still strong.

Now the story has become: The problem is high rates, but demand is weakening.

Conclusion: We have to asses this topic as a NOK in our tracker.

Gross margin

Gross margins have decreased towards 80% (from 84% typically). This doesn’t seem that worrisome. What’s positive is they are not sacrificing on price. They still sell their devices as a premium product.

Capital allocation

The buyback of shares is done. 8.37M shares were bought at an average price of 17.8 USD per share. That’s about 10% of shares outstanding.

Buying back more shares is not off the table. The problem seems to be that going beyond 10% in a year could introduce a dividend tax. They are looking into this with the regulator.

With their current 729M USD cash position (yes, although revenue is declining, Inmode is still very much a cash-generating business) there is still room for more buybacks and current prices.

An activist investor, DOMA, sent a letter to the board to ask for more buybacks.

To create proper and material shareholder returns, InMode's Board should immediately approve a tender offer of 40% of the Company's stock, to be followed by the already announced buyback.

In other words, buy back 40% of the company at current depressed prices. That would translate into 550M USD in cash used.

I do think, DOMA is right to ask for more buybacks. After all, the cash is just sitting there, and M&A seems far off. However, the medical device industry is highly competitive. Inmode and its competitors are suffering, although Inmode is suffering less. If the downturn continues, it might generate opportunities for Inmode. My take is that I’m in favor of more buybacks, but not to be too aggressive. An additional 10% this year would be great. Then, we wait and see what the market does.

Competitors revenue

Let’s take a look at other public companies

Cutera’s revenue has been in decline since the end of 2022

Classys’s revenue keeps on increasing (but is not active in the US), it mainly earns from the Asian market

In the tracker, it is tracked as OK. OK means, direct competitors are also losing on revenue.

The other criteria

Their distribution strategy remains similar, although I noticed a small decline in the number of sales reps. They have about 250 sales reps at the moment.

From an integrity point of view, there is no additional news related to the class action lawsuits.

EPS growth, because of the top-line decline, will take a hit. They are aiming for an EPS of 1.94 USD/share for the year. (compared to 2.3 last year and 1.89 in 2022).

Here’s the full overview of this quarter’s tracker:

Conclusion

Let’s go back to the first 2 questions:

Is the decline related to mistakes the business made?

To me, the biggest mistakes they have made in the past are:

Lack of transparency in their communication

Capital allocation not up to par

But other than that:

In an overall declining market, they continue to develop new platforms

They are still generating cash

They did the buybacks

Is the situation temporary or permanent?

I believe things will stay the same for another year, maybe 2. Imagine rate cuts set in, will this be their savior? If demand for procedures has declined, then the overall market will shrink. The good news is they have a strong position in that market. But how will they use it to become stronger compared to others?

The permanent aspect of this story is we will probably never see zero interest rates again. This also means that past financials for Inmode were inflated. Their business is heavily reliant on financing and rates, more so than other businesses.

There are 3 final factors to consider:

Physicians that already own a device, are not running to buy a new version. Their current devices still work. In the last article, I was hoping for the start of a big replacement cycle. However, it seems that the actual cycle will take more time as the economic lifetime (5 years) is shorter than the actual lifetime of these devices.

The biggest problem is Korean competition. A company like Classys wants to enter the US market in 2026. Imagine the macro situation improves, Inmode will face a much bigger problem. If a physician is offered a similar platform at a 30% lower cost, I do not think he will hesitate. That is what is bound to happen as the cost basis of these companies is lower.

The situation in Israel: When looking through some comments on Reddit and Seekingalpha, locals are giving feedback that the impact in the north may be exaggerated (based on the media, the situation in the north has worsened), and Inmode should be fine. I have no idea how to improve our assessment of this.

Valuation

Inmode is still generating cash.

The FCF generation of Inmode will decrease in the next 2 years, but it still delivers a very high FCF Yield near 12%. However, the business has become more expensive due to the underperformance.

Decision time

Since August, I have been fully invested. No more cash on the sidelines. If I look at my entire portfolio, Inmode sits at the bottom concerning ranking.

In other words, I’m looking for something better to trim or outright sell my position.

So in the coming months:

I find something better, and I switch out Inmode

Inmode starts performing better before I find something

Which company at the moment is a better investment?

Adyen - A high performer

Let’s get to the good news.

Adyen released their H1 2024 results, and they were solid. It took some time for me to understand Adyen’s business and the payments processing industry as a whole.

See the original article here:

One can quickly get lost in a myriad of technical details. For each quarterly call with Adyen, I focus on 3 things:

Do they stick with their organic growth full-stack model?

Do they stick with their premium-pricing model?

Do they behave countercyclical?

Why?

These are the 3 things I believe separate Adyen from their competitors, and these mantras should be considered holy.

If for some reason, Adyen would change strategy in any of these, that would be a reason to consider selling the business

Here’s a short update on the quarterly call:

24% in net revenue growth, gaining market share through existing customers and new ones

EBITDA margin increased from 43% to 46%

EMEA: 25% in a more mature market

US: 30% and new: Scheels and Crate & Barrel

Latam & APAC: They acquired a license for India and Mexico

Unified Commerce: Retail and new customers

Digital: Subscription services and SaaS

Platforms: Number of platforms > 1B: 22

The customer’s focus continues to be cost optimization

They continue hiring in North America. Sales and Engineering. A couple of hundred people. But the culture comes before the number.

Guidance for H2 of 2024:

H2 will be a little slower due to higher comparables in 2023, but still, 20% growth in net revenue is to be expected

Still on track to aim for EBITDA 2026 above 50%

Some additional info from the Q&A:

Cost reduction through cheaper alternative routes to process payments for their customers (the debit route). More data collection can help detect fraud and increase authorization rates.

They are uniquely positioned with their US debit solution

No real change in product offering

India: Bringing solutions for international customers to go local. Then the locals will follow. They are building their tech hub in India.

Winning in the US on value proposition so still premium pricing

Organic growth; No M&A

The more embedded Adyen is with its customers, the more value it can bring, and the more stickier the business becomes (increased MOAT)

The more data the better the authorization rates

Concerning the accelerated checkout solution (Paypal) -> Adyen is following and wants to develop something similar or better

Conclusion

Adyen is executing as expected and upholds the 3 criteria I outlined.

Valuation

Adyen’s price has risen since the quarterly update. It trades at around 1300 EUR.

I’m a holder here. I hold it because it’s a high-quality business. I had planned to add if the business got to around 900-950. But that ship has not sailed.

Not buying here because too expensive. It’s a great business, but great businesses can be lousy investments. Remember our article on quality and price.

This was a short update on these 2 companies. I’ll cover the other ones soon.

As always,

May the markets be with you!

Kevin

Kevin, I think INMD has value. My analysis :

Installed base is 25000 machines as of today. Life is 5 yrs (lease is 5 yrs and mgt alaso indicates life is 5yrs) but lets assume 6 yrs. We know the installed base since 2019 (its in your first deep dive) and till 2022. So we can easily model the pure replacement value from 2025 onwards - just installed base/6 starting from 2019. Even if INMD does not sell a single new machine from 2025 onwards, and as long as patients still want the procedures and doctors need the product, they will replace it every 6 yrs. I modelled that (just took 10 mins) and assumed a 35% Net Profit Margin and a 10X exit multiple ins 2029. I got EV of 870 million at 12% discount rate. Would love to see what you get. Its a very quick calculation.

The main questions are - will proceedure demand remain, what will competition do and what happens to INMD supply chain due to the war. If these three are fine, I think there is value here

I am still holding my small position

I understood "share premium" in their Consolidated statement of changes in equity to mean shares outstanding. It went from 374,992 on 6/30/23 to 417,923 on 6/30/24. Happy to be corrected if I am wrong. Not used to looking at financials from outside the USA.