GPT5.2 for stock analysis is here…

And the descent into cybersecurity

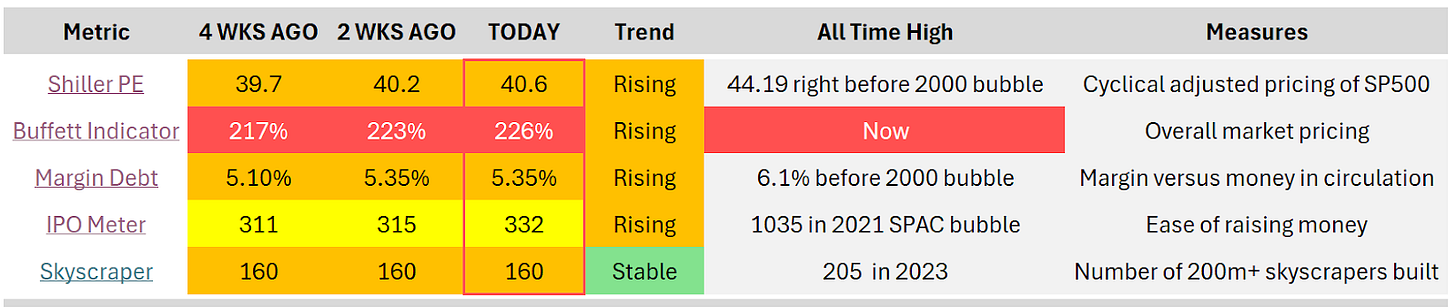

1. Bubble Meter

“We look at some metrics to gauge what the market temperature is.”

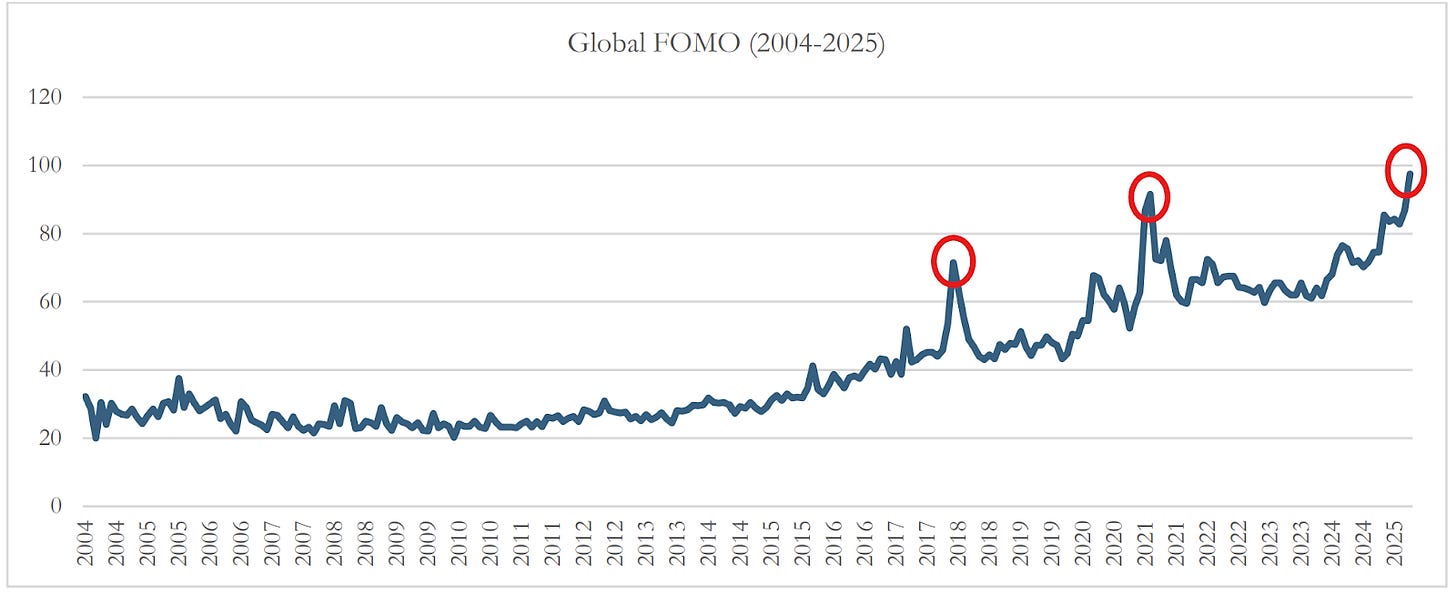

So I was hunting for a new metric to replace the Skyscraper and found an interesting one: The Global Fomo Index.

a novel sentiment metric constructed from monthly Google Trends data since 2004, designed to quantify this persistent psychological driver across countries and over time

In other words, you track certain keywords and verify how they evolve. According to their findings, an elevated FOMO Index predicts lower returns (1-2%).

Sadly, I do not think this index has been updated in real time. I found this chart, which ends in April 2025:

No real use during the great financial crises, but it does show the stock market's hotness in 2018, 2021, and, well, this year!

You know of a better metric we should track? Let us know ⬇️

Stock in the funnel

First, let’s go back to our previous positions in our funnel:

FiServ

-> I decided to PASS.

Short Rationale: Having gone deeper into the payment sector, this legacy company is trading at a lower price than the newer kids on the block. But I don’t buy management’s strategy to turn the ship around. In these kinds of situations, I prefer to bet on the winners. (Note: This is very different than the drawdown Adyen experienced in 2023. That was a high-quality company (a winner).)

Let’s get to the stock in the funnel, and this week that is:

Rubrik (Ticker: RBRK)

Description: Rubrik, Inc. (RBRK) is an enterprise software company operating in the cybersecurity and data management sectors. Its mission is to “secure the world’s data.” The company’s core business objective is to provide cyber resilience. Rubrik operates primarily in the Enterprise Software, Cybersecurity, and Cloud Services (SaaS) industries. Its key competitive advantage lies in its modern, cloud native, Zero Trust architecture, which is designed for complex hybrid and multi-cloud enterprise environments, differentiating it from legacy backup solutions. A major recent strategic initiative is the pivot to position itself as “the Security and AI Operations Company.” This shift is supported by the acquisition of Predibase and the development of new AI-driven offerings.

Type: Fast Grower (unprofitable)

Why it’s interesting: Traditional security tools don’t guarantee recovery, and legacy backup wasn’t built for cyberattacks, so Rubrik positions itself so it “assumes a breach” natively. (with recovery of data). And Rubrik has been recognized as a leader in the space for several years now.

In simple terms, Rubrik provides you with a secure back-up vault + UNDO button when things go bad.

Cash flow from operations has turned positive, but no free cash flow yet, as this company is in high growth mode with a 44% CAGR in revenue over the last 2 years.

The market priced in a lot of growth with an EV/Gross profit of 14 three weeks ago. After the earnings call, the number jumped to 18.

Current Status: Revisit later (more research). I did some work on it, but for me, it might be too early in its lifecycle. The recent earnings update was good and provided a jump in price, so waiting a quarter might settle down the markets a bit. Cybersecurity is a competitive place, but just like the payments sector, I think you’d better pay a premium for one of the leaders than to buy a laggard “on the cheap”.

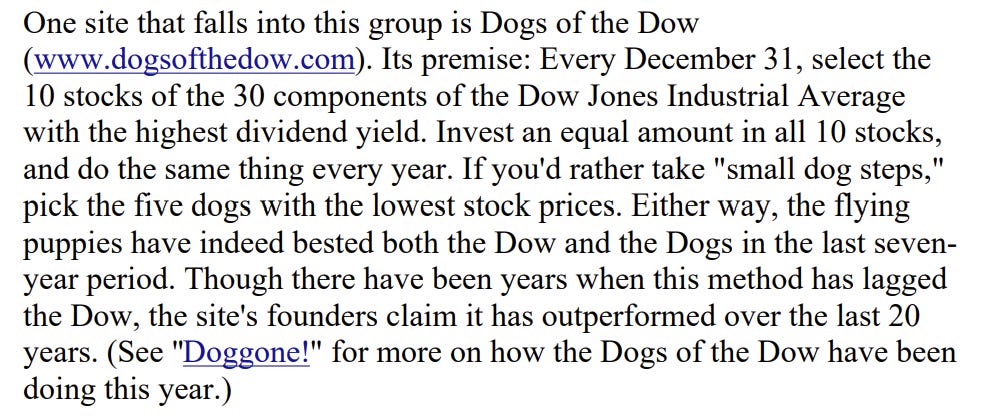

3. Best article of the week

Yeah, I can’t help it.

The Big Short is one of my favorite movies. I think I watched it 5 times already. So when Michael Burry launched his Substack, I couldn’t help but check it out.

And I love articles like this, because they take you back in time.

No summary this time. But a small snippet of one of the 1999 downloadable articles:

Love it!

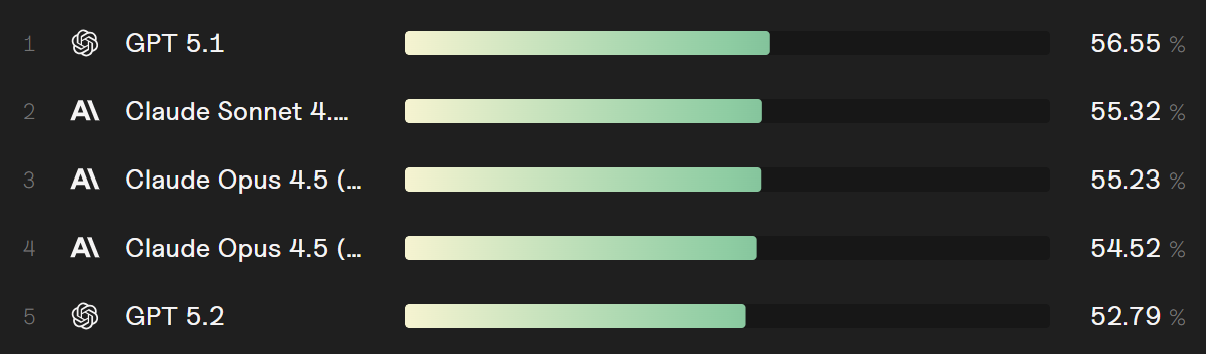

4. AI Tools for Stock Analysis

Well, GPT5.2 launched yesterday. And based on the overall benchmarks, it takes the lead. On this benchmark, Gemini 3 Pro was already behind the 5.1 model.

But when I look at what we want, stock analysis, we get this:

This is the benchmark for what vals.ai calls the Finance Agent. It simulates financial tasks, and as you can see, the previous model, GPT5.1, still reigns supreme.

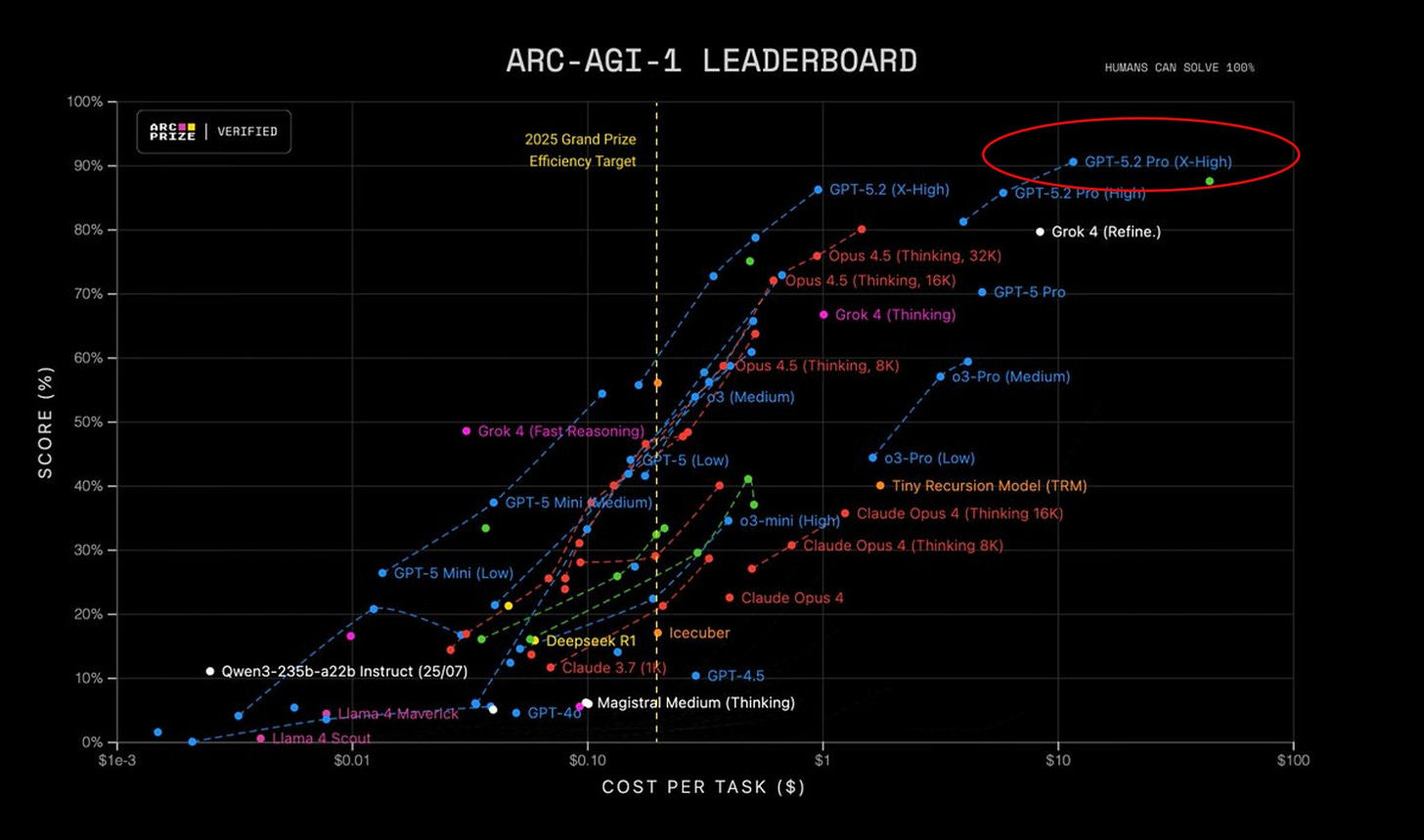

But there’s one benchmark that blew my mind. The ARC-AGI-1. This is the first benchmark to test general intelligence, reasoning capabilities that go beyond training data. Think logic, visual puzzles that, for a human, are quite easy to solve, but are hard for an LLM.

So GPT5.2 scores more than 90% (they are already building the second version of this benchmark, which will be even harder).

But what’s crazy is not that it achieved such a high score, it is the cost reduction:

1 year ago: 88% with O3 at 4,500 USD per task

Today: 90.5% with GPT 5.2 at 11.65 USD per task

That’s a 390-bagger in improvement!

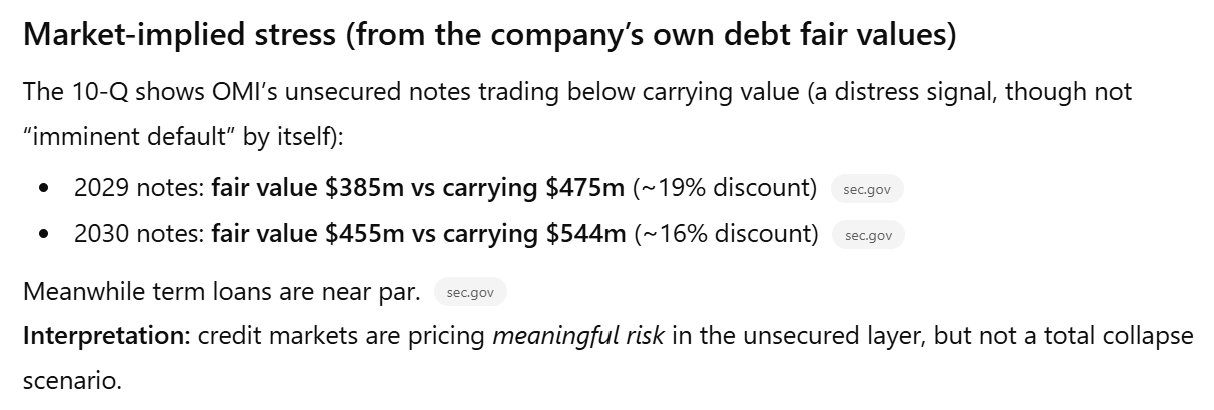

Now I was able to do a quick comparison using GPT 5.1 and GPT 5.2. Both are close; however, when I ran a bankruptcy prompt on a company that is near insolvency, GPT5.2 fetched information about certain loan notes that the company has issued in the past. And it came back with how the market is pricing the risk of insolvency. GPT5.1 didn’t do this, and it’s a very useful datapoint:

I’ll keep testing it and will do a comparison in the future.

5. Prompt of the week

Note: We’re building our own course and prompt library. You can join the waitlist here:

Ok, I’ll reveal a little secret.

The number 1 GPT use case for a stock analyst is to challenge an existing thesis.

Most articles you find online are people who are bullish on certain stocks. There are only a few publications that actively look for misery. But as an investor, you want to know the good, the bad, and especially the ugly side of the coin.

Is there a company you like? Then do the following:

Copy the prompt below

And then copy and paste your analysis, or one you can find online

You’re basically asking GPT to use the official filings and find the holes in the setup.

If it can’t punch many big holes in the thesis, it might be an interesting opportunity. (and I’ve been using the below prompt on my own bullish pitches)

Persona

You are a ruthless internal “red team” equity analyst trying to disprove a bullish stock pitch.

Resources used

Use only primary/official sources: 10-K/10-Q/20-F/6-K, S-1, DEF 14A, earnings releases + IR transcripts, investor decks, regulator docs. If it’s not in these, mark unsupported.

Instructions

Attack the thesis, don’t improve it. Find contradictions, omissions, and fragile assumptions: revenue quality, customer concentration, pricing/unit economics, dilution/SBC, leverage/liquidity/covenants, working capital, accounting choices, competition, TAM inflation, regulatory/legal risk, and timeline optimism.

Method

Split the pitch into individual claims.

For each claim, verify/contradict using official docs (cite exact section).

Build the simplest bear case consistent with disclosures.

List kill-shots and a doc checklist to confirm/refute.

Expression (output)

Return:

Bear case (5–8 bullets)

Claim audit table: Claim | Evidence (doc+section) | Hole/omission | Severity (H/M/L)

Top 5 kill-shots (with sections)

What would change my mind (3 conditions)

Input: Paste the bullish pitch + ticker + links (optional).May the markets be with you, always!

Kevin

That prompt you shared at the end is actual gold. I've spent decades playing devil's advocate on every pitch that crossed my desk, and most retail investors never do it once. They read a bullish article, get excited, and buy. The institutions pay six-figure salaries for people to tear apart theses - you just gave everyone that capability for free.

Just remember that GPT pulling bond pricing data on distressed debt is cool until it isn't. I've seen plenty of "cutting-edge models" blow up because they couldn't smell what the data couldn't show. The 2008 models all said everything was fine too, right up until it wasn't.

The real edge isn't having GPT 5.2. It's knowing when to trust it and when to trust your gut.

Brilliant breakdown on the cost efficiency jump with GPT5.2. That 390x improvement in cost per task while maintaining accuracy is the kinda shift that changes how we actaully deploy these models in production workflows. I've been experimenting with using older models for quick thesis validation but the bond pricing insight GPT5.2 surfaced automatically feels like it's crossing into genuinly useful territory for distressed situatons. Curious if the reasoning gains translate to spotting accounting red flags better tahn 5.1.