Half Year in: 6 to 25% YTD

I missed a 20-bagger

Dear Hunters,

We’re already at the halfway mark!

Time flies when you’re having fun.

Our portfolios have performed reasonably well. Here’s a short overview of their YTD performance:

Peter Lynch: 6.3%

Nick Sleep: 25%

Can we be happy with that?

I suppose so, considering we’ve only started building them this year.

But can we be happy with the process, the decisions that were made?

Never.

I’m a better investor today than I was 15 years ago. But I hope to be even better at playing this game 15 years from now. (And if you’re still reading this publication by then, we need to do a get-together)

It’s a continuous process, always trying to improve. 1% better each day.

I cannot control the outcome, but I can damn well control the process.

I have 2 main learnings over the past half year:

On building positions

On big wave surfing

Benchmark

A month ago, I added the S&P 500 benchmark to the portfolio website:

But is this the right benchmark?

After all, we’re hunting smaller companies that are under the radar, sometimes illiquid. Would a better benchmark be the Russell 2000?

In the end, there is only one benchmark you should use, and that is your hurdle rate.

Define your investing goals

From your goals, calculate your hurdle rate

The best way to feel lousy about your returns is to always look at all the people or benchmarks who have done better.

Trust your process. Stick to your goals.

For me, that is 15%/year. It can be less or more. There should be no judgment. It depends on your personal situation, how you can cope with short-term volatility, etc.

Rebranding (sort of)

Now, before going through the detailed analysis of our portfolios, I also plan to ‘rebrand’ this little publication. Well, rebranding is a big word. What I want is consistency in layout between our newsletter and our investor portal over at 100baggerhunter.com

And although I have a favorite pick sitting in between the below designs, let me know which one you would pick!

Design 1

Design 2

Design 3

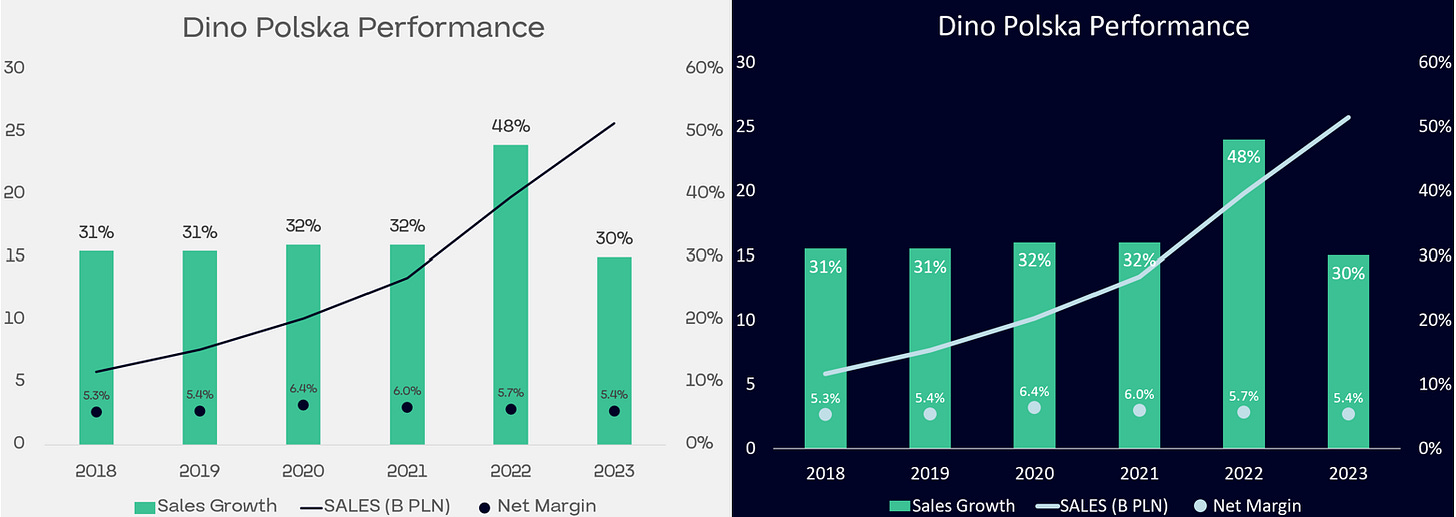

Once a design is set, our future articles will have consistency in charts, be it in light or dark mode, like this:

Big wave surfing

Investing is not only about the companies you buy. It’s also about the companies that you looked at and did not buy. One of those is a company called TSSI, which has been on my watchlist since 2024.

On the 23rd of May 2024, I wrote this to myself in my Gmail:

Then this happened:

Yep, a 23-bagger, in a little more than a year, which is crazy.

The company is called TSS Inc. (TSSI). They work in systems integration and procurement for AI-enabled data centers, and they signed a multi-year deal with Dell for AI server racks.

When I looked at it (I didn’t go beyond a 10-minute look):

Revenues were growing fast, but choppy

In Q1 of 2024, they had an operating margin of 1.6%

Their cash flow statement, when I looked:

Cash flow from operations is all over the place. What happened afterwards?

A big influx in Q3 of 38M USD. And the price kept going up, viewing the increased AI demand and the need for server racks integration.

Basically, I thought it was an AI hype stock, put a pass on it, and went further with other ideas.

The goal is not to conclude: I missed a 20-bagger. The goal is to see how I can improve my process in the future. Here’s what I learned:

Don’t underestimate a big wave. If you watched the video at the start of this article, you will see they are huge. The problem with AI is that it’s not clearly visible. You know the wave is big, you don’t know exactly how big.

Don’t shy away from lumpy figures. This might even be an advantage if we do the work. Everybody loves a figure like the one you saw with Robot Payment

Look more closely when others are buying. I always pride myself on trying to think independently. But there was 1 investor I know that I hold in high esteem who was buying this. I plan to include this more prominently in my future funnel.

Hey, maybe I should take a second look now. Can you imagine if this company 10x’s again?

So, enough about branding and missing multi-baggers. Let’s get into the nitty-gritty details. Something weird happened this morning with our favorite microcap. And our Japanese company did something that only companies with some kind of a moat would do.

If you want access to all our deep dives, portfolios, and the below discussion, please consider an upgrade to your subscription.