Industry roll-up at a 20% free cash flow yield (and poised for growth)

A pick from the database

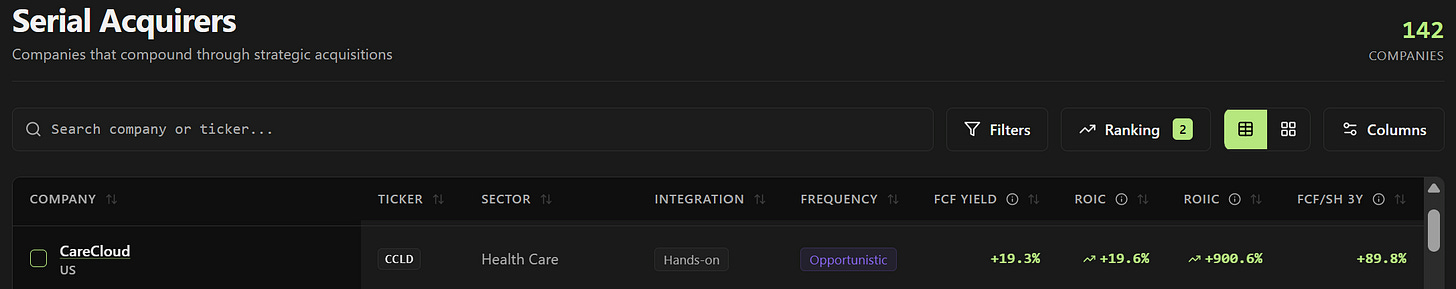

In a couple of days, I’ll be revealing our serial acquirer database.

And when using the ranking system with a focus on free cash flows, this company is the number 3 out of a total of 142 picks.

I already did an initial write-up a couple of months ago.

Time to dig deeper.

Like many companies, the stock price of CareCloud is falling.

Is the market throwing out the baby with the bathwater?

Who is CareCloud?

Ticker: CCLD

Exchange: NASDAQ

Industry: Health Care IT

Market Cap: $107 M

Founding year: 1999

Gross Margins: 48%

FCF margins: 21%

Guidance for 2025: $118 M +7% growth

CareCloud (CCLD) is a healthcare information technology (HIT) operating in the U.S. with a large workforce in Pakistan that provides mainly Revenue Cycle Management (RCM) and Electronic Health Records (EHR) for independent practices, Large Medical Groups, Critical Access Hospitals and so on.

They act as the “backbone” for medical practices and hospitals, helping them manage everything from patient records to complex insurance billing.

In recent years, the company has shifted to a more holistic and modern offering through a series of Acquisitions. The company was originally named Medical Transcription and Billing Company and changed its name to CareCloud after CareCloud’s Acquisition in 2021. Their style of acquiring could be best described as an industry roll-up where they buy smaller companies within their niche to achieve scale and use that scale as a competitive advantage.

Once a company is acquired, CareCloud integrates them Hands-on, meaning the acquired company is highly integrated (SG&A combined, etc.) and the original brand might disappear. The frequency of the deals is opportunistic and usually higher in deal volume relative to the company’s size.

The One-Sentence Pitch

CareCloud had a successful turnaround in the last two years, which shows in FCF and operating profit; however, it is still being priced as a declining business even though the company is growing again for the first time in two years, with peers trading at 2x the current valuation.

The One-Page Pitch

CareCloud’s financial trajectory over the last 24 months represents a radical departure from its historical performance. After years of growth-at-all-costs M&A, the organisation pivoted in 2024 toward operational discipline and restructuring. This shift resulted in the elimination of approximately $26 million in annual operating costs, positioning the company for its first full year of positive earnings per share (EPS) since going public in 2014.

Why is the company in a great position?

Customers of their solutions rarely switch providers (a 95% renewal rate), which is also true for potential acquisition targets.

The company can still be profitable while being one of the lowest-cost providers by leveraging its global offshore workforce of over 3500 employees in Pakistan (90%) and Sri Lanka.

CareCloud has de-leveraged its financial position, which resulted in funding the majority of acquisitions with Free Cash Flows.

CareCloud’s strategic monetisation focuses on upselling standalone SaaS clients (EHR/PM) to more comprehensive RCM services and typically realises a 3x to 4x uplift in revenue per client.

Through recent acquisitions, CareCloud has added new verticals of customers, which expands their TAM meaningfully.

Why is the company undervalued?

The stock trades at the same price as three years ago; meanwhile, the business has materially improved.

If the market recognises this turnaround, then based on their guidance for 2025 with a $26M in EBITDA, you’re looking at a company trading at an EV/EBITDA of around 5, compared to peers like Waystar (Trading at a 22 multiple).

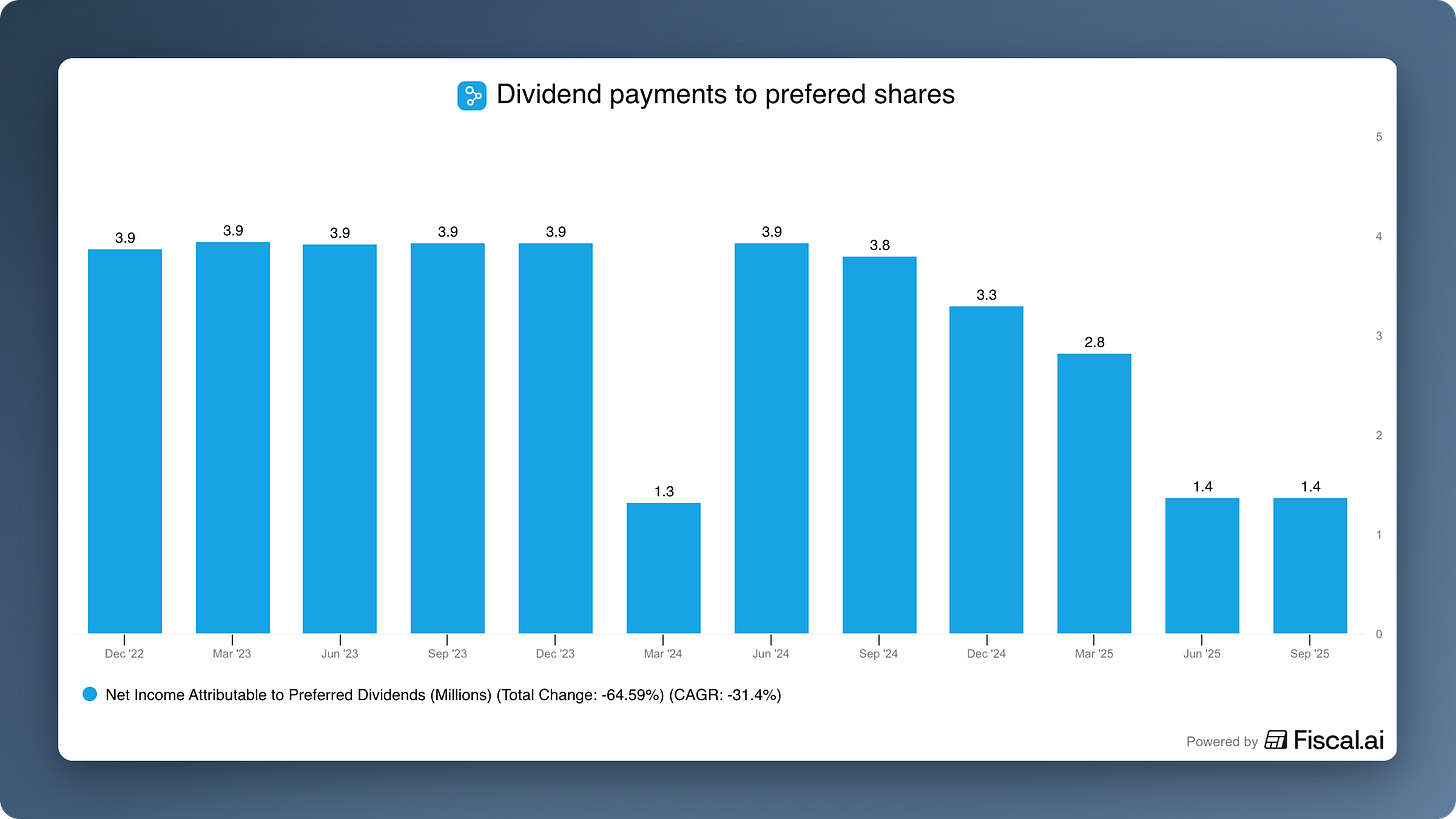

The company does not screen well because of the complex transition from dividend paying prefered shares to common shares, which disorted per share metrics.

With its highest Free Cash Flow ever, the company has a lot of optionality.

Margins across the board have improved since the restructuring in 2024 and are expected to improve further, thanks to the implementation of AI.

What are the risks?

A significant threat to revenue stability is the acquisition of CareCloud’s clients by larger health systems, which historically leads to those clients switching to the acquirer’s preferred enterprise vendors.

CareCloud’s heavy reliance on a global offshore workforce of over 4,000 employees, primarily located in Pakistan, Sri Lanka, and Azad Jammu and Kashmir, presents a significant operational vulnerability.

The company could fail to execute and integrate the acquired companies successfully.

As a cloud-based HIT provider, CareCloud is a high-value target for cyberattacks, and a major data breach could result in fines of up to $50.000 per violation.

History

The evolution of CareCloud (formerly MTBC) is characterised by a transition from a specialised billing service into a comprehensive, AI-driven healthcare technology platform.

Origins & Early Focus (1999–2004)

Founded in 1999 as Medical Transcription Billing Corporation (MTBC) by Mahmud Haq in Somerset, New Jersey. It started as a medical transcription and manual billing service provider aimed at reducing administrative burden on physicians, especially smaller practices.

In 2004, MTBC began developing a proprietary integrated software suite for practice management and electronic health records (EHR), marking an early shift from pure services to tech-enabled healthcare operations.

Expansion & IPO (2005–2014)

MTBC went public on NASDAQ in July 2014 under the ticker MTBC.

By this point, MTBC had started building technology platforms alongside its service offerings, recognising that integrated software plus billing and revenue cycle management (RCM) would be central to future growth.

Acquisition-Led Growth (2015–2019)

Post-IPO, MTBC pursued an aggressive acquisition strategy, buying numerous medical billing, practice management, and related healthcare IT companies to expand its footprint and capabilities. Examples include Gulf Coast Billing, Renaissance Physician Services, and MediGain in 2016, and Orion in 2018.

These acquisitions expanded MTBC’s client base and geographic reach, and increasingly shifted its model toward full revenue cycle management and SaaS offerings rather than standalone transcription.

In 2017, MTBC launched talkEHR, one of the industry’s first voice-enabled EHR solutions, underlining a move toward tech innovation.

Strategic Rebranding & Market Positioning (2019–2024)

2020: MTBC acquired CareCloud Corporation, a cloud-focused healthcare IT firm whose name it later adopted. The rebranding signalled a shift from service-centric billing to an integrated cloud-based healthcare technology provider.

Following the rebrand, CareCloud continued integrating acquisitions to build an end-to-end platform combining SaaS software with recurring revenue services in RCM, telehealth, analytics, and practice automation.

The company also focused on operational and financial efficiency, demonstrating a turnaround to profitability in 2024 after prior losses.

Business Model Shifts & The “AI-First” Transformation (2025–now)

Cost rationalisation: This shift resulted in the elimination of roughly $26 million in annual operating costs, leading to six consecutive quarters of positive GAAP net income through late 2025.

Capital simplification: During 2025, the company aggressively simplified its capital structure by converting a substantial portion of its high-dividend Series A preferred stock into common stock to free up cash flow.

Strategic realignment: As of January 1, 2026, the company implemented a leadership change where Stephen Snyder became the sole CEO and A. Hadi Chaudhry moved to Chief Strategy Officer to focus entirely on the enterprise AI vision.

AI centre of excellence: CareCloud now operates a dedicated AI Centre of Excellence with 100 full-time AI professionals.

Product evolution: Its current positioning is built on generative AI suites, such as cirrusAI (ambient listening for clinical notes) and stratusAI (conversational AI for front-desk automation).

Before we assess the company in full, we need to look at its lifecycle. ⬇️

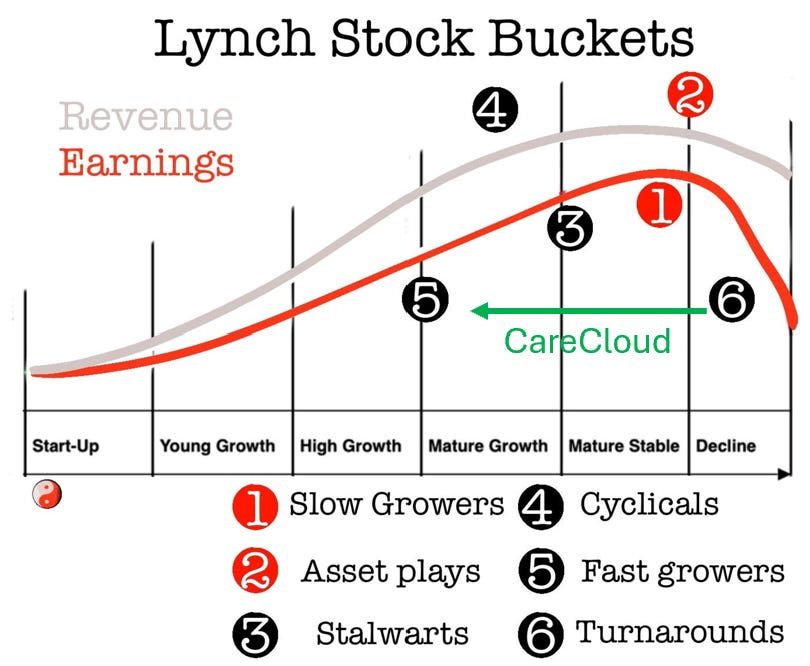

From 2014 until 2021, CareCloud was in phase 3: self-funding, with rapidly growing revenues but still unprofitable.

In 2022, the company crashed directly to phase 6: decline. Two massive, highly profitable clients that were acquired by larger health systems in mid-2022 caused revenue to decline for the first time in history. Revenue continued to decline year after year until the end of 2024.

2025 marks a turning point, as the company is closing in on a 7% yoy increase in revenue. From a life cycle standpoint, Care Cloud is now in phase 4: operating leverage with a net profit for the first time in its history since becoming a public company.

It looks like CareCloud has performed a structural turnaround with prospects of growing profitably in the future.

Now let’s take a look at how SPECIAL this company actually is.

How Special is CareCloud?

We measure the quality of the company through our SPECIAL score. We define it through 7 attributes.

S for Sales Strength

P for Profitability

E for Endurance

C for Competitiveness

I for Industry

A for Asset Agility

L for Leadership

In this part, we uncover the first 3 letters.

Sales Strength

We want to gain a fundamental understanding of the business model. Who buys what and why? How strong is the business model? Do they need to spend a lot on marketing to sell? Where is the company in its life cycle? (source used: income statement)CareCloud (CCLD) is a healthcare technology company that acts as the “back-office engine” for doctors and hospitals, using a global workforce and artificial intelligence to handle the complicated task of getting paid by insurance companies.

Every time we go to a doctor or to a hospital for a service, we receive the service first and pay later. If the doctors and the hospitals want to collect the money for the services they performed, they have to fill out the paperwork perfectly, otherwise the insurance company won’t pay them for their services. Once the insurance company agrees to pay for the service, they are going to send a bill back to us or cover the whole amount, depending on the Excess on insurance policies

Since doctors and hospitals are trained to help people first and run a business second, many choose CareCloud as a super-smart assistant to handle the administrative part. CareCloud gives the doctor a special computer program (called an EHR) to keep track of patients. When the doctor finishes seeing a patient, CareCloud’s team and its “AI robots” take over. They send the bill to the insurance company and make sure the money actually arrives in the doctor’s bank account.

How does this company make money?

CareCloud makes money in two main ways:

Subscriptions: Doctors pay a monthly “rent” to use their software (SaaS).

Success Fees (RCM): CareCloud takes a percentage (usually a small slice) of all the money they successfully collect from insurance companies for the doctor. This is called Revenue Cycle Management.

This model is great because CareCloud always gets paid via the subscriptions and benefits when their customers are successful through their processing fee.

Why do customers pay CareCloud?

Healthcare providers (doctors and hospitals) pay CareCloud because it is cheaper and easier to pay CareCloud than to hire a huge team of office workers to handle the complicated medical laws and insurance rules.

Who are the customers? They serve over 40,000 providers across more than 50 medical specialties. This includes:

Small family doctors.

Large groups of specialists (like cardiologists or surgeons).

Small and mid-sized “resource-constrained” hospitals that need to save money.

CareCloud started out with small family doctors, but recognised the need to vertically expand into the other categories to improve the resilience and quality of the business

Who are the suppliers? CareCloud’s most important “supply” is labour. They have a massive “offshore” team of over 3,500 employees in Pakistan and Sri Lanka. These workers do the heavy lifting of processing data and coding at a much lower cost than hiring people in the U.S..

What is their sales segmentation? As of 2025, their business is split into two main parts:

Healthcare IT (~87% of revenue): This is the core business of selling software and billing services.

Medical practice management (~13% of revenue): This is where CareCloud actually manages the daily operations of specific medical clinics. It serves as a “live environment” or real-world laboratory. They test their new AI tools and software in these clinics to make sure they work perfectly before selling them to thousands of other doctors.

What is their sales process?

They use a strategy called “Upselling.” They might start by selling a doctor one simple software tool. Once the doctor trusts them, CareCloud convinces them to switch to the “full package”, where CareCloud handles all their billing, which can generate 3 to 4 times more revenue for CareCloud than just the software alone.

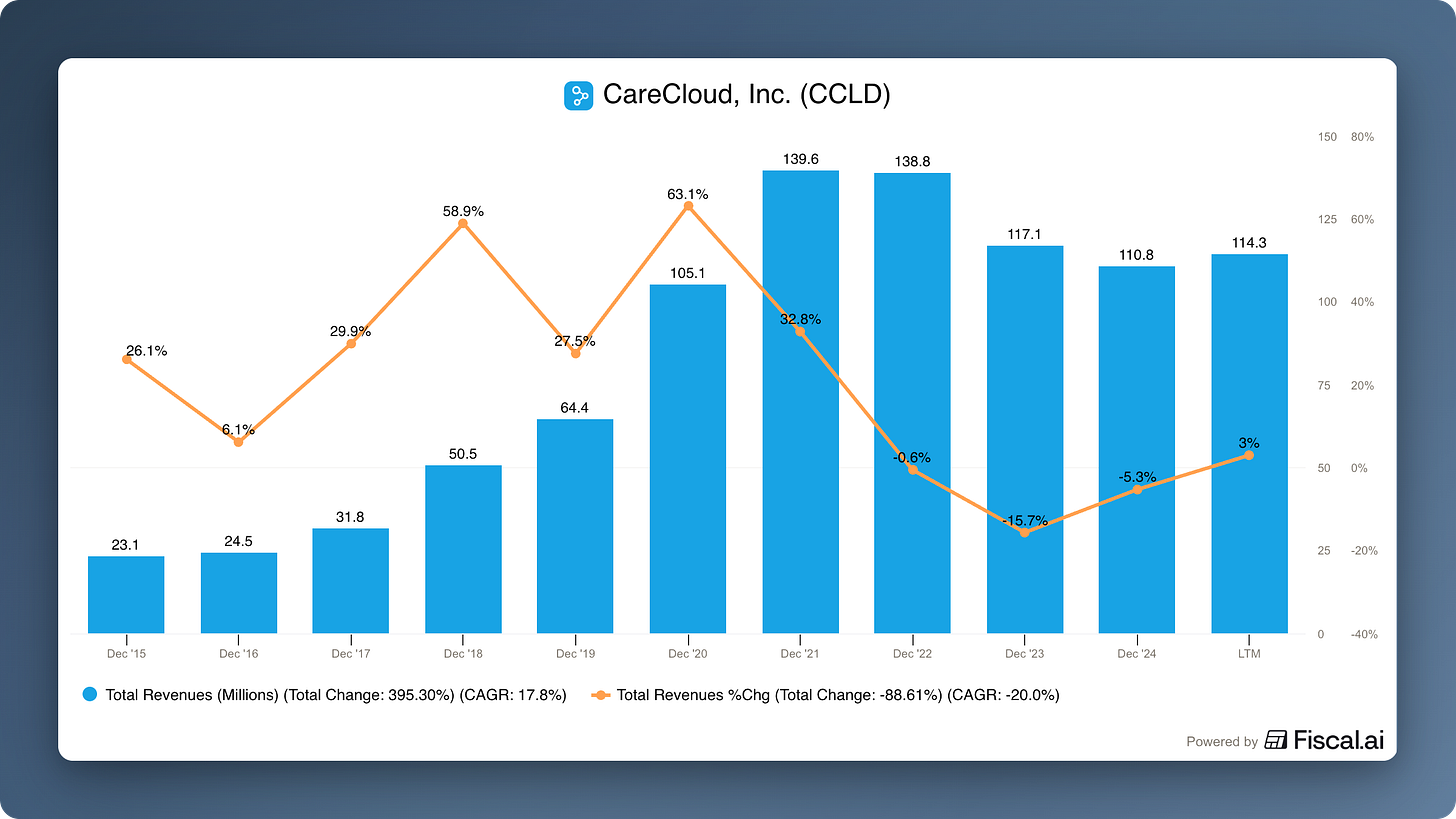

How did sales evolve over the last few years?

Since 2021, revenue has been in a steady decline. However, this year marks the first time in 5 years with positive growth. Assuming they can deploy their free cash flow into acquisitions efficiently and upsell their existing client base further, revenue should reaccelerate again.

CareCloud has successfully slashed its sales and marketing intensity by more than half over the last two years (8% →4% of sales), transitioning from a high-spend customer acquisition model to an efficient “upsell” strategy. This reduction is a primary driver of the company’s recent return to GAAP profitability.

The current weaknesses in sales strength are:

Growth is still slow

It’s hard to onboard new clients because often the staff needs training, data needs to be migrated, budgets are tight, and sometimes clinics don’t make the decisions on IT spending themselves, but rather Hospital associations. That is why they prefer to acquire other companies with a new customer base.

Sales Strength Verdict: 6/10

Profitability

We look at the different margins and the quality of the earnings. Can the company be self-sufficient? Is there reinvesting potential or will they have to rely on debt or share issuance? (source used: income statement)To assess the profitability of the company, we are going to look at the margins first.

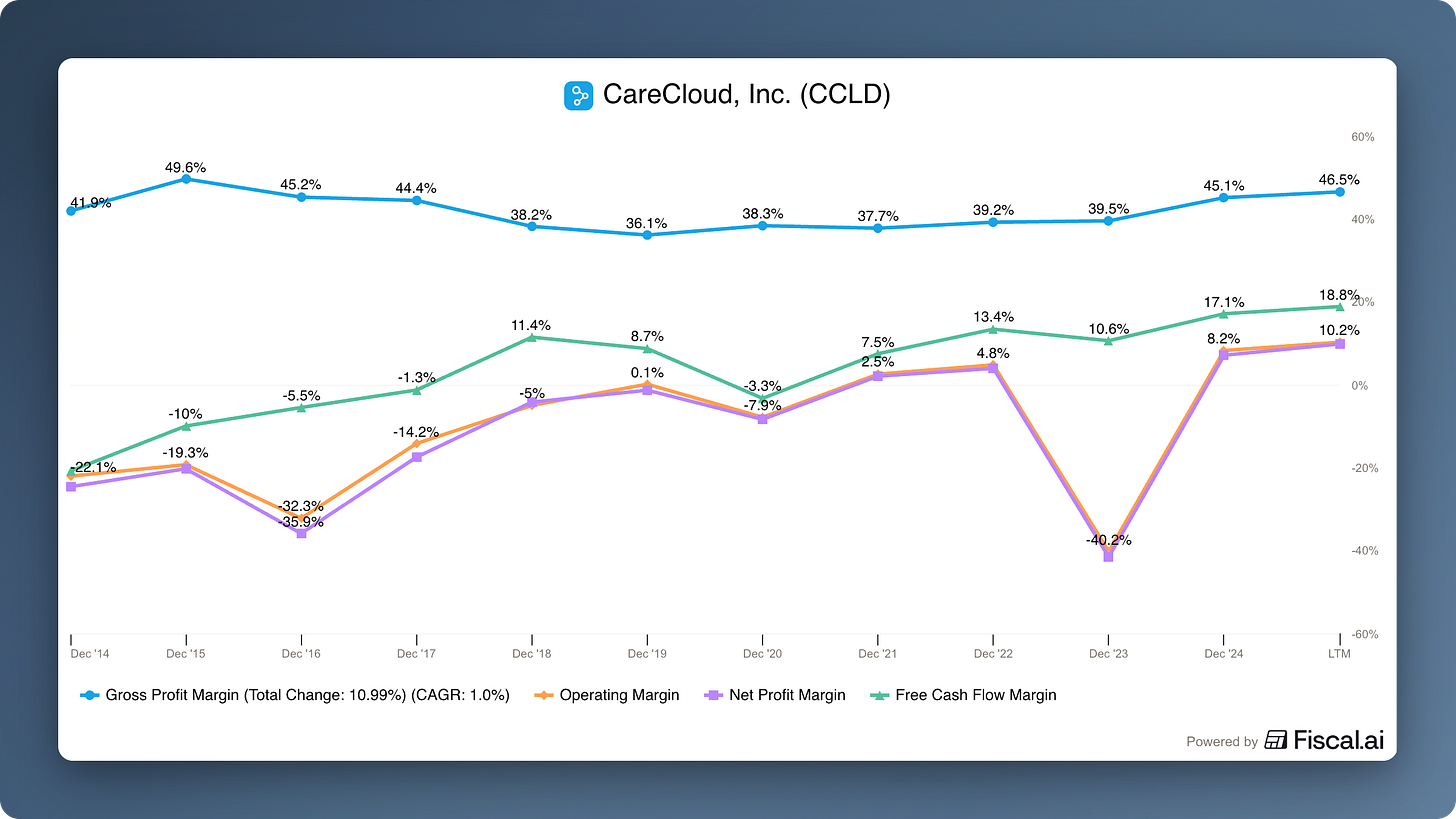

CareCloud’s Gross Margin originally started out in the mid 40s but got worse over time through the aggressive M&A without a focus on profitability. In 2024, the turning point occurred when the company eliminated approximately $26 million in annual operating costs as part of the restructuring focused on streamlining the legacy aggregator model into a unified platform. Part of this initiative impacted the operating margin as well, since only a part of the employees’ cost gets recognised under Cost of Sales and others as SG&A.

The most transformative driver, however, has been the internal deployment of the CirrusAI and stratusAI suites. Those solutions are automating 80% of the medical coding tasks. This can also be seen as a critical development since their initial edge was their low-cost structure provided by the offshore workforce who operates at approximately one-tenth the cost of comparable U.S. labour. If now every company can use AI in the same way as CareCloud does, their cost advantage diminishes.

Net Profit Margin has been positive for the first time in Q2-2025. Although the company had periods of operating profit, net income was always depressed because of the “Hidden” Cost: Preferred Stock Dividends.

For years, instead of going to a bank for loans, CareCloud raised money by selling preferred stock (Series A and Series B). While bank debt requires interest, Preferred Stock requires dividends. In a financial report, dividends are not listed as an operating expense like interest is. Instead, they are typically subtracted at the very bottom of the Income Statement (after net income) or shown in the statement of shareholders’ equity.

A major part of CareCloud’s recent success is that they fixed this expensive capital structure, freeing up millions in cash for the company to use for AI development. This development can be best seen in the development of the fcf margin, which is at a historic high. If we assume they can bring those dividend payments to zero, then net income = operating profit - tax. Normally, the tax rate would be 21% (federal), but because of CareCloud’s significant Net Operating Loss (NOL) carryforwards (exceeding $100 million in recent years), CareCloud is expected to pay minimal U.S. federal taxes for several more years until these NOLs are exhausted.

So with this in mind, net profit is more or less equal to operating profit in the foreseeable future. This would mean net profit margins of around 10%. Using analysts’ estimates that the company is supposed to generate $131 million in revenue in 2026, we would look at around $13.1 million in profits and a forward P/E of around 8 based on today’s market cap.

Profit Strength Verdict: 6/10

Endurance

We look at the strength of the balance sheet and how resilient the business is. Can it withstand regulatory changes or downtrends in the economy? How long can the company endure? (source used: balance sheet)Balance sheet strength and de-leveraging

The company has aggressively cleared its traditional debt obligations, moving toward a “clean capital stack” that provides high financial flexibility. As of September 30, 2025, borrowing under the company’s line of credit was reduced to $6.5 million, compared to cash and Equivalents of $5.1 million. Even their historical burden, the high-dividend preferred stock, got significantly reduced. In 2025, the company converted approximately 78% of its Series A Preferred Stock (reducing it from ~4.5 million shares to ~985,000 shares).

As a result of the restructuring, the company now has more fcf at its disposal than ever, allowing it to fund acquisitions like Medsphere largely through cash on hand and rapidly deleverage the associated credit facilities.

Business resilience and economic endurance

CareCloud’s resilience is built on a “sticky” and predictable revenue model that can withstand economic downtrends:

Client retention: The RCM (Revenue Cycle Management) segment maintains a 95% renewal rate, indicating that its services are mission-critical for providers regardless of the economic climate.

Operational advantage: By leveraging an offshore workforce that operates at a “structural cost advantage,” CareCloud can maintain profitability at price points that competitors cannot match, making it the “affordable” choice during economic contractions.

The transition of standalone software clients to RCM creates a 3x to 4x revenue multiplier with nearly zero switching costs, allowing for organic growth without high capital expenditure.

How long can the company endure?

With six consecutive quarters of positive GAAP net income through Q3 2025 and a surging free cash flow profile, CareCloud is no longer in survival mode. The company has enough dry powder (financial flexibility) to not only endure indefinitely under current conditions but also to pursue additional acquisitions and reinvest in its AI Centre of Excellence. The balance sheet is now positioned attractively due to this lack of debt and simplified capital structure.

Endurance Strength Verdict: 7.5/10

Up until now, the company has not performed excellently, due to its relatively recent pivot towards growth and profitability. However, this is what makes it so interesting, because the markets seem not to have recognised that shift yet.

And since the company has been caught in the software storm, the price is trading lower and lower.

The rest of the S.P.E.C.I.A.L framework and the full valuation will appear in the third and final article on CareCloud soon!

You’ll receive part 3 before the CareCloud earnings update at the end of this month.

May the markets be with you, always!

Kevin