Peter Lynch’s golden rules: 41 Fast Growers on the cheap

Hunting for multi-baggers

Peter Lynch is one of my favorite investors. He wrote 3 books and had an incredible track record when he ran the Magellan fund over at Fidelity.

We’ll dive into Lynch’s playbook, select 10 golden rules for investing, and set up a screener to see if we can find some interesting companies.

Let’s go! ⬇️

Lynch’s Playbook

Baseball

One of my favorite things about how Peter Lynch invests is that he uses the analogy of a sports team.

Any team and you can pick any sports team for that matter, has different roles in it. The idea is picking the right players for a sports team, and you are the manager. The misconception is that Peter was known for searching for fast growth. Although he did believe this, over the long term, provided the best returns, it only composed about 40% of his portfolio.

I’m going to use soccer as an example as that’s the one my son plays. You’ve got a keeper, defender, mid-fielders (defending and attacking), and attackers.

A team can win because it's a combination of all of these, it can’t possibly win if it’s composed of only 1 type of player.

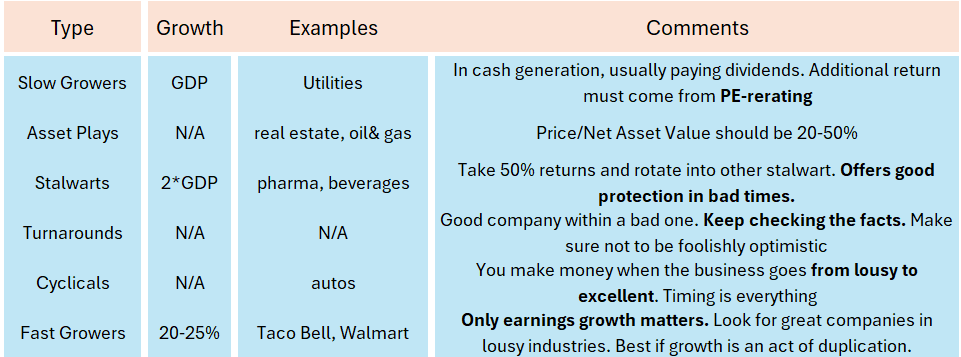

So he devised categories and types of business. Here’s a summary table:

Now how much of these should one hold in our portfolio?

Here’s what he recommended:

You can download the full Peter Lynch playbook here.

Now if we had to make a soccer analogy, I would do it like this:

A super substitute is someone on the side, who comes into a match and turns the tide for the team. We can debate these choices of names, but you know what I mean 🙂

In my view, this was a brilliant idea from Lynch to use an analogy to simplify business understanding and put them in buckets. He’s looking for patterns between business models.

If you have a strategy that focuses on different types of companies, make sure to swap one out for the other. Remember the dual strategy approach? This means a quality compounder for a compounder and an underfollowed microcap for a microcap.

The Peter Lynch Chart

One of the simplest charts he proposed in his books was later dubbed the Peter Lynch Chart. The goal is to compare the evolution of the price line to the earnings line. You only consider buying when the price chart drops below the earnings chart.

Here’s the one for General Electric:

The idea is simple, you plot the earnings line (15 times EPS) versus the price. When the price dips below the earnings line, it might be a great time to buy.

We’ll use this later on for one of the companies.

It’s time to delve deeper into Lynch’s 25 golden rules. I’ve condensed them into 10 I believe to be the best.

Find your edge and put it to work abiding by the following rules. ⬇️

The 10 Golden Rules.

1 Turn over lots of rocks

If we assume that the market is efficient 99% of the time, then finding that 1% takes time and work. Lynch was a maniac when it came to stocks. He had 16h workdays which compounded into about 400 company visits and reading more than 700 annual reports every year.

As a retail investor, this means it’s important to pick a strategy. Once you’ve picked one, you can automatically ignore a slew of companies. A second takeaway is a deliberate practice. Don’t spend x hours on stock investing, read x annual reports.

2 Never invest in any idea you cannot illustrate with a crayon

This is similar to our previous discussion on Polen Capital: Keep it crayon simple.

Every investment has to be condensed into a 2-minute pitch where you convince the portfolio manager of the idea. That's about 500 words. The pitch has to be explained so that a fifth-grader can understand it.

This also assumes that you know what you own. In other words, don’t buy a stock because it's cheap, but because you know a lot about it.

3 Owning stocks is like having children, don’t get involved with more than you can handle.

A non-professional stock picker probably has the time to follow anywhere from 5 to 12 companies. I think patience is key here.

Imagine you inherit 100k tomorrow. You decide to build a portfolio. How fast will you build it?

If you build it within a year and we assume 10 positions, this means you’ve found 10 great pitches in a single year.

That’s a lot. Chances are some of them might not be all that great.

This goes back to turning over a lot of rocks. You’ll be surprised to find better ideas when you keep on turning them over. You don’t need to be in a hurry to build that portfolio. You’re not a fund manager.

4 Everyone has the brainpower to make money in stocks. Not everyone has the stomach.

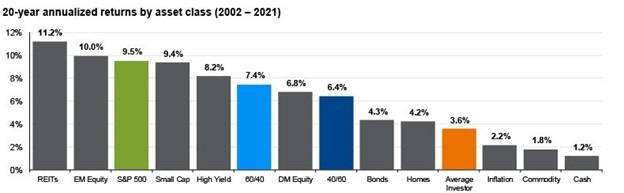

This is a classic lynch quote. Temperament is what matters. When looking at the JP Morgan chart and the returns for the áverage investor, this underperformance is explained by temperamental decisions. Be aware that our biology is not made to behave rationally within the stock market.

5 The best stock to own might be the one you already have

How many times do you add to an existing position? I find myself always looking for new opportunities. The goal is to compare and see if it is better than what I already have. But if you have the cash, and you can’t find anything better, do you add to it?

6 In business, competition is never as healthy as total domination

Consider a high-performing company in a lousy industry. What happens when there is a downturn in the industry and some of the competitors are in trouble? The high performer can come in and acquire on the cheap. Or the low performer goes out of business.

Don’t look for the flashy hot stocks. Look for the great performers in dull industries.

7 The biggest losses come from companies with poor balance sheets

I think this rule is self-explaining. The balance sheet is looking down. The income statement is looking up.

8 If you have the stomach for stocks, but neither the time nor the inclination to do the homework, invest in equity mutual funds

The only thing I would change is the mutual funds at swap it with index funds. See also our article and how to invest when you have little time:

9 Time is on your side when you own shares of superior companies

Patience is key. A 100-bagger was a 10-bagger first. A 10-bagger was a double first. You can get in, even after the stock has already performed well. Look at the potential future runway.

10 Scuttlebut, scuttlebutt, scuttlebutt

Although not part of the list of 25, I think this should be a golden rule. If possible, do the groundwork, visit a store, use the product, and do what you can to gain more information on a company than just looking at a computer screen.

Which is your favorite golden rule?

Building the Lynch screener

Based on Peter’s playbook, we’ll try to screen for Fast Growers trading at a reasonable price.

Let’s go through the screening criteria.

Industry

We’ll avoid basic materials, energy, real estate, and utilities. Lynch was a favorite of betting on what you see around you. What is your edge? He also aimed at a business model that works in one area and could be replicated elsewhere. We’ll see if the screener comes up with these kind of business models.

Market Cap

If you want to find a ten-bagger, look smaller. We have set the upper limit at a market cap of 5 Billion USD

Institutional ownership

Look where fewer professionals are looking. We discussed this aspect in detail in our article on Paul Andreola’s discovery cycle. We’ve set the limit at 10% ownership.

Debt

We’ll use the interest coverage ratio (EBIT divided by interest payments) to get an idea of the debt burden within the company. It has to be at least 4.

Growth

We’ve used EPS growth rates over 1, 3, and 5 years. It is set within a narrow range between 20 and 25%.

Valuation

You can’t run a Lynch screener without using the PEG ratio. The ratio here is defined as the trailing P/E divided by the EPS growth rate over 5 years.

Bonus: Owner’s earnings

Because all these metrics do not take into account the capitalization or money needed to grow the business, we’ve added the owner earnings increase with a 5-year CAGR of over 20%.

Check the Buffett article if you want to dig deeper into the Owner’s earnings.

The screener (www.unclestock.com) gives us a list of 36 companies worldwide out of a total of 100,000. I removed the market cap constraint to see what would happen, and only 5 companies were added to make a total of 41 Fast Growers. Because of the low institutional ownership and the PEG < 1, I expect not to find well-known companies on this list.

Let’s take a look at some overall data before looking at a couple of companies in detail.

You can download the full list below

Data By country

We took a worldwide approach. The Fast Growers are mostly located in Asia, with almost 40% of them coming from Malaysia and Hong Kong.

By market cap

When looking at the size of the companies, we know they are small, but how small?

Most are sitting in the nano and micro space. This seems logical as companies growing at rates of 20% should be smaller. (it’s difficult for a large company to grow at that kind of rate).

By Industry

They are all over the place. There is no concentration here whatsoever.

Let’s look at some of them in more detail. First off, there might be some companies in there that do not fit the bill. Screeners aren’t always perfect, they are just a way to generate ideas.

The biggest: Subaru (Ticker: 7270.T)

Not what I expected to find. But it has compounded its earnings per share at a 21% clip for the last 5 years.

Peter would put this in the cyclical bucket and rightly so. Remember, only buy these when they are not performing.

Other interesting tidbits:

Cash is bigger than its market cap

4% dividend yield

But then its ROIC has declined…

Timing is everything and now does not seem to be the time.

The cheapest (high FCF yield)

Weconnect (Ticker: ALWEC) currently has a 35%+ FCF yield.

So what does it do?

Founded in 2003, this is a small company, with a 58M USD market cap that designs, produces, and distributes computers, peripherals, and electronics in France.

I’ve never heard of the brand before, but looking at their cash flow statements, they have been free cash flow negative for years, until 2023.

I’m not a big fan of the business though so we’re not going to explore this any deeper.

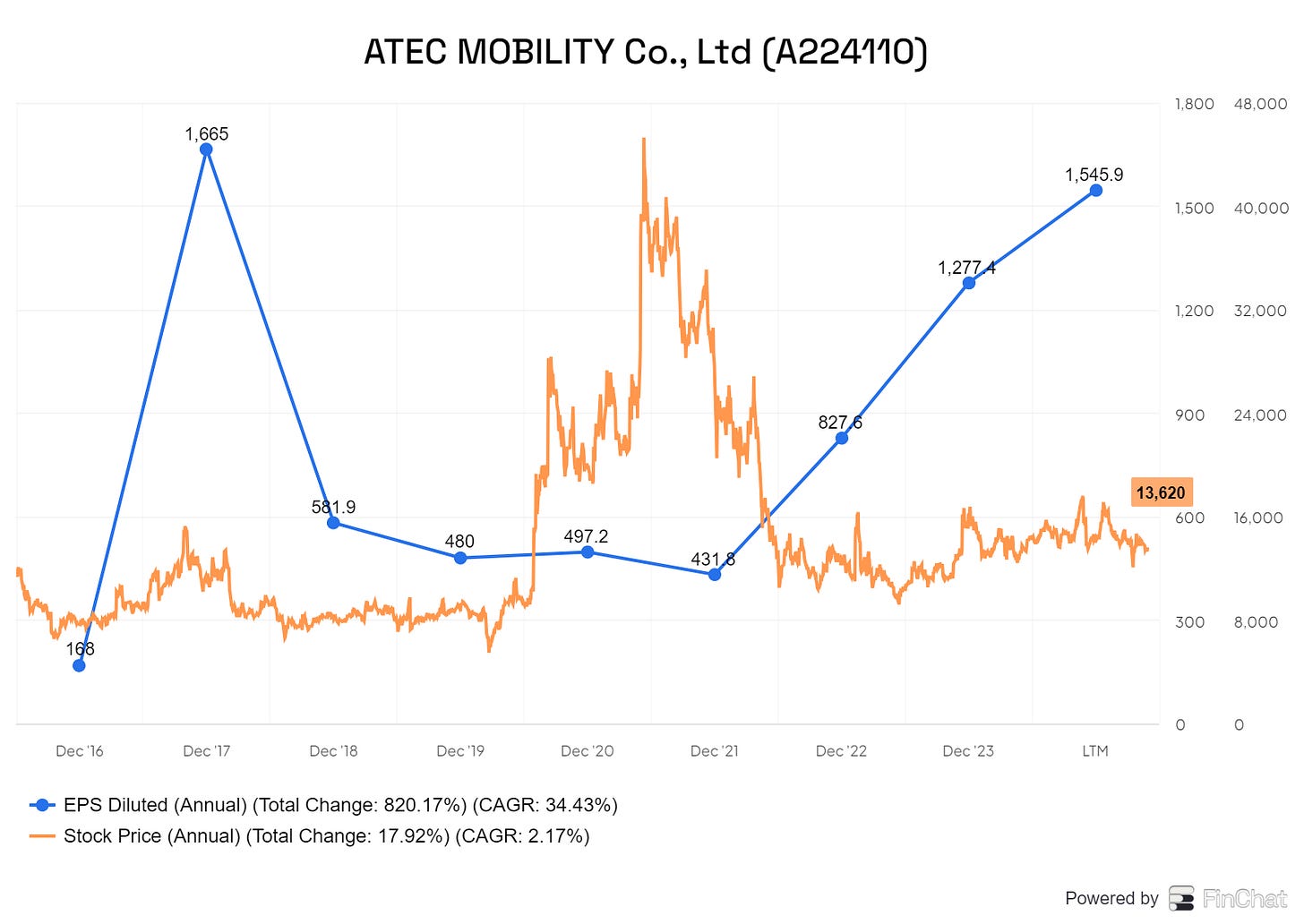

The most promising? Atec mobility (Ticker 224110)

They produce electronic equipment for transportation purposes in Korea. A picture will be more helpful:

This looks like a better business than WeConnect.

I especially like a chart like this:

EPS has tripled over the last 3 years, and the price of the stock has done nothing. This one might warrant diving a little deeper to figure out what is going on.

Other positive traits on first notice:

Healthy balance sheet

30% insider ownership from the CEO

ROIC is only 10% but improving in line with EPS

Because this looks like an interesting company, we have to take a look at the Peter Lynch Chart. Here’s the one on Gurufocus:

Based on this chart, it might be the right time to buy. Of course, you already know that looking at a pure PE/multiple is not enough.

Summary

I’m not sure how well the classic fast growers with replicable business models still exist. More will pop up if you remove the valuation metric (PEG), but the shift from tangibles to intangibles means the fast growers might dwell more in the realm of software and services.

Still, Peter Lynch provides some great insights:

Categorize businesses to better understand them

Each category has to be treated differently

Without growth, you can’t find big returns

And of course, price always matters. You can pay a little more if the growth seems consistent in the future, if not pay less. The PEG ratio has its drawbacks, but the insights it delivers are powerful.

We did a top-down approach using a screener, and in the future will do the opposite, and look for interesting franchise models (regardless of price). Maybe we can find one to put into a ‘to buy on a dip list’.

Have a great week-end, and as always.

May the markets be with you!

Kevin

Atec mobility is great on financial metrics. But given the double digit free cashflow, the 1% dividend yield is a bit puzzling. Sure they buy back 2-3% of shares per year but capital return is still gross inadequate given the business is not capital intensive and they’re now growing like weeds.

Another 'hum-dinger' of an article Kevin.

I did know this stuff, but as they say, to know but not do, is the same as not knowing at all.

I am guilty of constantly kicking stones to see if there are diamonds underneath - when in fact, I already have diamonds in my portfolio where I am probably better at investing further.

Also, I would suggest this isn't a one rule fits all. Age, for instance, comes into it. At 70+ I am more comfortable with proven stalwarts that provide a decent return. Won't be much fun for me for someone to say to me on my deathbed, 'guess what you know that share you bought 15 years ago, it has just hit the moon'