Poised for 2,500% returns like Costco?

Aim for the long-term

Costco is one of the best businesses in the world.

Think about it.

It gets stronger with scale.

David wouldn’t stand a chance against the Goliath it has become.

Nick Sleep recognized Costco’s superior business model 20 years ago. He called it Scale Economies Shared.

And the concept is as simple as it is elegant:

Earn more money as you scale

Give some of the money back to the customers

The customers buy even more in return

Earn more money as you scale

Etc…

It’s a flywheel.

Scale economics shared incentivise customer reciprocation, and customer reciprocation is a super-factor in business performance.

Nick Sleep

And you could ask yourself the question of whether it is even possible to disrupt such a business?

As long as management makes sure to share profits with customers and employees, the business should thrive, and shareholders too.

Now, something magical happens when you find a business that combine Peter Lynch and Nick Sleep’s approaches.

Lynch: I use this company’s product, and I absolutely adore it.

Sleep: Moat build-up through scale economies shared

The past of this business is incredible:

5-year revenue growth at a 40% CAGR

5-year EPS growth of 66%

Gross margins of almost 80%

ROE of 28%

Forward earnings yield of 4.3%

And the CEO owns 16%.

We categorize this company as a “Bigger market cap in a temporary downturn.”

Why has the market driven the stock down?

Because management has decided to lower the price to increase volume, and at the same time is investing in the future.

And although the market might not like that, if we remember Nick Sleep’s point of view, that might actually be a good thing.

Let’s look at this new opportunity!

Note: These are the types of articles within our paid subscription. I removed the paywall for this one so that you can look at what’s inside.

Company Snapshot

Company: Wise

Ticker: Wise. L (WIZEY for the ADR)

Exchange: London Stock Exchange/US OTC Market

Industry: Cross-border payments

Market Cap: 8.7 Billion GBP

Founding year: 2011

Gross Margins: 80%

Wise (Ticker: Wise) has been on my radar for some time.

But I was waiting for 2 things:

A combination of price decrease and increased investment ✅

The price in the market is under pressure ✅

Now that both conditions are fulfilled, we can dive into this company.

Note: Wise has a list of all brokers that should offer Wise for trade. Wise is available in the US through Interactive Brokers. A shareholder vote in July has approved to list Wise in the United States as its primary listing. This listing should be completed in Q2 of 2026.

Wise is a UK-based financial technology company, originally known as Transferwise. The company was founded in 2011 with the mission of making international money movement faster, cheaper, and more available. Instead of relying on the traditional banking system, Wise has built its own network of direct connections into local payment systems worldwide, which allows it to process cross-border transfers fast, cheaply, and transparently with clearly stated fees. This is what differentiates Wise from its competition.

And despite that, Wise was formerly known as Transferwise; their goal is not to transfer. Their goal is to teleport your money.

Let me explain.

Wise maintains bank accounts in many currencies and jurisdictions. Let’s say you want to send money from Europe to the United States.

When you send money:

You send, say, EUR to Wise’s EUR account in Europe (a local transfer).

Wise sends USD from its USD account in the US to your recipient (a local transfer).

It feels like the money teleported. That’s two domestic payments plus a book transfer on Wise’s internal ledger.

Now, in reality, because of differences in volume (lots of people sending GBP to EUR but not the other way around), Wise has to

Rebalance positions (move liquidity between countries/banks)

Hedge FX risk

Sometimes use traditional rails (SWIFT/correspondent banks) and/or market FX execution to square the books

So it’s not perfect teleportation. And for the customer, it’s still a transfer. But the way it’s implemented allows Wise to charge lower fees.

Today, Wise serves over 15 million customers, ranging from individuals sending money abroad to small and medium-sized businesses using Wise to manage international payrolls or supplier payments. Its product line includes the Wise Account (your bread and butter multi-currency account with local bank details, debit card, and the ability to hold 40+ currencies), Wise Business (bulk payments, employee cards, and integrations), and Wise Platform, an API that lets banks and fintechs embed Wise’s infrastructure directly into their own products.

By combining their pricing philosophy of “lower costs, reinvest, repeat” with their size and geographical width, Wise has positioned itself less as a consumer app and more as a global payments backbone, aiming to replace slow, outdated, and expensive systems with a faster and cheaper alternative.

How does Wise make money?

When I think of Wise, I think about how easy they make everything for their users. It seems seamless. You know what I mean if you ever sent a payment over to someone.

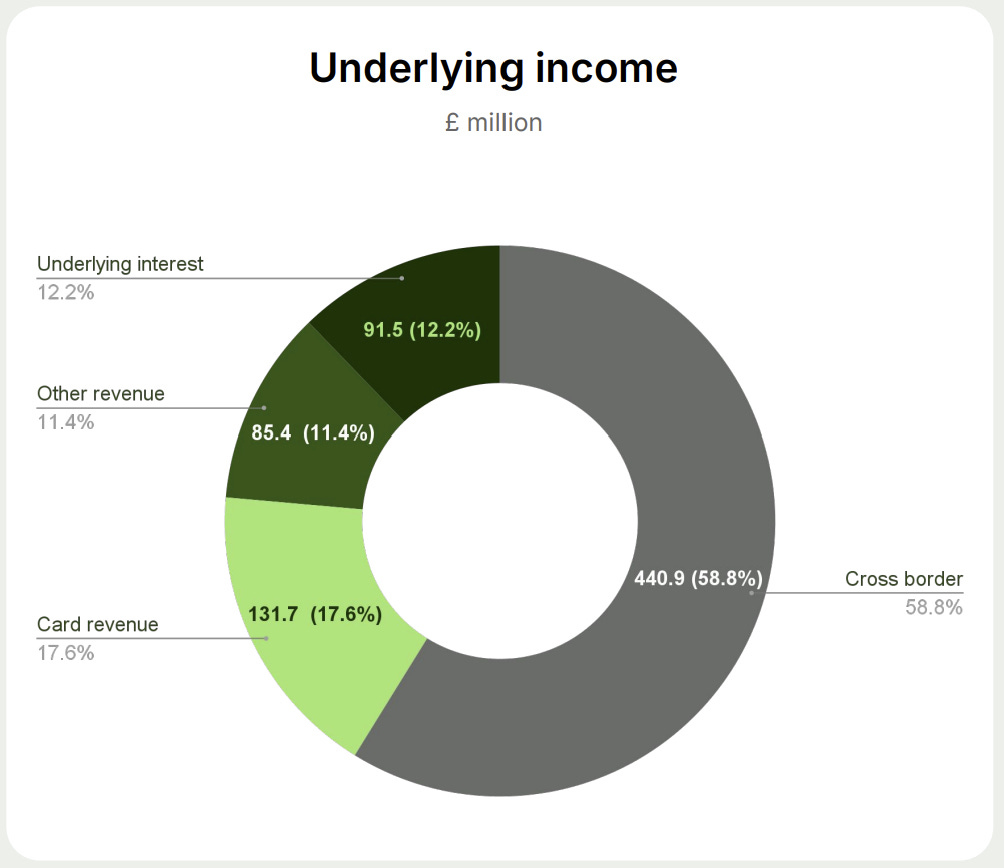

Here’s their H1 2026 revenue by source:

There are 4 parts:

Cross-Border: When you send money abroad, Wise shows you the mid-market rate and adds a small fee on top. This is their main source of revenue

Card Revenue: Wise issues a card that runs on top of the Mastercard and Visa rails. Wise collects an interchange fee every time you tap your card

Other Revenue: Top-ups to your account, business account set-up, physical card issuance

Underlying interest: When you hold cash on your Wise account, Wise holds that money in cash/bonds. They earn interest on those deposits.

Now, for someone like me, who uses the Wise app, it looks like this:

But even if you use your own bank, it is possible that you’re still using Wise’s infrastructure. Wise platform is a single API that banks, neobanks, and other financial institutions can use to connect with their infrastructure. (In the same vein, dLOCAL offers one API to its customers).

But don’t confuse them:

Dlocal’s main customers are big global merchants and platforms (marketplaces, SaaS, ride-hailing, ads, streaming services)

They solve their customers’ main problem: “I sell to users in Brazil, Egypt, India, etc. I want to get paid and pay out locally without opening a company and stitching together 20+ payment providers.”

Wise’s main customers are: banks, fintechs, and some large enterprises that want to offer cheaper international transfers and multi-currency accounts inside their own apps.

They solve their customers’ main problem:

“I’m a bank/fintech. I want to offer my customers Wise-style FX and cross-border transfers without rebuilding the rails myself.”

So when in the H1 update, they write:

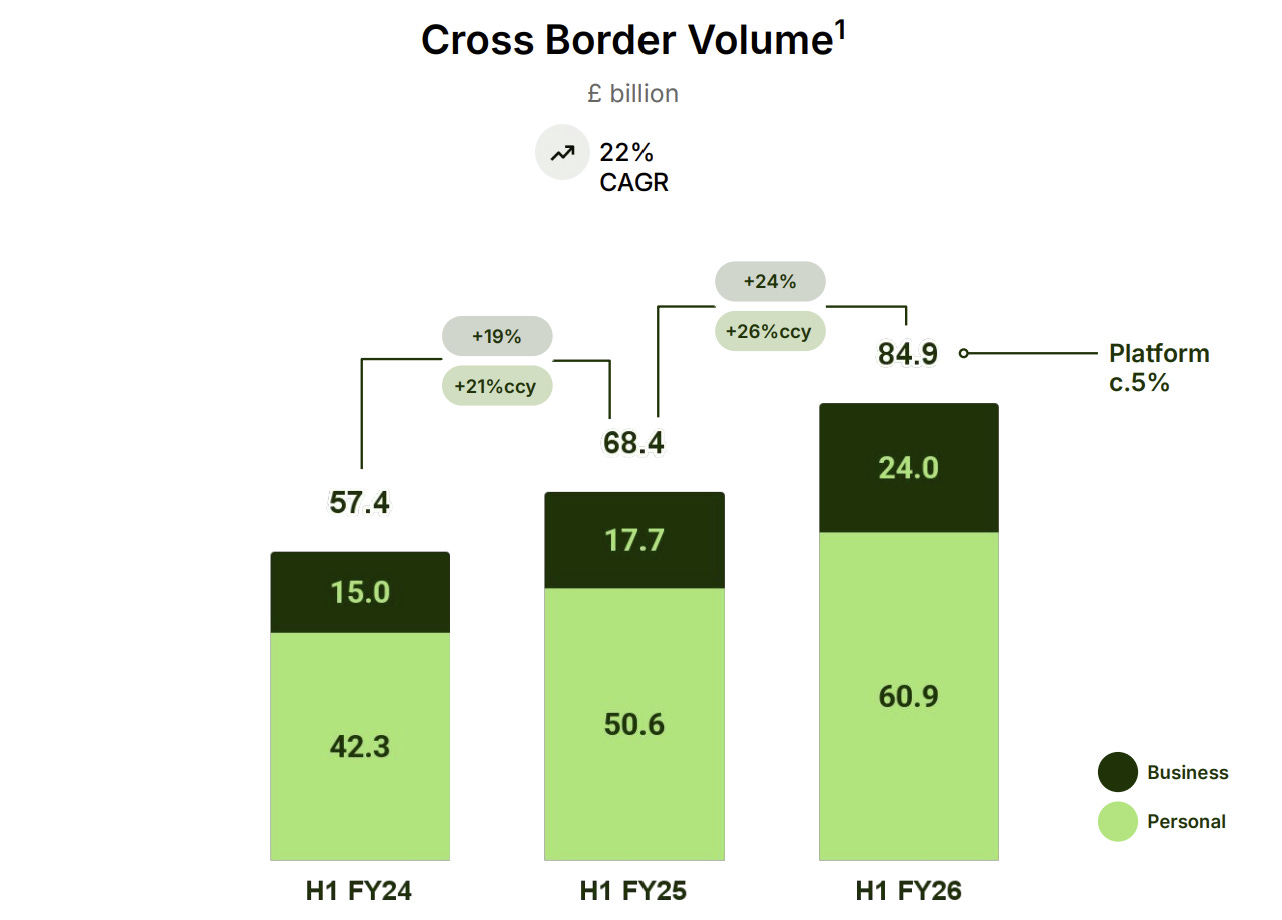

Wise Platform welcomed new partners, including Upwork, MBSB Bank and Lunar, with both new and existing partnerships contributing to growth in cross-border volume from Wise Platform, now representing c.5% of Wise’s total cross-border volume.

That’s more and more partners signing up. They have over 70+ partners at this time on their platform.

The Lay of the Land

The market

Global cross-border flows exceed £32 trillion annually. Most of this still travels over outdated, costly banking rails. In other words, a market ripe for the taking. Wise’s mission is simple:

To become the global network for the world’s money.

Managing billions to moving trillions.

From the H1 2026 update:

The opportunity that comes with solving this problem is enormous, estimated at around £32 trillion across personal, SMBs, and large enterprises. We currently have around a 5% and 1% share, respectively, of the expanding personal and SMB market segments, and we’re just getting started in the large enterprise segment of the market.

Their Philosophy

Lower prices → more volume

More volume → lower unit costs

Lower costs → reinvested into speed, product, and further price cuts

Stronger product → more adoption and retention

Ok, so after being around for 14 years, why the low market penetration?

Because the market keeps growing. Because they haven’t cracked the code for the big money yet.

If you break down the 32 trillion GBP market opportunity:

Personal: 2 Trillion

Small Business: 14 Trillion

Enterprise Business: 16 Trillion

And it’s the business part that will take time to penetrate. Most of the money flows through the legacy banks and existing rails (at a higher cost, but higher profit for those banks). So the banks like high FX rates as they make more money. And they don’t mind losing some share as long as they keep getting the profits in.

So when Wise talks about the 32 trillion market opportunity, it’s important to understand that a part of that is not addressable for them at this time. They will need much deeper product and sales build-out to seriously attack that enterprise layer, and that’s a multi-year endeavor per region and per use case.

It’s a long-term game.

Now they are not alone in this space.

The competition

From the discussion above, the main goal is to capture more and more market share in a market that is growing, from the legacy systems already in place.

But other players are going after the same market, sort of. Most people talk about Wise, Revolut, and Remitly in the same breath.

But that’s not entirely right. They are similar but still very different.

Let’s focus on the 2 other well-known players: Remitly (Ticker: RELY) and Revolut. Now I don’t want to go too deep into the weeds here. That’s why we’re writing an overall sector report.

Upgrade to get it ⬇️

Here’s a short overview.

Wise (Market Cap = 11.7B USD)

Is an infrastructure-driven, asset-light, cross-border account & payments specialist, expanding into small businesses and into the bank infrastructure (Platform).

They are the “Infrastructure, price-led compounder”.

Remitly (Market Cap = 2.8B USD)

Is more focused. A consumer-only digital remittance player, optimised for migrant to family flows in emerging markets.

Remitly is the “pure digital remittance app”. It can grow faster as less “infrastructure” to build.

Revolut (private, value = 75B USD) is a broad financial super-app or emerging bank. There is less focus, with revenue coming in from different streams.

Revolut is a multi-product financial ecosystem.

That means the main overlap the 3 companies have is the ability for a consumer to send money abroad. Wise is the cheapest of them. However, Remitly, having a focus on this, has a dense cash pick-up network.

Conclusion: Yes, there are a lot of players. What we need to remember is that they are playing a different game. Wise wants to go after the small business and enterprise market. That’s where the bulk of the money is.

That’s a very different game from the other two.

Wise’s Robustness Ratio

Nick Sleep introduced the concept of the Robustness ratio.

Where robustness comes into its own is in identifying companies, such as Costco, which may be under-earning when compared to their potential. This generates super long-term investment opportunities for those willing to look beyond reported earnings

Nick Sleep

Here’s my interpretation of it.

Robustness Ratio = (Value to customers + employees) ÷ Value to shareholders

A high RR (5:1, 10:1) means the business is currently allowing most of the surplus to sit with customers (and/or employees) rather than shareholders

A low RR (0.5:1, 1:1) means the shareholders are already taking a big slice. There may be less “unused space” to push the price without damaging the business.

So if the company has a high Robustness Ratio, we need to ask the following question:

“Is this because the business is weak and cannot charge more, or strong and chooses not to do so?”

And maybe profitability is by design, pushed into the future, in order to make room for more growth at scale?

Now you cannot apply the robustness ratio to any company. There needs to be some sort of pricing factor so that you can calculate the benefit in dollars for the consumer.

You could figure that this model can be applied to any business where you can estimate how much money you are saving the customer.

Ideally, your ratio is big. This could signal that money is purposely being left on the table. Management could, in the future, increase prices, but it has to do so carefully. Go too far, and you might erode the moat you’ve built.

In June of 2005, here’s what Nick came up with for Costco:

With an overall Robustness Ratio of 5 to 1.

It helps us understand the competitive advantage of the business. Nothing more or less.

Now let’s apply it to Wise.

Value to the customers

Wise has repeatedly stated that its customers for the year 2024 saved 1.8 billion GBP in fees.

Value to the employees

Employees at Wise are called Wisers. That’s a good thing. That’s like a sports team. It helps to build a strong company culture.

So what is the excess value that accrues to the employees? It’s not as easy as the Costco example, as the salary difference between Costco and Walmart was evident.

Based on the data I found, the compensation and benefits for Wisers are in line with the market. So the excess value to employees = 0.

Value to the shareholders

Sleep uses profits before tax, which for Wise was 481 million GBP in 2024.

That gives us a final Robustness Ratio of 1,800/481 = 3.7. (compared to 5 for Costco)

That means most of the pie goes to the customer. When you have a Robustness Ratio of 1, that means you don’t have a lot of margin left in the future.

It’s a first signal that Wise is purposefully leaving money on the table and pushing towards the future.

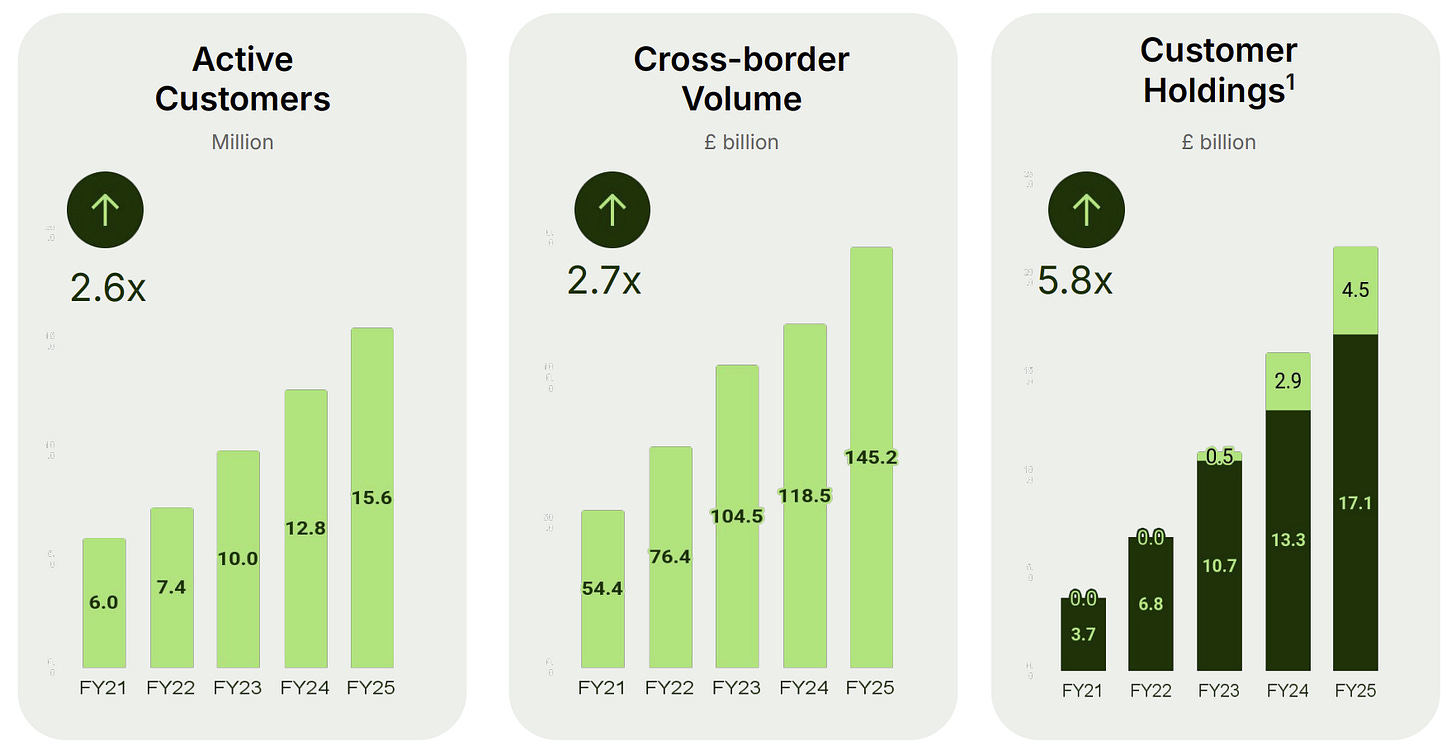

Underlying growth metrics

Just like any payment company, take rates and transacted volume are a big deal. Wise uses several growth metrics to run its business.

And it’s directly tied to their revenue streams. If you were Wise, you would want:

More active customers (a customer who does a transfer)

More deposits in the accounts

More and more volume is transacted

Here’s an overview of some of these metrics, which have all been growing in the double-digit range.

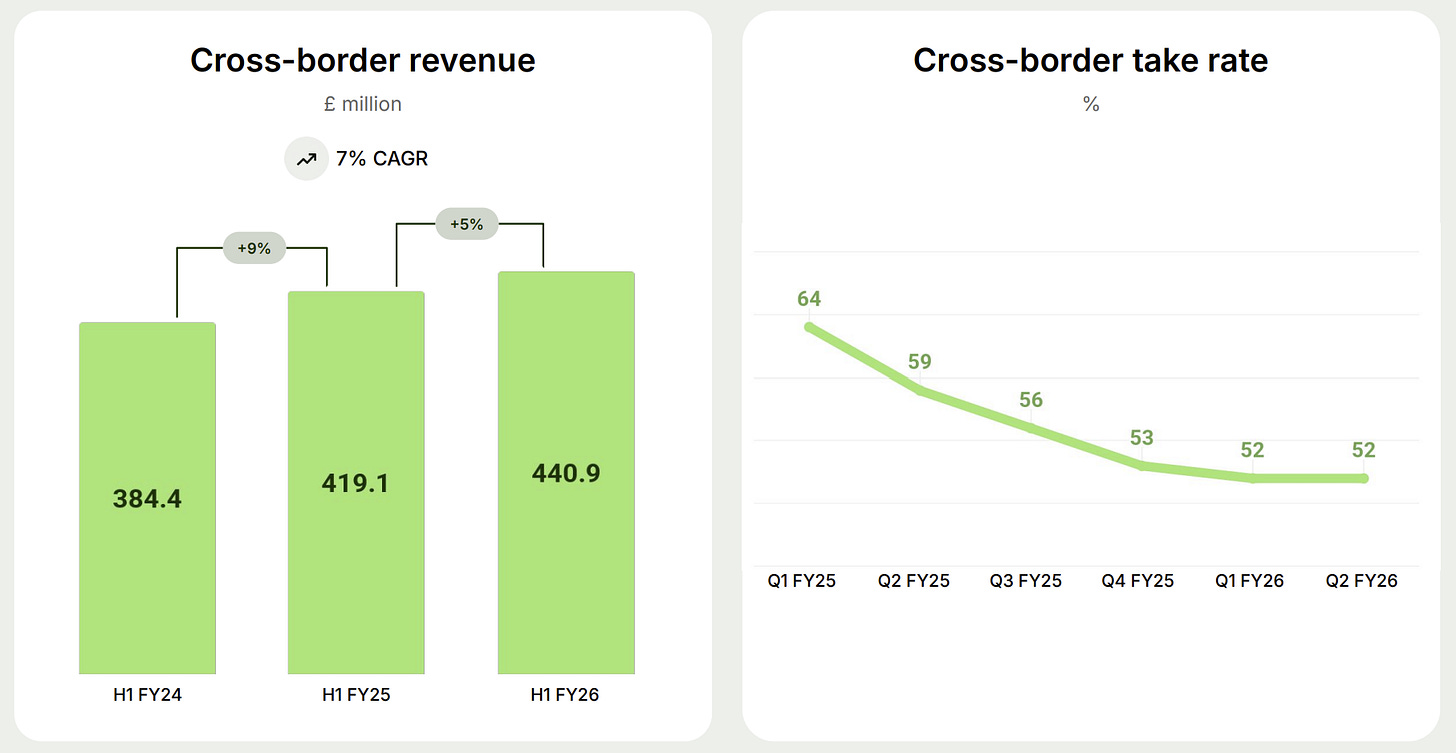

And based on their latest update in H1 2026:

Cross-border volume increased 24% compared to H1 of FY25

But revenue did not follow that growth path because of a lower take rate:

And just as with Adyen, we had a decline in take rate, where Analysts are quick to ask: What is happening, and management just responds: We focus on revenue, not on take rates.

The Valuation

Since this is the first write-up, the valuation here is back of the envelope. But if you followed my chain of thought, I do think this is a unique business.

Price always matters, but when you have a high-quality business, you have to be prepared to pay a premium (or you’ll never own it).

What do we know?

“Investing” heavily with over 1,000 new employees in the first half of 2025 (expensed)

Investing in more infrastructure and partnership

Growth has slowed

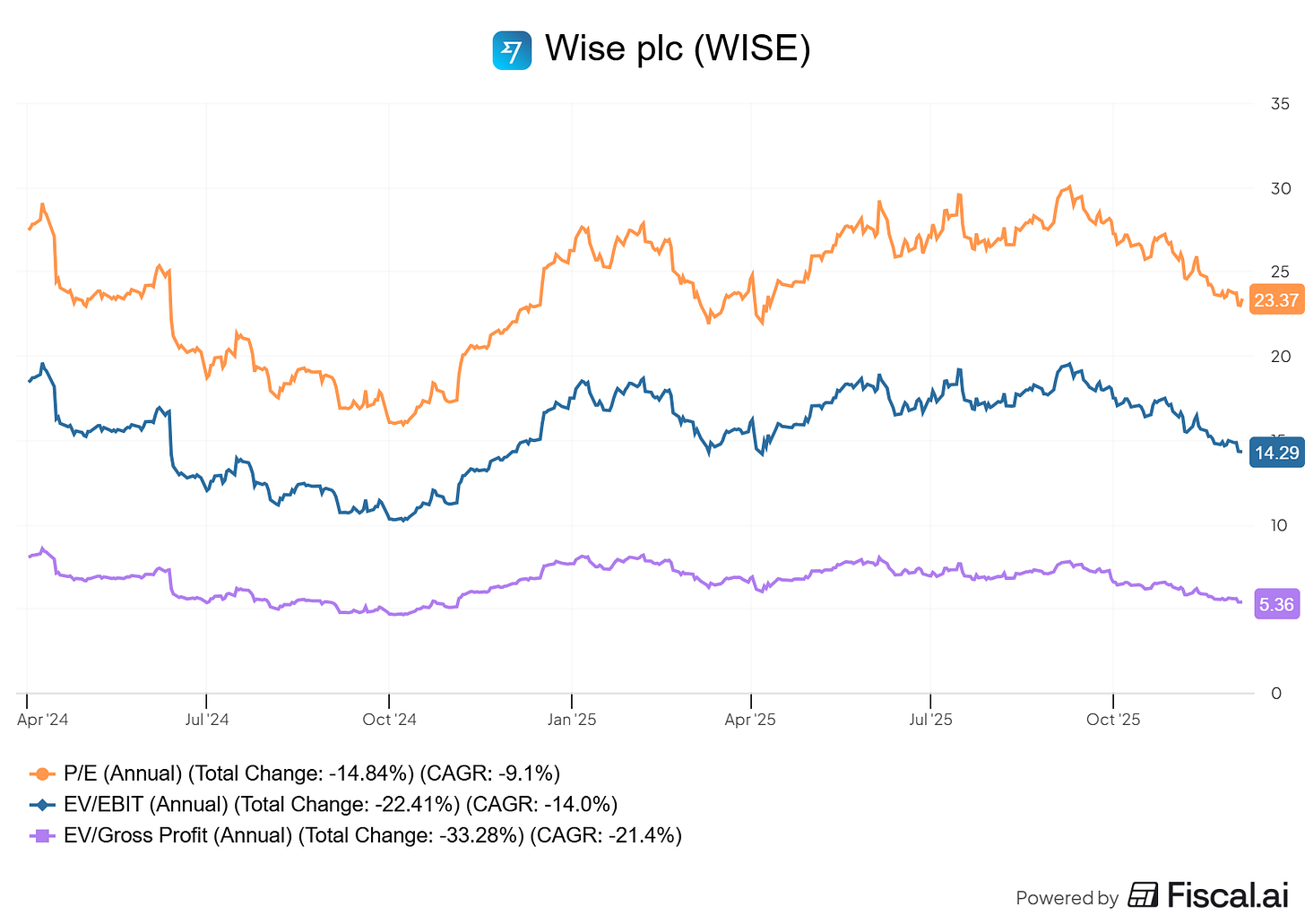

Let’s look at some trailing multiples: P/E, EV/EBIT, and EV/Gross profits

And Wise is now trading back to its previous multiples.

Now, a trailing P/E of 23 is not that bad, especially if growth resumes after their investment period.

But we must be mindful of one thing. The earnings are a sum of their operational business and higher interest rates.

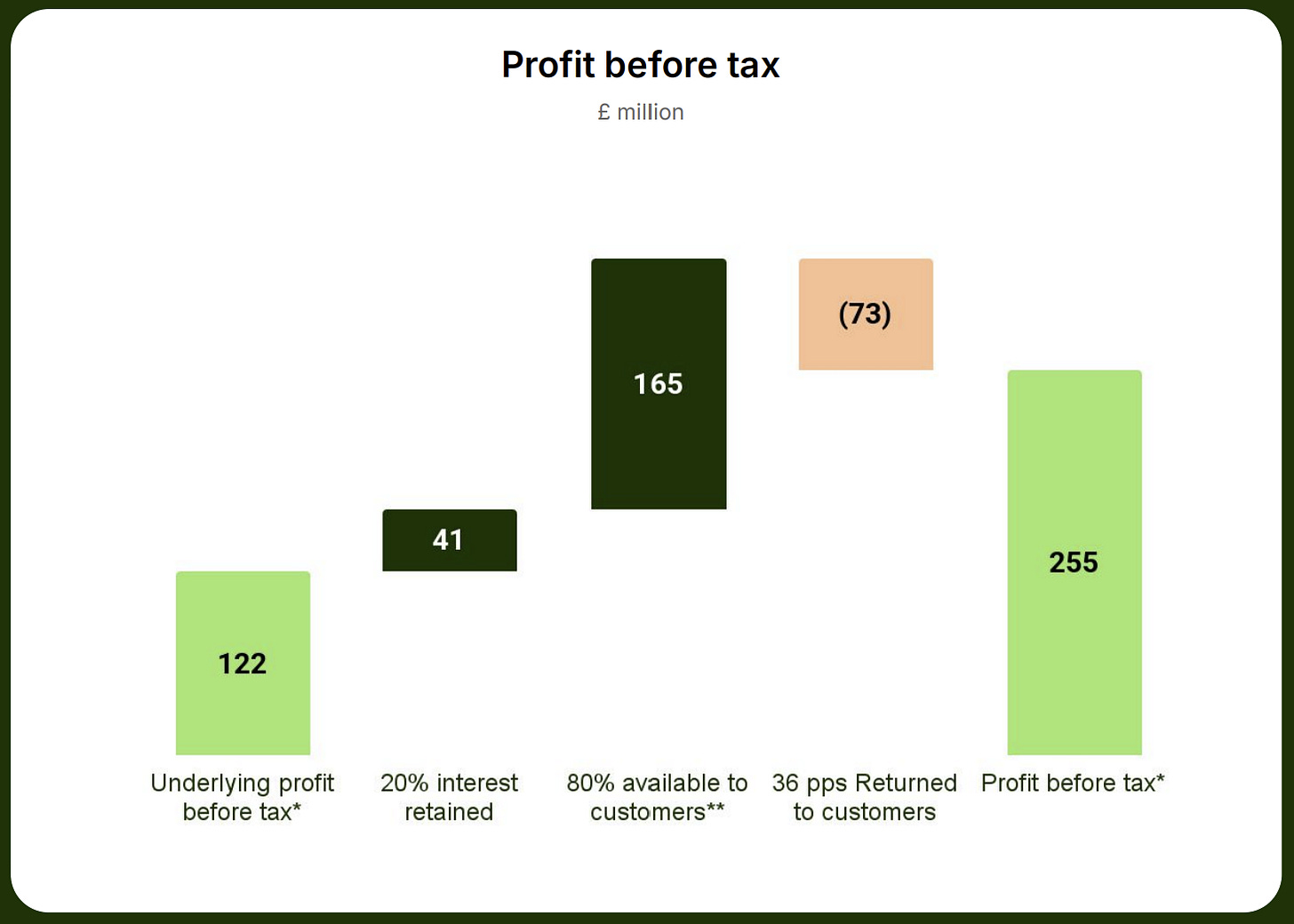

In typical Wise practice, they are very transparent about it:

This is the example for H1 of 2026.

You have the 122 million profit. You add the 20% Wise retains from the deposits. Then you have 165M available for the customers and 73 Million returned to the customers.

Imagine a low-interest-rate environment, you would only get the first part, the 122.

The most important net income we need to monitor is that 122 million.

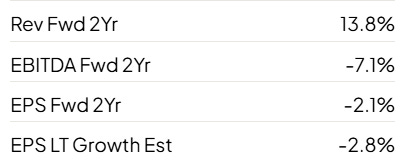

And the consensus growth estimates according to fiscal.ai look like this:

Well, that’s not a pretty picture.

But I believe the market is looking at Wise the wrong way. It’s too short-term focused and does not price in what it can achieve.

That means, based on all this information, I believe in the next 5 years, we should be able to see EPS growing at 15% per year. I consider no multiple expansion in that story.

Continued investment will drive growth in active customers and revenue, which eventually will lead to continued profit growth.

In the short term, there might be some downward pressure on the stock price. But the investments will pay off in the future.

Decision

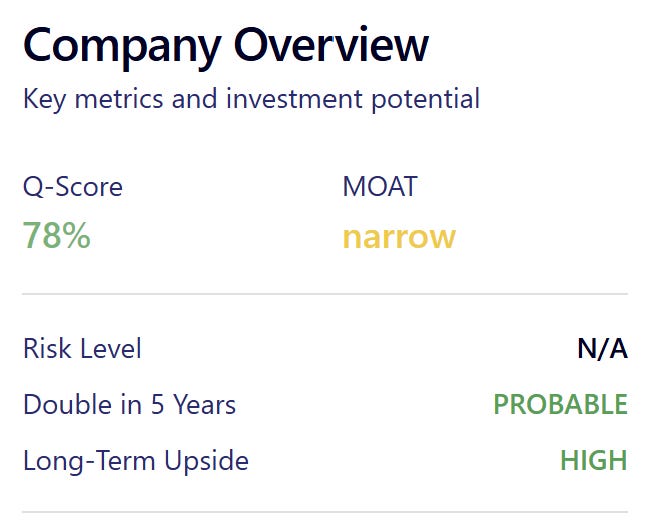

Although I’m not finished with all the research, I have given it an initial score and added it to the database over at 100baggerhunter.com.

It’s the second-highest score in the database. Which is not really a surprise. The quality of this company is there for all to see. I classified the moat as narrow (ok for 10 years). We’ll see if I can assign it a “wide” score or not once the full analysis is completed.

Additional write-ups on Wise will follow in the future, as we deepen our understanding of this company (first principles unit economics, moat, and competitive analysis + leadership review).

I will start an initial position in the Peter Lynch portfolio (3%) and, of course, the Nick Sleep portfolio (5%). Limit orders are set at 850 GBX.

Watch out for the full sector report towards the end of the month.

May the markets be with you, always!

Kevin

FYI It looks like you can buy WIZEY on Fidelity and Schwab in the US.

Wise, so far so good. Some suggestions for the deep-dive : (1) quality of earnings (artificially inflated by high interest rates, no more the global trend) (2) durability of the moat (Wise lower prices because no choice?) (3) £16T market, big banks to outsource their core payment & welcome a newcomer? (4) hidden P/E when we strip out "the excess interest income" what's the P/E on the operating business ?(5) governance dispute (potential overhang)? (6) competition with REVOLUT (IPO next year backed by smart money & NVDA).