Weight watchers, value trap or multibagger?

The 100 bagger hunting bi-weekly

This week’s setup

1. Google DeepMind CEO on the AI-bubble

2. Is Weight Watchers (WW) done for, or revival imminent?

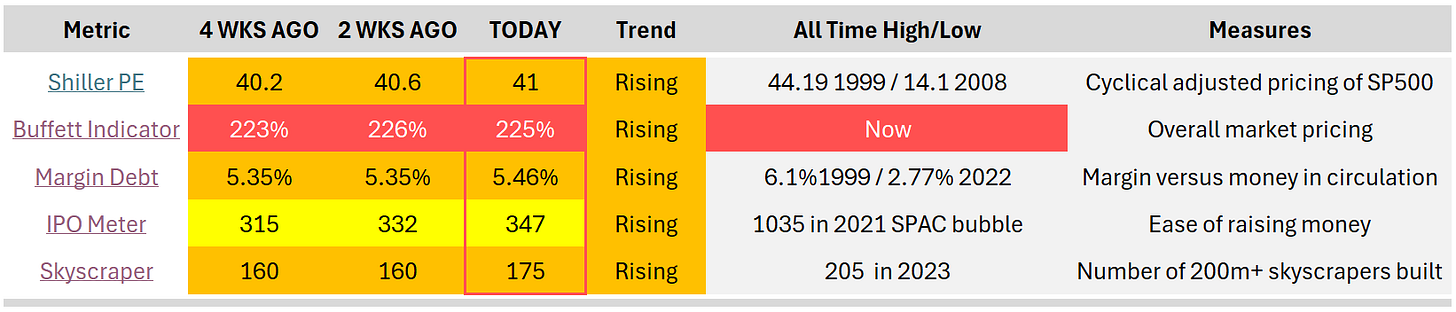

3. Going further than ROIC1. Bubble meter

Note: Take the skyscraper metric with a grain of salt. Margin debt keeps increasing. Shiller PE creeps higher.

When Demis Hassabis, CEO of Google Deepmind speaks about AI and the markets, I’m listening.

Google was the first to build AlphaGo to beat a GO grandmaster. Google was the first to write a paper on transformers, which eventually led to ChatGPT (well, it dropped the ball there, as it should have been first to market).

Demis was in Davos, and in a nutshell, he doesn’t view the current market as “an AI bubble”. To him, it’s a venture bubble within the overall market. Companies get funded fast, without a lot of verification if the product or service provides real value.

Early stage AI-money is getting sloppy. And private companies get huge billion-dollar valuations. Now, that also matters for the public markets, as certain public companies get price-anchored to these private ones. And when certain private companies implode, some of the public ones will follow.

So AI is not a mirage. He still believes in the long-term potential. But checks are written ahead of evidence.

He sees a definite increase in usage of their latest Gemini models, and thinks Google will withstand any “bubble implosion”.

But usage does not auto-translate into profit pools. And so we’ll have to see if Google search keeps its dominance.

2. Stock in the funnel

Let’s get to the stock in the funnel, and this week that is: Weight Watchers (Ticker: WW)

Description: Weight Watchers. If you’re “old” like me (I’m 44), I don’t have to explain the company, right? But for the youngsters, here’s what it does: It has a behavioral program that helps people lose weight (used to be live, in the flesh, now they also do digital). But the business has been decimated over the years with the growth of telehealth and, of course, the introduction of GLP-1 drugs.

Type: Potential turnaround

Why it’s interesting: Weight Watchers has been suffering over the past few years. Filed for Chapter 11 bankruptcy last year. Was delisted. After a successful refinancing, was relisted on the Nasdaq. Just like stock investors need a process to be able to continuously outperform, people who want to lose weight also need a process, a community that helps them.

That’s what Weight Watchers offered in the past. But there’s always been a problem with retention. You know how it works. You start the year with your new year’s resolution to lose weight (that’s when WW spends the most on their ads, by the way). And then somewhere along the way, you stop. At least, that’s how I remember it from people I knew following the program in the past.

But there’s an opportunity now. The magic of GLP-1. The weight loss drug. Now also available in pill format.

Again, I know people who have used it. Instant results. However, without guidance, to change your lifestyle, those results are only temporary.

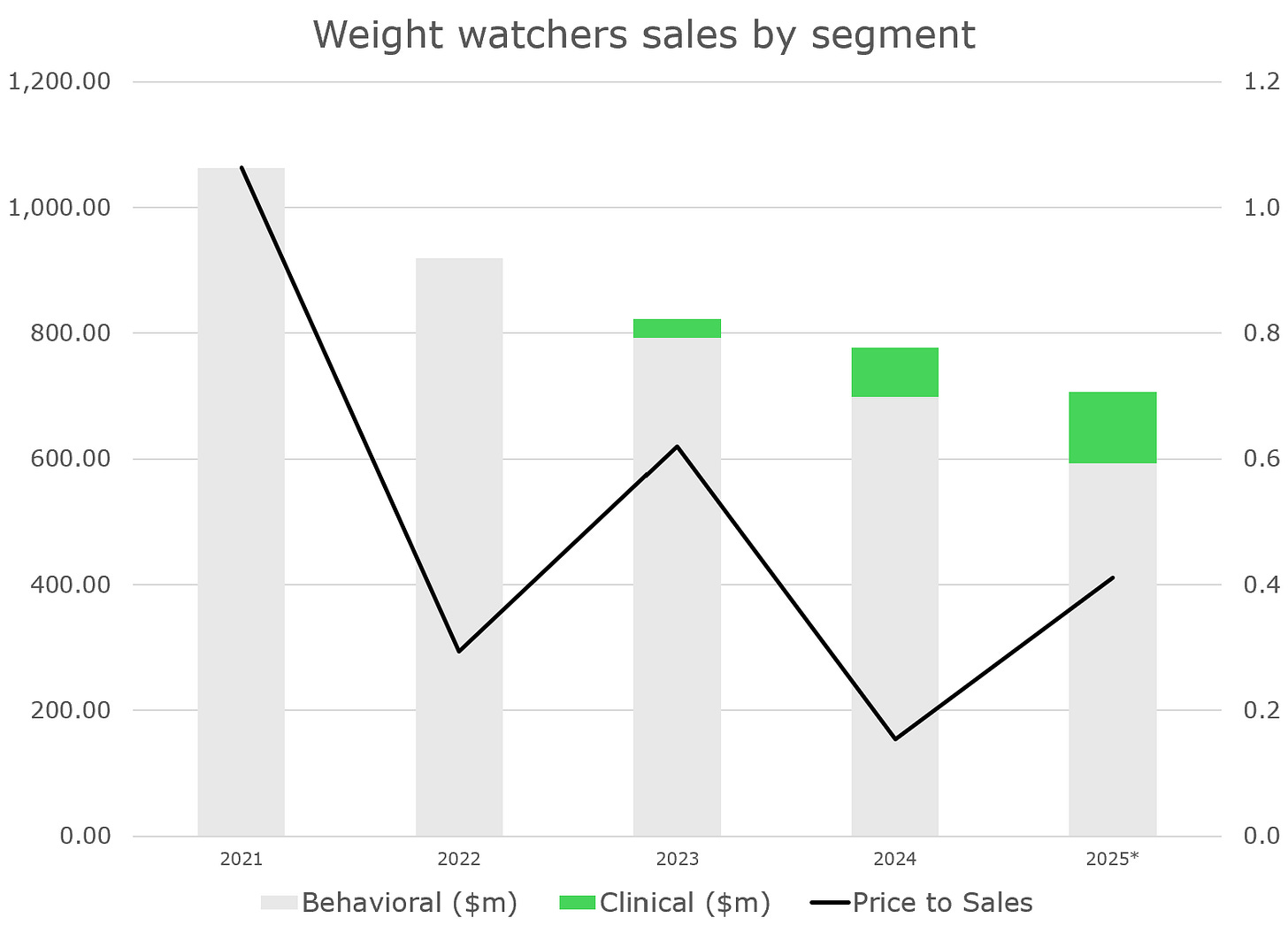

That’s the shift WW is going for. Away from the typical behavioral program, but focused on a clinical program. That means, GLP-1 subscription to a patient combined with a program to change their lifestyle. That sounds like a winning combination. And the clinical segment side is growing (in green)

Current Status: (more research needed). Yes, clinical is growing, but up until now, it cannot compensate for the decline in revenue from their traditional business. And WW is not the only player in town. Noom is a private company that has a telehealth weight loss app and sells GLP-1 drugs, too. It has 1.5 million paying subscribers, has taken market share of WW, and is valued at $3 Billion. Compare that to the current enterprise value of WW at $558 Million, which has 3 million paying members in total.

One last thing is that the capital restructuring leaves them with about $465M in debt. Based on their cash balance at the end of Q1 each year, they have to mandatory pay back part of their debt above a 100M threshold. So if their current cash balance is 170M. And let’s say, at the end of Q1, they still have that 170M in cash. They will be forced to pay down 70M in debt, reducing their debt to 395M. This system is in place up to 2030.

So the question then becomes: Is WW too cheap?

Two possible outcomes:

Clinical keeps growing and offsets the overall decline in revenue. Total revenue stabilizes and starts growing (albeit slowly) in the future. Free cash flow is generated. Part of the debt is paid down. The market applies a rerating as it sees the company turning around.

Clinical keeps growing, but at a lower pace. Overall revenue keeps declining. No cash flows or modest cash flows are generated. Weight Watchers dies slowly as it will not be able to meet their debt obligations towards 2030. Refinancing becomes difficult.

The metaphor I would use to describe this stock is like an old man, wanting to ride that big wave (GLP1) with his surfboard one last time. If he keeps his balance, he’ll go for glory. If he falls off the board, he might die in the water.

3. Best article of the week

Well, I actually reread Mauboussin’s article on ROIC and the investment process.

A good company, which has a high ROIC, and a good stock, which has a high total shareholder return (TSR), are two different things. The reason is that a stock price reflects the market’s expectations about a company’s future financial results. Excess returns are the result of revisions in expectations. Of course, actual financial results shape and reshape expectations. But the stock of a company with a high ROIC will not deliver attractive returns if it fails to exceed expectations over time.

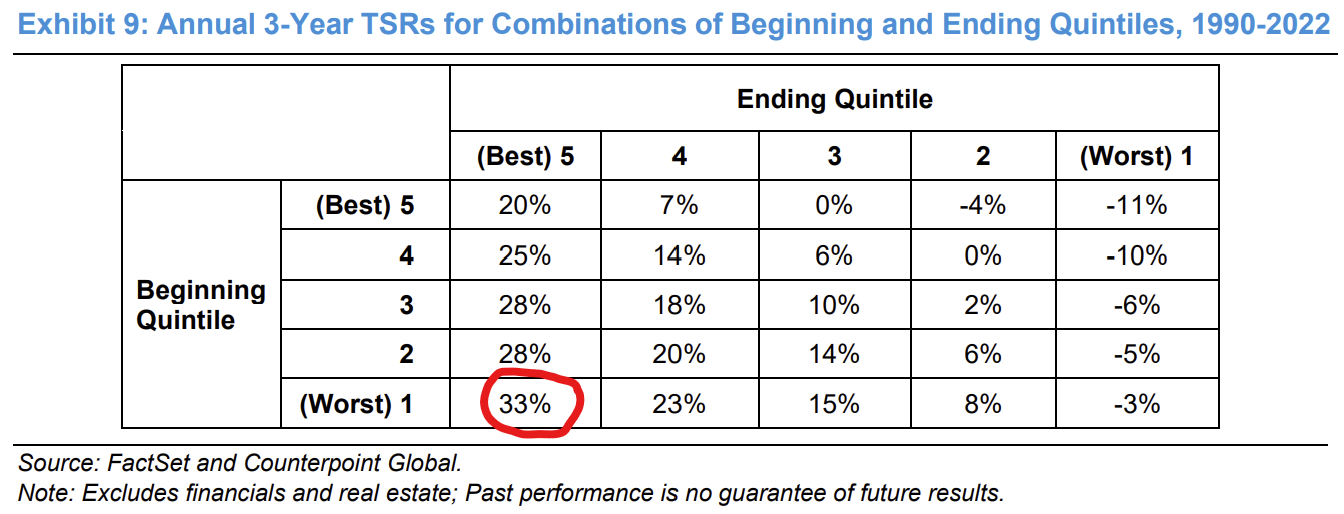

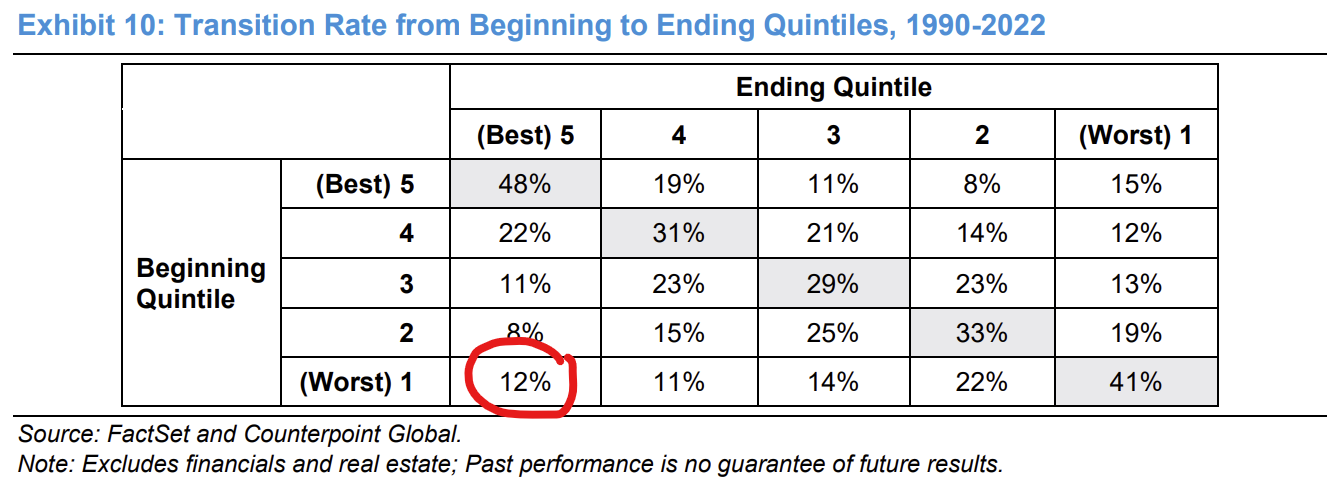

Two tables in this article caught my eye:

Rising ROIC’s are good for shareholders. If in the 3-year period, you bought a company in the worst quintile, and it somehow ended up in the best quintile in year 3, you got yourself a TSR of 33%. A typical turnaround or profit inflection story.

High ROIC’s are sticky. 48% of the companies that started the 3-year period in the highest ROIC quintile stayed there. On the other hand, only 12% of the companies that started in the worst quintile actually ended up in the best quintile.

In other words, turnarounds are less likely (12%), but when they do, they offer great returns (33%). So a quality strategy or a turnaround strategy can both work.

Some closing thoughts on ROIC:

If you value past ROIC, you’re probably looking at mature growth companies (high growth companies often have bad ROIC, but can be great investments)

ROIC is always backward-looking (by definition); it therefore has little to do with what will happen tomorrow

Our goal is to find future high ROIC companies

I went deeper into this topic in this article. ⬇️

That’s it for this week.

May the markets be with you, always

Kevin

WW : debt covenant (a stranglehold; better for creditors than shareholders) + "Old WW" shrinking faster than "New WW" growing + middleman (doesn't own the drugs) role = a "Zombie Scenario"? A declining legacy when there are so many better alternatives.