5 steps to accelerate your stock research with Perplexity AI

Be like Dr. House

“The person that turns over the most rocks wins the game”, he said, “And that's always been my philosophy.” I've made turning over many rocks my philosophy too and hope that I've motivated you to try and make it your philosophy.

- Peter Lynch

As a hunter in the smaller stock space, I’m always looking for ways to speed up my research process. I wasn’t investing when the Internet boom happened. But I’m diving head first into this AI boom to see how it can help me during the day. New AI tools are popping up every day, but the one I use every day is Perplexity.

So let me show you how in 5 steps how I use it, what it’s good for, and what you should absolutely avoid.

1. What is Perplexity?

It’s an advanced search engine. Or, as it explains itself, it is an AI-driven search engine that uses Large Language Models to gather insights from the best sources online.

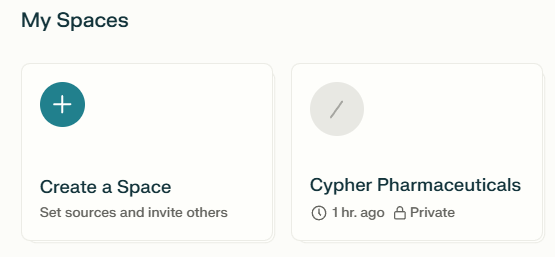

On top of that, it allows you to create spaces, your little environment where you can feed it files to increase its response accuracy on certain questions.

What AI tool are you using frequently for your research?

You can use Perplexity for free, but what you get with Pro is more.

More queries and the ability to set up your own spaces (more on that later)

I use Perplexity Pro (20 USD/month), as I’m a pretty heavy daily user now. (Disclosure: I’m not getting anything from Perplexity and have no affiliation with it.)

2. What is Perplexity good at?

Just like Cursor for coding, Perplexity is good for learning and research. You can talk to it just like you would a human to learn about a specific topic. Now, when an experienced coder uses cursor, he/she will dramatically improve their productivity.

But there are conditions ⬇️

You need to be able to understand what the tool is generating

You need to be able to ask the right questions

This means that

If you don’t know how to code, you learn faster.

If you already know how to code, you’ll code more in less time.

It’s the same thing for an investor or equity analyst. If you’ve never read an annual report or have no knowledge about accounting, Perplexity can help you to learn these things, but will not give you quality answers.

The quality of the answer starts with the quality of the question.

Or to put it more blatantly: Bullshit in equals bullshit out ➡️Ask great questions, and you shall receive.

I’ve been using Perplexity Pro for a couple of months, and I rarely use Google anymore.

I believe it’s good for the following problems:

You want to understand in the most basic way what the business model is of a certain business

You want to get an idea about the market; is it growing or not? What are the future prospects?

You want to see who the competitors are. Who are the major players? Who are the direct and indirect competitors?

You want to get an opposing view of the company you’re analyzing (one of my favorites)

You want to create a knowledge hub that represents a company and talk to it (spaces)

Perplexity can also help you buy stuff.

C’mon.

You came here to make some money, not spend it! 😉

3. What does it suck at?

It will not give you the best investment advice at this time. (Luckily, because that would render this newsletter rather useless). Well it will give you something, but I would be very careful.

You can ask it for a complete analysis of a company. It can produce a great write-up, but at the moment, there are regular hallucinations within these, and that’s dangerous if you’re basing your investment decisions on it.

Perplexity can go fetch data from different documents and populate a table or even chart them. But these again are not always accurate. It’s a good start to get a general idea, but you will need to cross-check. Bear in mind that it does not have access to full historical financial data (as opposed to Finchat.io)

It reasons based on existing knowledge. Be aware of that. If there are 20 articles publicly written on how great Nvidia is and only 2 that are bearish, the overall sentiment Perplexity will give you is bullish. It aggregates what the world thinks unless you explicitly tell it to do otherwise.

4. A practical case

Let’s pick a company and analyze it using Perplexity. I just want to emphasize that although this tool accelerates my research, it does not replace reading through an annual report or financial statement. You cannot build conviction in a company by reading summaries or betting on the AI doing the reasoning for you.

You build conviction by reasoning your way through a problem.

Remember the funnel I posted a long time ago?

We can use Perplexity in the first 2 stages. Once you get to the end, the full reading starts.

We’ll pick Cipher Pharmaceuticals (Ticker CPH), as it’s been sitting on my watchlist for a while now. I need to spend some time to see if I can cut it or keep it for further research.

Context is everything

My first boss told me: If you don’t know the context, and people ask you “yes or no questions”, the answer is always no.

It’s impossible to give a reasonable answer without knowing the context, and it’s the same for any chatbot you will use. So, the very first prompt should always be to contextualize.

I call this priming the model.

So, let’s prime it. Here’s a prompt I use:

You are an experienced equity analyst. You search for the truth, weeding out the subjective from the objective. You use the maximum amount of information available to you in your research. I need your help in analyzing and understanding a company. I want to know if it’s a good investment opportunity or not. Are you ready to assist me?Ok, so now Perplexity has been primed, it’s ready for us to feed it with the right questions.

When I research a company, the first thing I want to do is to make sure I understand its business model.

How are the dollars coming in?

What does the company need to do to generate this business?

If I can’t figure out the business model in the first 15 minutes, it goes on the “too hard pile”, and I’ll pass.

To make sure we get the most basic explanation of the business I want Perplexity to explain it to me as if I’m a kid. So here’s the prompt I use.

The company we are researching today is called [insert name], which is publicly traded on the [insert exchange] with the ticker [insert ticker]. Can you go through the publicly available filings and other sources and break down the business model for me? How does this company make money, and what does it need to do to generate its business? Is it a capital intensive business? Please explain it to me like I’m an 8-year-old. Provide an example to illustrate the business model.For now, we won’t be uploading any files. We’re just going to see what it finds.

So let me break down this prompt for you.

Context: I’m being very specific with the company because sometimes, it gets confused. When it’s searching the web, there are usually several companies with the same name. So to be sure it fetches the right one, be specific.

Goal: Then, I ask what I want to achieve. I want to understand the business model

Format: Finally, we ask HOW we want Perplexity to return the results.

With this last sentence, you can be even more detailed if you want Perplexity to generate something within a specific format.

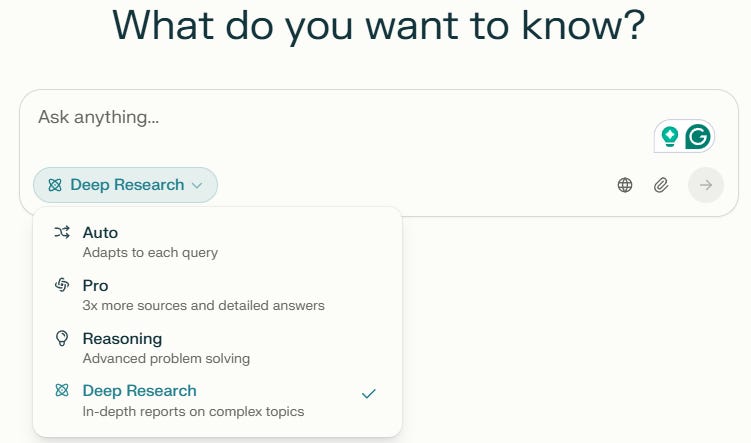

Now, let’s test this on Cipher. We’ll run Perplexity with a general search, and then afterward I’ll run a new thread by using pro and deep research.

So, first off, something weird happened. I primed Perplexity, but I did it while accidently activating deep research ⬇️

It just kept on searching, adding more and more sources, up to 300+, where I had to close my browser down. Crazy.

Ok, so that was my mistake.

So let’s try the second prompt and see what it says about Cipher. With Perplexity PRO, you can use the AI Model. I just select Sonar, which is Perplexity’s model aimed for fast research and response. Here’s the result⬇️

Business Model Overview

Cipher Pharmaceuticals is a specialty pharmaceutical company that focuses on acquiring and selling prescription drugs, mainly in Canada and the U.S. They don't develop new drugs from scratch but instead buy the rights to existing or developing drugs from other companies. This approach is called an "asset-light" model because it doesn't require a lot of money for research and development (R&D).

How Cipher Makes Money

Selling Drugs in Canada: Cipher buys the rights to drugs and sells them directly in Canada. For example, it sells a drug called Epuris, which is used to treat severe acne.

Earning Royalties: Cipher also licenses drugs to other companies in the U.S. and other countries. When these companies sell the drugs, Cipher earns a percentage of the sales as royalties. For instance, they earn royalties from the sale of Absorica, a version of Epuris sold in the U.S.

Acquisitions: Cipher grows by acquiring new products or businesses. Recently, they bought the Natroba business, which treats head lice and scabies, expanding their presence in the U.S.

Is It Capital Intensive?

No, Cipher's business is not very capital intensive. They don't spend much on R&D because they buy existing drugs or drug rights. This means they don't need a lot of money to keep their business running. They focus on generating cash and using it for strategic acquisitions or returning value to shareholders.

Example

Imagine you have a lemonade stand, but instead of making lemonade from scratch, you buy it from someone else and sell it to customers. You also let your friend sell lemonade in another neighborhood and give you a small amount of money from each cup they sell. This is similar to how Cipher operates: they buy drugs (like lemonade) and sell them directly or let others sell them and earn royalties.

What Cipher Needs to Do

To generate business, Cipher needs to:

Identify and Acquire New Products: Find drugs that fulfill unmet medical needs and have good sales potential.

Market and Distribute Products: Use partnerships and sales teams to sell drugs effectively in Canada and the U.S.

Manage Royalty Income: Ensure that licensed products are sold well by partner companies to maximize royalty earnings.

Conservatively Manage Capital: Use cash wisely for acquisitions and investments that increase shareholder value.

Overall, Cipher's model is designed to generate cash efficiently without needing a lot of capital for R&D, making it a unique player in the pharmaceutical industry.

You can see the strength of using the prompt. I believe anyone can understand this business, and the example of the lemonade stand makes it even easier. Perplexity used 44 different websites to come up with this answer. It took a couple of seconds.

Cipher might be more interesting than another Pharma company we covered recently!

Now as a test, let’s use Perplexity’s deep research on this first prompt to see if the results are any different.⬇️

Cipher Pharmaceuticals Business Model Analysis: A Simple Explanation

Cipher Pharmaceuticals (TSX: CPH) operates like a "treasure hunter" for medicines. Imagine you love trading toys but don’t make them yourself. Instead, you find cool toys that other kids don’t want anymore, fix them up, and then either sell them at your lemonade stand or let friends sell them in their neighborhoods for a cut of the profits. That’s essentially what Cipher does with medicines!

How Cipher Makes Money

Step 1: Finding "Treasure" (Acquiring Medicines)

Cipher looks for medicines that aren’t widely available yet or need improvements. For example, they might find an acne cream that works better than others but hasn’t been approved for sale in Canada. They buy the rights to these medicines, like how you’d trade for a rare Pokémon card12.

Step 2: Fixing the Treasure (Testing and Approvals)

Before selling the medicine, Cipher makes sure it’s safe and effective. They work with scientists and doctors to run tests (called clinical trials) and get permission from health authorities. For instance, their partner Moberg Pharma is testing a nail fungus treatment called MOB-015 in the U.S.811. Once approved, it’s like getting a gold star from the teacher—ready for the market!

Step 3: Selling the Treasure (Two Ways to Profit)

Cipher makes money in two ways:

Selling Directly in Canada

Letting Friends Sell Elsewhere (Licensing)

What Does Cipher Need to Do?

Find Good Medicines: They must pick winners, like their recent acquisition of Natroba, a lice/scabies treatment with no generic competitors until 203312.

Keep Costs Low: Cipher partners with factories (e.g., Galephar) to make medicines instead of owning labs, saving money611.

Grow Smartly: They reinvest profits into new medicines, like their experimental tattoo-removal cream DTR-001811.

Is It Expensive to Run This Business?

No! Cipher’s model is like a toy trader who doesn’t build toys from scratch. They avoid costly factories and labs, which means:

High Cash Flow: In 2024, they generated $8.3 million in cash from operations4.

Real-Life Example: The Acne Treasure

Imagine Cipher finds a magic acne pill (isotretinoin) that works better than others. They:

Buy the rights from a company in Puerto Rico6.

Get Canadian approval and sell it as Epuris at their "stand" (earning $12.7 million in 2024)4.

Let a U.S. friend sell it as Absorica, earning royalties ($3.7 million in nine months)11.

This way, Cipher earns money twice from one pill—without making it themselves!

Future Treasures in the Pipeline

Cipher is testing new medicines, like:

MOB-015: A nail fungus treatment in Phase 3 trials (like final exams for medicines)211.

DTR-001: A cream to remove tattoos (still in early testing)8.

If these succeed, they’ll add even more "treasure" to Cipher’s stand!

In short, Cipher is a savvy trader of medicines—finding, fixing, and sharing profits with partners. Their lightweight model keeps costs low while unlocking value from overlooked treatments1612.

Surprisingly, it used fewer resources this time (only 31), but the result was more detailed, with explicit mention of the different drugs. In comparison to before, the whole answer is tailored as if “speaking to an 8-year old.

The next step would be to look at the growth metrics and profitability of this company. (Income Statement. Balance sheet and cash flow statement. )I use Finchat for this. It takes a couple of minutes to get a rough idea about the company’s finances.

I never look at a company in isolation. When looking for 100-baggers, it’s important to know:

Is the market growing?

Why is the market growing?

What is their runway? How big can they become? Ideally, the current market share would be great

This leads me to the third prompt:

I want you to perform the most thorough competitive analysis research report known to man on this company and its competitors. What makes [Insert Company] different, and in what way is it the same? What makes Cipher SPECIAL? What makes it unique? Is it considered one of the best companies in its industry? Please use at least 150 different sources before giving me your final research report.You can look at the PDF report it generated below.

I can already tell you that it’s a nice summary, but it doesn’t come close to a true deep dive like we do (phew 😮)

Ok, so first, it did not use 150 different sources. That doesn’t work. I tried it in different ways, but you cannot define the final length of its answer. It did not create the best competitive analysis research report “known to man”. But the report it generated was pretty good with only minor hallucinations in there.

Let’s end it with my favorite question. The report it has created was rather bullish on the company. But as I mentioned before, if the articles on the internet are bullish, then perplexity will follow. Let’s now ask it explicitly to show us the bear case. Here’s the prompt I used.

You are running a short-focused hedge fund. The only thing you do is look for businesses that could be in trouble so that you can write a short report and profit from the stock plunging. Please use your analytical capabilities to generate a short report on Cipher Pharmaceuticals. Where could it go wrong, and what are the major risks? Please list the number of articles you've found while researching where people take a more bearish stance. Thank you!You can download the report below.

On our first prompt, its conclusion was: A Niche Leader with Disciplined Execution

On the second (short report) prompt, its conclusion was: Recommendation: Short CPH.TO with a 12-month horizon. Pair with long positions in dermatology-focused peers (e.g., Bausch Health’s Ortho Dermatologics) to hedge sector exposure.

It truly reflects the real world, with different investors using the same information to come to different conclusions 😄

5. Use Spaces

We come to a final feature that is only available on the PRO plan.

It looks like this:

The great thing about spaces is that they give you more control. You force it to use certain files and links. (Upload limit of 50 files)

As an example, I downloaded all the past annual reports and management letters and put them in a space. Now you can ask it questions. This will once more increase the quality of the answer if you use great prompts.

We now rerun all the previous prompts. Here are the results:

The overall quality was better than before

It took a lot more resources into account (100+)

It still hallucinated sometimes, so it was not bullet-proof

The report contains a lot more detailed financial information.

Conclusion

The moral of the story is to be more like Dr. House.

He gets his light bulb moment to solve the problem of a horrible disease, not because he’s the smartest in the room (although he is), but because he asks a ton of questions and verifies hypotheses. That’s the beauty of an advanced search engine.

To summarize:

Know the limitations of any tool you use

When using a chatbot, always prime it first

Use detailed prompts. You only have to draft these once

We’ll go deeper into the rabbit hole of AI tools in the future. Oh, and I will keep Cipher in my research funnel for now.

May the markets be with you, always!

Kevin

Yes, a brilliant article Kevin and some pithy questions to get better quality from AI. It would be great to develop a library of questions…and I am more than happy to contribute.

One suggestion: Analysts tend to specialize, so in the priming phase I adopt the following:

You are an experienced analyst specializing in the <insert industry>.

And there are questions where the requester might state ‘and I am an experienced investor requiring a high degree of confirmation as to fact based data’

Hi, great tool, good article 👍😃

Two comments of mine (I use free perplexity, but also notebooklm and Claude, all free atm)

1) the spaces feature is available also on free

2) I like the idea of the hedge fund short prompt. I wonder if an AI analyst battle would be fun: 2 rooms, both get the files you uploaded and get the appropriate printing. Then, e.g. create an investment thesis for a company that is then provided to the other to put holes into... The reason for suggesting two rooms is that I wonder if the creation of e.g. a long-sided thesis will act as priming for the short-side prompt that follows... Idk