A 4-step AI enhanced stock analysis process

2025 process review

As you know, I’m building a course and advanced prompt library to save hours on stock analysis.

Check it out here.

Each year, while I prepare my annual review, I also refine my stock investing process.

You can check out what I wrote last year.

As a former nuclear process engineer, I love building and applying systems. I strongly believe this was one of the biggest reasons why my performance in the markets increased over the last 15 years.

The one thing that changed in 2025 was me diving headfirst into all these AI Tools to see where they can help:

Saving time on tedious tasks

Deepen my understanding of businesses

An overall enhancement of my research process

The problem is that most of the time, you only see the outcome, the final results; you never see the journey towards it.

So here’s a short overview of what my modified process looks like these days.

I will flesh this out in detail in a future post.

“You do not rise to the level of your goals. You fall to the level of your systems.” - James Clear

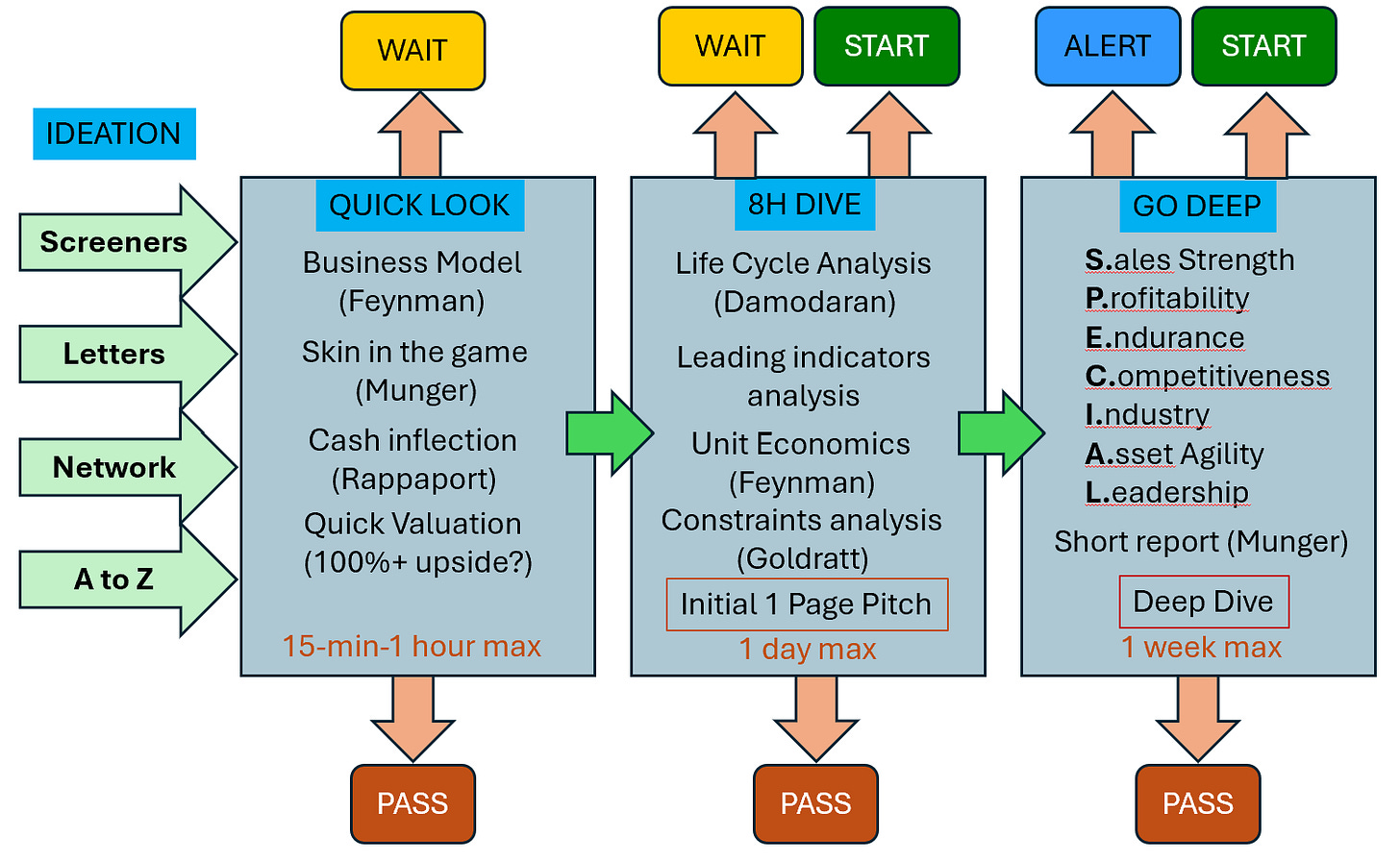

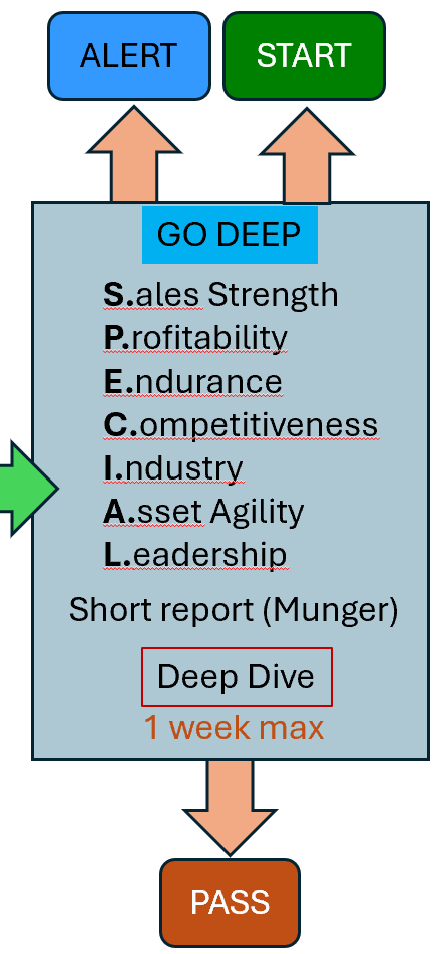

Here’s the overall process:

Ok, let’s go through all the phases.

Phase 1 ideation

Where do your ideas come from?

The 4 ways I get ideas are:

Screeners: I don’t use these often. Sometimes I use an inverse screener. If you screen for a high-quality company, it’s usually already priced in. I’m not saying screeners are useless, but it’s not my GO TO area for ideas

Letters: Just like you, I’m subscribed to a load of Substacks and fund letters. I try to flag what’s interesting.

Network: I talk to a lot of investors. We exchange ideas. I go to conferences where ideas are pitched. This is a great resource.

A to Z: Buffett style, you pick an exchange, and you start with the A’s.

Here are some of the criteria I use before an idea goes into phase 2:

Skin in the game: If the company is small, there has to be alignment of interests. I will say NO if that’s not the case

Gross margins at 40% or increasing: It gives the company some leeway. A cushion for its further operations.

Rising cash flow from operations: CFO could be negative, but it needs to improve

…

I have others, of course.

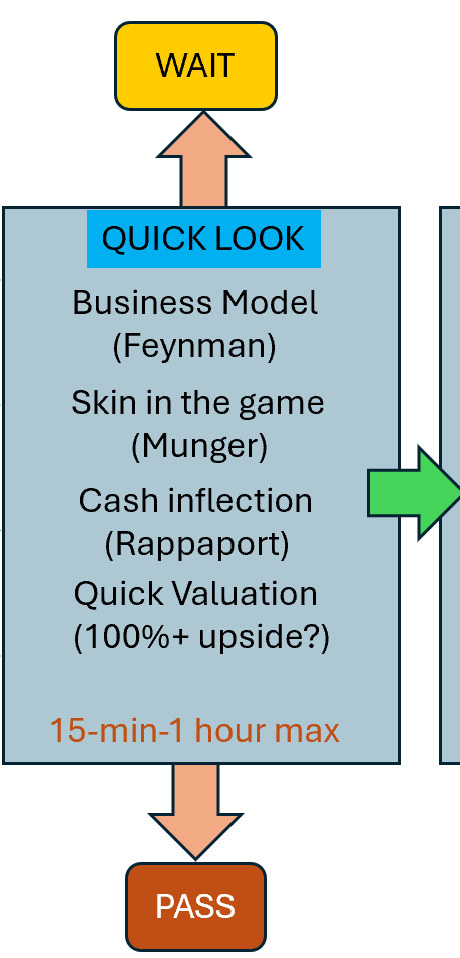

Phase 2: Quick Look

The goal is to quickly go through a company. And of course, AI is a big help.

I use a specific prompt that uses the Feynman Technique. To be able to understand the business model

Another one gives me a more detailed breakdown of the incentives

I run a prompt that looks at the cash flows (Rappaport)

And finally, a quick valuation assessment. The idea here is that I do not want to waste my time on the company if there are no signs of undervaluation.

What happens next?

Go to Phase 3

PASS: Based on this quick assessment, I don’t like the setup

WAIT: It looks good, but there are 1 or 2 criteria that are not good enough at the moment -> (This means I’ll quickly check it again in the next quarter)

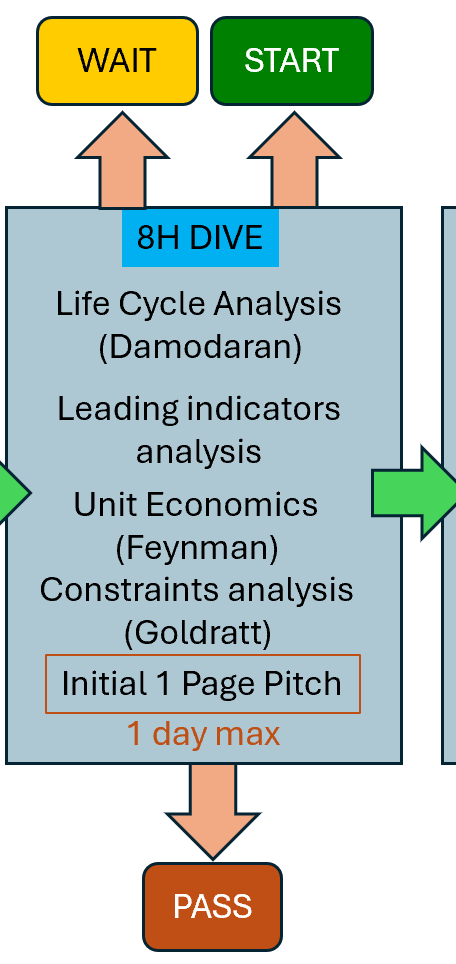

Phase 3: 8h max dive

In phase 3, we’re going to spend a day max on a company. I try my best to limit it to half a day. But it depends on the complexity of the company.

What I do:

Look at where the company is in the life cycle (I run a Damodaran prompt)

Do a leading indicators analysis: Like contract backlog, etc. Something that can help us predict future revenue

Do a unit economics analysis (I run a Feynman prompt) to understand the business model on the tiniest level

Constraints analysis (I run a Goldratt prompt) to understand what is holding the company back in its growth.

I usually try to write down my final assessment on a one-pager.

The possible outcomes:

Go to phase 4

PASS: Example: The overall picture was good, but the unit economics look bad

WAIT: Everything looks good, but there is one constraint I first want to see lifted -> Revisit next quarter

START: After this first pass, it looks compelling. Take an initial position (1-2%) in the company

Phase 4: Deep Dive

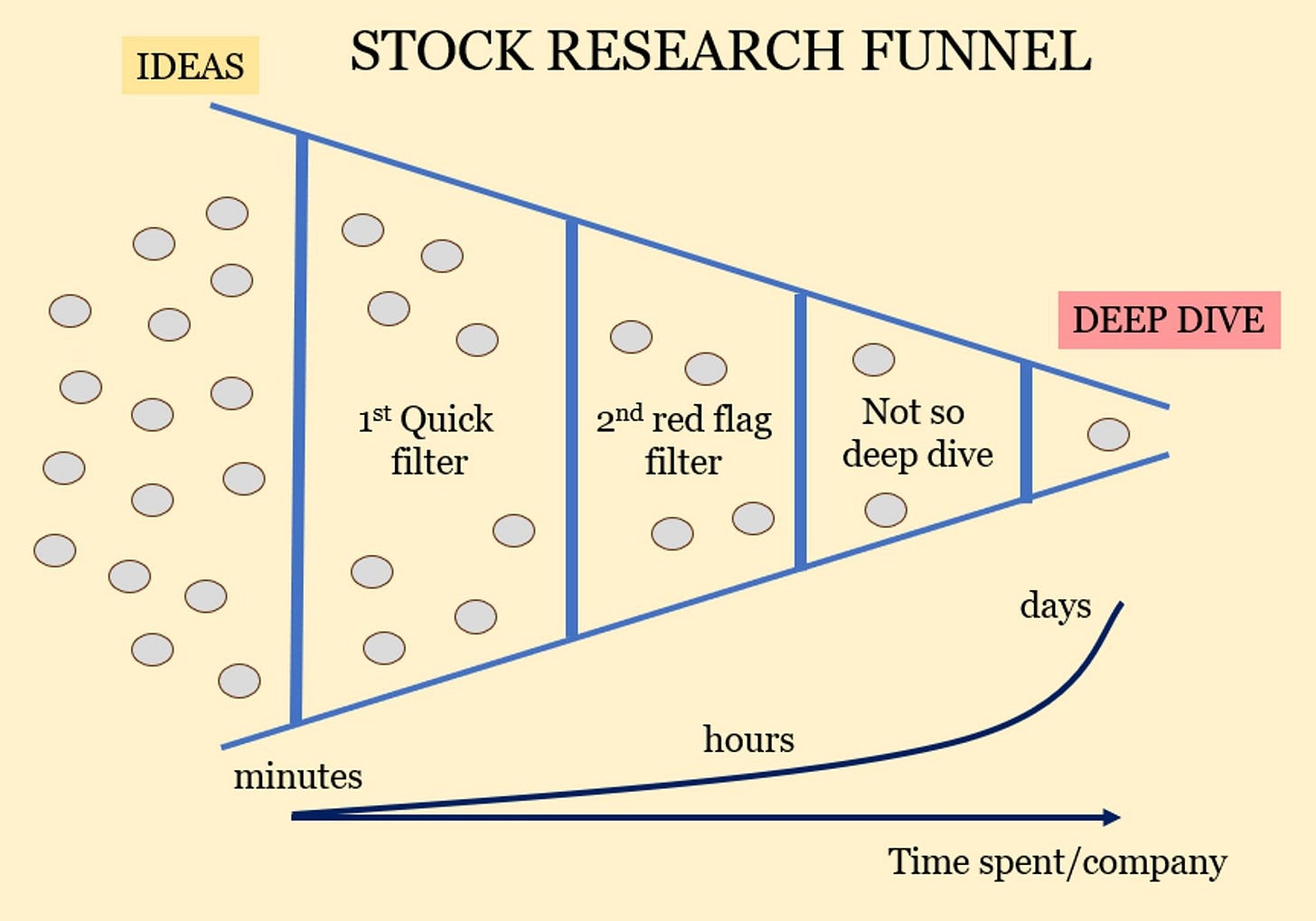

You already guessed it, but this is supposed to be a funnel.

Lots of companies enter the funnel, but only very few receive a deep dive.

If you’ve read my previous deep dives, you know I evaluate how SPECIAL the company is. What I recently added was an inversion or short style report on the company.

In this last stage, I’ll do a lot of reading. That means AI and prompts help a lot in the first 3 phases. But you need to build the conviction in this last phase. That means you need to do the work. Or you won’t be able to handle the volatility.

The possible outcomes;

PASS: This can still happen. You never know if you uncover something in the annual report or proxy statements that finally puts you off. But I do hope these are rarer.

ALERT: I like the company, but I do not like the price. A price alert will be set.

Start: Buy an initial position, or maybe ADD if I already took an existing position.

Conclusion

This inside look into my process only shows how to research and buy a stock. It doesn’t cover when to sell, trim, or how to handle position sizing.

I’ll cover those when I write a full process outline.

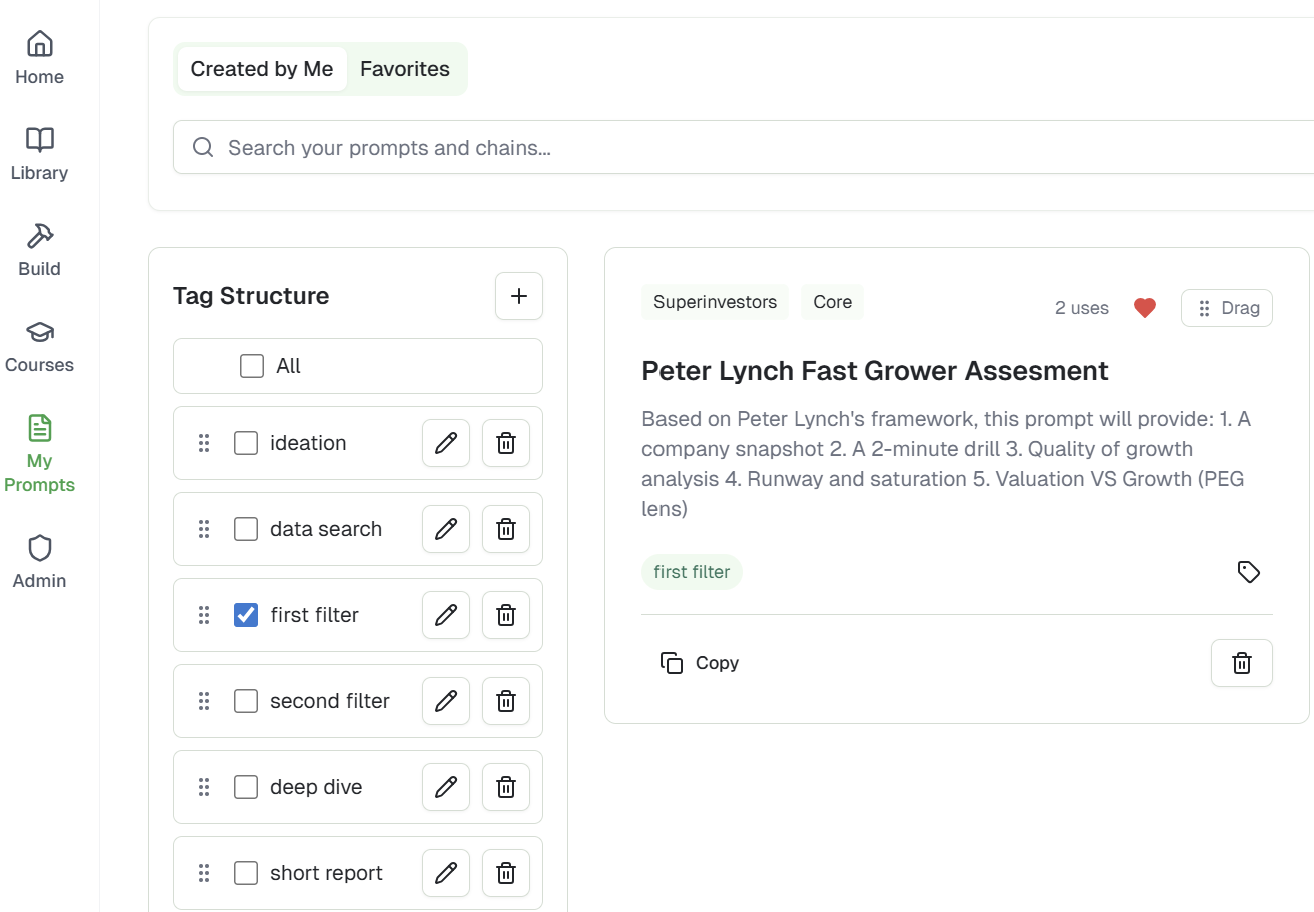

What I did not tell you is that my entire process is mapped into prompts for ease of use, like in the picture below.

If you’re interested, you can still join the waitlist.

May the markets be with you, always!

Kevin

P.S. The payments sector reports should have been ready. But I was a bit under the weather and had to postpone it.

The funnel approach really makes sense for filtering out noise before commiting serious research time. I've been experimenting with AI for due diligence too and the biggest value add is exactly what you hit on - using it for the tedious parts early on so you can spend your actual brain power on conviction-building later. That inversion/short report you added in Phase 4 is clever, forces you to steelman the bear case before going all-in. Been burned before by skipping that step and just cherry-picking bullish data points. The life cycle positioning (Damodaran) in Phase 3 seems especially useful for avoiding value traps, companies that look cheap but are actuallyslowly dying.

Excellent step by step overview. But the VERY first step should always be an analysis of the overall market regime. Because if you start to invest in a seemingly late stage bull, but actually early stage bear market all that other analysis taking so many hours is near meaningless, because the picked stock will only underperform less (if high quality), but still drop lower among with the entire rest of the market (except if the stock was aligned in a contrarian way, e.g. being deemed defensive).

To make that very first market regime analysis step MUCH easier, you can use for example the market dashboard which @Reflections-of-Reality offers. I’m also aware of other market gauges, but those aren’t shared on Substack (at least that I know of):

https://substack.com/@reflectionsofreality/note/c-189466298