Better Call Grok: 5 prompts to analyze a stock in less than a minute

Turning over rocks faster

I’m always trying to turn over more rocks and enhance my stock analysis.

And just like Saul Goodman, I try to turn chaos into opportunity—financial clutter into a sound conclusion.

Today, we’ll be using Grok-3 to do just that.

What is it?

How does it compare to other models?

How can you use it for stock research?

Let’s dive deep.

What is Grok?

Grok is a large language model (LLM) that can engage in conversations, answer questions, and generate text formats similar to the ChatGPT models or Gemini.

Why is Grok interesting for equity investors?

Trained on a unique data set: the X(Twitter) platform. The best stock investors I admire are on X and share their insights. No other model has been trained on this data (and has full access to it)

Trained by the most advanced infrastructure: Colossus is the data infrastructure built with about 200,000 GPUs running in parallel. xAI wants to scale it to 1 million. For comparison: The latest ChatGPT model has been trained on 80,000 GPUs.

So what? Does size really matter?

It does.

Although the analogy is not perfect, consider a GPU like a neuron in your brain. More GPUs mean more data you can absorb and more complex tasks you can handle.

So even if the model itself is more refined and fine-tuned, big data and big brains make the final model better.

Nvidia and even AMD should continue to benefit. But as always, there will be diminishing returns at a certain point in time. It also seems that 10x the compute does not lead to a model that is 10x better. The relation is asymptotic.

How good is Grok?

When you open up Grok, it has 4 modes:

You can just start asking it questions like any other AI chatbot

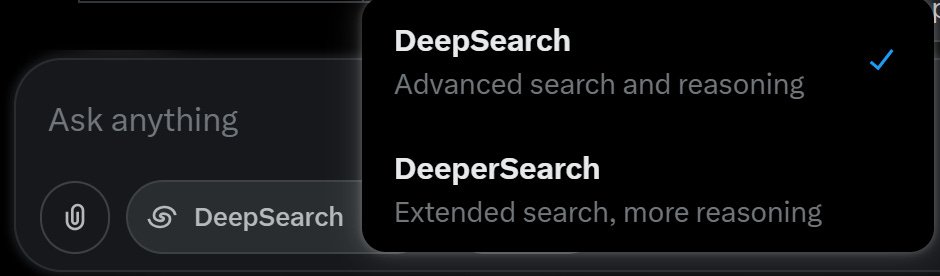

You can select Deepsearch, which will scour the web for additional information

You can select Deepersearch, where it will gather even more resources

And finally, you can select the “think” icon

For stock analysis:

DeepSearch is your research assistant

Think mode is your analyst, thinking through a set of data

We’ll go deeper into a company example with these modes later on.

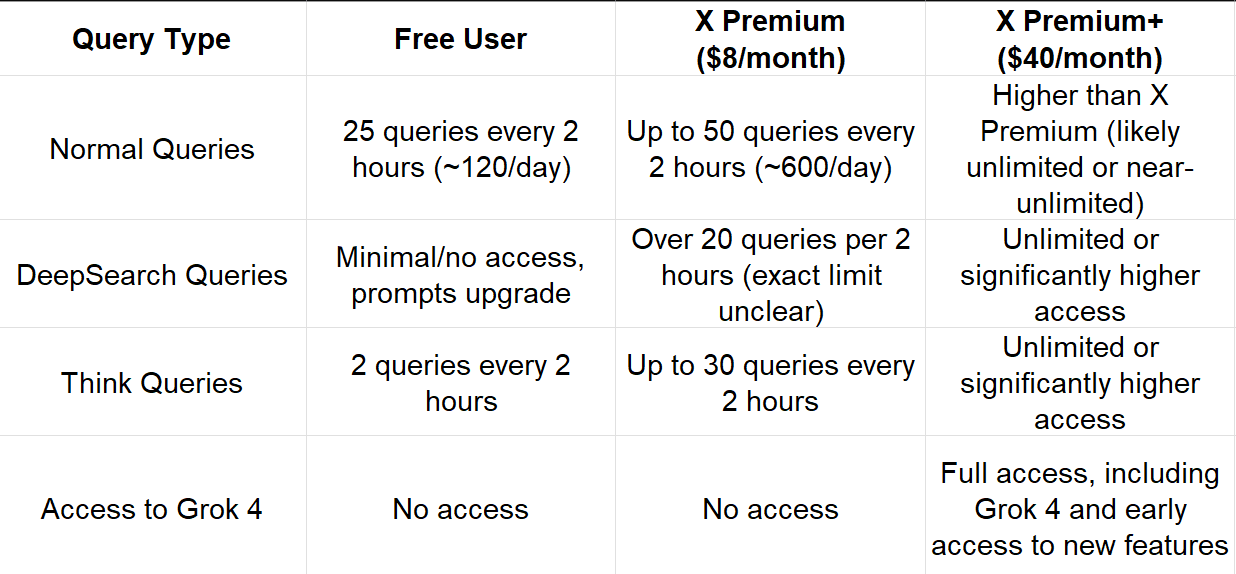

Grok has a free or paid version. Here’s a quick comparison of what you’ll get for each mode:

I have an X Premium subscription, which is enough for me at this time. I haven’t run into any capacity constraints over the last months, so..

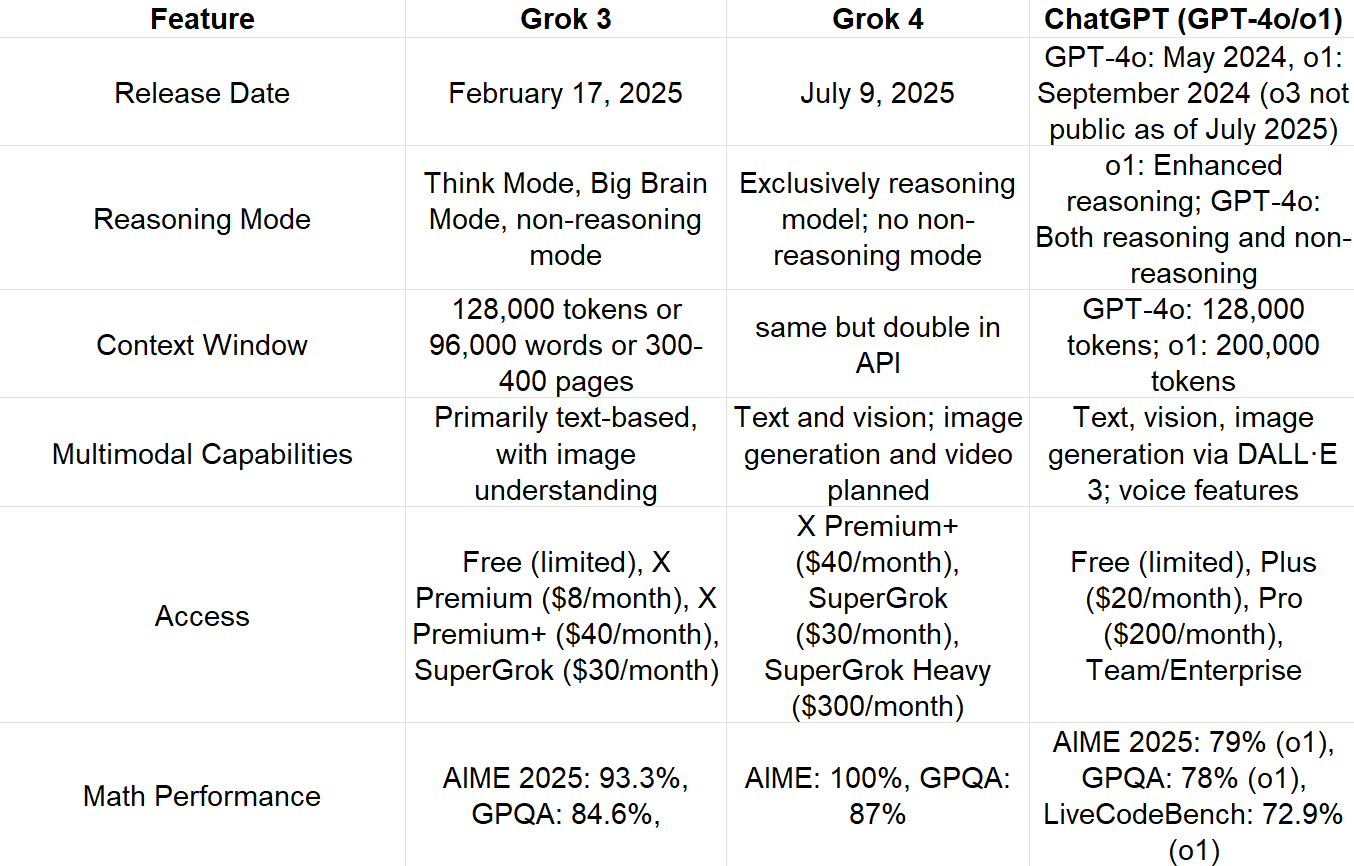

Now, let’s do a quick comparison of some of the models:

3 important things to mention:

The context window. When using an AI Chatbot, context is everything, and GPT-4 and Grok have large windows that should be sufficient

Multimodal: For our purposes, text-based is sufficient, but you can see that ChatGPT is aiming more and more towards multimodal capabilities, including voice (Grok does allow image generation)

Performance: Here we see 2 scores:

AIME identifies how the model scores on a math competition

GPQA: To assess its reasoning capabilities through complex problems

Not sure how these performance benchmarks are going to help us as stock analysts. But I found other benchmarks that are more useful.

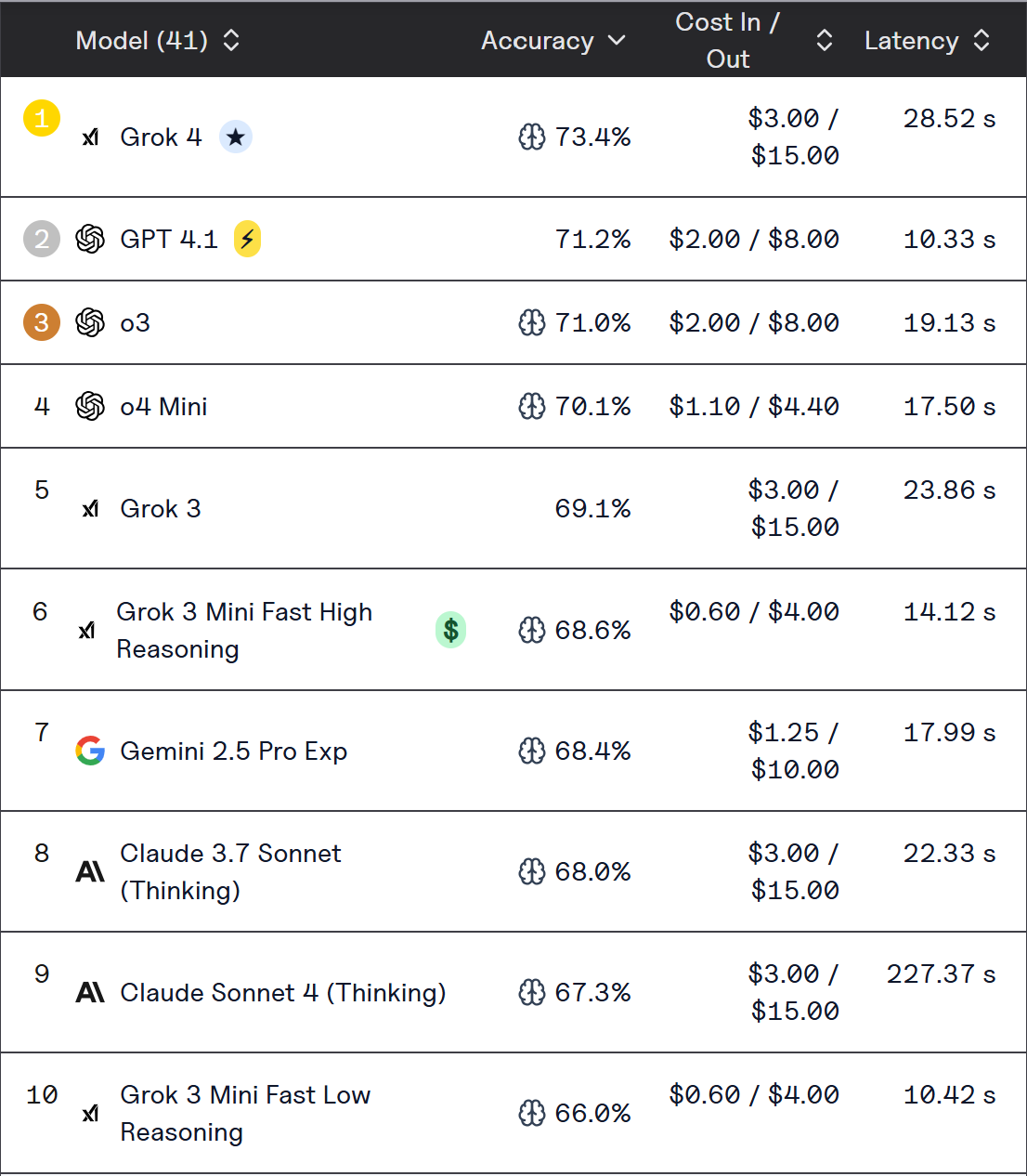

Like these two:

Corpfin: Measures the performance of a model answering a very specific question on a 200-page-long document (like an annual report). Interesting if you quickly want to retrieve very precise information.

Finance agent: This benchmark tests the tasks of an entry-level financial analyst. It goes through a dataset of 537 questions and provides a final score.

Let’s first look at the TOP 10 models for Corpfin

Grok-4’s reasoning model reigns supreme. Although the differences between the top 5 models are only 4% in accuracy.

If you have a large PDF and you’re looking for specific answers, these are the models to use. But bear in mind that compared to math (90%+), there is still a long way to go, so don’t rely blindly on the answer that the LLM gives you.

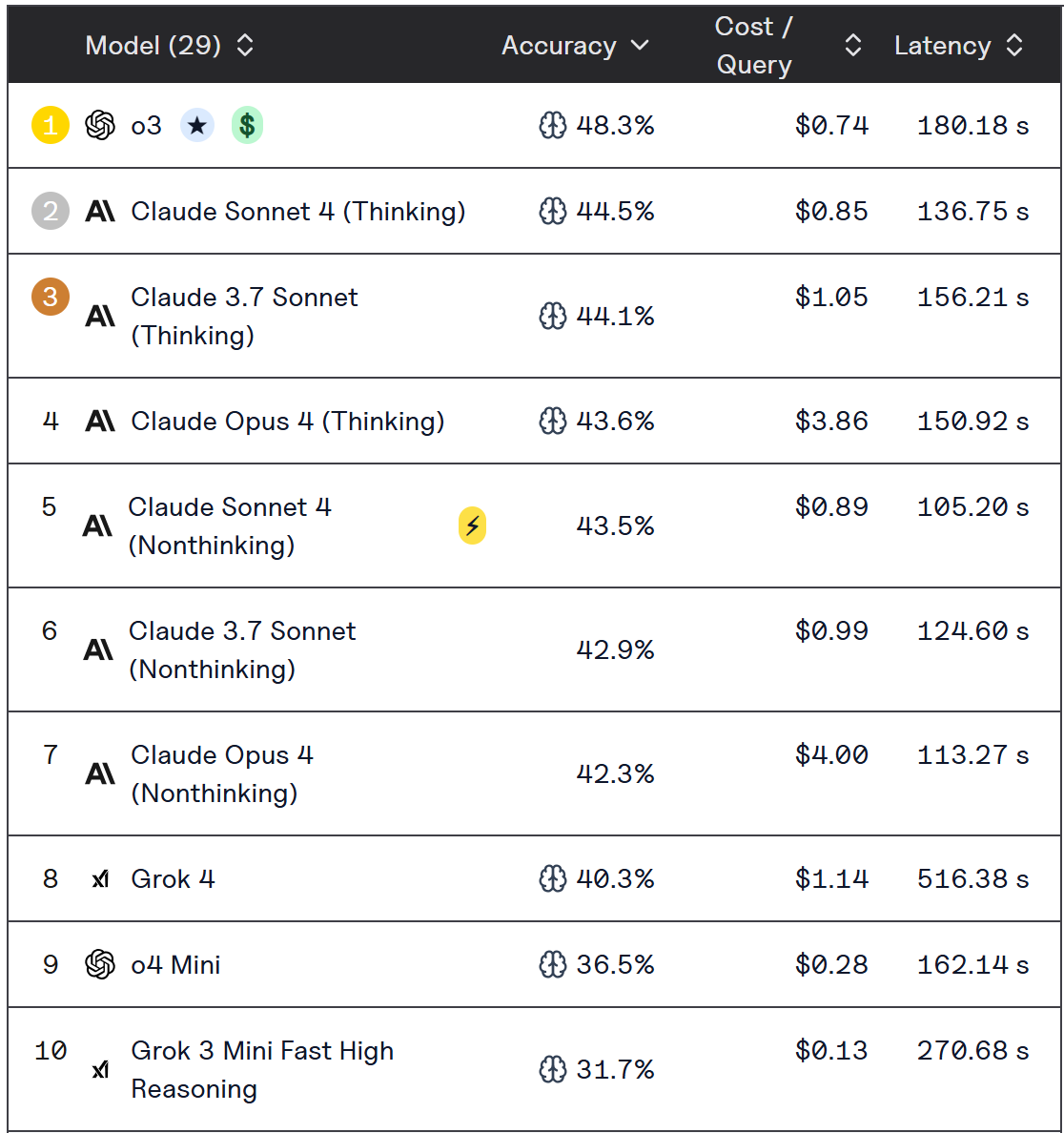

Now, let’s look at finance agents.

Here are the results:

I was hoping that Grok being trained on X data would increase the finance agent’s performance, but alas. Claude and O3 reign supreme, although accuracy is still below 50%.

That’s less than a coin toss! In other words, the job of a junior financial analyst is not in danger anytime soon!

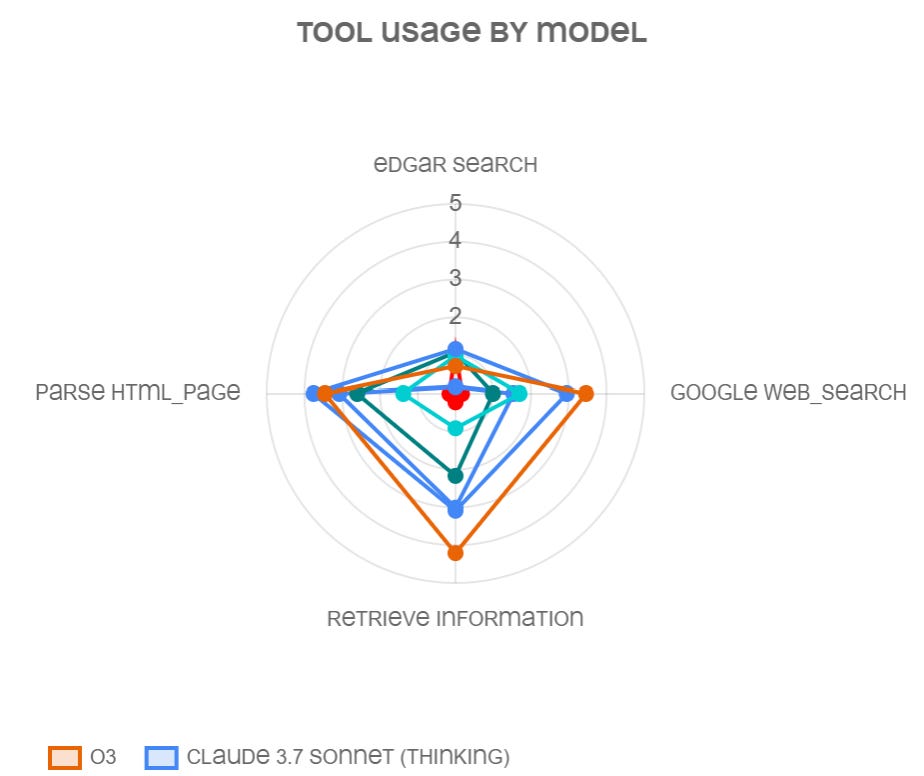

One of the reasons why O3 and Claude perform better is because of their tool calls. Meaning, the number of calls they make to search for additional data. Out of all the models, they had the highest number of tool calls.

Claude 3.7 is the one that did the most of everything: Parsing pages, doing Google web searches, and even doing an Edgar search for financial information.

Ok, so we have an overview of different models, and how Grok compares to others. Let’s apply Grok-3 to research a company.

Analyzing a company with Grok

The company we want to research is called Wise PLC (Ticker: Wise)

And if you’ve read our past article on using Perplexity, you know that to get great results using AI Tools, you need good prompts.

➡️Bullshit in = Bullshit out

Priming the LLM

Let’s start with the basics. What does this company do? I used the following prompt to prime Grok. Then we’ll go through all 5 prompts in detail.

Here’s the priming prompt:

You are an experienced equity analyst. You search for the truth, weeding out the subjective from the objective. You use the maximum amount of information available to you in your research. I need your help in analyzing and understanding a company. I want to know if it’s a good investment opportunity or not. Are you ready to assist me?It should return that it understands what you’re doing, and that it is ready if you give it the name of the company. So let’s do that.

Prompt 1: The task and format

Now we will give Grok a task and add how we want it to present the outcome (understandable by an 8-year-old)

The company we are researching today is called [Wise PLC], which is publicly traded on the London Stock Exchange with the ticker Wise. Can you go through the publicly available filings and other sources and break down the business model for me? How does this company make money, and what does it need to do to generate its business? Is it a capital-intensive business? Please explain it to me like I’m an 8-year-old. Provide an example to illustrate the business model.Here we assign a task to Grok. The last 2 sentences in the prompt clarify the formatting of the result.

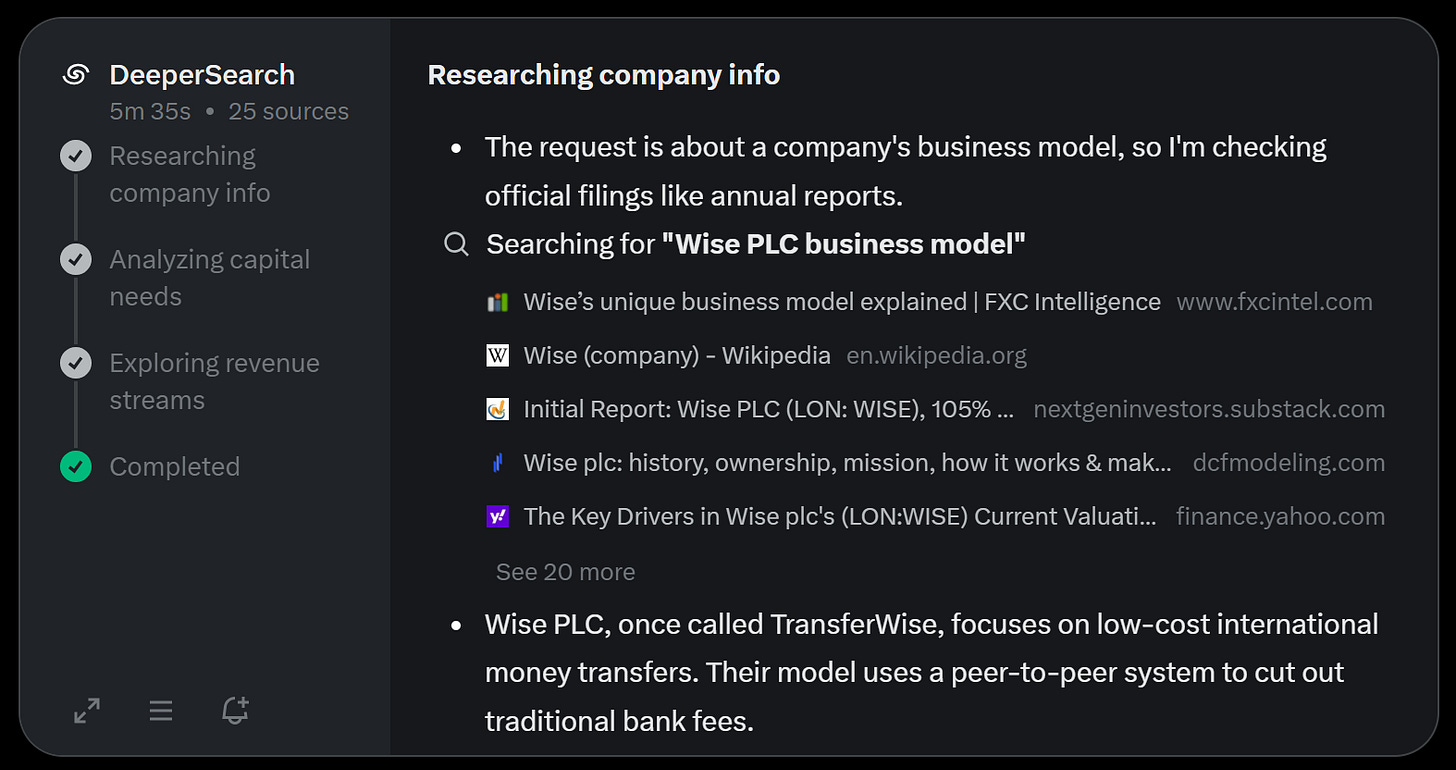

I tested this as a normal query and as deeper research to see what the difference is.

The normal query is superior. We’re looking for speed, and for some reason, in the deeper research mode, it forgot the “Please explain it to me like I’m an 8-year-old”.

Here are some parts of what it gave me on Wise:

Wise is like a super-smart money messenger. It helps people and businesses move money from one country to another without losing too many coins to fees. It also offers tools like bank accounts that work in many currencies, debit cards for spending, and a platform that banks or other companies can use to send money.

Here’s how it works:

Sending Money Across Countries: If you want to send money from the UK to the US, Wise lets you do it quickly and with low fees. Instead of moving your money across the ocean, Wise uses a clever trick: it has bank accounts in both countries. So, your money stays in the UK, and Wise uses money from its US account to pay your friend. This saves time and money!

Multi-Currency Accounts: Wise gives you a special account where you can hold and spend money in different currencies, like dollars, euros, or pounds. It’s like having one piggy bank that can hold all kinds of coins from around the world.

Debit Cards: Wise offers a card you can use to spend money in different countries without paying extra fees to banks. It’s like a magic card that works everywhere!

Wise Platform: Big companies, like banks, can use Wise’s system to send money for their customers. It’s like letting other stores use Wise’s super-fast delivery service.

Other Services: Wise also lets you receive money, send large amounts, or even pay lots of people at once (like a company paying its workers).

How Does Wise Make Money?

Wise makes money in a few simple ways:

Fees for Transfers: When you send money to another country, Wise charges a small fee. For example, if you send $100, they might charge $0.50 to $1. This fee is much lower than what banks charge (banks might take $5 or more!).

Exchange Rate Charges: Wise uses the real exchange rate (what you see on Google) but adds a tiny percentage to it. For example, if $1 equals £0.75, Wise might charge a bit more, like £0.76, and keep the difference.

Interest on Money in Accounts: When people keep money in their Wise accounts, Wise puts that money in safe places (like banks) and earns a little interest, kind of like earning pocket money for keeping coins safe.

Card and Other Services: Wise might charge small fees for using their debit card or for special services like sending huge amounts of money.

I’m not going to copy/paste the rest. You can find the full PDF reports at the end of this article.

I will also include the deeper search results. It retrieved financial information and provided some tables, but honestly, that’s not what I need in this part of our research.

The Deepersearch took him more than 5 minutes, so it’s a balance between more data and speed. But we’ll do a detailed comparison.

So we have a good idea of the business model. Let’s go further.

Prompt 2: How unique is this company?

Instead of just asking it blatantly how unique the company is, we want to be more precise. One specific trait for multibagger companies is counter-positioning. There are other traits, of course, and you could imagine expanding this prompt to assess all of them. For simplicity, we’ll just stick with this one.

How is it positioning itself towards the classic banks, and how many other companies out there are doing the same thing as Wise? In other words, how unique is this company?

Here’s the prompt I used:

Does their business model show signs of counter-positioning towards established businesses? How many other companies are there out there that are similar to Wise? If there are only a few, why is that? Are there any particular barriers to entry? Why does the establishment not replicate what this company is doing?Notice that it continues in the previous context window. It's still trying to explain it to me like I’m an 8-year-old. If you don’t want that, you will need to start a new chat (or remove the 8-year-old phrase in the initial prompt).

Let’s go through the different parts and my take on it

Does Wise’s Business Model Show Signs of Counter-Positioning Against Established Businesses?

What is Counter-Positioning?

Counter-positioning is when a company creates a new way of doing things that challenges the old, established ways, making it hard for traditional businesses (like banks) to copy without hurting their own profits or changing how they work. Imagine Wise as a kid who invents a faster, cheaper way to trade toys with friends across the world, while big toy stores charge a lot and take forever to deliver.

Wise’s Counter-Positioning Strategy

Wise’s business model is a textbook example of counter-positioning against traditional banks and legacy money transfer services like Western Union or MoneyGram. Here’s how:

Transparency Over Hidden Fees: Banks often hide fees in bad exchange rates, so if you send $100, your friend might only get $90 worth of their currency, and you don’t even know why! Wise uses the real exchange rate (like what you see on Google) and charges a clear, low fee (e.g., 0.52% vs. Western Union’s ~3.5% or Remitly’s 2.3% take rate). This transparency makes banks look sneaky, and they’d lose money if they matched Wise’s low fees. For example, a 2017 memo from Santander said they’d lose 84% of their money transfer revenue if they charged like Wise

Peer-to-Peer System: Wise doesn’t move money across borders like banks do, which is slow and expensive. Instead, it uses local bank accounts in each country to “match” transfers. If you send dollars to pounds, Wise uses pounds it already has in the UK to pay your friend, and your dollars stay in the US. This cuts out middlemen (correspondent banks) that banks rely on, saving time and money. Banks can’t easily copy this because their systems are built on those middlemen, and switching would mean rebuilding their whole setup.

Low-Cost, High-Volume Approach: Wise is like a lemonade stand that sells tasty drinks for $1 instead of $5 like the big store next door. They make less per sale but sell way more because everyone loves the price. Wise keeps lowering fees (27 times between 2017 and 2018!) to attract more customers, which banks can’t do without cutting into their profits. This “low-margin, high-volume” model is tough for banks to match because they have expensive branches and staff to pay for.

Customer-Centric Brand: Wise markets itself as the good guy, fighting against “predatory” bank fees with campaigns like “Stop Hidden Fees.” This builds trust, which banks struggle to match because customers often see them as greedy. Wise’s 4.6 Trustpilot score and 10 million+ customers show people love this approach. Banks would need to rethink their whole brand to compete here.

Tech-Driven Efficiency: Wise’s app and platform are super easy to use, and 62% of transfers happen in less than 20 seconds. Banks’ systems are often old and clunky, so they’d need to spend billions to build something as slick as Wise’s tech.

Why This Hurts Established Businesses: Wise’s model forces banks to either lower their fees (losing money) or lose customers to Wise. It’s like choosing between giving away your toys or having no one play with you! In 2024, Wise saved customers £1.5 billion compared to banks, showing how much it’s disrupting the old way.

How Many Other Companies Are Similar to Wise?

There are a handful of companies that do something similar to Wise, but not many match its exact combination of global reach, low fees, and tech-driven model. Here are the main players:

Remitly: A US-based company focused on remittances (money sent by migrants to their home countries). It had $944 million in revenue in 2023 and 7.8 million customers, growing 44% year-over-year. Remitly targets specific corridors (e.g., US to Mexico) and often serves cash-based transfers, unlike Wise’s broader bank-to-bank focus.

WorldRemit: Another remittance-focused fintech, similar to Remitly, targeting specific regions and corridors. It’s smaller than Wise in scale and focuses more on mobile money transfers in places like Africa.

Revolut: A UK-based fintech that offers multi-currency accounts, debit cards, and transfers like Wise. Revolut is a bigger competitor because it’s expanding into banking services, but its fees are sometimes higher, and it’s less focused on cross-border transfers as its core business.

PayPal: Offers international transfers but charges higher fees (closer to banks) and isn’t as transparent with exchange rates. PayPal’s broader focus (e.g., online payments) makes it less specialized than Wise.

Currencies Direct: A smaller player focused on private clients and SMEs, but it lacks Wise’s global scale and tech infrastructure.

InstaReM (now part of Nium): Focuses on remittances and business payments in Asia-Pacific but is smaller and less global than Wise.

How Many Competitors? PitchBook lists 38 competitors, but only a few (like Remitly, Revolut, and WorldRemit) are close in scope. Most are either smaller, region-specific, or focused on niches like cash remittances. Wise stands out with its 10 million customers, £145 billion in transfer volume (FY 2025), and global presence in 70+ countries.

Why Are There Only a Few Similar Companies? What Are the Barriers to Entry?

The reason there aren’t tons of companies like Wise is because it’s really hard to build a business like theirs. Imagine trying to start a new toy delivery service that’s faster and cheaper than everyone else—it’s tough! Here are the barriers to entry that keep competitors out:

Regulatory Licenses: To operate in many countries, you need special permissions (like banking licenses) from governments. Wise has licenses in over 80 countries, which took years and millions of dollars to get. New companies would need to spend a lot of time and money to get these, and some might not even be approved. For example, Wise’s UK Financial Conduct Authority license adds trust that new players struggle to match.

Network Effects: Wise gets better as more people use it. If lots of people have Wise accounts, it’s easier to send money within their system (like passing toys between friends instead of through a store). With 10 million customers and growing, Wise’s network is hard to catch up to. New companies start with zero users, so they can’t match this speed or convenience.

Technology and Infrastructure: Wise built a fancy computer system that connects to payment systems worldwide (like Pix in Brazil or InstaPay in the Philippines). This took years and lots of money to create. New companies would need to build their own systems from scratch, which is super expensive and complicated.

Brand and Trust: Wise’s brand is all about being fair and cheap, with a 4.6 Trustpilot score and campaigns like “Stop Hidden Fees.” People trust Wise because they’ve been around since 2011. A new company would need to spend a lot on ads to get people to trust them, and that’s not easy when banks already have a bad reputation.

Economies of Scale: Wise can charge low fees because they handle huge amounts of money (£145 billion in FY 2025). This spreads their costs thin, like buying candy in bulk to sell it cheaper. New companies with fewer customers can’t afford to charge as little because their costs per transfer would be too high.

Intellectual Property: Wise has over 50 patents for its tech, like algorithms that make transfers fast and cheap. These patents stop others from copying their exact system, making it harder for new players to compete.

Why Only a Few Competitors? These barriers make it tough for new companies to start. You need money, tech, licenses, and a lot of customers to even get close to Wise. Most competitors focus on smaller markets (like specific countries) or niches (like cash transfers) because they can’t match Wise’s global scale or low prices.

Why Doesn’t the Establishment Replicate What Wise Is Doing?

Big banks and companies like Western Union haven’t fully copied Wise’s model because it’s hard for them to change their ways. It’s like asking a big, old toy store to suddenly start delivering toys for free—they’d lose money and have to redo everything! Here’s why:

High Costs of Legacy Systems: Banks use old systems with lots of middlemen (correspondent banks) to move money across borders. These systems are expensive, and banks make money from high fees. Switching to Wise’s peer-to-peer model would mean rebuilding their tech from scratch, which could cost billions and take years. They’d also lose revenue from those middlemen.

Profit Pressure: Banks rely on high fees (like 5% per transfer) to make money. If they matched Wise’s 0.52% take rate, they’d lose a ton of profit. For example, Santander’s 2017 memo said matching Wise’s fees would cut 84% of their transfer revenue. Big companies like Western Union also rely on higher fees (~3.5%) and can’t afford to lower them without hurting their bottom line.

Customer Relationships: Banks have loyal customers who stick with them for other services (like mortgages or savings accounts). They don’t want to upset these customers by changing how transfers work or admitting their fees were too high. Wise, as a new player, can focus only on transfers and build trust by being transparent.

Regulatory Inertia: Banks face strict rules, and changing their systems to match Wise’s model would mean getting new approvals from regulators. This is slow and risky, so they stick with what they know. Wise, as a fintech, built its model to work within these rules from the start.

Brand and Culture Clash: Banks are seen as formal and profit-driven, while Wise markets itself as the friendly, fair alternative. If banks tried to copy Wise’s transparency and low fees, they’d have to admit their old ways were unfair, which could hurt their reputation.

Wise’s First-Mover Advantage: Wise started in 2011 and has a 14-year head start. They’ve built a huge network, tech, and customer base that’s hard to catch up to. Even if banks tried to copy, they’d be playing catch-up while Wise keeps improving.

What Banks Are Doing Instead: Instead of copying Wise, some banks partner with them through the Wise Platform, letting Wise handle their cross-border transfers. For example, big names like Nubank, Monzo, and Interactive Brokers use Wise’s tech. This way, banks avoid rebuilding their systems but still offer cheaper transfers. However, this also helps Wise grow stronger

I think this is a very decent analysis. It’s easily understandable and gives me an overview of what makes Wise unique. In a handful of seconds, it gives me a sort of MOAT analysis and identifies some competitors.

Prompt 3: Scale-Economies-Shared

Now, I want to test Nick Sleep’s Scale Economies Shared model. Wise tries to keep costs low for its customers. So as Wise grows, does it redistribute part of its profits back to its customers to get a flywheel going?

Here’s the prompt.

A business like Costco uses a model that is called Scale-Economies-Shared. This was popularized by the investor Nick Sleep. It means when a company grows and generates more cash, it uses parts of that cash to distribute back to the customers in some way. Costco uses this to guarantee the lowest prices for its customers as it scales. Is Wise doing something similar? Is there proof of a scale economies shared business model?And here’s the answer

Does Wise Follow a Scale-Economies-Shared Model?

Wise’s business model has strong signs of the Scale-Economies-Shared approach, especially in how it uses its growth to lower costs for customers, which fuels more growth. Here’s how it stacks up, step by step:

1. Does Wise Achieve Economies of Scale?

Economies of scale mean that as a company gets bigger, it can do things cheaper per unit. For Wise, this means handling more money transfers or accounts at a lower cost per transaction.

Evidence of Scale: Wise has grown massively. In FY 2025 (ending March 2025), it processed £145 billion in transfer volume, up 23% from £118 billion in FY 2024. Revenue grew 16% to £1.65 billion, and it served over 10 million active customers, with 6.5 million personal and 435,000 business customers. This shows Wise is handling way more transactions as it grows.

Lower Costs Per Transaction: Wise’s filings show its “unit cost to serve” (how much it costs to process each transfer) keeps dropping. In FY 2024, operating costs per transaction fell because Wise spread fixed costs (like tech and staff) over more transfers. For example, their tech platform is built once but can handle millions of transactions without needing much more money to run.

Network Effects: As more people use Wise, its system gets more efficient. If lots of people send dollars to pounds and pounds to dollars, Wise can “match” these transfers within its own accounts, reducing the need to use expensive external payment systems. In FY 2025, 26% of transfers were “cross-currency,” and Wise’s matching system saved costs, showing scale at work.

Infrastructure Investments: Wise spends on tech and payment network integrations (like Pix in Brazil or InstaPay in the Philippines), which are fixed costs. As volume grows, these costs get spread over more transactions, lowering the cost per transfer. For instance, Wise’s 2024 Annual Report notes “economies of scale in our infrastructure” as a key driver of profitability (28% EBITDA margin in FY 2025).

Verdict: Wise clearly achieves economies of scale. As it processes more money and serves more customers, its costs per transaction drop, generating more cash.

2. Does Wise Share These Savings with Customers?

The “shared” part means Wise should pass these savings to customers, like Costco does with low prices, instead of keeping all the profits.

Lowering Fees Over Time: Wise has a history of cutting fees to make transfers cheaper. Between 2017 and 2018, it reduced fees 27 times, as noted in a 2017 Santander memo. In FY 2025, Wise’s average take rate (fees plus exchange rate margin) was 0.52%, down from 0.67% a few years ago. For example, sending £1,000 to EUR cost 0.41% in fees in 2024, compared to banks charging 3-5%. This shows Wise passing savings to customers.

Transparent Pricing: Unlike banks that hide fees in bad exchange rates, Wise uses the mid-market rate (the real rate) and charges a clear fee. In FY 2025, Wise saved customers £1.5 billion compared to bank fees, per their investor presentation. This transparency is like giving customers a discount by not tricking them with hidden costs.

Free or Low-Cost Features: Wise offers free multi-currency accounts and low-cost debit cards (e.g., £5 issuance fee in some markets). It also introduced features like free ATM withdrawals up to a limit and “Wise Interest” accounts that share interest earned on customer balances (e.g., 4% yield in Europe in 2024). These are ways Wise shares its scale benefits with customers.

Speed Improvements: As Wise grows, it makes transfers faster without charging more. In FY 2025, 62% of transfers were instant (under 20 seconds), up from 50% in FY 2023. Faster service at the same low price is another way of sharing value.

3. Does This Drive More Growth?

The final piece is whether sharing savings brings more customers, creating a virtuous cycle.

Customer Growth: Wise’s low fees and transparency attract more users. Customer numbers grew from 7 million in FY 2022 to over 10 million in FY 2025. Business customers grew 29% year-over-year in FY 2025, showing small businesses love the low costs.

Volume Growth: Lower fees encourage people to send more money. Cross-currency volume grew 23% in FY 2025, and high-value transfers (over £100,000) grew faster, as businesses switched from banks. This shows customers are using Wise more because it’s cheaper.

Word-of-Mouth and Brand: Wise’s 4.6 Trustpilot score and campaigns like “Stop Hidden Fees” make customers trust it. Happy customers tell their friends, bringing more users without Wise spending tons on ads (marketing is only 10% of operating expenses).

Network Effect Cycle: As more customers join, Wise’s matching system gets better, lowering costs further. This lets Wise cut fees or add features, which brings even more customers. For example, adding local payment rails (like SEPA in Europe) makes transfers cheaper, attracting more users, which lowers costs again.

Verdict: Wise’s low fees and better services drive customer and volume growth, creating a cycle where scale leads to savings, which leads to more scale.

And in the end, it compares Wise to Costco’s model:

Comparison to Costco’s Model

Wise’s model is very similar to Costco’s:

Costco: Sells in bulk to lower costs, keeps membership fees low (e.g., $60/year), and passes savings to customers with cheap prices (e.g., $1.50 hot dogs forever). This brings more shoppers, increasing scale.

Wise: Processes huge transfer volumes to lower costs, keeps fees low (0.52% vs. banks’ 3-5%), and adds free features like multi-currency accounts. This brings more customers, increasing scale.

The main difference is that Costco uses physical warehouses, while Wise uses tech and bank accounts. But both share savings to keep customers happy and fuel growth. For example, Costco’s 5-6% markup is way below Walmart’s 20-30%, just like Wise’s 0.52% take rate is way below banks’ 3-5%.

The goal of this article is not to do a complete analysis of Wise. It’s an initial view of a company early in our research funnel. Up until now, I’m pretty happy with what Grok has delivered. Remember, all of this is done using the normal queries, so the feedback is fast.

So if we take our LLMs’ word for it, up until now:

Wise has a business model we can understand

It shows clear counter-positioning towards traditional banks

There are some direct competitors out there, but they are few

It shows signs of the scale-economies-shared model like Costco

Let’s make it more challenging for Grok. Time to do some predictions.

Prompt 4: How big is the market?

You can have a great company, but sitting in a fully developed, saturated market, it can’t grow anywhere.

So our next question would be: How much growth potential is left?

Here’s the prompt:

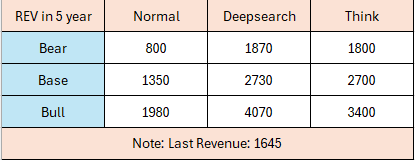

Based on the current revenue size of the company, how big is the potential future market for this company? Give us a bear, base, and bull case view of what the future market could be for this company. If possible, translate this into a possible revenue number for each case, 5 years from now.I don’t expect too much from this, because now we’re entering the prediction game. The most important thing is that it lays out its assumptions so that we can judge for ourselves if the feedback is worthwhile. But remember, our aim is to do a first quick analysis.

Here’s the feedback

Explanation for an 8-Year-Old

Imagine Wise is a kid running a super-cool toy-trading club. Right now, she trades £145 billion worth of toys and makes £1.65 billion by charging a tiny fee. The world loves trading toys, and more people are joining every year. In five years, the toy-trading world could be way bigger, like $2.8 trillion worth of toys!

Bear Case (Things Go Okay but Not Great): Some kids start trading with other clubs (like Revolut), so Wise only trades $159.6 billion worth of toys and charges a super-low fee (0.45%). She makes £614 million, which is less than now because other clubs are tough competition.

Base Case (Things Go Well): Wise keeps her club awesome, trading $224.8 billion in toys with a 0.48% fee. She adds cool new games (like interest accounts) and makes £1.04 billion. It’s less than now because she’s sharing more savings with kids, but the club’s still growing.

Bull Case (Things Go Amazing): Wise’s club becomes the best in the world, trading $297 billion in toys! She charges a 0.50% fee and adds new stuff like toy loans, making £1.52 billion. It’s still a bit less than today, but her club is huge and super popular.

To total feedback is a lot longer, but I only copied the final summary.

We run into the limits of LLMs. It’s using the previous context to do its modeling. In this case, it projects a revenue decline based on the scale economies shared principle. It considers that even though there will be growth in the market in the future, because Wise will continue to keep its fees lower and lower, its revenue will decline in all cases.

That’s not what I expected from a bear, base, and bull case scenario analysis.

Prompt 5: Red Flag Analysis

Let’s finish this testing of Grok with a red flag analysis.

When you’re early in your research funnel, you’re looking for reasons to say NO to a company. And try to go as fast as possible to the next one.

You’ll have to define your own red flags, but some of them can be:

The company has never been profitable

Accounting errors have surfaced in the past

A lawsuit is ongoing concerning the company

Low insider ownership (<5%), which means a lack of skin in the game

There has been a lot of turnover in the executive team of this company over the last 3 years

…

Note: Your red flags depend on what you’re hunting for. If you’re hunting for a turnaround, then you want to see exec turnover or a past lawsuit.

Here’s the prompt I used based on this:

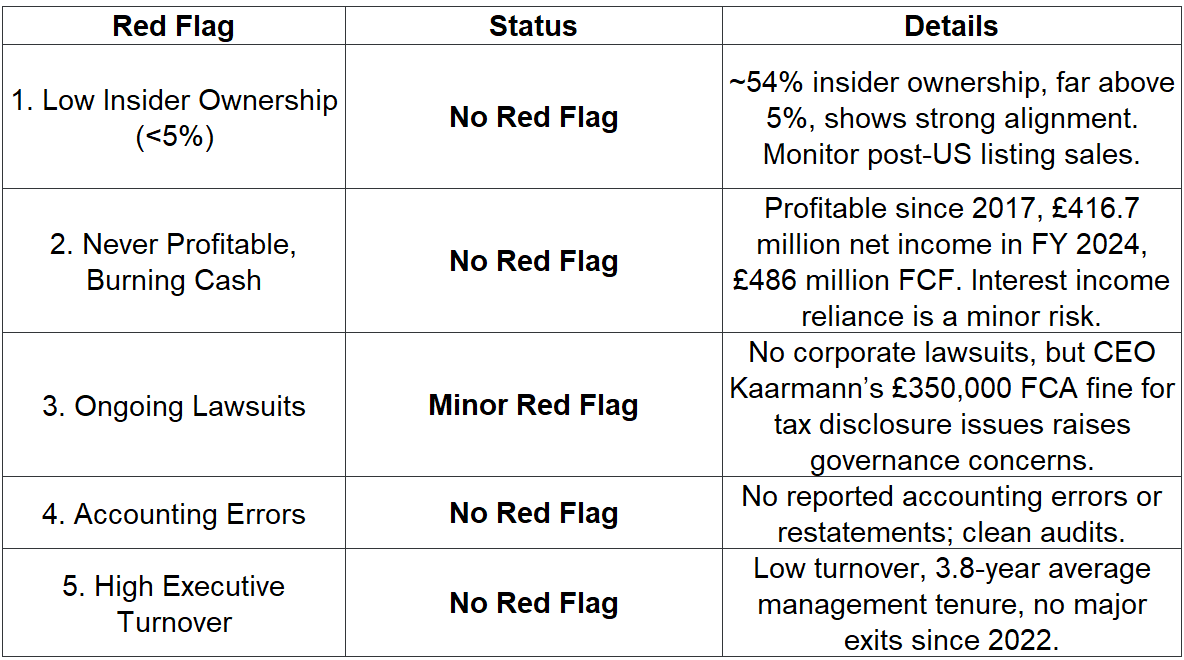

I would like to identify any red flags surrounding this company that would prevent me from considering it as an investment. Here are 5 red flags I want you to research and identify. 1. Is there low insider ownership (<5%), which would imply low skin in the game? 2. The company has never been profitable in its history and is still burning cash. 3. Are there lawsuits ongoing concerning this company? 4. Have accounting errors surfaced in the past? 5. Has there been a lot of turnover in the executive team of this company over the last 3 years?And do a red flag analysis. Here’s the result

This last one I really like.

Make a list of your own red flags that would make you reject a company, and put them in a prompt. Ideally, you’re adding red flags that it can detect based on text and not necessarily numbers. For example, if a red flag for you is that you only want companies with a gross margin > 40% then a normal screener will perform better.

I don’t know about you, but I’m starting to like this business.

So in total, we’ve used all prompts in normal query mode. Let’s compare the same prompts used in DeepSearch and Think mode.

Normal vs Deep vs Think

Note: It’s a bit of a pain to copy the results from Grok into a document. If you copy-paste like usual, it will not copy-paste the links it has used during its research. If you decide to use the copy/paste button, it also copies the links, but you lose all the formatting.

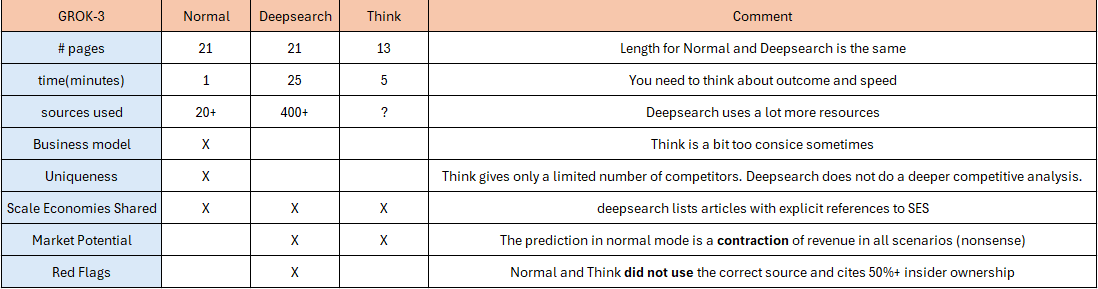

This is the conclusion of a detailed analysis of what the results were for each prompt in each mode. Here’s an overview:

You might think that Deepsearch would produce a lot more content, but that’s not the case. The total length in reporting is similar to normal mode: 21 pages in total. Think as expected was more concise

Normal mode is fast, very fast. You’ll need to balance what you want versus the speed it takes. While Grok uses deepsearch, you can do other tasks, of course. So this might not be an issue

It’s not clear how many sources Think uses; it might be somewhere in between Normal and Deepsearch. However, Deepsearch uses the most sources by far

Now, let’s look at each prompt (I’m skipping the priming one) and see how each mode handles it

Business model: The normal mode is the winner here for me because the result is almost instant, and it gives a clear picture of the business model. The think mode is too concise.

Uniqueness: Again, the normal mode is the winner. Surprisingly, it lists more competitors than DeepSearch. We might have to split this prompt into 2 or 3 prompts and do a single prompt for pure competitive analysis. I expect DeepSearch is more suited for that.

Scale Economies Shared: All models gave a similar result. Deepsearch gives specific references to articles that mentioned SES in the past.

Market Potential: Surprisingly, normal mode projected a revenue decline in all 3 cases. That’s not what you expect from a bear, base, and bull case. Think and Deepsearch provided similar numbers. You can find them in the table below.

Red Flag Analysis: Normal and Think used the wrong number of 54% to check insider ownership. So, although all modes gave the same result: No red flags on all accounts, it might be useful to use DeepSearch if your red flags contain checks versus numbers.

You can find a PDF for each of the 3 Wise research reports below

Intermezzo: How to handle hallucinations or faulty numbers?

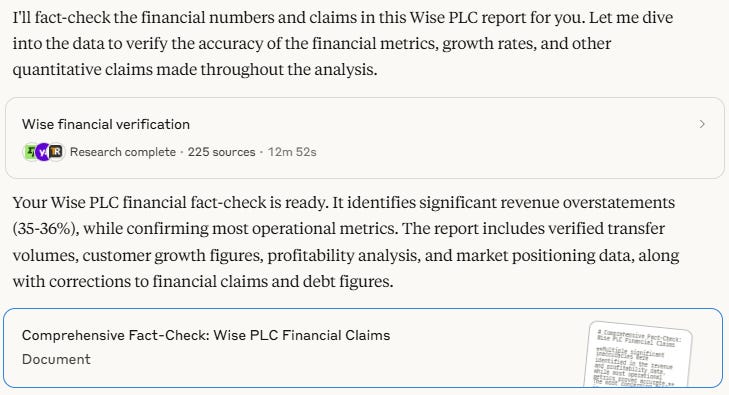

I copied the entire Wise report generated by Grok and pasted it into the search mode of Claude Sonnet 4.

Then I asked it to fact-check all the numbers. I want to see if, at the least, it will flag the insider ownership number.

It took Claude 12 minutes using 225 sources, and it provided us with a beautiful fact-check report.

It claims revenues were overstated (which was not the case)

It provided a nice overview of facts that they were able to confirm

It also listed several facts where more data is needed (Like the insider ownership %)

➡️Even though Claude made some errors of his own on the revenue front, I do believe a fact-check by another LLM is useful. (I tried to fact-check with Grok, but it found no errors 😉)

Conclusion

LLMs won’t replace financial analysts anytime soon. But I believe it excels as a tool to quickly go through a company early in your research funnel.

We’ll need to do more testing, but maybe the type of prompts needs to match the mode you’re using:

Normal mode for easier, shorter prompts

DeepSearch for competitive analysis or red flag checking

Thinking and Deepsearch for future projections (where you really need a reasoning model)

In retrospect, we should probably invest a lot more time in developing a solid red flag prompt and use that as early as possible in the process. This would allow you to quickly screen through a list of companies.

As always, the quality of the prompts matters. Just like any human, it needs context, and it needs detailed questions if you expect a quality response.

And when it comes to Wise, I’ll keep researching the company for the time being.

I you like this type of article, please consider sharing it with someone who might be interested.

May the markets be with you, always!

Kevin

Excellent post! Thanks for such a detailed article.

If you convert pdf to word docs it makes it easier for AI to read and you get more accurate results