A secretly growing net-net at an EV/EBIT of 3

Is a heist going on?

Disclaimer: I hold shares in this company. The below analysis was written with the intent of becoming a long-term shareholder. This week, a notice was published that the major shareholders are planning to tender the company's remaining shares. This would mean the company would be privatized. If you are a shareholder, you can reach out to me. I’m banding together with other shareholders to make sure we’re not taken advantage of. If you want more information about what’s going in, please read the end of this article. I decided to remove the paywall on a long-form article like this as I think it’s important that all of you are properly informed. If you want more in-depth articles like this or access to one of our former deep dives.

We have a 25% discount on a paid subscription running at the moment. Use the link below.

You’re in London.

It’s 01:23 AM. Rain falls out of the sky like there’s no end in sight.

Pff, ah man, still 2 minutes and my shift is over.

Yawning, you look at your phone.

Damn it, one last order just came in. A pickup and delivery at that pizza joint 3 miles away.

Gotta pay the bills. You get into your minivan and off to pick up a pepperoni pizza.

You stop at the red lights. They turn green, and you accelerate.

Suddenly, you hear a thump, a bump, and a crash. For a minute, it’s like the world is standing still.

Slowly, you awaken, your head engulfed in the airbag. A guy is screaming at the window, relieved that you’ve awakened.

“I already called an ambulance! They will be here soon!”

Your whole body feels sore. You step out of the van and slump to the pavement.

“Are you ok? Maybe you should sit down, yeah?”

Your van seems a total loss. Completely torn to smithereens. Bloody hell. Now what?

You have no money to buy a new one. Insurance will take forever. You’re taken to the hospital, and your van is towed to the nearest garage.

The doctor examines you, and except for some bruises, waives you off in pretty good health. But he wants you to stay for the night, make sure there is no lingering concussion or anything. What’s that going to cost?

The next day, you’re discharged and head over to the garage.

No van, no income. You’re screwed. The other guy drove through a red light!

Bills incoming…

Hospital: £934 for the night

Garage: “Yeah, I can fix it, but it ain’t gonna be cheap, probably £2000.”

I don't have that kind of money!

The garage manager: “Well, then I've got good news for you. “

What do you mean?

“You don’t have to pay anything if you want to. And I can even get you a replacement van while this one is being repaired, at no cost. “

Are you joking? How is that possible?

Well, let’s say, for people in your situation, there are angels out there in the world.

There is a company that somehow has managed to create a profitable business model out of a situation like this, and it has been growing in secret.

Some numbers:

Revenue has grown 15%/per year over the last 5 years

Gross margins of 75%

Price to book of 0.4

And a consensus price target of £2.6 for a current price of £0.6?

Let’s dive deep into one of the most unique companies I have ever encountered

Anexo Group (Ticker: ANX/L) Category: Growing Net-Net

Introduction

Founded in 2006

72M GBP market CAP

Trading on the London Stock Exchange (AIM)

This company should not exist. And I bet in an alternative universe it doesn’t.

But there it is. The only reason it exists is that the husband had a car hire company, and the wife had a legal office. And lo and behold, they didn’t only unite in marriage, but in business too. A special company was born in wedlock.

This company sits in our “Growing Net-Net” bucket of our modified Lynch investing strategy:

Always applying the same principle: “Don’t use a hammer to tighten a screw.”

How do they make money?

If you think about it, this business model doesn’t make sense. In the introductory story, they give you a vehicle and the time needed for repairs. And then they pay the garage. So they put up the cash. Usually, when I see something like that, my warning signs go off: Bad working capital cycle!

The only reason you would do that is if you’re confident you’ll recoup your investment and then some.

Let’s break down the business model in detail.

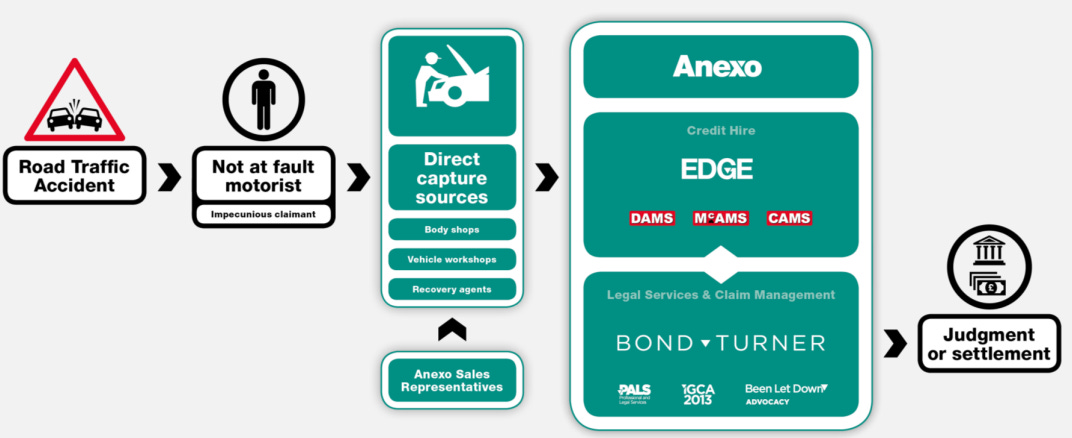

Anexo operates at the frontier of automotive accident management and legal services, offering a vertically integrated solution for individuals involved in non-fault accidents.

The words in bold are essential.

First revenue stream: Credit Hire Operations

Anexo provides replacement vehicles to claimants who cannot afford upfront rental costs after non-fault accidents, also called "impecunious".1

They charge much higher credit hire rates than the standard spot market rates for car rentals. These costs are later recovered from the at-fault party’s insurer through litigation.

A simple example: A delivery driver’s van is rear-ended. Without rent savings, the garage contacts Anexo, which supplies a replacement van for £50/day (vs. £30/day market rate). Anexo’s legal team then sues the at-fault driver’s insurer for £50/day + legal fees. (and additional personal injuries, if any)

So, who pays Anexo?

The insurance party of the at-fault client.

This immediately poses a question: Isn’t there a risk that in the future Anexos' business model would be destroyed because of some ruling that would not allow them to claim these higher rates?

At this time, and in the coming years, that risk is low. Several legal precedents validate their business model, the most prominent being a ruling in the House of Lords (the UK's supreme court). The most significant case is Clark vs Ardington (2003), where the House of Lords confirmed that such claimants are entitled to recover the full cost of credit hire from the at-fault party’s insurer.2

So what happens in reality?

The insurers have no desire to pay the full price. Anexo, because of its working capital constraints, wants to get paid in a reasonable amount of time. This usually leads to a settlement where 50-60% of the gross hire claim is recovered.

Second revenue stream: Legal Services Integration

Through subsidiary Bond Turner, Anexo handles litigation end-to-end, eliminating reliance on third-party law firms. This integration allows higher margin retention by avoiding referral fees and faster claim resolution via in-house expertise in personal injury and credit hire law.

We’ll get to that later on, but the speed of claim resolution is important as it directly impacts their cash conversion cycle.

In 2020, Anexo entered into a new business line of class action lawsuits regarding the infamous emission scandals. They won the case against Volkswagen, and an active case is ongoing against Mercedes and other manufacturers.

Since December 2021, they have expanded their legal services towards housing disrepair. They saw an opportunity in this segment, as in the UK, more and more houses are rented instead of owned. Increased regulation strengthened the market as more power was given to the tenant, who could take legal action against negligent landlords. This business line has a much higher return on investment.

The diversification of their legal offering offers cross-selling opportunities. Their clients are usually from the weaker part of society. When a person loses their motor vehicle because of an accident, there is a chance they are renting a home that might not be up to standard.

So, the legal branch has 4 types of claims:

Credit hire

Personal Injury

Housing disrepair

Class action lawsuits

How do they sell?

How do they source their clients? Do they need to do a lot of marketing?

Anexo has a pretty unique way of sourcing clients as compared to its competitors. They have a direct capture business model, meaning they employ an extensive network of independent garages in the UK. When a person comes in for repair of their motorized vehicle and is identified as not being at fault, the garage will contact Anexo and see if the person can file their case with them.

We’re talking about a network of 1,100 active “introducers” in the UK and Wales.

What does a garage have to gain by doing this?

First off, it’s against the law for them to receive a fee or any kind of direct benefit from Anexo. However, by helping their clients file a claim:

They add more to their value proposition

They take no financial risk if the file is accepted (Anexo takes the risk)

Increased customer retention by getting these people back on the road quickly

The group also has 5 vehicle deposits spread out over the UK to provide a replacement vehicle quickly. (80% of vehicles are delivered within 24 hours).

So:

The victim wins

The garage wins

And Anexo wins

You could say that the insurer of the opposing party does not win. But since these are at-fault instances, well, I guess they never win the individual cases.

From Anexos statistics, the number of cases they are funding (or accepting) keeps rising. I haven’t found any data on how many case applications they receive in a year to see the acceptance rate and how big the demand is.

Now for the housing disrepair business and the class action lawsuits, Anexo does specific targeted marketing and expenses these as line items.

Their total marketing spend to acquire customers as a % of revenue is about 10%, which is low. In other words, they don’t have to spend a lot to sell their service. (but it has increased with the class action lawsuits)

How Anexo Recognizes Revenue

Credit Hire Revenue

Revenue is recognized over time as vehicles are hired out, based on the number of hire days provided to the customer. The recognized amount is limited by an estimate of the likely recovery of credit hire charges, using historical settlement rates. This means Anexo does not recognize the full gross claim value but applies a "settlement adjustment" reflecting the proportion of charges it expects to recover from at-fault insurers, based on past outcomes and current market conditions.

Legal Services Revenue

Revenue is recognized upon delivery of legal services, but due to the "No Win–No Fee" structure, recognition is constrained to the minimum fee that is contractually recoverable at each stage (typically the lowest court-fixed fee). Any additional uplift (e.g., percentage of damages or higher fees upon successful settlement) is only recognized as revenue when the outcome and amount are certain, i.e., on settlement and cash receipt.

All revenue is measured conservatively, using historical data and management judgment to estimate what will ultimately be collected. The net revenue value is obtained by estimating a settlement adjustment. (They know they won’t recover the full amount.)

Historical Timeline

Before further analyzing this business, it’s important to understand what happened in the past.

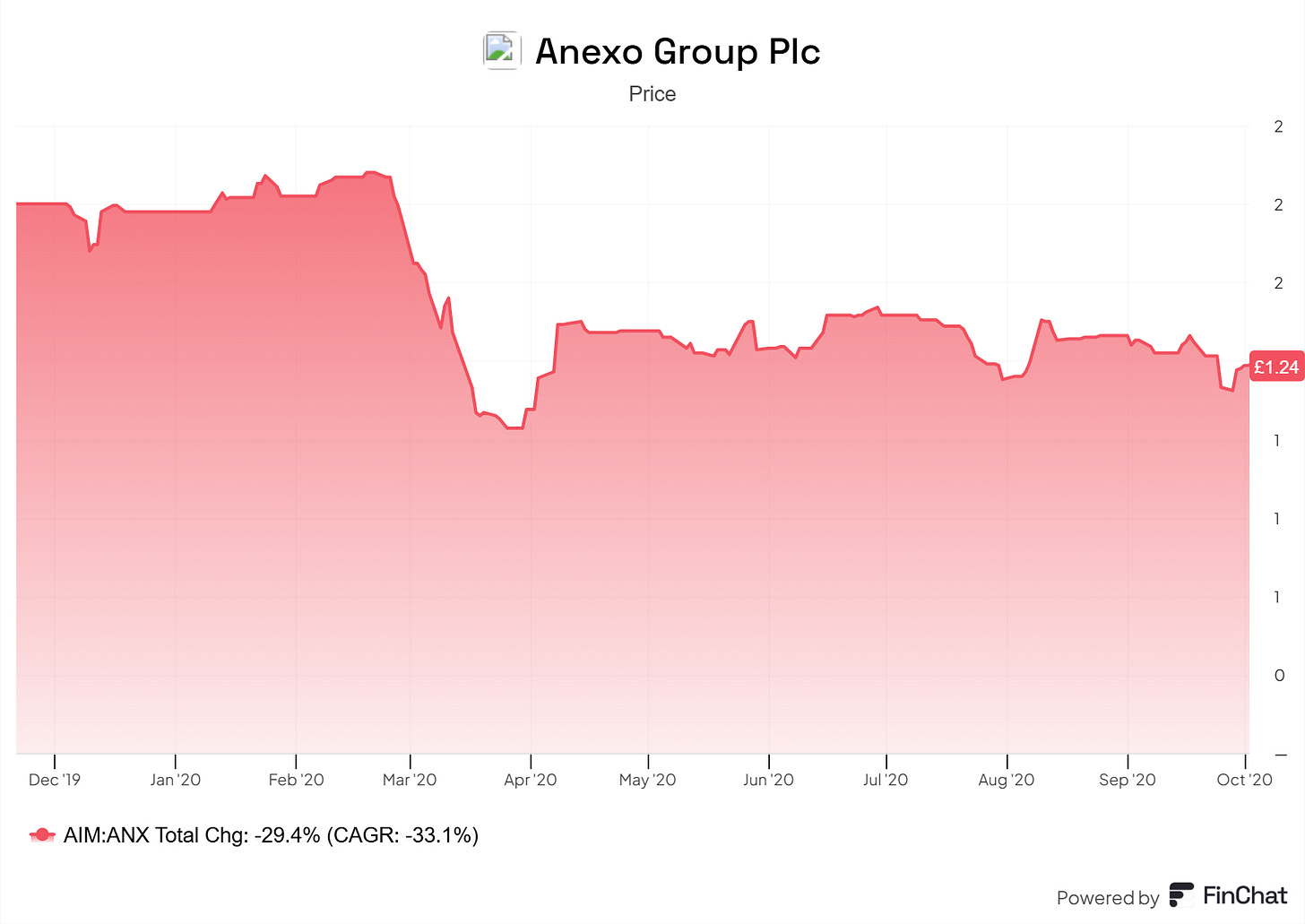

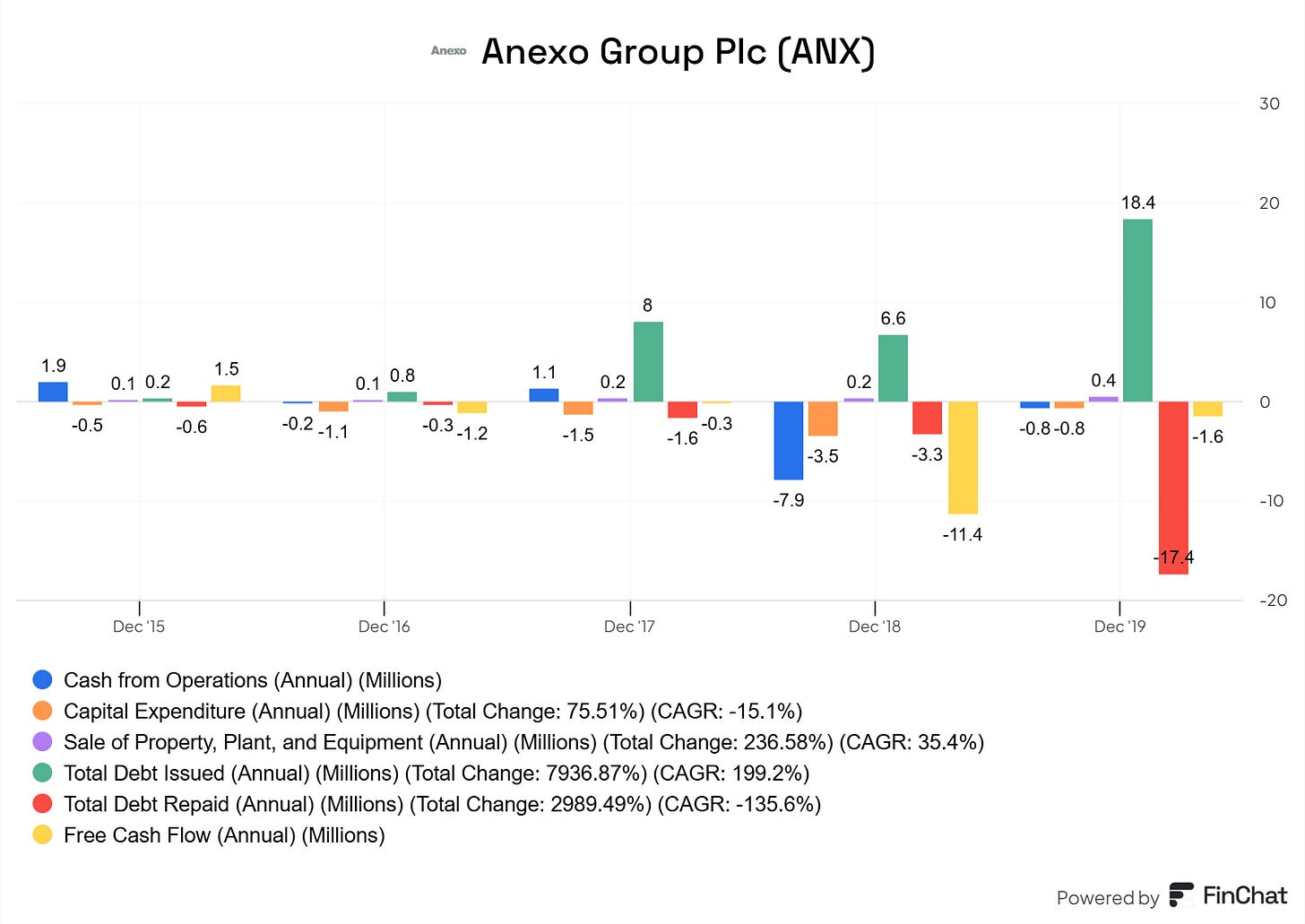

In particular, we need to understand the following chart ⬇️

When we compare certain metrics from the IPO to today, we get this:

Let’s construct a timeline of the most important events:

June 2018: IPO and early expansion

Anexo raised £25m through its IPO at 100p/share, leveraging its credit hire/legal services model.3

The capital was used to expand their services by increasing the number of employees and recruiting in-house barristers to reduce external counsel costs.

2020–2021: Pandemic-Induced Court Delays

In April of 2020, UK courts suspended physical hearings, creating a backlog of 61,000 crown court cases nationally by June 2021. Anexo’s Legal Services division (Bond Turner) faced delays in settling credit hire claims, with case resolution times extending by 6–9 months.4

Anexos’ accounts receivable grew as settlements stalled. Cash collections rose 30.9% YoY to £48m in H1 2020, but unresolved cases accumulated. Anexo’s business model is particularly sensitive to these kinds of issues. The fact that the stock plummeted due to COVID is normal. But due to this “timing problem,” it never recovered…

March 2021 Insider Share Sales

Executive Chairman Alan Sellers and Managing Director Samantha Moss sold 20.1m shares (17% of issued capital) at 150p.

They timed it perfectly, I would say…

2022–2023: Strategic Pivot to Housing Disrepair

Anexo shifted focus to housing disrepair claims, which settled faster (average 12–18 months vs. 24+ months for credit hire). By 2023, 3,900 housing cases generated £12.7m revenue (36.6% YoY growth)

June 2023 Volkswagen Emissions Settlement

Anexo secured £7.2m net cash from settling 12,000 VW diesel claims

November 2024 Mercedes Litigation Ruling

The High Court ruled German regulator decisions non-binding except for vehicle recalls.. While favorable, the judgment did not resolve liability (scheduled for Oct 2025 trial), and it required £6.5m FY2024 litigation investment. That investment continues. There’s no view on the timing of a possible settlement.5

Future growth metrics

Now that you understand how they do business, here’s a view of some of the key metrics they use in their reports:

The main takeaway: They continue to invest in growth. And even though revenue has not increased over the last year, cash collections have. Notice the growth for housing disrepair, which takes a larger and larger part of total revenue (and is a lot more beneficial to do cash conversion cycle as settlement length is reduced).

The environment

Are there external factors that could reverse the damage done by the COVID pandemic? Is the backlog decreasing?

Based on several articles, the backlog has not been significantly reduced. The situation is more or less stable. But the settlement time has gone up.6

This systemic backlog, compounded by Anexo’s case volume growth, explains its rising accounts receivable.

I believe backlogs will stay at elevated levels. Maybe in the coming years, the process speeds up, but since we don’t have any specific data points, we should be careful when we value the company later on.

Profitability

Let’s look at margins and profitability

You can see why the market has punished Anexo.

The chart shows the entire income statement every half year over the last 5 years.

Revenue is flat over the last 2 years, except for the Volkswagen payment

Gross margins are stable at 76% every year

Operating income margin is stable at 22% every year

Net income suffers from the increased interest payments, but these have decreased over the last 2 half years because the group used some of the proceeds of the Volkswagen settlement to pay back debt and refinance. You can only see it if you look at the half-year results; on a full-year basis, it’s as if nothing has happened.

Getting out of this ‘mess’ seems pretty straightforward:

Find growth

Collect cash faster

Pay down debt faster

Reduce interest payments

Double effect on the bottom line

Additional optionality with class action lawsuits

All these topics will be discussed in the following paragraphs.

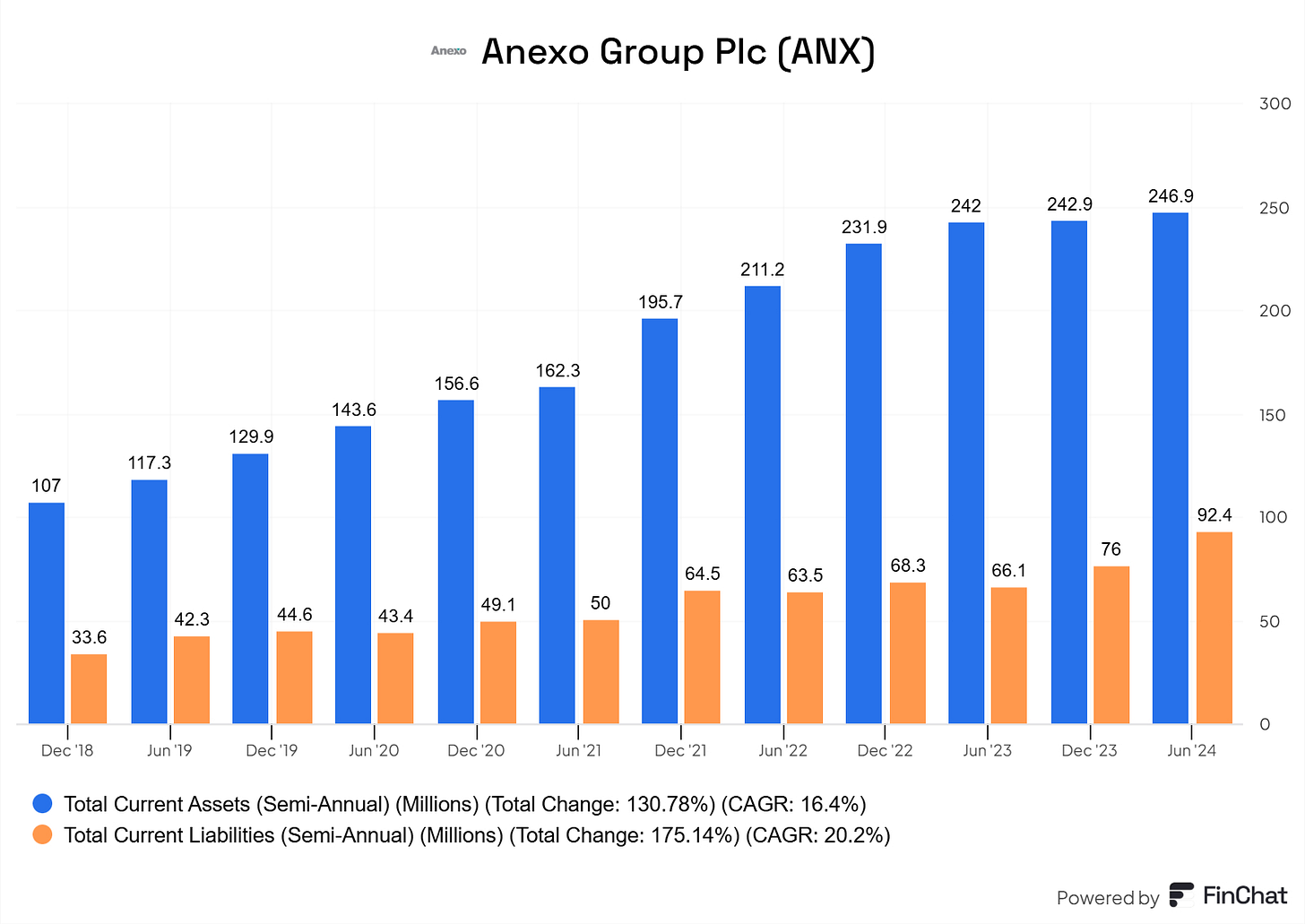

Endurance: The balance sheet

How strong is this company? Can it endure a storm?

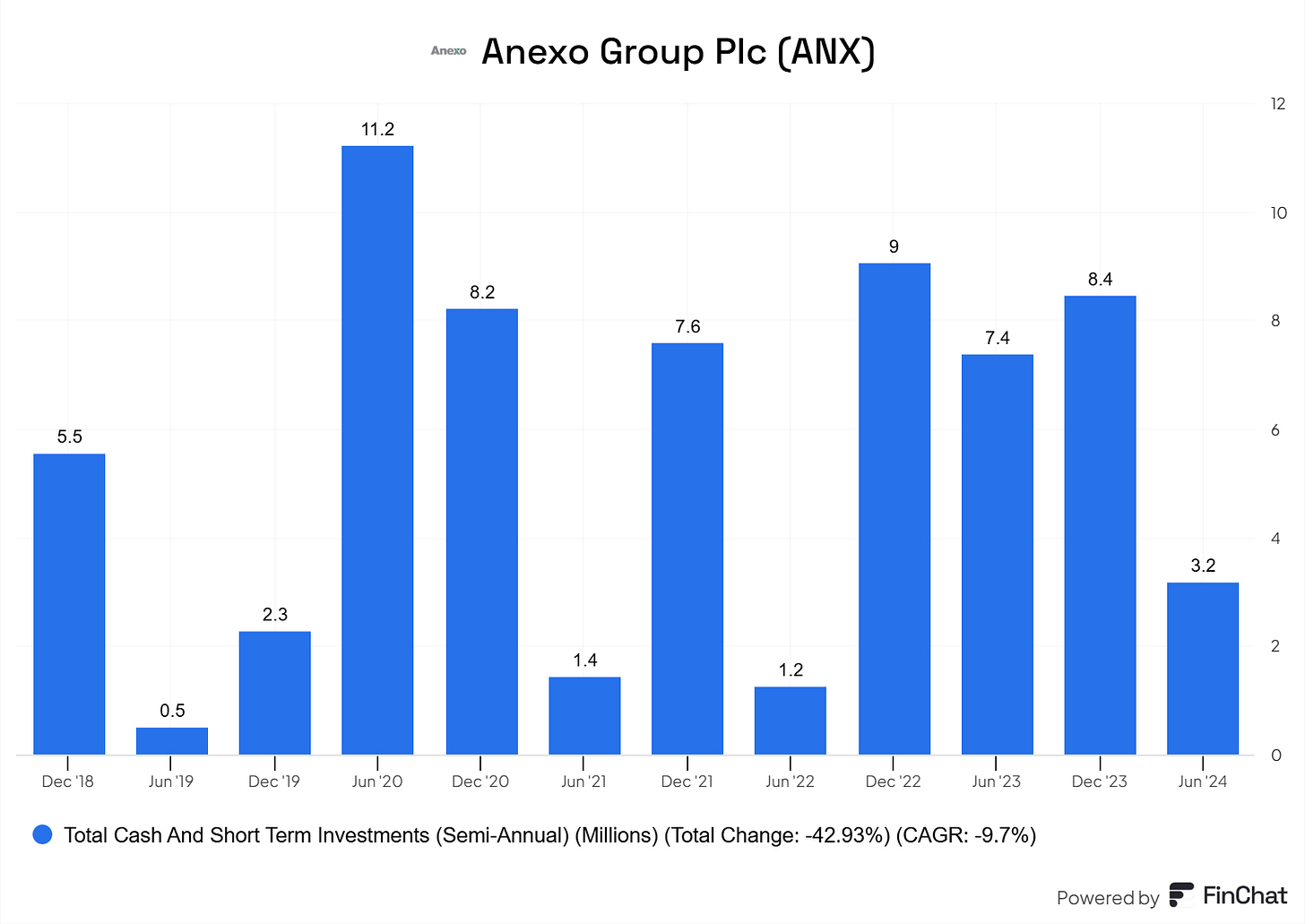

This is not your typical net-net. As opposed to a net-net in Japan, this company is not drowning in cash. It’s drowning in highly probable IOU’s. It has to do a careful balancing act to make sure it has sufficient working capital to keep the business going. There is a discrepancy between the income statement and the cash received. We’ll go deeper into this when talking about asset agility.

But then why is it a net-net?

Let’s look at the receivables and payables.

The current assets keep increasing. They are dominated by accounts receivable. If we take the difference, for the last half year, you’re looking at £155M for a company trading at a market cap of 60 or an EV of 140 M.

That’s why it can be considered a net-net. The big difference with a typical net-net is the timing difference. Those accounts receivable are high, but it takes time to recover and collect that cash.

Anexo has a specific KPI it uses, which they call cash collections. The goal is to show whether their investments in staff lead to more cash collections or not. In other words, does it speed up the engine, and does it lead to faster settlements?

If we compare 2022 to 2023:

3.5% increase in senior fee earners

11% increase in cash collections

This is the lifeblood of the company. If they can keep the growth rate of these cash collections higher than the rate of their staff investments, they will do fine.

Competitiveness

You’ve got credit hire companies in the UK. And you’ve got legal offices in the UK. But Anexo is the only company that combines both in this particular niche.

Due to the synergistic effects of combining both, Anexo should have an advantage over smaller players. But this is a microcap. There is no market domination here.

Based on a quick estimate for both the credit hire and the legal services division, we’re looking at a current market share of 2-3%.7

And the past ROE or ROIC is trading downwards. But hidden behind those numbers is a growing part of the housing disrepair segment (with higher returns on capital)

Asset Agility

This business is pretty asset-light. A breakdown ⬇️

Vehicle Fleet Costs

Anexo maintains about 1,500 vehicles (cars, motorcycles, cycles), requiring £15–20 million annually in upfront capital for fleet acquisition/maintenance. This is the main depreciation line on their income statement..

Legal Case Financing

Contingency-based litigation demands significant working capital:

Emissions claims: £6.5 million invested in 2024 (+51% YoY)

Housing disrepair: 1,300 new cases/month added in 2022

These investments create a cash conversion cycle lag—costs precede settlements by 12–36 months.

This company is investing in growth, but it doesn’t do it through the cash flow statement. Meaning, it expenses it on the P&L.

It’s simple.

More staff means more cases can be accepted and more people can be used to settle with certain insurers.

Depreciation added back to the net income is based on the right-of-use assets of their car fleet.

Let’s split their cash flow history into 2 parts, before 2020 and after:

Before 2020:

In the first years, there’s not a lot going on. But then Anexo takes on more debt to reinvest that cash into growth. Capex requirements are low as they only have capex related to their motor vehicle fleet.

In 2019, you saw the debt refinancing going on.

After 2020

Look at the half-year results:

Some notable developments:

They raised capital in 2020 through stock issuance

There was a massive increase in financing through debt in 2021

Over the last 18 months, debt repayment has increased compared to debt issuance: 48.6M versus 24.5M, which is a reversal from the past

Cash from operations was remarkably higher in H1 of 2024 compared to the previous half year, showing the effects of better cash collections

Free cash flow is showing up in the last several half-year results

Based on the cash flow statement, it seems the business is getting stronger. But the market thinks it’s not enough. (because it’s less visible on the income statement?)

The biggest concern could be the cash burn related to the class action lawsuits. When compared to the credit hire claims or the housing disrepair claims, the cash conversion cycle is even longer here, because these trials take more time. It’s not just about the probability and the amount of the future settlement. It’s also about the timing of that settlement and when the cash would be received.

What can we learn from their cash flow history?

Up until 2018, not a lot was going on. Low debt levels

Small dividend since 2016

Since 2019: Gradual, more and more debt issuance compared to debt repayment

Since 2023: reversal: More debt repaid than issued (in particular thanks to the cash inflow from the Volkswagen settlement)

H1 of 2024 was free cash flow positive

IMO, the dividend is a bad form of capital allocation. To me, a company with this kind of working capital structure, and since at the moment it’s not drowning in cash, it should not pay a dividend. It should focus on reducing the debt load and the interest payments.

Other than that, an inflection seems to have happened, looking at the cash flows. The question is: will this inflection continue?

Here are some reasons why it might:

Revenue from housing disrepair keeps rising and provides higher margins

Cash collections keep on increasing

A settlement in the Mercedes et al case in 2026 would allow them to once more repay their debt and get to a more comfortable working capital position.

I still think they should cut the dividend. But that’s the problem with dividends, once they exist, they are hard to cut.

Leadership

Alan Sellers and Samantha Moss, the company's founders, each own 17% of the company. As mentioned in the timeline, they sold part of their holdings when the price reached a peak in 2021 for a big payday.

They both have significant experience in their roles, as do other members of the management team.

The company has multiple incentive programs for its employees.

From an incentive point of view:

Employees receive an annual bonus based on profitability metrics

Shareholder incentive program over the longer term, with 3-year vesting periods. They mention that awarding is done in compliance with an individual's performance towards the long-term strategy. But there is no mention of specific metrics.

The CEO’s pay of 830,000 seems ok for the amount of revenue they are generating. Half of his pay comes from bonuses, which are tied to profitability targets.

But the recent tender offer doesn’t bode well for their sense of character.

We’ll get to that shortly.

Their growth strategy is outlined below ⬇️

Valuation

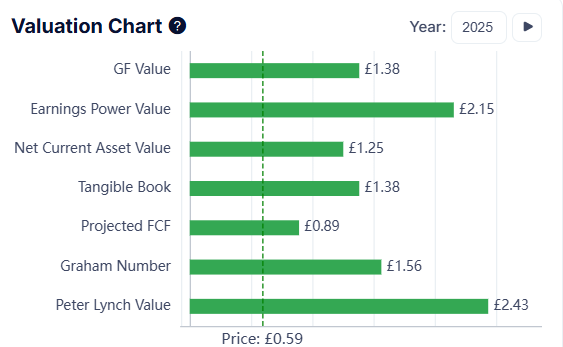

Since it’s a growing net-net, we’ll value the company using the Net Current Asset Value and look at forward normalized EBIT (Greenblatt)

NCAV

The latest Net Current Asset Value (NCAV) per share for Anexo Group is approximately £1.3, based on the most recent half-year report as of June 30, 2024.

Current Assets: £247M

Current Liabilities: £92M

Shares Outstanding: 118M

Of course, accounts receivable are less liquid than cash. If you were to liquidate this company, you would need to keep certain barristers to collect the cash. But still, at this price, Anexo is undervalued.

Greenblatt (forward normalized EBIT) (adapt this paragraph)

Here’s an overview of the past income statement:

I’ve highlighted in color specific items.

What can we conclude?

Since June 2022, revenue has been flat

Underneath the hood, housing disrepair revenue is growing

A bump in revenue in H1 2023 due to the Volkswagen settlement

Increased debt payback in H2 2023

SG&A increased due to more staff ➡️increases cash conversion

If we take the 10-15 in a half year as normalized (because there were no peculiar items), we have an annual £20-30M in EBIT.

With the current EV, you’re looking at a trailing EV/EBIT of 4.6 to 7.

But they are investing in their staff, so my guess is their revenue will grow again in the future.

Before looking into what the impact of a settlement on the Mercedes and cohorts case would look like, let’s look at how much they generated from Volkswagen.

£7.2M in proceeds for 12,000 out of the 16,000 clients.

If we take the 37,000 clients (for all motor companies), we take 75% and use 600/client, we arrive at 16.7M

Note that the company has stated that proceeds would be anywhere between £30 and 50 M. I’m not sure where that number comes from

So, if additional cash of 16.7 to 30 could come in due to a settlement, we need to take a look at the timeline. I see the following possibilities:

Best case: Ruling goes in favor of Anexo -> Mercedes wants to settle. It creates precedent for the other manufacturers who decide to settle quicker. Settlement payment in Q2 of 2026

Bad case: Ruling goes in favor of Anexo. Final trial for damages will occur in October 2026. Once the trial is over, Mercedes goes into appeal. Count 12 to 18 months for a retrial. If payment occurs, we’ll be in 2028.

Worst case: Ruling goes against Anexo -> All investments are lost

From a probability point of view, and based on past class action lawsuits on this topic, the best case is the most probable. Given the ruling in October 2024, the worst case is extremely unlikely.

What would this mean from a Forward EV/EBIT point of view?

In the past, when growth was there, even after COVID, the company traded at an EV/EBIT of 10.

What’s the difference between now and then?

Revenue growth has slowed down

EBIT growth is down some, but still at 20%/year

EPS growth is down

Debt has gone up

A multiple re-rating would come from future EPS growth, so the thesis is:

Increased cash collections through settlement

Payout of the class action lawsuit

Payout is used to reduce debt

Interest payments go down

EPS goes up

The slower growth no longer justifies such a multiple, but based on this analysis, the company is undervalued.

Conclusion

To visually show how undervalued this company is, let me show you a screenshot from Gurufocus:

Even though these are automatic calculations, you rarely see all the greens in a football field view like this.

And the projected FCF takes into account the winnings of the Volkswagen case, but underestimates the future cash flow from the Mercedes + others case.

We never consider valuation in a precise manner. We want to know if there is a high probability of this company doubling in the next 5 years.

Based on the above analysis, I do believe that the probability is high.

But things have changed due to the tender offer. ⬇️

Summary

Anexo looks like a hidden net-net, and it seems to be growing underneath the surface. While revenue is more or less flat over the last 2 years, their cash conversion is getting stronger. Businesses generally go bankrupt not because they are unprofitable, but because they run into cash flow problems. A strong business has a negative working capital structure. Anexo in that regard is not strong. But a decent company can make for an excellent investment if the price is low enough.

And that seems to be the case here.

Anexo is not a super-easy business to understand. It almost went on my too-hard pile.

Where will Anexo be in 10 years? I’m going to be honest here, I don’t know, and I don’t care.

Investment decision: I had an initial position at 1%, which I increased to 5%. The basic rationale is this ⬇️

Tails, I win. Heads, I don’t lose much.

Let me first explain the tender offer, as the above analysis was written before the tender offer was available.

The tender offer

On the 22nd of April, Anexo released a press statement of a possible tender offer considered by the 2 owners and DBAY, a private fund. Together, they own more than 50% of the shares outstanding. Several things create uncertainty in the market:

No price is mentioned

Payment would be proposed in loan notes

For the buyers, it creates an opportunity. If you’ve read the article, you know that this company is severely undervalued by the market. It provides them with a chance to pick up the remaining stock on the cheap, which would be detrimental for the small shareholders.

Also, the prospect of being handed an unlisted loan note, where it’s unclear how liquid these will be, is not very enticing. (I would prefer cash)

The only thing we can do now is communicate our concern to management and wait until the actual price offer is revealed. Once that happens, we can take further action.

Why is the downside limited?

DBAY picked up shares right after the announcement (which was timed at 4:24 PM) and before the market closed. The highest price they paid was 61 pence. This could be considered as the floor for the offer they are preparing. (although the current price is trading below that floor…)

Why?

Under the UK City Code on Takeovers and Mergers, which governs Anexo, any offer must be fair to minority shareholders. DBAY’s recent purchase at 61 pence could be seen as a market-based indicator of the company’s value, and offering less in the tender offer might attract scrutiny from regulators or shareholders. The Takeover Panel might view a lower offer as unfair.

But what about the upside?

Well, the upside has been limited, too. Without the tender, we could have been looking at a multiple expansion + EPS growth story. The twin engine, as Chris Mayer has mentioned in the past.

This, of course, can’t happen anymore. So what does the potential upside look like?

Let’s first look at the history.

In 2021, DBAY considered a cash takeover offer for Anexo at 150 pence per share but ultimately withdrew it, citing that the offer did not reflect the company’s value in the board’s view. The fact that DBAY previously valued Anexo at 150 pence (when they also acquired a 29% stake) sets a historical benchmark. Now the company today is not the company in 2021, but if you include a probable win in the Mercedes case, and a housing disrepair business growing fast, the 150 pence sounds reasonable

So I believe the maximum upside you can imagine in the current situation is a cash offer at book value (let’s say a double from today).

I discussed position sizing in the past. And the main lesson for me is to size based on the downside risk. That’s why I increased from 1% to 5%.

Why not go higher?

If the final offer is in the form of unlisted loan notes with a certain interest rate, this would mean there is a chance you would be stuck with these for a certain period. That’s like holding a bond you can’t sell, and might ultimately be a lot more costly from an opportunity cost point of view.

Worst case scenario?

The company gets delisted. You don’t have a market anymore for your shares. You still receive dividends from the company, but it may become hard to sell those shares. Of course, if you believe in the LT prospects of this company, in theory, it’s not a problem. But in practice, you want some kind of exit in the future. Else, your money is stuck in limbo… There have been examples where, after delisting, cash tender offers were made for the remaining shareholders, or some form of trading was made available on a service like Asset Match. It’s impossible to predict.

I want to thank my friend Iggy on Investing in particular. He has taken the initiative to assemble all the small shareholders to make sure our rights are protected. You can follow him in the coming days for more detailed information.

May the markets be with you, always!

Kevin

If you like this article and want to read more like these in the future, we have a 25% discount running at the moment.

Wild how Anexo’s edge really comes from exploiting a structural inefficiency in the legal + insurance system — fronting working capital where others can’t or won’t. What stood out to me was how the real bottleneck here isn’t demand or even margin, but settlement velocity and court throughput — a literal throughput problem, not a demand-side one. If that clears up (or gets monetized via litigation wins like Mercedes), you could see this thing re-rate dramatically. Also, the net-net angle layered with optionality from class actions gives this a Greenblatt-meets-distressed flavor I don’t see discussed enough. I’ve been writing a bit about similar "cash timing vs value recognition" mismatches lately — would love to swap thoughts sometime.

Thanks Kevin. This company bears a striking resemblance to an Aussie law company - Shine Justice (ASX:SHJ) in that both are 'Ambulance chasers' and derive their income in the main by selling 'legal hours' - in the case of SHJ on personal injury cases and class actions.

Both have the same problem - falling share price ($1 at listing in 2013 now 72c for SHJ) and building 'assets' rather than cash. If you look at the ratios, SHJ looks compelling value at 0.55x the tangible book value.

The real issue is how to do get the cash out. I see SHJ as value trap. Maybe your company has an opportunity to take a stag profit if the owners go through with the buy out.