How to break the rules to find 100 Baggers

One of the best investing books, ever

I’m calling it.

Rule Breaker Investing by David Gardner will become a classic.

In the same vein as One Up On Wall Street by Peter Lynch.

It’s that good.

David has done something incredible.

He has picked and held on to not one, not two, but seven 100-Baggers. Combine that feat with incredible writing skill, and you’ve got yourself a must-read if you’re interested in stock investing.

Since this publication is titled “100 Bagger Hunting,” you know I had to dig deep into this one.

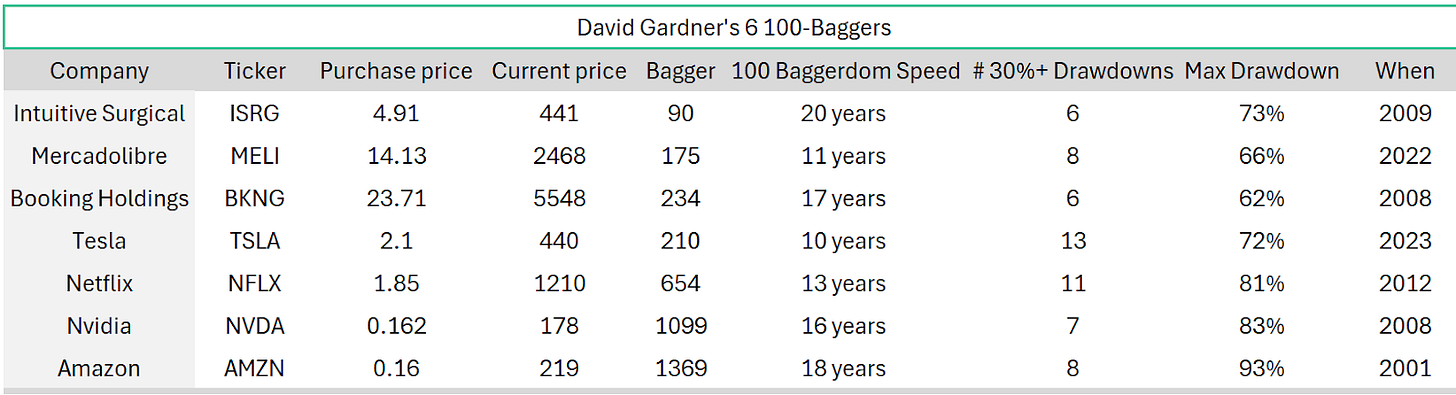

If you’re wondering which 100-Baggers he has picked over his 30 years of stock picking, here they are:

I’ve added some important statistics:

The speed to 100 Baggerdom -> even the fastest take at least 10 years, which can feel like ages in a fast-evolving market

The max drawdown he experienced -> at least 60% but it greatly depends on WHEN you experience these

The number of 30% drawdowns he had to endure -> Tesla was the most volatile with 13 drawdowns in a mere 10 years

I’ll reveal the most important lesson of all from his book:

➡️Be an optimist who can envision a better future.

You won’t find (or be able to hold on) to 100 Baggers without it.

It means you can peek into a more positive and wonderful future. And pick the companies that are building that future.

Now I would love to reveal everything that is written in this book, but I personally hate spoilers. So I’m just going to stick with the 6 traits of rule-breaking stocks and see if we can come up with a list of these stocks today.

If you want to discover the 6 habits of a rule breaker investor and the 6 principles of portfolio construction, you’ll have to go through the book. (I might do a full article on it in a year or so when everybody has read the book 😉)

Trait 1: Top dog, first mover in a new emerging industry

The number 1 emerging industry at this time?

AI Platforms.

Current top dog: OpenAI

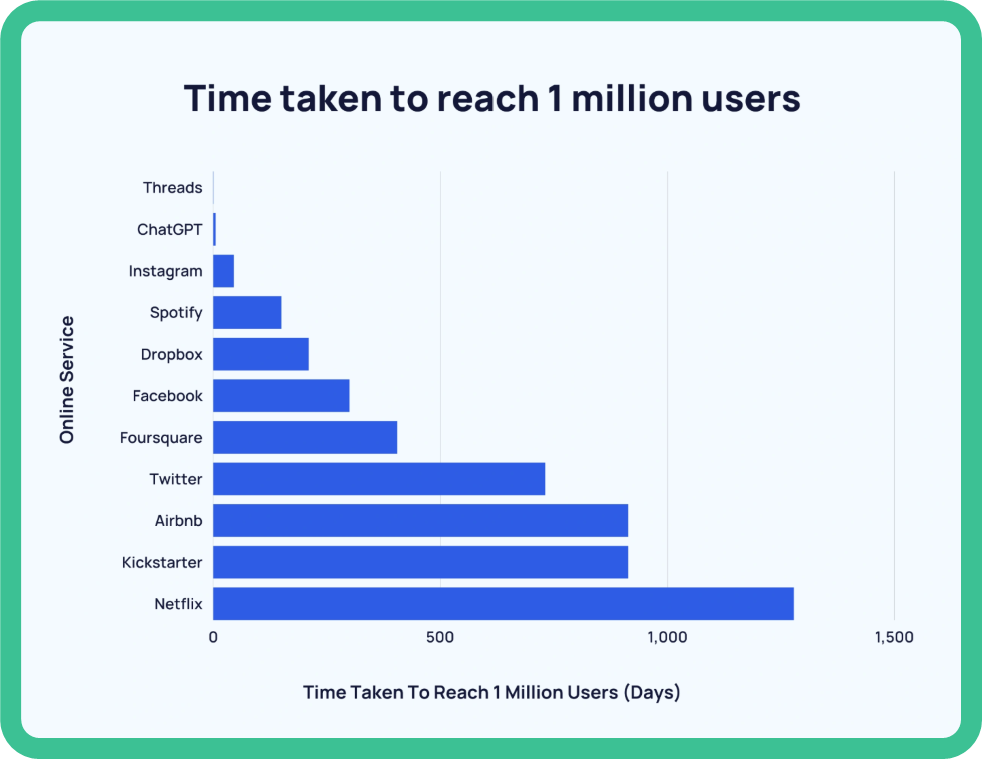

Just to emphasize even more, what an impact OpenAI had as a first mover:

Note: Threads appearing as number 1 may not be the best comparison, as Threads was launched from within the Meta network. (with 3.3 billion daily active users 😮)

And when it comes to comparing this top dog to the others out there:1

Yep, it’s still in the lead.

But, how to invest in OpenAI through the public markets?

The only company that will hold an equity stake in the future (under negotiation) is Microsoft.2

Current valuation of OpenAI: 500 billion

Current market cap of Microsoft: 3,800 billion

If Microsoft negotiates its way into a 30% equity stake, then it could become a meaningful part of its overall business value. We’ll need to wait and see how it will impact profitability in the future.

David proposes a simple test you could apply to test if it’s a top dog.

➡️The Cola test

Is there a Pepsi for each Cola?

In the case of OpenAI, you could cite Gemini, Grok, and Claude.

But as mentioned before, OpenAI is still firmly in the lead, so yeah, a dog it is.

Trait 2: Sustainable competitive advantage

We talked about moats and sustainable competitive advantages in the past. This is probably one of the hardest of the 6 traits to discover.

Because being a top god and first mover in a new emerging industry, the company might have a competitive advantage in the short term, but how to assess whether it is sustainable?

It takes time to dig up a moat around a castle.

And moats are easy to spot once they are built; it’s harder when they are being built.

A telltale sign is when a competitor tries to move in and is repelled by the defender. Then you have proof that it has a moat, like what we uncovered at our favorite company.

Does OpenAI have a sustainable competitive advantage?

It’s too early to tell. Things change fast on the tech front.

One thing to look for is Dark Clouds. When there are lots of people saying “this will never hold”, or this is just a fad and you bet on it anyway, it could lead to incredible returns.

On the AI front, you hear things like:

Hyperscalers are overspending

The ROI on all that capex will be 0

What has generative AI really accomplished?

This is probably still a very localized dark cloud, as overall sentiment is bullish.

Trait 3: Stellar Past Price Appreciation

This one is my favorite.

I prefer averaging up instead of averaging down.

Most of the time, the market is right, at least in the shorter term.

So when the price of a stock is going up, it means the company is doing something right, and the market is pricing that in. But the market is not that great at looking far into the future.

In October, we’ll be publishing a company deep dive that I believe is a generational opportunity to buy. It ticks all 6 rulebreaker boxes. If you want to receive this report, a paid subscription will get it right to your inbox.

The company we bought last week had already gone up 6x over 13 months.

But we still added to it.

Similarly, the company we covered a month ago had already gone up 100% in a year.

Again, we added.

Just like star athletes keep outperforming, great companies do the same.

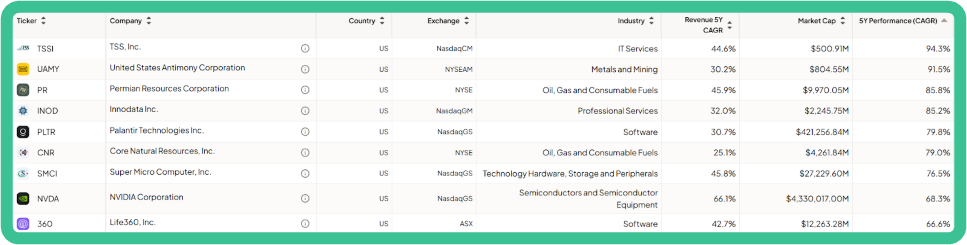

Which stocks are in the top 10 of best-performing US stocks over the last 10 years?

If you just look at price, you’ll get companies you’ve never heard of.

But if you screen for this:

Highest price CAGR

Revenue CAGR of at least 25%

Minimum market cap of 500M USD

Then this is what you get:

Instead of screening on fundamentals alone, add price appreciation to see the winners of today.

Instead of asking:

➡️Will this be the winner of tomorrow?

The question becomes:

➡️Will this company keep on winning?

Trait 4: Good Management and Smart Backing

A leader. A visionary.

The next Jeff Bezos.

Have you ever seen an interview with Bezos?

Have you read Amazon’s annual reports?

They stand out.

They’re not your normal way of communicating to the world.

That’s what you’re looking for. You’re looking for CEO’s that stand out.

Not in a promotional way.

In a profound way.

And don’t forget skin in the game. Most of the 100-Bagger holders are successful CEO’s because they never sold.

Some examples of outstanding CEOs with skin in the game (% insider ownership):

Jeff Green (The Trade Desk -TTD)

Kristo Kaarmann (Wise - WISE)

Marcos Galperin (Meli - MELI)

Peter Beck (Rocket Lab - RKLB) -> although I think he sold most of his shares?

Jensen Huang (Nvidia - NVDA) -> I could not, not add him to this short list

Who is your favorite CEO?

Trait 5: Strong Consumer Appeal

Brand.

There’s something magical about it.

And it is a powerful trait to have.

This is most obvious for a B2C company, but even in a B2B setting, it is still a human with emotions who is doing the buying.

It’s not only about what the brand makes you feel. Do employees love working at the company?

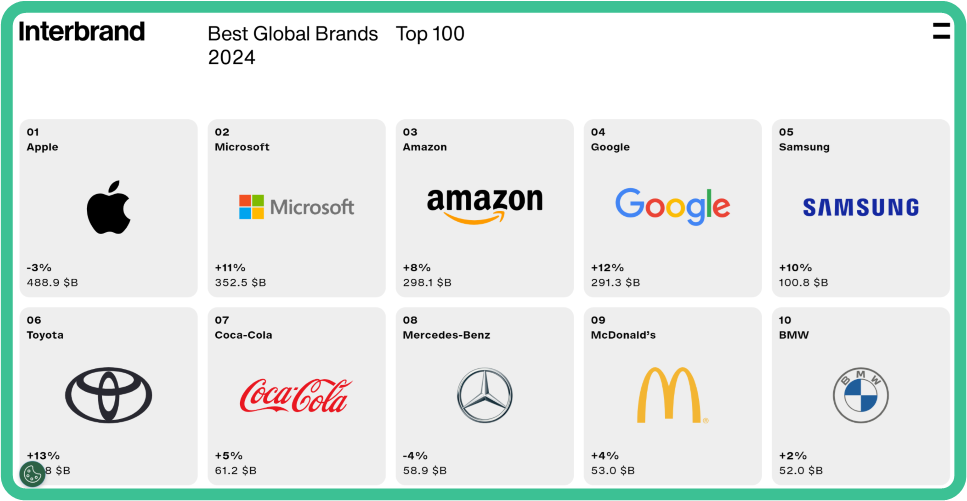

Interbrand publishes its yearly TOP 100 brands in the world.

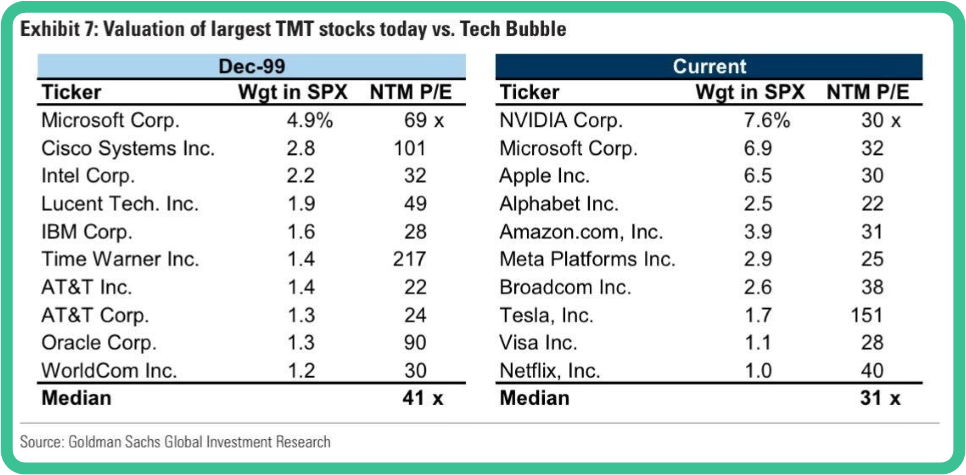

Trait 6: Overvalued

With the rise of the internet, we live in a world of intangibles. And our accounting system has not been adapted to cope with this.

There’s a big change when compared to the “old hard economy”: a top god (or dog) in a new emerging industry, led by a visionary leader, will generate far more growth in the future than your current models will be able to predict.

For high-growth companies with long runways, the P/E ratio is a bad multiple.

Remember the wisdom of Peter Lynch:

Don’t use a hammer to tighten a screw.

Use the right tools for the right type of companies. But it might just be that whatever tool you use, the company will always look overvalued.

This is the most counterintuitive rule.

But it is most important chapter in the book. I have been following Tesla since 2010, but never invested in it because it always looked overvalued. That has been a serious error of omission on my part.

Here’s a comparison of the S&P500 in 1999 versus today:

Do you think we are in “overvalued” territory?

To conclude

To end this article on RuleBreak investing, I do want to give away one habit of the 6 habits that I think are important.

➡️Get ready to lose.

Rule Breaker Investing is about hunting for power laws. That means you’re looking for outliers that will carry your entire portfolio. If you pick 20 stocks, not all of them will succeed. You have to get used to picking losers.

The good thing is, you can only lose 100% on that position. But a winner can go up 1000%!

On hindsight bias

When you look at the seven 100 Baggers David picked, and you see the company names, you’ll say: How obvious.

But was it?

Amazon in 1997

Tesla in 2011

It’s never obvious. Especially so early on. Although it was possible to get in later on.

And don’t forget about the drawdowns you have to suffer through.

Just like Bill Gates, David had one big advantage.

He started the Motley Fool when the internet was on the rise. And he was an early adopter of everything related to it.

The internet has been a huge wave, and when you can start surfing it from the base, you’re in for a great ride.

The next wave is probably AI. The shift is not as dramatic as “from nothing to using a modem and communicating with everyone.” But it is still a shift.

And when looking at how quickly OpenAI has grown, or how other companies related to the AI Industry generate multibaggers in a matter of years (I’m not even talking about Nvidia):

IREN: +500% in a year

NBIS: +460% in a year

TSSI: +2300% in 3 years!

You’ll see me looking for opportunities in emerging sectors like AI, Robotics, Nuclear, and of course, my favorite, “Payments’ in the future.

I highly recommend reading Rule Breaker Investing!

May the markets be with you, always!

Kevin

Please share and rate this article

Gardner’s record speaks for itself, but not everyone’s temperament fits the 100-bagger path. Holding through 60% drawdowns sounds noble until you’re living through one. Eventually every investor figures out whether they’re built for growth, dividends, or income — the key is knowing your lane and staying there.

Fantastic piece. I like how you highlight that the path to 100-baggers is rarely smooth or obvious.

The insight that even the fastest winners took over a decade (with brutal drawdowns along the way) is a humbling reminder: staying power is what compounds the most.