Hunting for global stocks that return 1,000%

Lessons learned

2 messages before starting today’s article!

Almost 300 of you were so kind to fill out our survey last week. This will help improve our offering. A raffle was included, and the innocent hand of my 10-year-old son pushed the button to stop the fortune wheel (I use the wheel of names). The winner is: Arthur Bom. Arthur has received an annual subscription. Congrats to him!

Over 200 have joined the waitlist for our upcoming course at investwithgpt.ai. I would like to do a shoutout to my friend over at Compound with AI. Check out his content. In my view, he is the master of Notebooklm when it comes to stock analysis

You might be aware that I’m doing a study on multibaggers, and the first step in any analysis is to read everything that already exists.

So I started compiling the available literature on multibaggers and added a new page to 100baggerhunter.com

You can head over there if you’re interested in the other studies. And if you know of a book or paper that should be on the list, but is not -> please reach out to me!

Today, we’re diving deep into the lessons learned from Dede Eyesan’s Global Outperformers.

I met him shortly in Omaha this year. Please check out his Substack!

From 2012 to 2022, hundreds of small, often obscure companies quietly achieved what most investors only dream of: they turned $1 into $10 or more (A 26% CAGR). These multi‑baggers aren’t confined to Silicon Valley tech giants. In fact, the majority began life as tiny firms in Asia, Scandinavia, or emerging economies, operating in industries as varied as salmon farming, wind turbines, and airport operations.

What separates these global outperformers from the tens of thousands of stocks that fail to meet that bar?

That’s the question Dede wanted to answer.

And what I love about his study is that he starts it off by explaining some caveats:

He studies 0.8% of public companies out there. This, of course, means there is survivorship bias included in the study (it’s a recurring story in all the literature)

All companies had to have a market cap of at least 500 million USD in 2022

We want to learn from history, but in investing, only the future matters. The goal is to gain a better perspective of what drives returns and apply it in our stock selection

Globally, in a span of 10 years, 446 companies returned over 1,000% to their shareholders.

This article is divided into 3 parts:

The 5 mutlibagger traits

The 5 lessons for us as investors

The 5 top picks from a global outperformers “screener”

The 5 multibagger traits

1. Size matters

Well, the other way around this time. The law of small numbers is in effect:

63% of the winners were nano-cap stocks (< $50M)

24% where microcaps ($50-300)

The remainder were bigger, with only 7 companies that started as 10 billion companies and became 100 billion dollar companies.

If you’re a long-time reader, you know I favor the small.

2. Profitability

A whopping 85% of the winners were already profitable at the start. The median operating margin was 12%. But what contributed more was margin expansion.

Those that expanded their margins by 10% over the decade were 3 times more likely to join the 10-bagger club.

So, try to avoid unprofitable companies and look for those that can still expand their margins.

3. Pricing

A high multiple must be accompanied by high profit growth. 93% of the profitable companies had a 3-year forward EV/EBIT <1 (EV/EBIT divided by 3-year EBIT growth rate).

74% traded below a trailing EV/EBIT of 10.

If you’ve read some of our deep dives, we usually only project 3 years in the future. The lowest we found was a forward EV/EBIT of 3.

4. Skin in the game

67% had insider ownership of at least 5%.

This is particularly important for smaller companies.

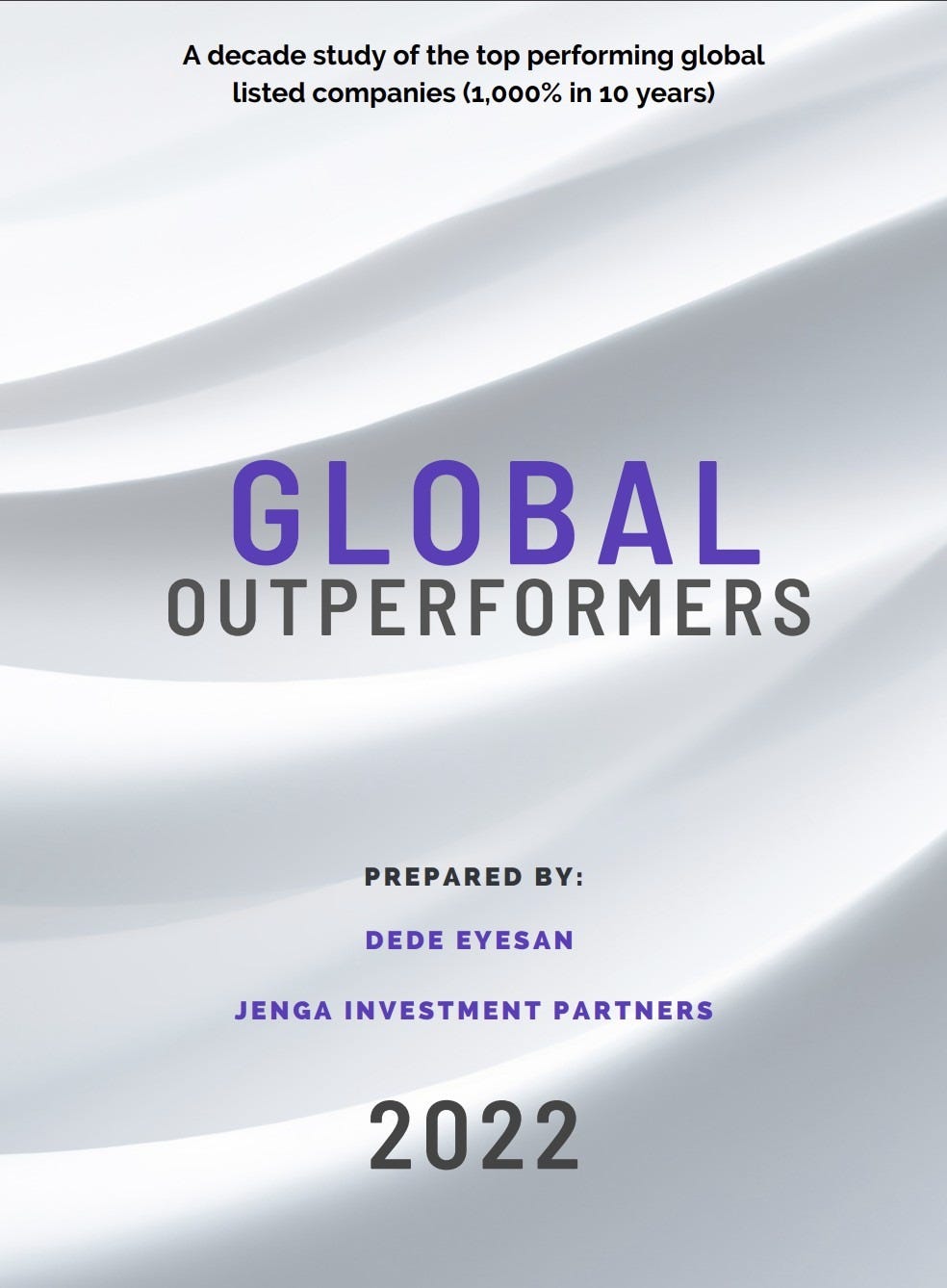

Now the true magic happens when you start to combine all the factors. These numbers just scream to be added to a stock screener. Would simply doing a screen like this capture the winners?

Dede studied this and found that you would have missed 54% of the winners.

In other words, in addition to a quantitative analysis, a qualitative analysis (leadership, moat) is needed to be able to pick all of them.

5. Geography

Asia produced 58% of the 10-baggers. Countries like India or the Nordic region (Sweden, Denmark, Norway) showed very high earnings-to-return ratios.

Nearly half of the winners came from Cyclical industries (mining, energy, construction, airlines, banking, semiconductors, and consumer discretionary)

The key is to look for businesses with structural tailwinds or cost advantages that can endure downturns.

The 5 lessons for the thoughtful investor

1. Value‑Chain Investing

Map out how a product is made. Who are the suppliers? Who are the suppliers of those suppliers? Remember how we used GPT-5 to find 2nd and 3rd order companies in the AI data infrastructure buildout.

2. Optimism

Even during crises—Greece’s sovereign debt woes, US‑China trade wars, Brexit—hundreds of stocks delivered 10‑bagger returns.

Facts matter more than headlines.

A simple reality check is to ensure EV/EBIT to future growth stays below 1–1.5.

3. Patience

The average holding period for stocks has collapsed to just 5.5 months, yet multi‑baggers often test investors’ patience. In the study, 46 % of winners delivered total returns below 20 % in their first two years, and 36 % had negative returns. Selling early is usually the biggest mistake we make. The study suggests holding cyclicals for 3–5 years and compounders for 5–10 years (this is the goal of our barbell portfolio)

4. Turnarounds

Distressed companies can deliver enormous upside if problems are solvable. Eyesan proposes evaluating the distance to a more profitable future (e.g., higher EBIT margins), the speed at which issues can be fixed (operational inefficiencies are quicker to address than product flaws), and shortcuts.

Note from me: Make sure the turnaround is structural, meaning bad business lines or assets are being divested.

5. 100-Baggers are rare

Only 7.7 % of 2002–2012 ten‑baggers repeated the feat in 2012–2022.

Valuations often re‑rate winners, reducing future upside.

This means finding new ground. Only the rare few 100x

The multibagger screener

Here’s the criteria we used in a software called Unclestock.com

I can already tell you this is a high bar screener. Excluding banks and some countries, we cannot trade in it delivered:

500 companies below 500M USD market cap

100 companies between 500M and 2B market cap

50 companies between 2B and 10B market cap

And the reason is probably related to the valuation of EV/EBIT < 10.

Here are the 5 that caught my eye:

VOTUM S.A.

Polish insurance, legal claims company.

Ticker VOT

83% gross margins

20%+ revenue growth over the past years

Double-digit earnings yield

Financial information is in Polish. I could not find a write-up, so I made one with GPT-5. You can download it below.

Base CO

Japanese software development company

Ticker 4481

30%+ gross margins

Consistent double-digit growth on all fronts

Low capex -> Returning capital to shareholders through dividends

No write-ups I could find.

EZZ Life Sciences

Remember this company

Ticker EZZ

75%+ gross margins

PEG <1

I need to put this one back on my radar

This company sells supplements, so by definition no real moat. Still, it could be an interesting play if the price drops once more.

Upwork

Freelancer platform Upwork has had a tumultuous past

Ticker UPWK

75%+ gross margins

PEG = 0.5

Started to generate lots of cash over the last 2 years

See this write-up by Kostadin Ristovski, ACCA .

Conclusion

Global Outperformers brings us some solid insights to better guide our stock picking. It’s a worthy addition to our multibagger reading list.

But as you’ve seen, just screening is not enough. (although I did miss EZZ).

Fundamentals have to be complemented by qualitative analysis. Only the future matters; that’s exactly why I love turnaround stories like our write-up last week.

Have a great weekend, and

May the markets be with you, always!

Kevin