Perplexity Finance VS GPT-5—here’s what truly wins

AI Tools for better research

I’m a very “neat” monster

- Dexter Morgan

Dexter is a hyper-organized serial killer.

He prepares

He performs the kill

He cleans the scene of the crime

And as Dexter, I also want to feed into my “Dark Passenger”.

I assure you, mine is about finding undervalued opportunities. 😉

We’ve discussed using GPT-5, Grok, or Perplexity in previous articles.

But when using these, it sometimes feels messy, cluttered, and lacking focus.

In 2025, the problem is not a lack of information. It’s about channeling the overflow of information into a signal and filtering out the noise.

It’s about asking the right questions, using the right prompts, and most importantly, having access to great financial data.

Within the 100-Bagger data project, I’ve been experimenting with building a custom GPT that also links to reliable financial data.

But I’ve had mixed results.

So today, in our “Invest with AI” series, we’re diving into a tool specifically tailored towards stock research that uses financial data.

And we’ll apply it to a pretty “popular” company in the investing space: UnitedHealth Group with ticker UNH.

Will it become the one software that displaces everything else?

Let’s find out.

As a reminder, for the 2nd anniversary of our newsletter, you can grab a paid subscription using a significant discount. The offer will expire in the next 72 hours.

What kind of monster is Perplexity Finance?

Perplexity can be considered an advanced research engine that uses the power of the existing LLMs.

For our purpose, it’s important to understand where the data comes from.

For Perplexity, it looks like this:

[ Financial Data Sources ] ← Raw data feeds (FMP, SEC EDGAR, Fiscal.AI)

│

▼

[ Perplexity Finance ] ← Specialized app: financial queries, charts, summaries

│

▼

[ AI Reasoning Core ] ← LLMs (GPT-5, Claude, Mistral,...)

│

▼

[ User ] ← You ask finance questions, get structured insights

Perplexity Finance can:

Browse the internet to retrieve data

Get options data from Unusual Whale

Has access to fundamental data from Financial Modeling Prep

Has access to SEC EDGAR filings to retrieve 10Q or 10 Ks

Has a partnership with Fiscal.Ai (former Finchat) for real-time earnings updates and call transcripts

Live transcripts from Quartr

Will query Google Finance or Yahoo Finance as a backup for additional data if needed

This means if you use Perplexity Finance for free, you also have access to this data!

So what do you get with a paid subscription?

More

More deep searches

You can select your favorite LLM

You can add more files to a perplexity Space

A bigger context window (up to 1 Million tokens)

I have a paid subscription to Perplexity Pro at $20 USD/Month.

Let’s discover the different features (there is one that wowed me).

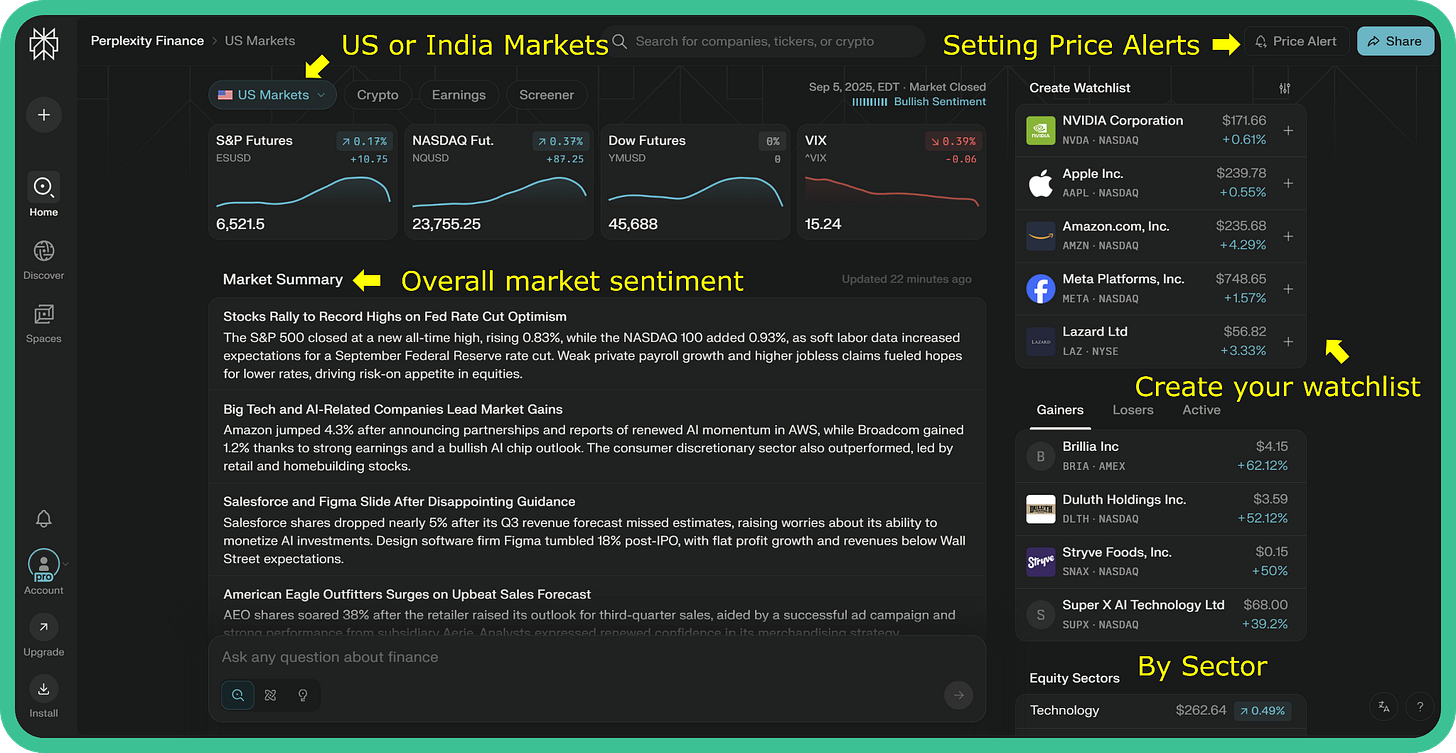

An overview of its features

Here’s the general overview

First impressions:

Only the US and India, no global coverage

Setting Price Alerts is always a good feature (let the price come to you)

Watchlist creation

General daily market sentiment

Overview by sector

Ok, but thus far, the overview does not go beyond any other financial software.

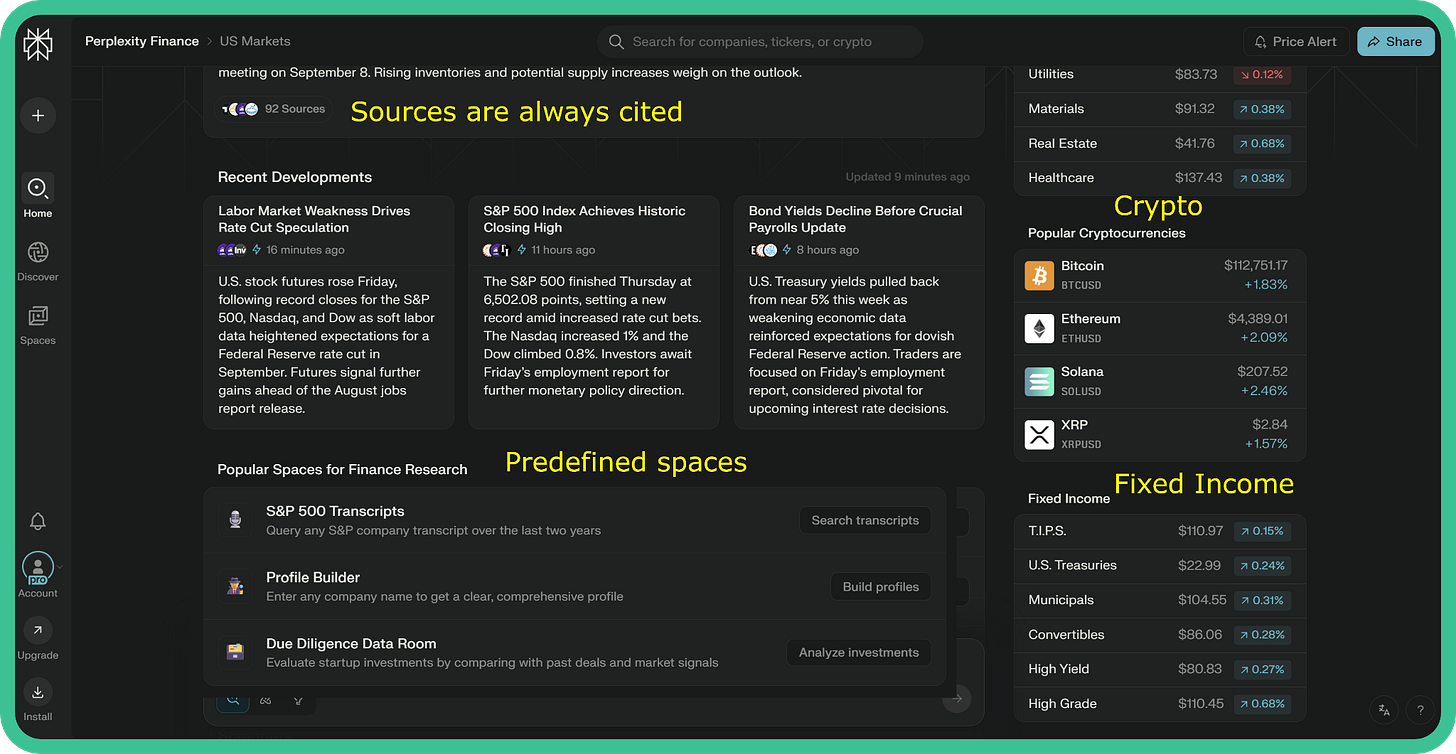

If we scroll down

You always get the sources, which is great

Crypto or a fixed income overview, where Perplexity tries to cover it all

And finally, predefined spaces

This is where it gets interesting.

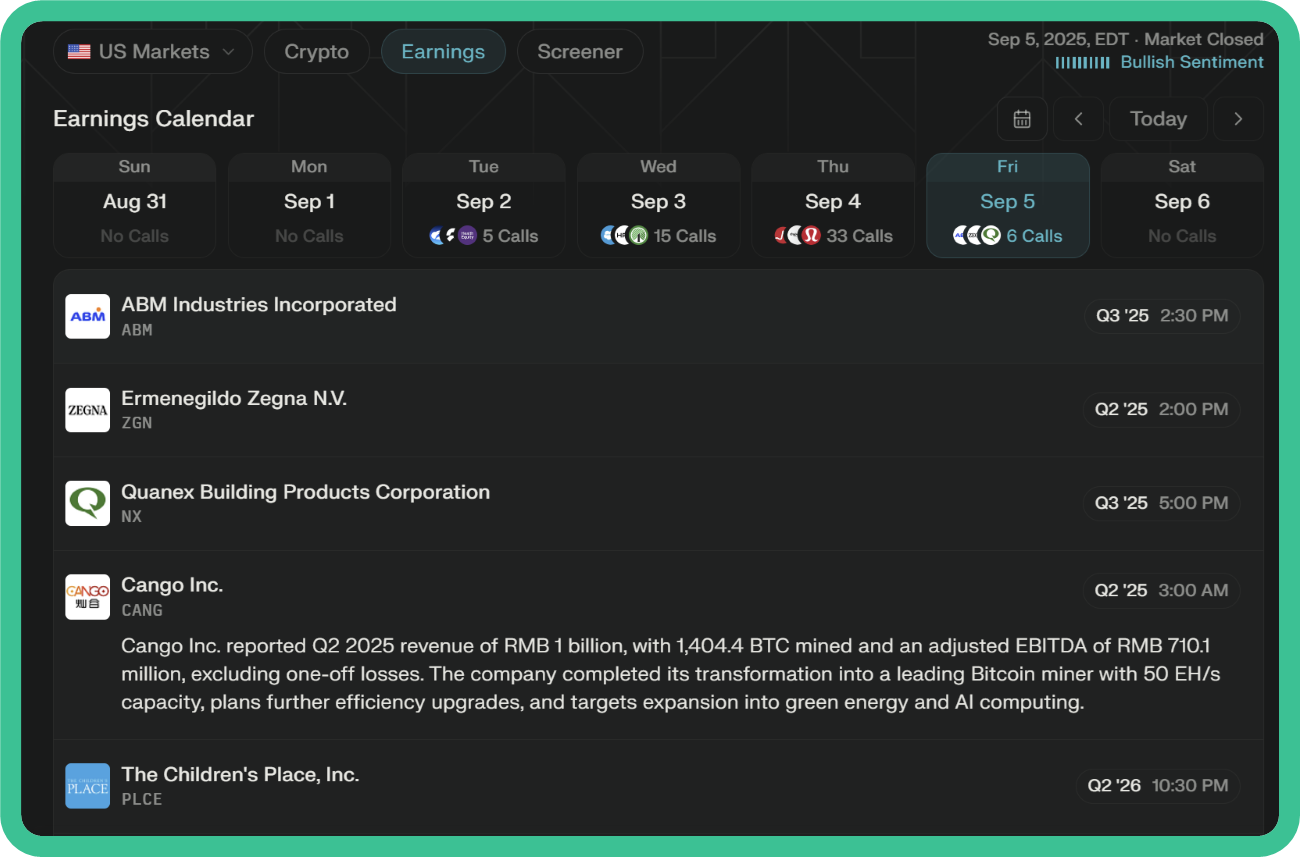

The earnings tab brings you to the earnings calendar, which I like:

And the screener brings you to a text prompt screener

Now, let me show you what I believe is useful when using Perplexity Finance

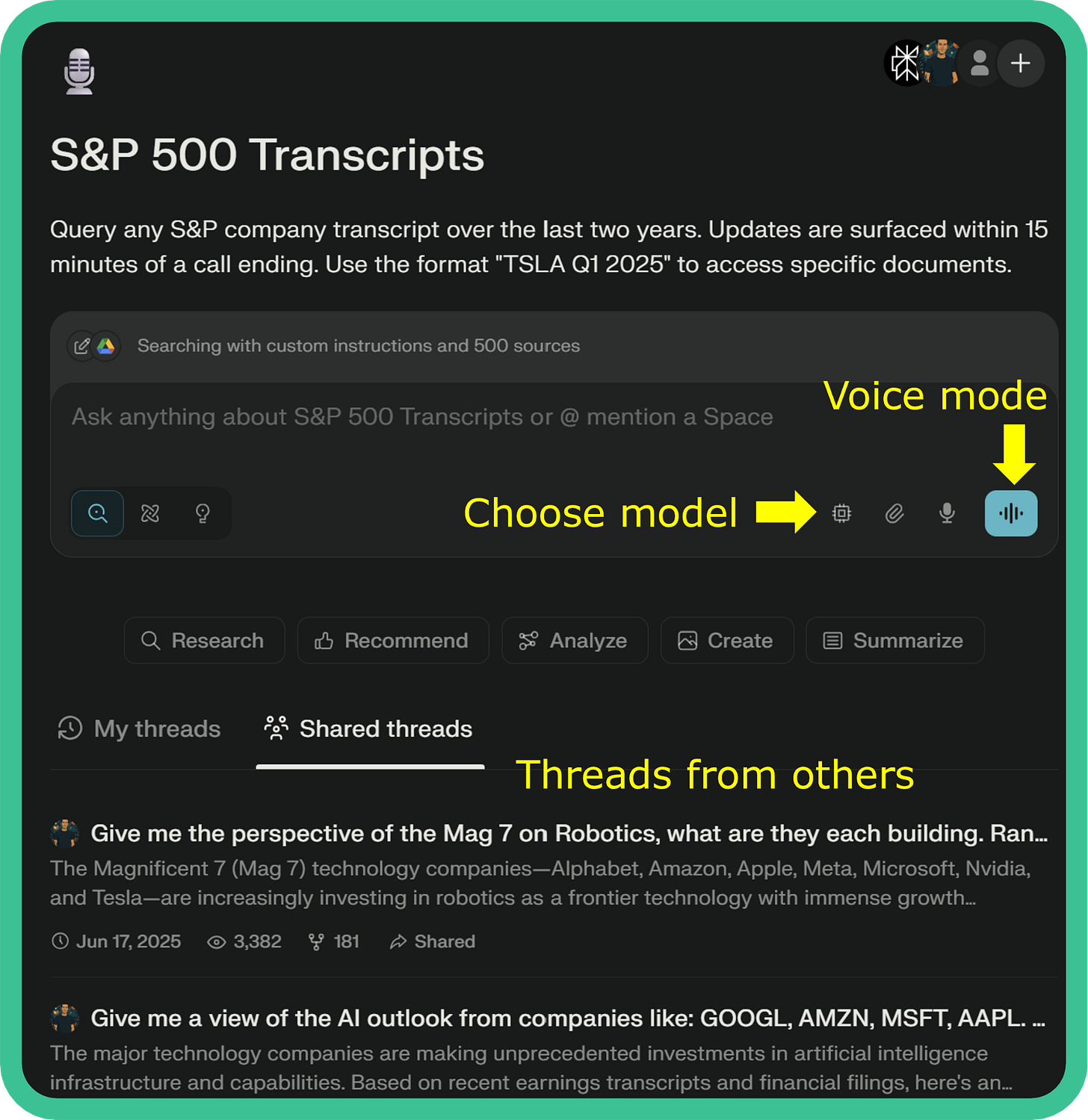

Predefined spaces

Just like building a notebook in Google LLM, a Space in Perplexity collects data in a single room, and you can then ask questions to it.

But imagine you’re investible universe is the S&P500, then the S&P500 space with perplexity can be useful.

It looks like this:

This is the only space I found that actually had data in it.

In this way, you can query the 500 companies in the S&P500 since the data room has the earnings calls for the past 2 years in it.

The main goal is to get the current state of affairs of any of these companies.

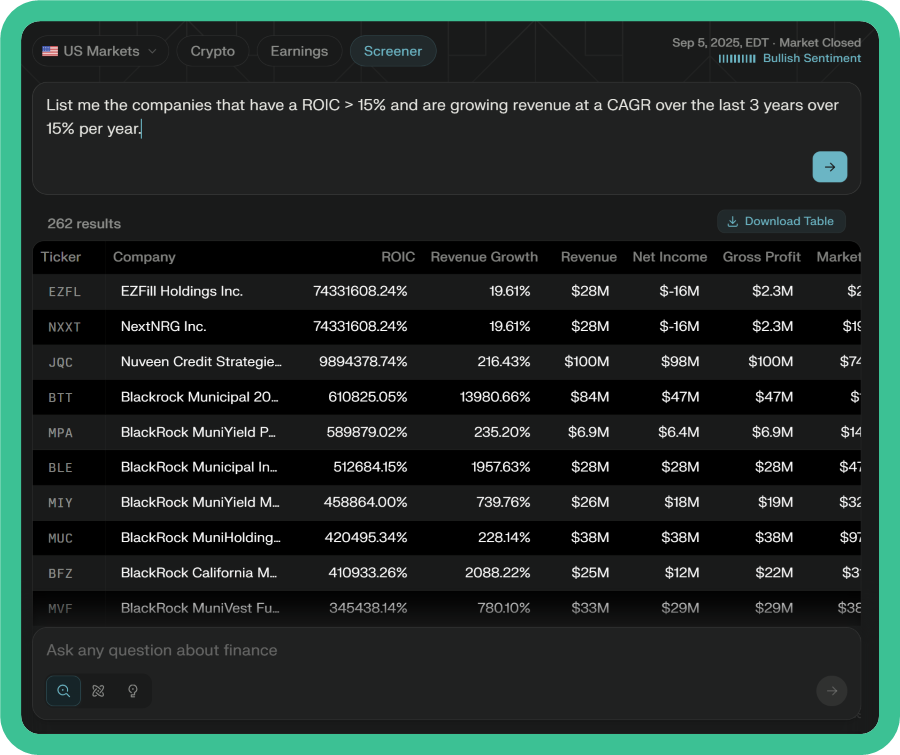

A Text prompt screener?

In a normal screener, you could add rules like:

ROIC > 15% and

3-year revenue growth rate > 15%.

Let’s test this.

Perplexity generates 262 results. And it’s fast. It only took a couple of seconds.

Now this is ok, but it does not go beyond what any screener can do.

Where it gets more interesting is if you can compare values to each other.

We know from the Alchemy of Multibaggers that companies need to reinvest their earnings, but not at a rate that is greater than the incoming cash flow.

So in the screener, we need something like this:

➡️Reinvestment rate is more or less equal to earnings growth rate.

Another useful screen would be to look at the ROIC trend. We know from beyond ROIC that a rising ROIC is more important than the absolute value.

Sadly, these comparisons are not possible with Perplexity Finance.

But no worries. It gets better.

Let’s see what happens if I ask this in the general context window.

Company analysis

When you select individual stocks in Perplexity Finance, just like Yahoo Finance, you can look at the financial data.

But you get the earnings reports, transcripts, and an automatic summary of the transcripts. A Morningstar report and finally a complete Investment Analysis Coverage report, which looks like something generated by Perplexity Labs. (but I can’t be sure)

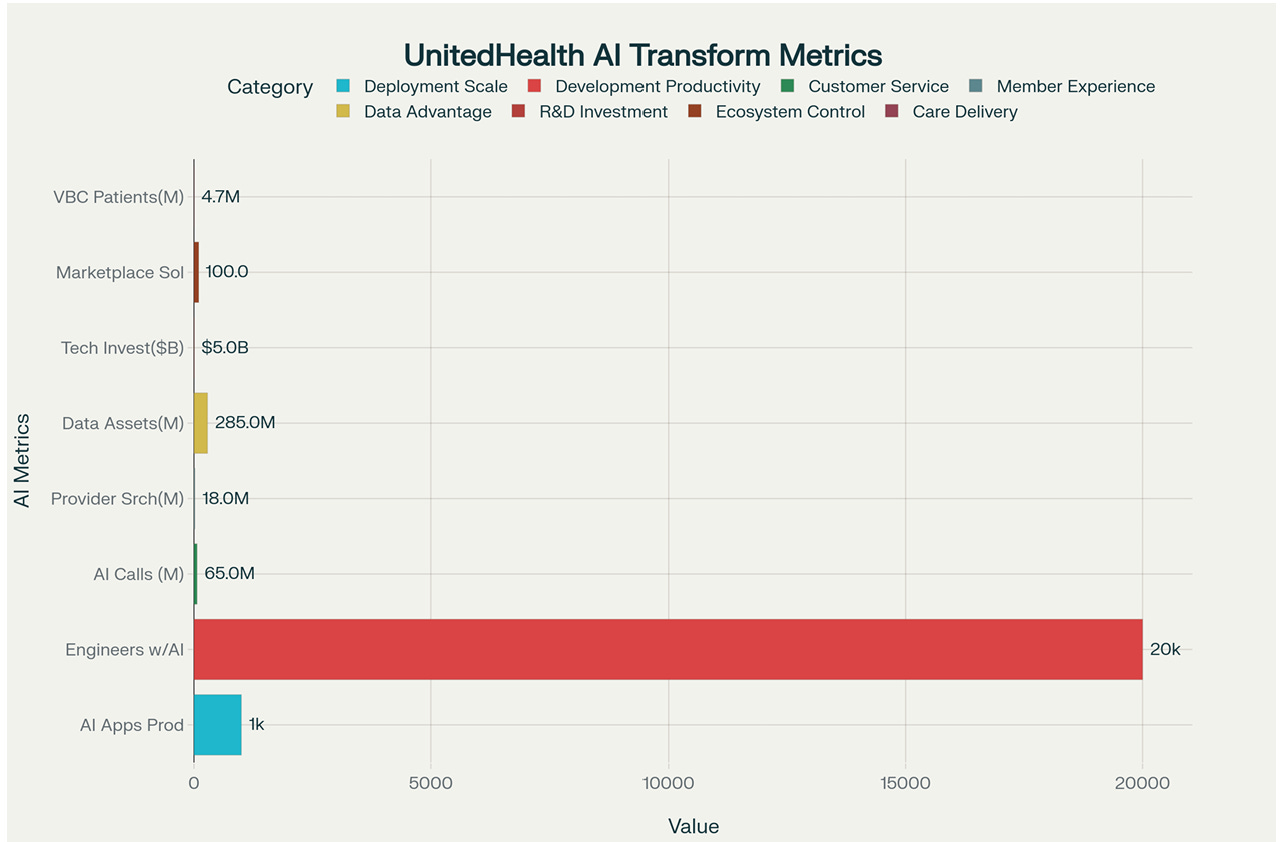

The report is quite impressive; it presents data like this:

UnitedHealth Group AI Transformation Dashboard

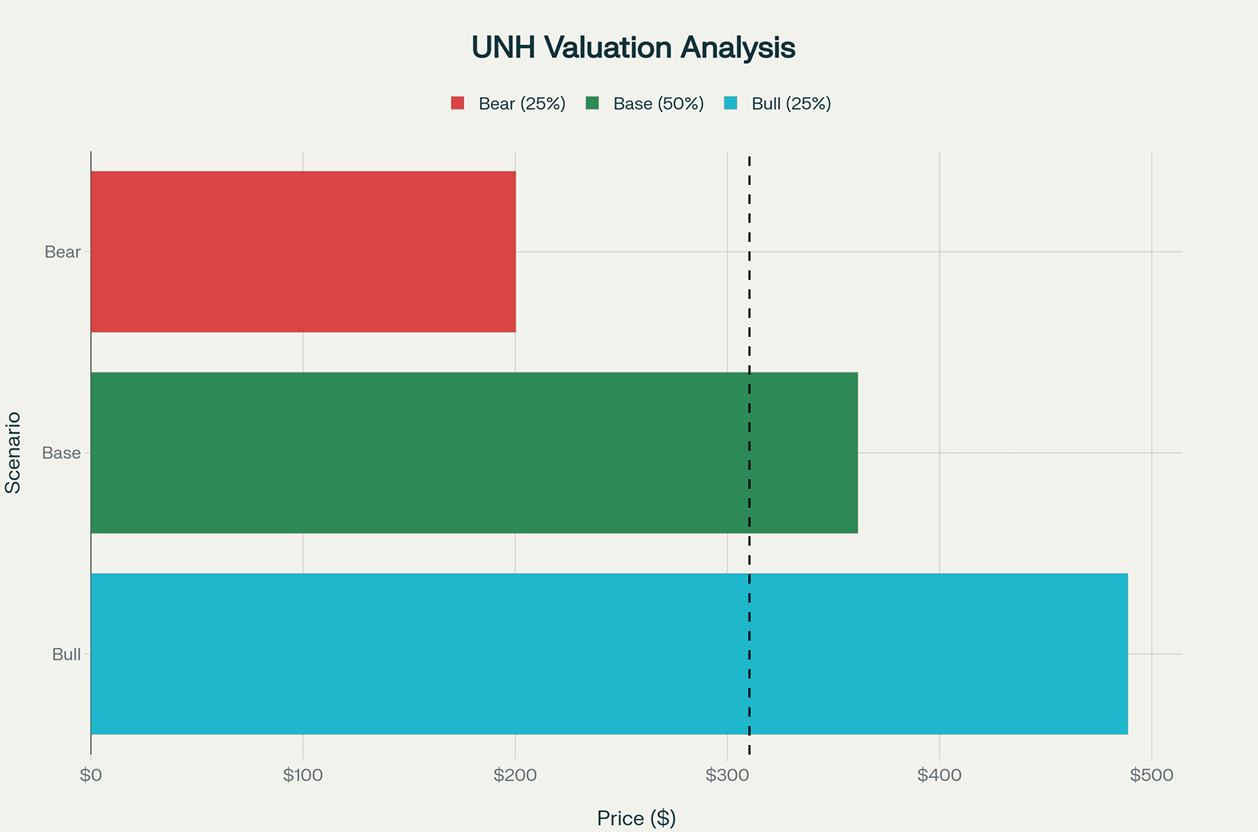

And a bear, base , and bull case valuation:

It’s a 51-page-long report, with lots of data. You can download it here:

Advanced prompting Perplexity vs GPT-5

Let’s use Perplexity’s most powerful feature.

When you start prompting for deep analysis, like we did here, you leave the finance environment of Perplexity.

In other words, you don’t have any access anymore to the financial data or all API’s linked.

It appears that all those financial data connections are not being leveraged to make a 1 + 1 = 3 product.

So let’s compare the deep research feature to “just” using GPT5. We’ll use the same prompt to make a comparison possible.

The goal is to give a balanced view of United Health Group. ($UNH). This company has seen a lot of press coverage over the last year.

The advanced prompt is more than a page long and looks like this ⬇️

You are a seasoned equity analyst specializing in the U.S. health care sector with deep expertise in large-cap managed-care and services companies.

I am evaluating a potential investment in **UnitedHealth Group (ticker: UNH)** following its recent price decline. As of [insert date], its share price is approximately $XXX — please verify and cite the current figure.

Your task is to produce a **deep, institutional-quality investment analysis**, structured as follows:

---

### 1. Company Overview & Fundamentals

- Provide a concise but detailed overview of UnitedHealth Group’s business model, revenue mix, and key segments (UnitedHealthcare, Optum).

- Summarize recent financial performance (revenue growth, EPS, margins, cash flow, debt).

- Where possible, use at least the last 3 years of data.

- Cite all figures from reliable sources (SEC filings, investor presentations, Bloomberg, FactSet, Yahoo Finance, etc.).

---

### 2. Market & Sentiment Context

- Summarize consensus analyst ratings (Buy/Hold/Sell breakdown) and 12-month price target ranges (high/low/average).

- Provide context on sector-wide valuation or recent news (e.g., regulatory trends, M&A activity).

- Clearly cite sources (e.g., Nasdaq, Reuters, Morningstar).

---

### 3. Scenario Analysis (Bull / Base / Bear Case)

For each case, include both **qualitative drivers** and **quantitative estimates**:

- **Bull Case**: Upside catalysts (growth in Optum, favorable policy shifts, margin expansion). Quantify with EPS/valuation assumptions and potential price range.

- **Base Case**: Steady execution with industry-average growth. Provide likely valuation multiples and price target range.

- **Bear Case**: Downside risks (reimbursement pressures, regulation, operational challenges). Quantify worst-case EPS compression and downside price range.

*Each case must include explicit assumptions and a price/valuation range.*

---

### 4. Valuation & Peer Comparison

- Compare UNH on key metrics (P/E, EV/EBITDA, Price-to-Sales) versus major peers (e.g., CVS, Humana, Cigna).

- Highlight relative over/undervaluation versus historical averages and industry benchmarks.

- Include both trailing and forward multiples, citing all sources.

---

### 5. Data Integrity & Transparency

- Use **at least two independent sources** to confirm all major financial figures.

- If data is unavailable or contradictory, state this clearly and recommend where to verify.

---

### 6. Executive Summary

- Provide a 2–3 sentence, professional summary of your analysis and overall investment view.

- Tone should reflect an **institutional equity research report**: concise, data-driven, objective.

---

**Formatting & Output Requirements**

- Write in a clear, professional style suitable for an investment committee memo.

- Use section headers, short paragraphs, and tables/charts (where applicable).

- Length: Aim for 1,500–2,000 words to ensure depth.

- End with a **“Sources” section** listing all references with links.

---

**Important Constraints**

- Only use publicly available, reputable data.

- Do not speculate beyond available evidence.

- If uncertain, explicitly say so rather than inferring.

There are some caveats for the comparison:

As previously mentioned, you can select a model like GPT5 within Perplexity; however, when you select DeepSearch, it will automatically select a modified DeepSeek R1 model. So the comparison is not 1 on 1.

We’ll generate 4 reports on top of the standard Perplexity report available.

This means in the end, we have 5 reports

The Perplexity Finance standard report

The Perplexity Pro prompted report

GPT5 report

GPT5 think report

GPT5 pro report

So, who is the winner?

It’s not that clear.

Perplexity excels at generating these kinds of reports as it adds charts and text. In addition, it uses the largest number of sources.

When it comes to GPT5, there’s no huge difference between the normal, thinking, and pro models.

Perplexity and GPT5 both arrive at the same conclusion: That UNH has upside. This is not surprising, as these models will just emphasize the aggregate sentiment of the investing world surrounding this company.

Actually, although it’s a high-quality prompt was used, it’s better to use more focused prompts instead of asking a complete analysis in a single prompt.

Conclusion

Perplexity Finance can be useful if you want to have a quick look, summaries, and follow-up of the latest earnings calls. Just like Yahoo Finance, it provides financial data and news on the latest developments.

The biggest difference is the Coverage Report that is available and generated through Perplexity, which is quite impressive.

The screener is not better than any other screener.

And the biggest disappointment is that when searching through Perplexity, it cannot use any of the API’s like Financial Modeling Prep.

However, you can select the SEC filings in the search prompt, but you need to do it manually.

Finally, when comparing all the research reports, all models have a pretty bullish stance on UnitedHealth Group. The Perplexity one is visually the best. From a content perspective, all reports rival each other.

Perplexity still has the best deep research feature. It is ideal for market analysis or competitive analysis.

GPT5 Thinking is still the best reasoning model out there. It is ideal for understanding a business model or doing step-by-step equity analysis.

I hope this will help with your own research.

If you like this article, please consider sharing it with someone

May the markets be with you, always!

Kevin

Nothing beats Perplexity

Great overview! Thanks Kevin!